-

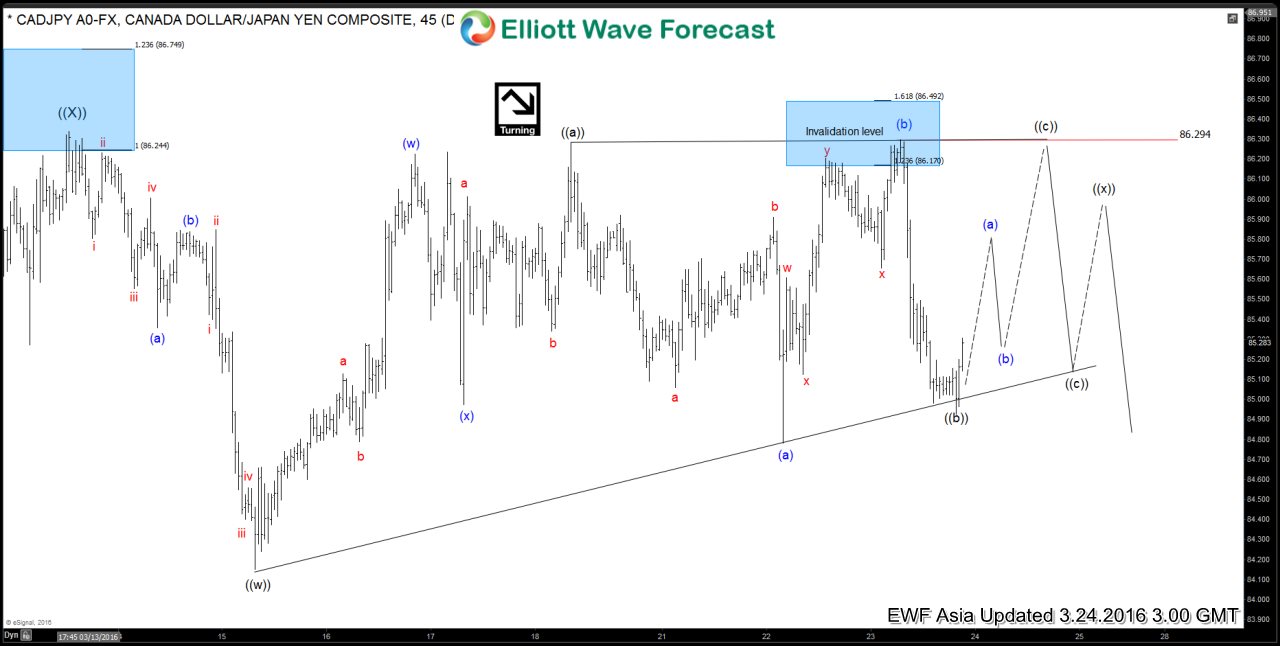

$CADJPY Short-term Elliott Wave Analysis 3.24.2016

Read MoreRevised short term Elliottwave structure suggests dips to 84.15 ended wave ((w)). Wave ((x)) bounce from there is unfolding as a triangle where wave ((a)) ended at 86.29, wave ((b)) ended at 84.92, and wave ((c)) is currently in progress. Pair is expected to do sideways movement and consolidate in the triangle while wave ((a)) at 86.294 needs […]

-

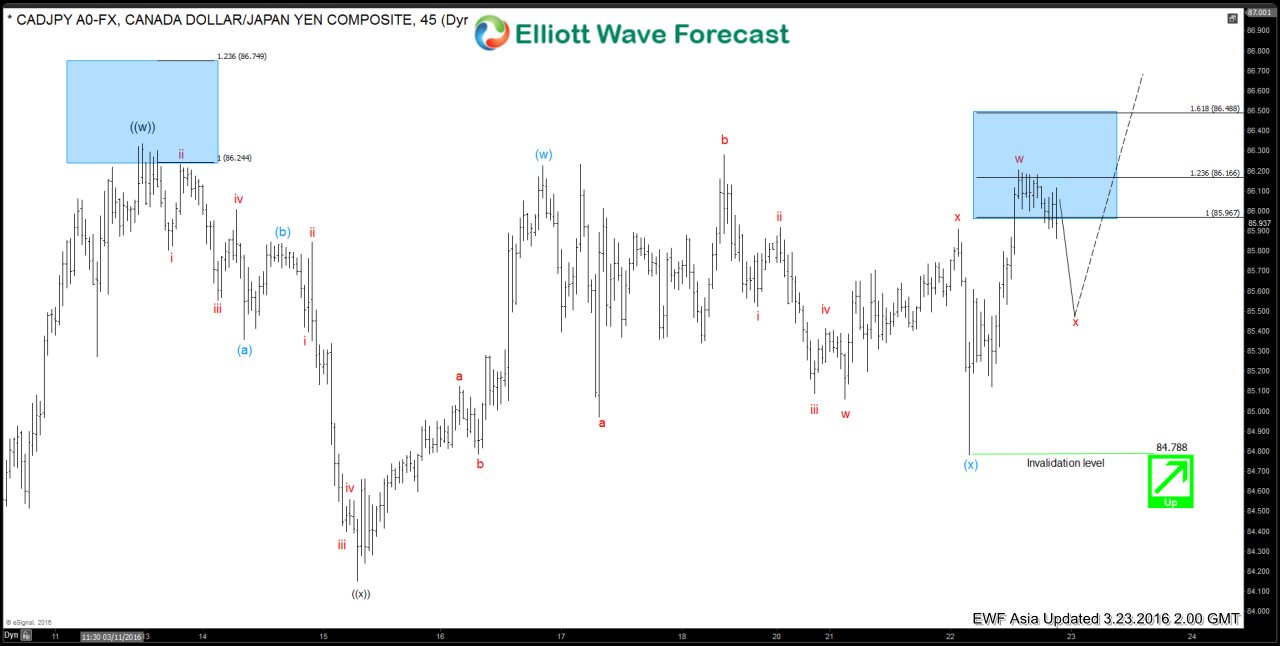

$CADJPY Short-term Elliott Wave Analysis 3.23.2016

Read MoreShort term Elliottwave structure suggests dips to 84.15 ended wave ((x)). Rally from there is unfolding in a double correction where wave (w) ended at 86.22, and wave (x) ended at 84.78. Near term, wave x pullback is in progress with an ideal target of 85.3 – 85.5 (50 – 61.8 back of the rally from 84.78), […]

-

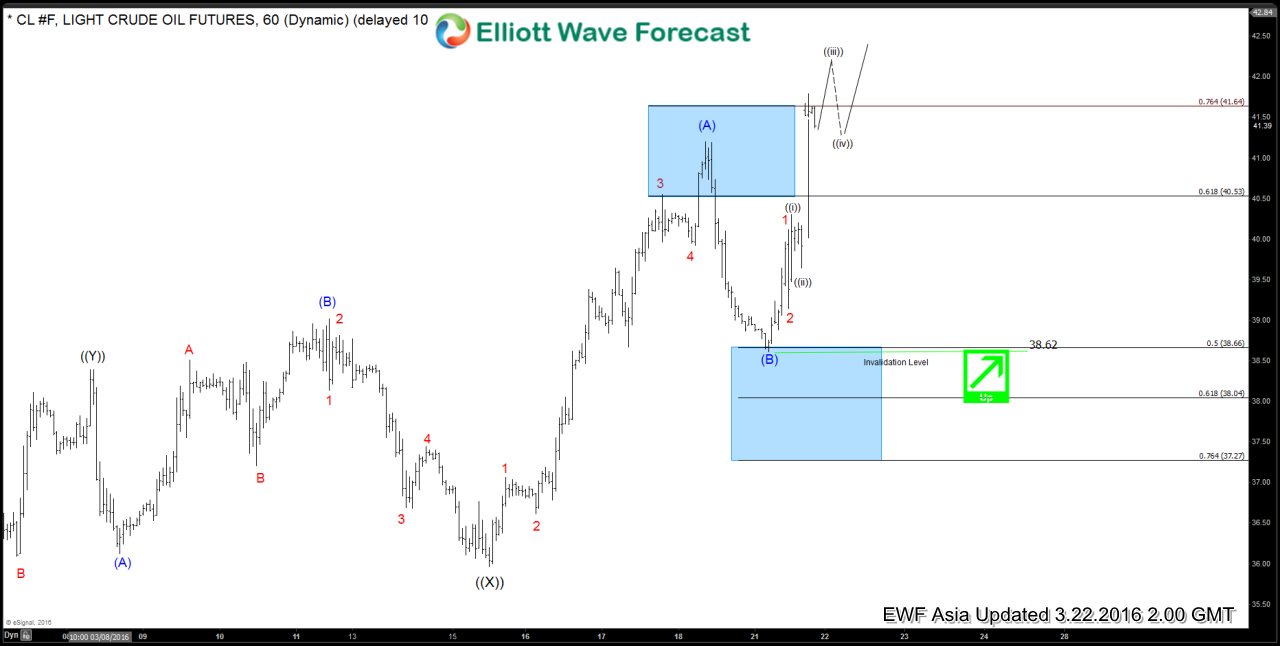

Oil $CL_F Short-term Elliott Wave Analysis 3.22.2016

Read MoreShort term Elliottwave structure suggests dips to 35.98 on March 15 ended second wave ((X)). Rally from there is unfolding in a zigzag structure where wave (A) ended at 41.2, wave (B) ended at 38.62, and wave (C) is in progress higher as 5 waves. While pullbacks stay above 38.62, Oil is expected to continue higher in wave […]

-

$NZDCAD 4 Hour Elliottwave Analysis 3.21.2016

Read MoreThis is a 4 hour Elliottwave Analysis video on $NZDCAD. As far as bounces hold below 0.9119, the pair is looking to go lower in wave (y) of ((y)) towards 0.8457 – 0.858 area. Check and click here technical blogs for more. EWF currently covers 50 instrument ranging from forex, indices, and commodities in 4 different time frames. Try our […]

-

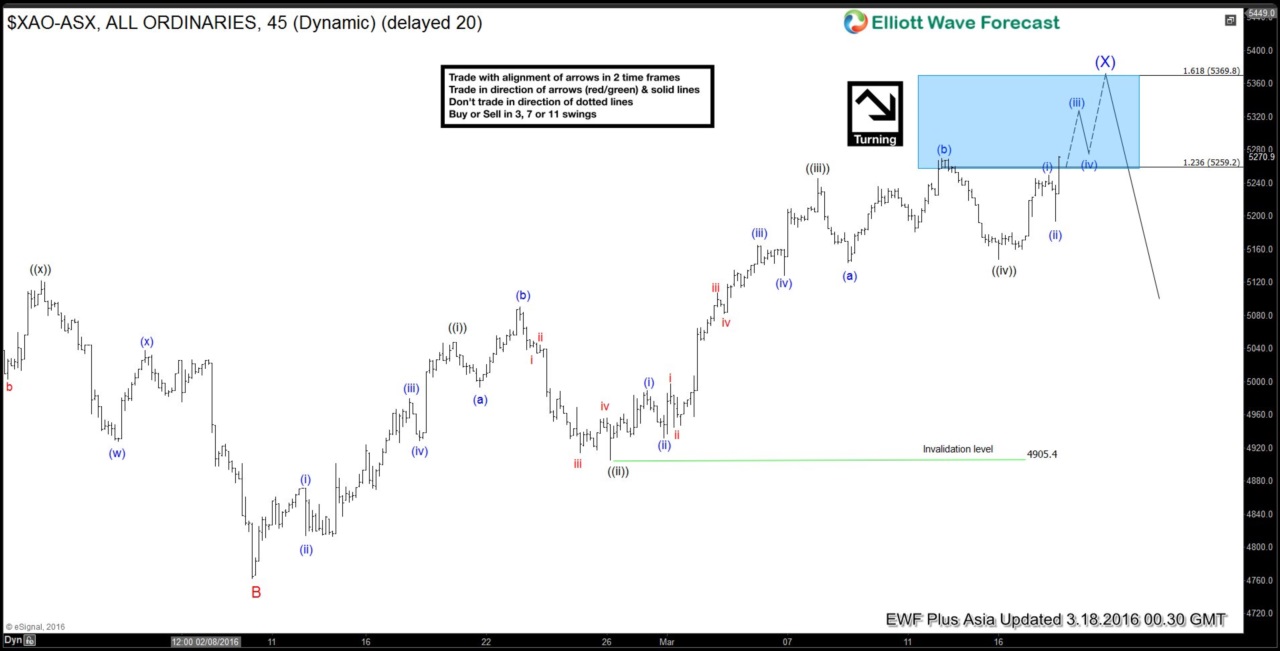

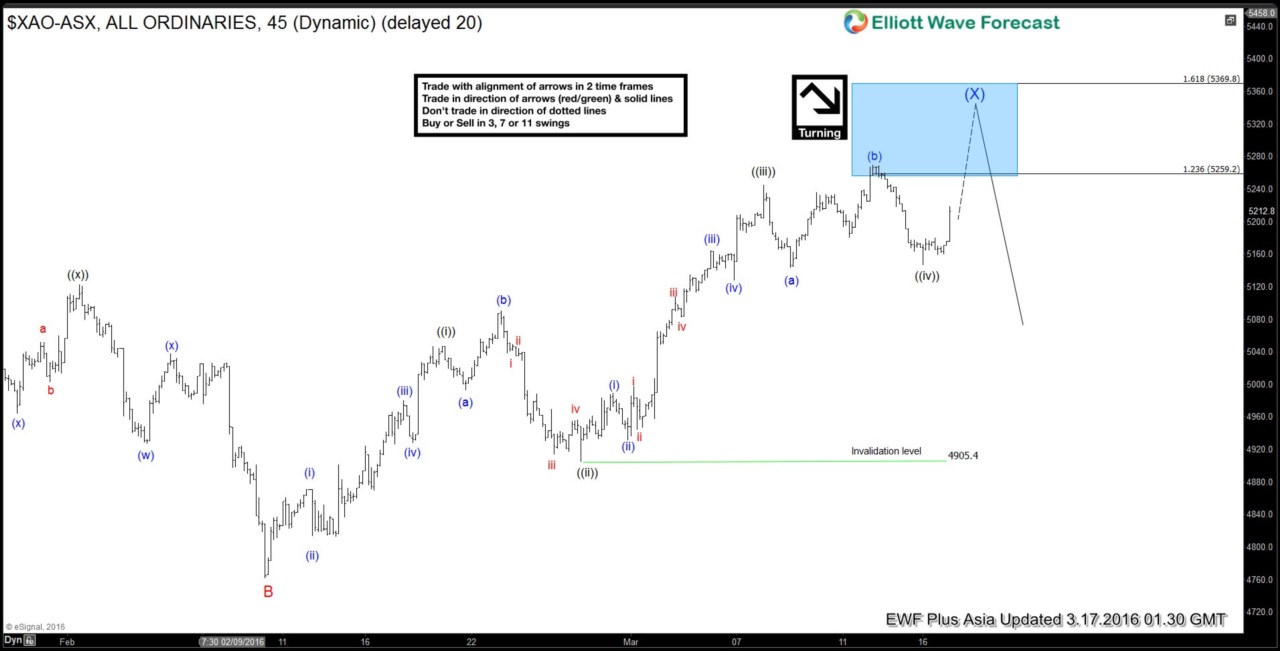

ASX All Ordinary Short-term Elliott Wave Analysis 3.18.2016

Read MoreShort term Elliottwave structure suggests wave C rally from 2/10 low is unfolding as 5 waves where wave ((i)) ended at 5047.1, wave ((ii)) ended at 4905.5, wave ((iii)) ended at 5245, and wave ((iv)) ended at 5147.4. While Index stays above 5147.4, and more importantly as far as wave ((ii)) low at 4905.4 stays intact, Index is […]

-

ASX All Ordinary Short-term Elliott Wave Analysis 3.17.2016

Read MoreShort term Elliottwave structure suggests wave C rally from 2/10 low is unfolding as 5 waves where wave ((i)) ended at 5047.1, wave ((ii)) ended at 4905.5, wave ((iii)) ended at 5245, and wave ((iv)) ended at 5147.4. While Index stays above 5147.4, and more importantly as far as wave ((ii)) low at 4905.4 stays intact, Index is […]