-

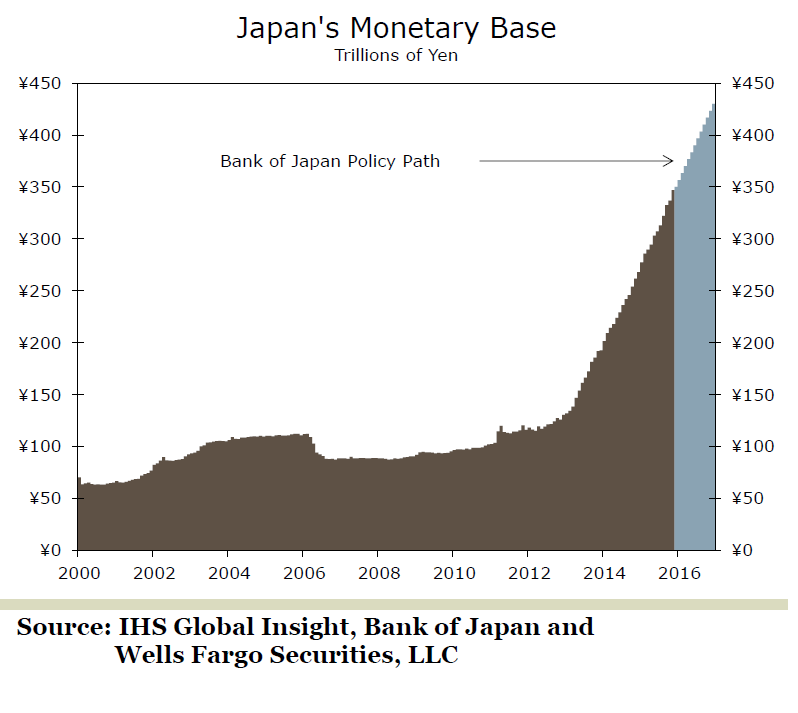

Will Bank of Japan’s hands be forced to ease further?

Read MoreThe Bank of Japan (BOJ) will have a meeting this week on Friday, Jan 29 to decide on monetary policy and they are going to have a tough decision to make. Having introduced asset purchase program in 2013, dubbed as QQE (Quantitative and Qualitative Easing) and then in 2014 expanded the program to 80 trillion Yen ($665 billion) per year, […]

-

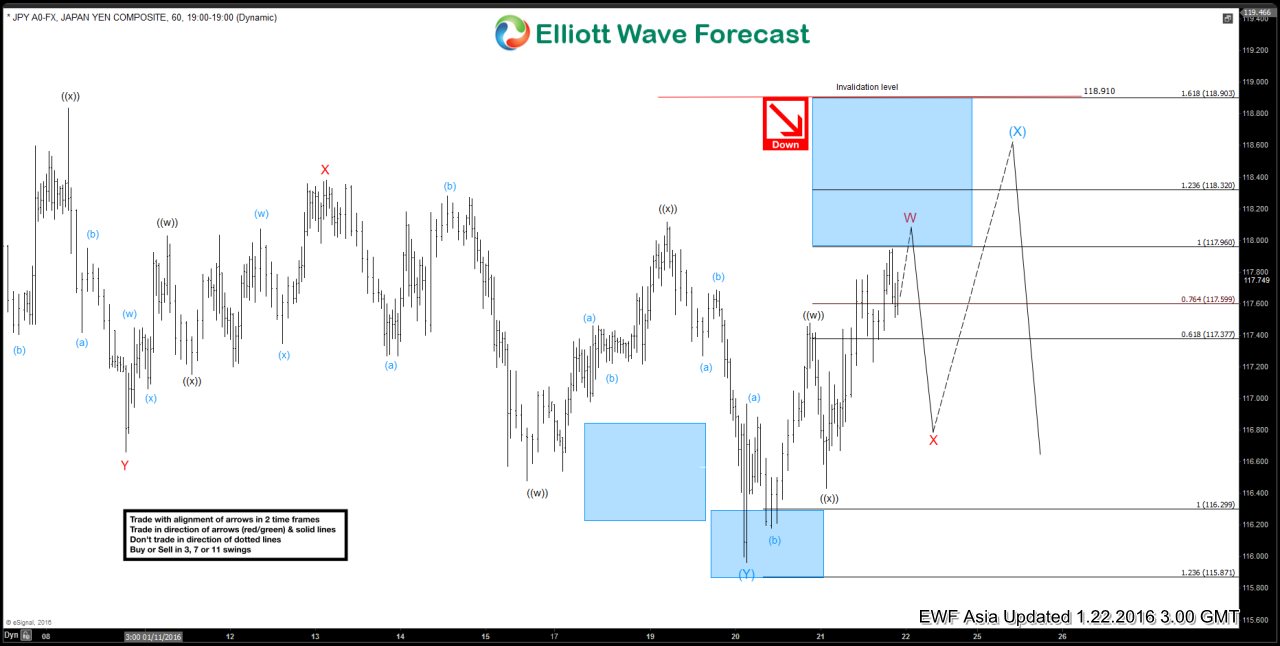

$USDJPY Short Term Elliott Wave Analysis 01.22.2016

Read MoreRevised short term Elliott Wave cycle suggests cycle from 12/18 peak has ended with with (Y) at 115.96. From this level, pair has bounced in 3 swings so far. Wave W is expected to complete at 117.96 – 118.32 area, then it should pullback in wave X before potentially another leg higher to finish wave (X) for a […]

-

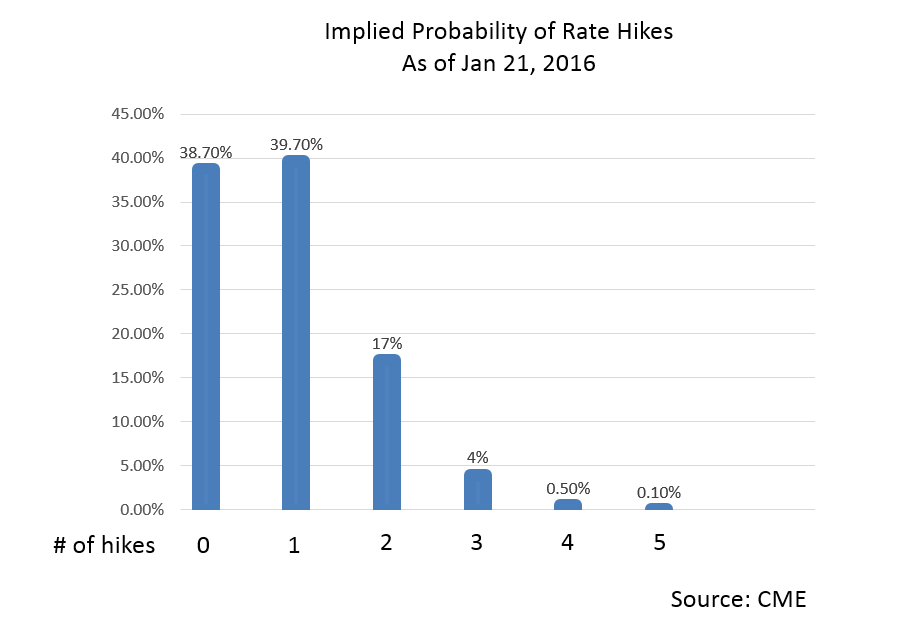

Equities Performance During Fed’s Tightening Cycle

Read MoreThe aftermath of the 2008 financial crisis saw a massive deleveraging and repricing of risky assets, forcing many central banks in the world to adopt near-zero interest rate and in some cases introduce unconventional monetary policy like quantitative easing. Fast forward to 2016 today, after 7 years of near-zero interest rate policy, the Federal Reserve […]

-

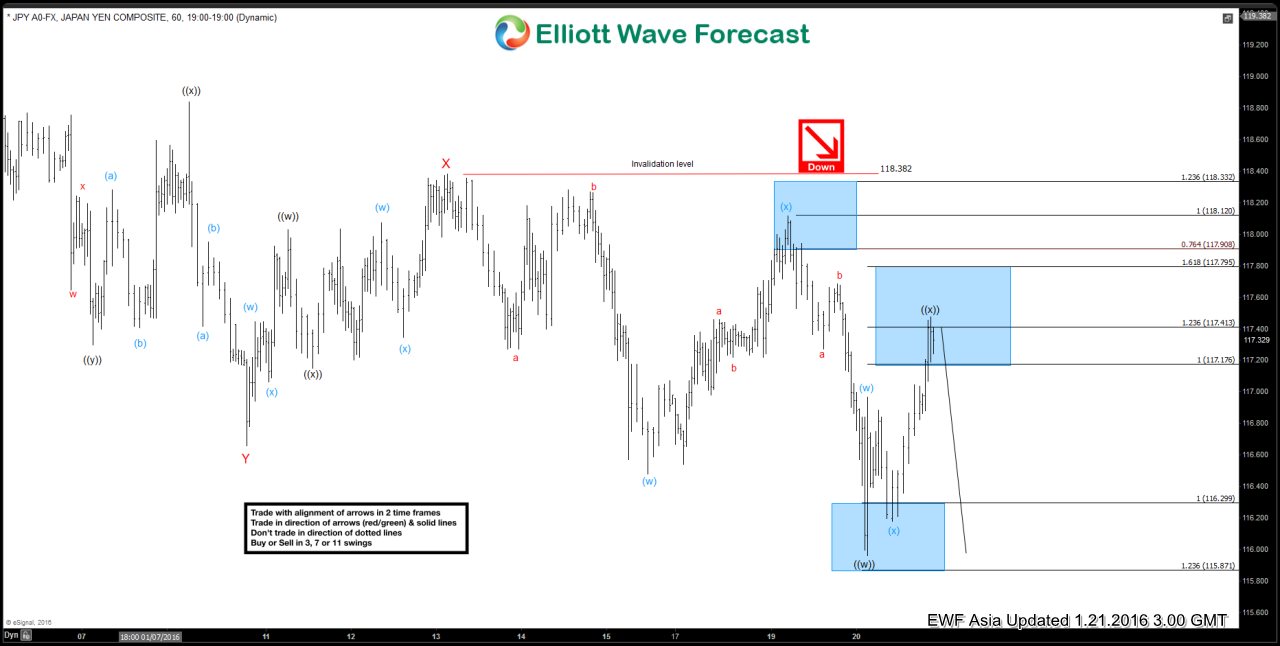

$USDJPY Short Term Elliott Wave Analysis 01.21.2016

Read MoreShort term Elliott Wave cycle suggests decline from wave X at 118.38 is unfolding in a double three structure where wave ((w)) ended at 115.96 and wave ((x)) bounce is proposed complete at 117.48. While below 117.48, but more importantly as far as 118.38 pivot stays intact, pair is expected to resume lower in wave ((y)) towards […]

-

$EURJPY Short Term Elliott Wave Analysis 01.20.2016

Read MoreShort term Elliott Wave cycle suggests cycle from 12/4 peak at 134.58 remains alive as a double three where wave (W) ended at 127 and wave (X) bounce is in progress as a triangle. Wave A of (X) in the triangle is proposed complete at 129.08, and as far as bounces stay below this level, the triangle idea remains […]

-

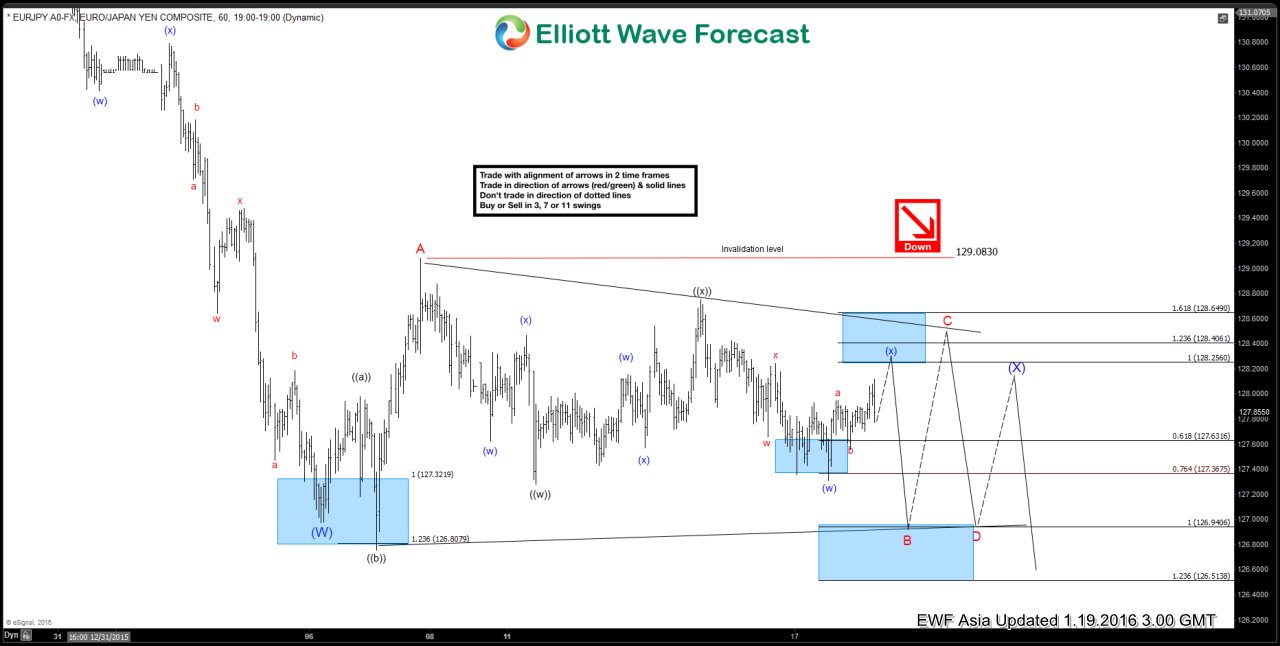

$EURJPY Short Term Elliott Wave Analysis 01.19.2016

Read MoreShort term Elliott Wave cycle suggests cycle from 12/4 peak at 134.58 remains alive as a double three where wave (W) ended at 127 and wave (X) bounce is in progress as a triangle. Wave A of (X) in the triangle is proposed complete at 129.08, and as far bounces stay below this level, the triangle idea remains valid […]