-

$USDCAD Short Term Elliott Wave Analysis 01.12.2016

Read MoreShort term Elliott Wave cycle suggests rally from wave (X) low at 1.38 is unfolding in a double three structure where wave W ended at 1.417, wave X FLAT ended at 1.406, and pair has resumed higher in wave Y towards 1.44 area. Near term, rally to 1.423 ended wave (a), and pair is in wave […]

-

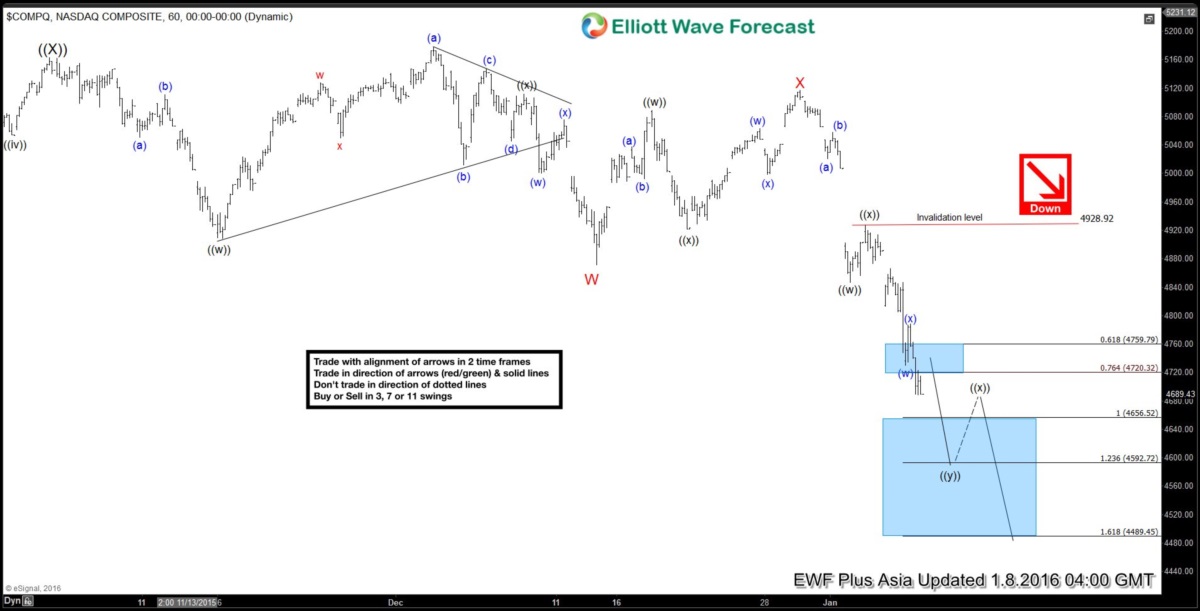

Nasdaq Short Term Elliott Wave Analysis 01.08.2016

Read MoreShort term Elliott Wave cycle suggests bounce to 5117.3 ended wave X. Decline from this level is unfolding in a triple three where wave ((w)) ended at 4847 and wave ((x)) bounce ended at 4928. Wave ((y)) is in progress towards 4592 – 4656 area, then it should bounce in second wave ((x)) before lower again. We don’t like […]

-

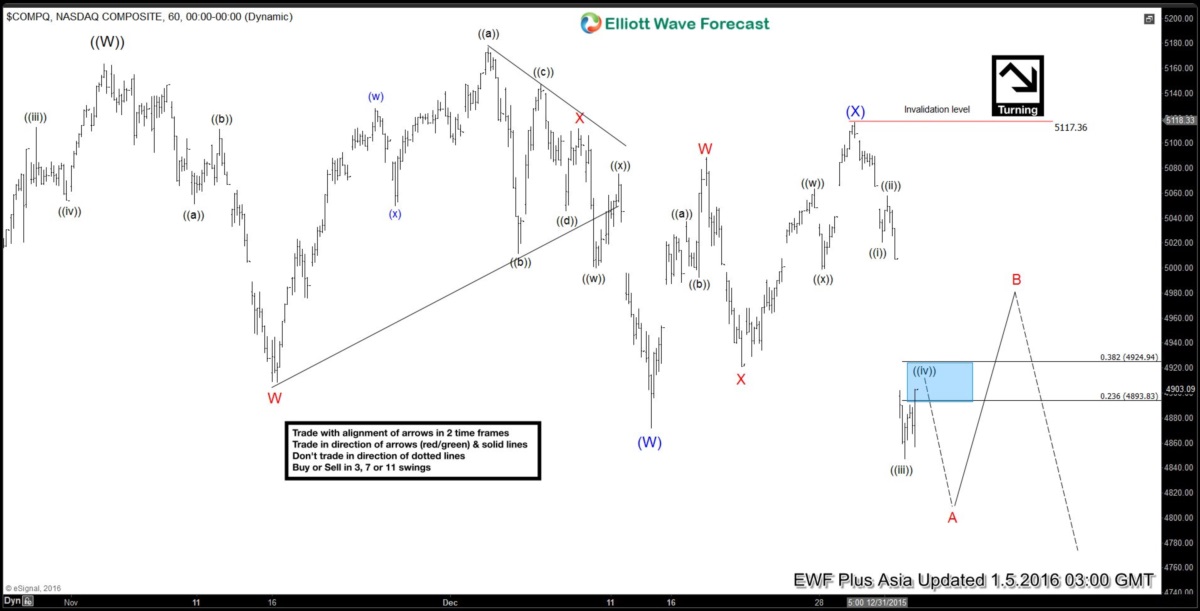

Nasdaq Short Term Elliott Wave Analysis 01.07.2016

Read MoreShort term Elliott Wave cycle suggests bounce to 5117.3 ended wave (X). First leg of decline from this level unfolded in a zigzag and ended wave W at 4847. Wave X bounce is proposed complete at 4926 and the Index has resumed lower again. Decline from 4926.2 unfolded in 5 waves and ended wave (a) at 4804.7. Wave (b) […]

-

Nasdaq Short Term Elliott Wave Analysis 01.06.2016

Read MoreShort term Elliott Wave cycle suggests bounce to 5117.3 ended wave (X). First leg of decline from this level unfolded in a zigzag and ended wave W at 4847. Wave X bounce is currently in progress in 3 or 7 swing to correct the decline from 5117.3 and ideally can reach 4981 – 5012 area before the […]

-

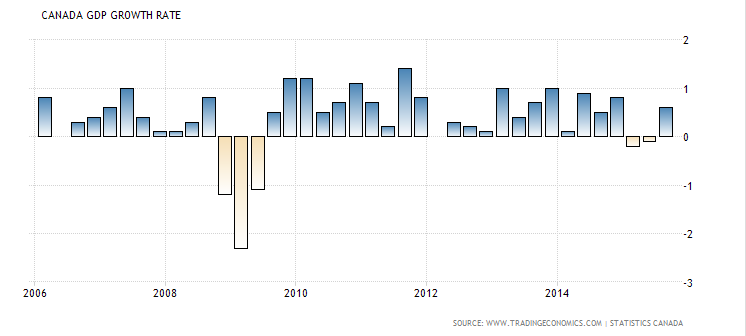

How Bearish is Canadian Dollar?

Read MoreCanada’s Economy In the first half of 2015, Canada slipped into technical recession, as defined by two consecutive quarters of negative GDP. Depressed oil prices in 2015 has caused significant pain to Canadian economy which is a net exporter of energy, and it has also caused the weakening of Canadian dollar, which is down 10% […]

-

Nasdaq Short Term Elliott Wave Analysis 01.04.2016

Read MoreShort term Elliott Wave cycle suggests bounce to 5117.3 ended wave (X). Decline from this level is unfolding in 5 waves and another swing lower in wave ((v)) is possible to end wave A towards 4823 before a larger bounce in wave B is seen to correct the decline from 5117. Wave B bounce is expected to fail […]