-

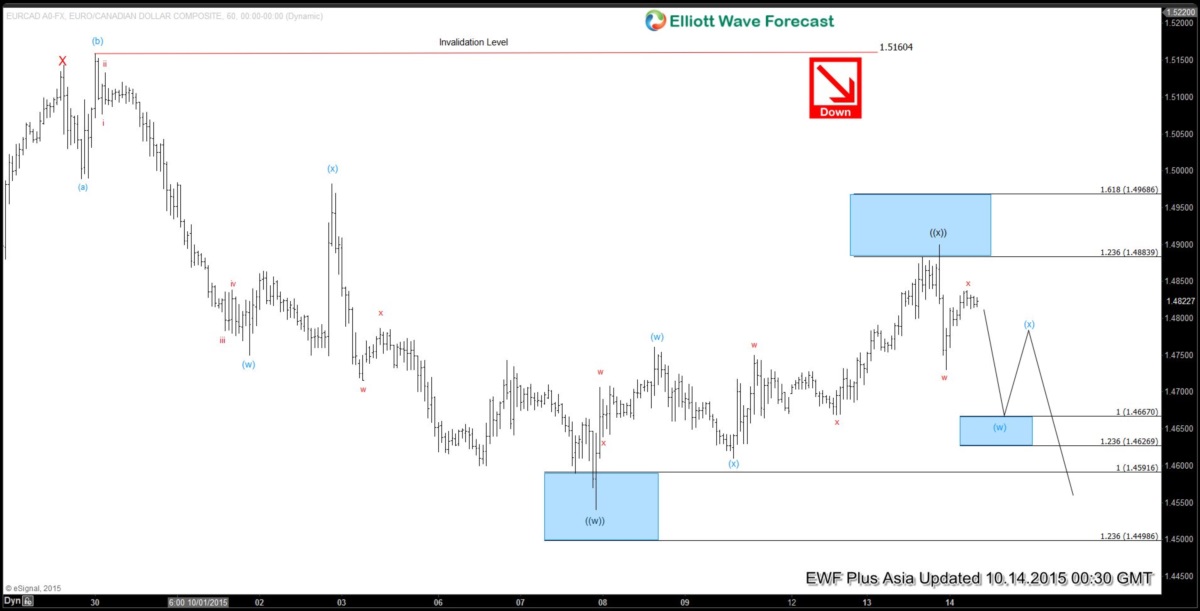

EURCAD Short Term Elliott Wave Update 10.14.2015

Read MoreBest reading of the cycle in the short term suggests decline to 1.454 ended wave ((w)). Wave ((x)) bounce is unfolding as a double three structure where wave (w) ended at 1.476, wave (x) ended at 1.461, and wave (y) of ((x)) is proposed complete at 1.49. While below 1.49, or more importantly as far as […]

-

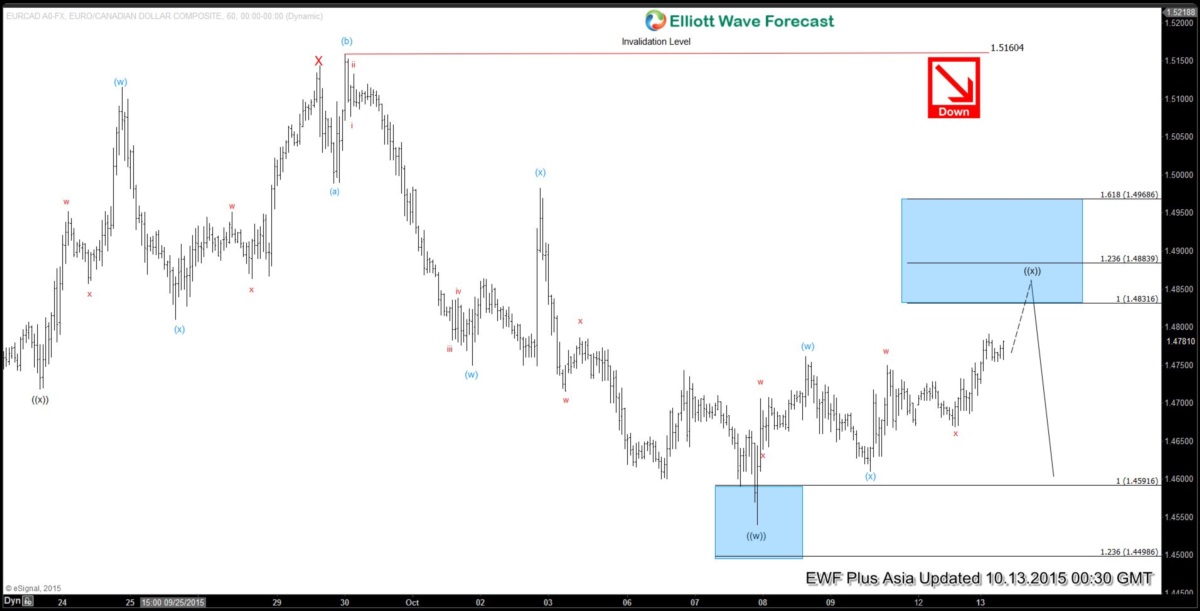

EURCAD Short Term Elliott Wave Analysis 10.12.2015

Read MoreBest reading of the cycle in the short term suggests decline to 1.454 ended wave ((w)). Wave ((x)) bounce is unfolding as a double three structure where wave (w) ended at 1.476, wave (x) ended at 1.461, and wave (y) of ((x)) is in progress towards 1.483 – 1.488 area before the pair turns either […]

-

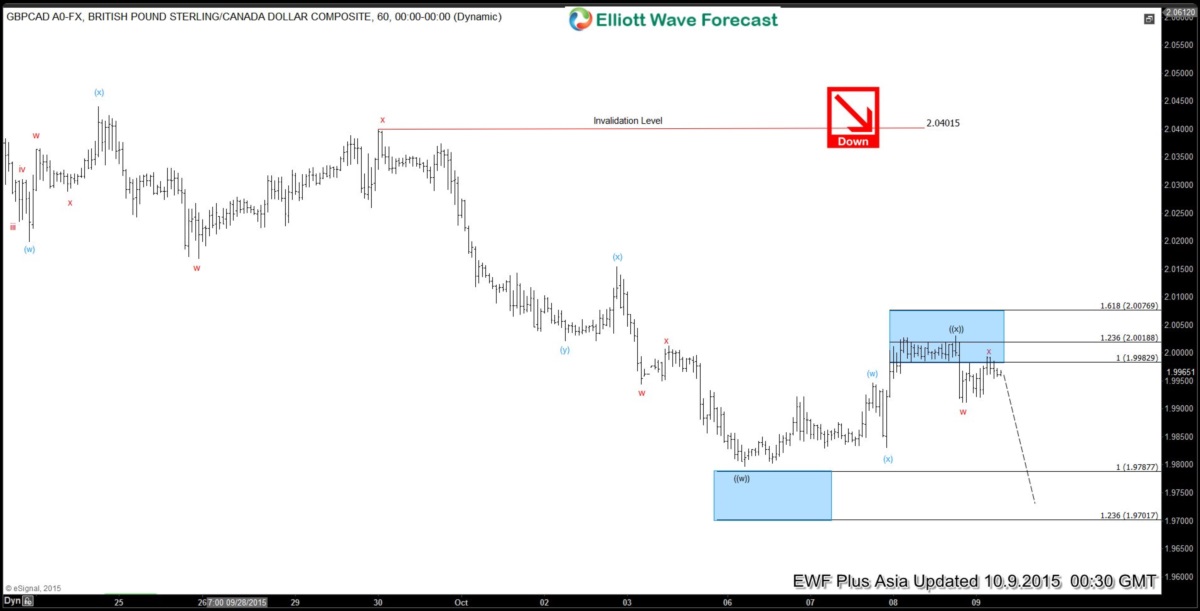

GBPCAD Short Term Elliott Wave Update 10.9.2015

Read MoreBest reading of the cycle suggests that rally to 2.057 ended wave X. From this level, the pair resumed the decline in wave ((w)) as a double three structure wxy where wave w ended at 2.0168, wave x ended at 2.04, and wave y of ((w)) completed at 1.98. Wave ((x)) bounce unfolded also in double three […]

-

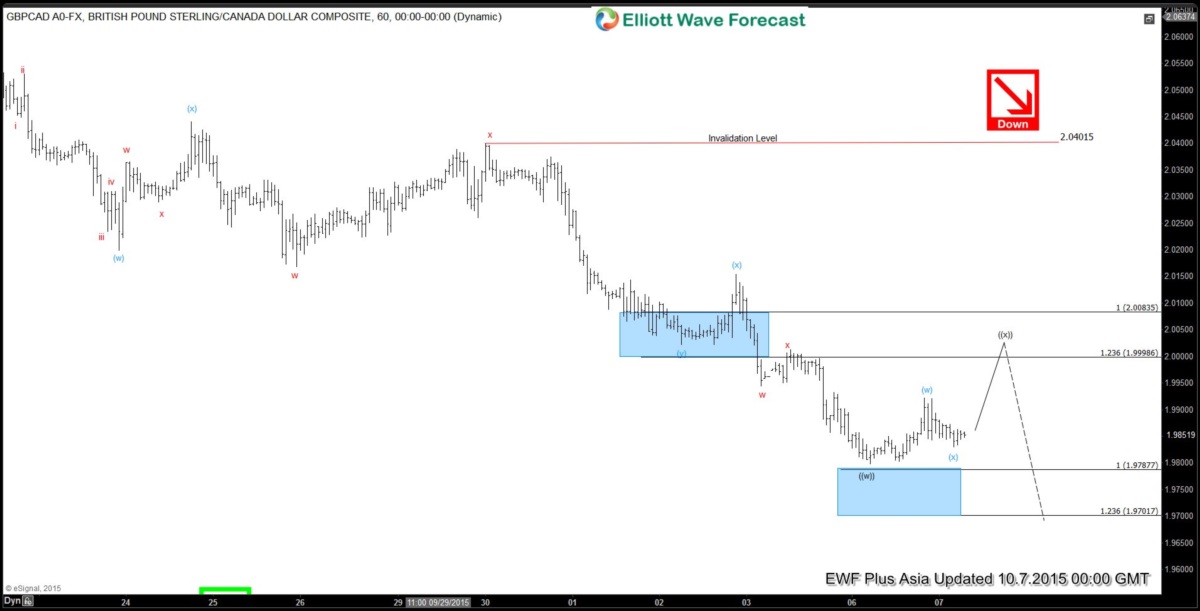

GBPCAD Short Term Elliott Wave Update 10.8.2015

Read MoreBest reading of the cycle suggests that rally to 2.057 ended wave X. From this level, the pair resumed the decline in wave ((w)) as a double three structure wxy where wave w ended at 2.0168, wave x ended at 2.04, and wave y of ((w)) completed at 1.98. Wave ((x)) bounce is currently in progress […]

-

GBPCAD Short Term Elliott Wave Update 10.7.2015

Read MoreBest reading of the cycle suggests that rally to 2.057 ended wave X. From this level, the pair resumed the decline in wave ((w)) as a double three structure wxy where wave w ended at 2.0168, wave x ended at 2.04, and wave y of ((w)) completed at 1.98. Wave ((x)) bounce is currently in progress […]

-

NZDCAD Medium Term Elliottwave Analysis 10.6.2015

Read MoreThis is a medium term Elliottwave Analysis video on $NZDCAD. Bias is to the downside as far as 0.883 pivot stays intact. EWF currently covers 50 instrument ranging from forex, indices, and commodities in 4 different time frames. We just recently added 8 more instrument in EWF Plus Plan ($AUDCAD, $AUDNZD, $EURCAD, $EURNZD, $USDSEK, $GBPCAD, Apple, Coffee). […]