-

USDCAD Elliott Wave View: Extending Higher

Read MoreShort term Elliott Wave view in USDCAD suggest the decline to 1.322 ended Intermediate wave (X). The rally from there is unfolding as a double three Elliott Wave structure where Minute wave ((w)) ended at 1.3525 and Minute wave ((x)) ended at 1.3406. Minute wave ((w)) is subdivided as a Flat Elliott wave structure where Minutte […]

-

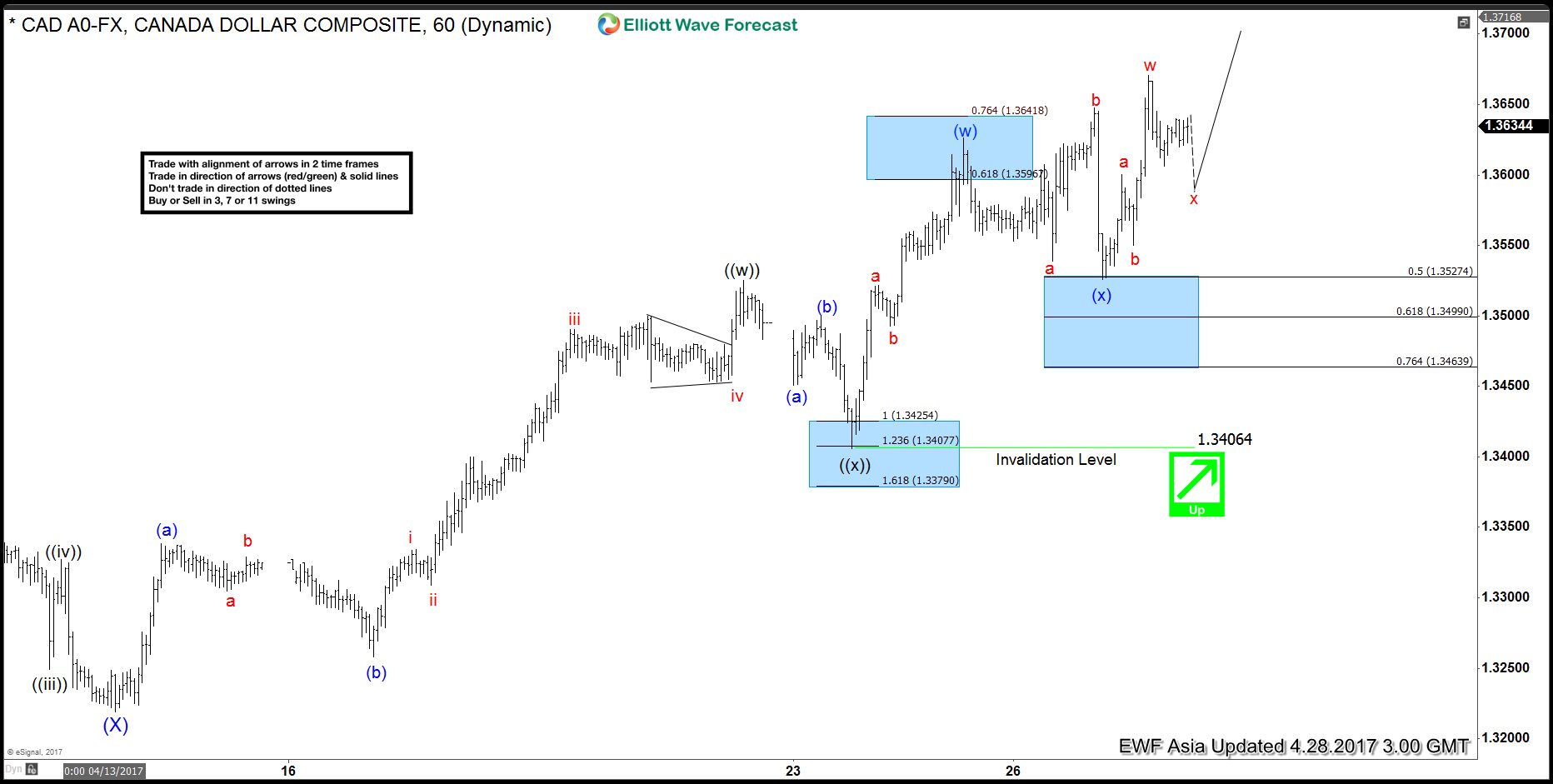

USDCAD Elliott Wave View: Flat correction

Read MoreShort term Elliott Wave view in USDCAD suggest the decline to 1.322 ended Intermediate wave (X). The rally from there is unfolding as a double three Elliott Wave structure where Minute wave ((w)) ended at 1.3525 and Minute wave ((x)) ended at 1.3406. Minute wave ((w)) is subdivided as a Flat Elliott wave structure where Minutte […]

-

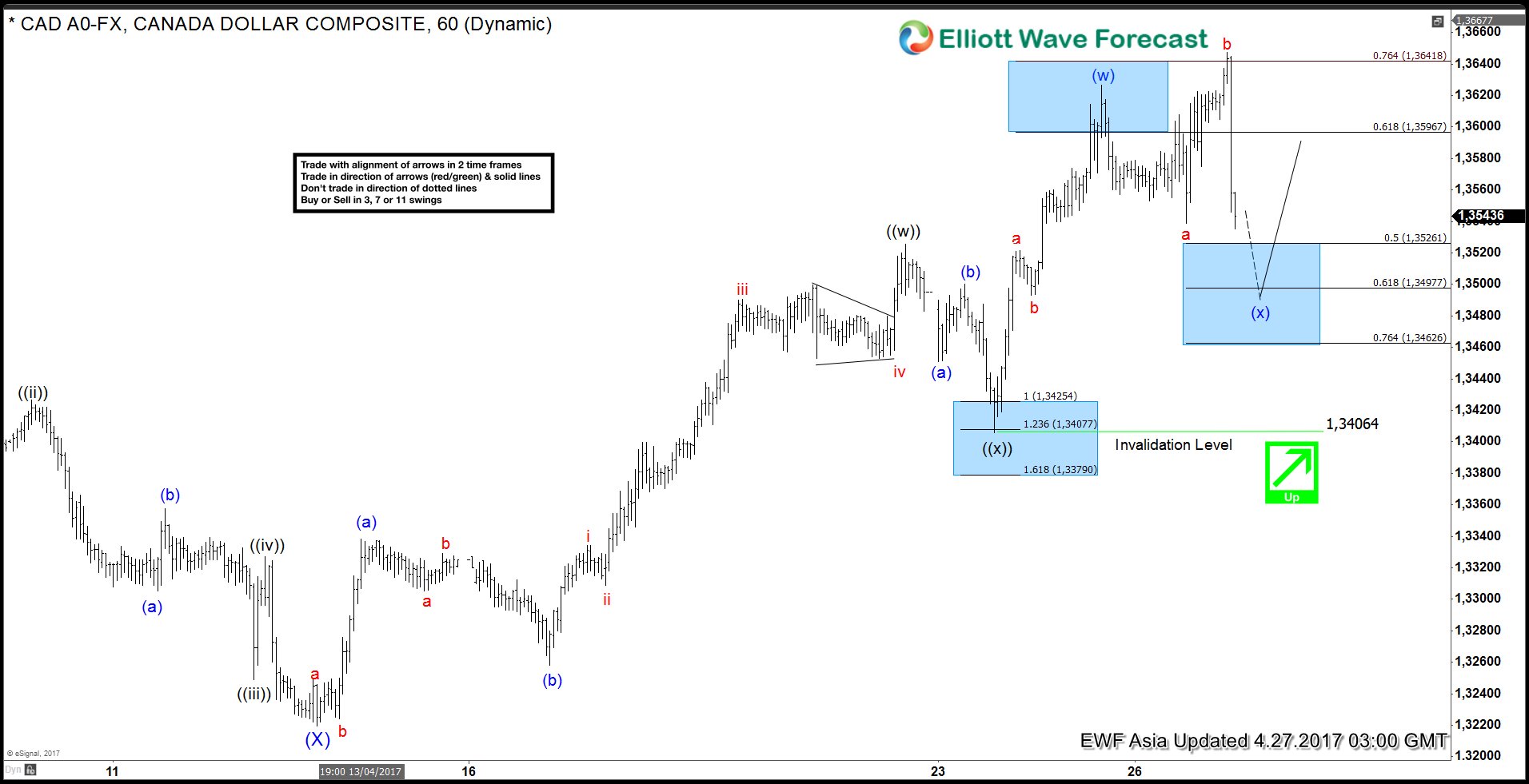

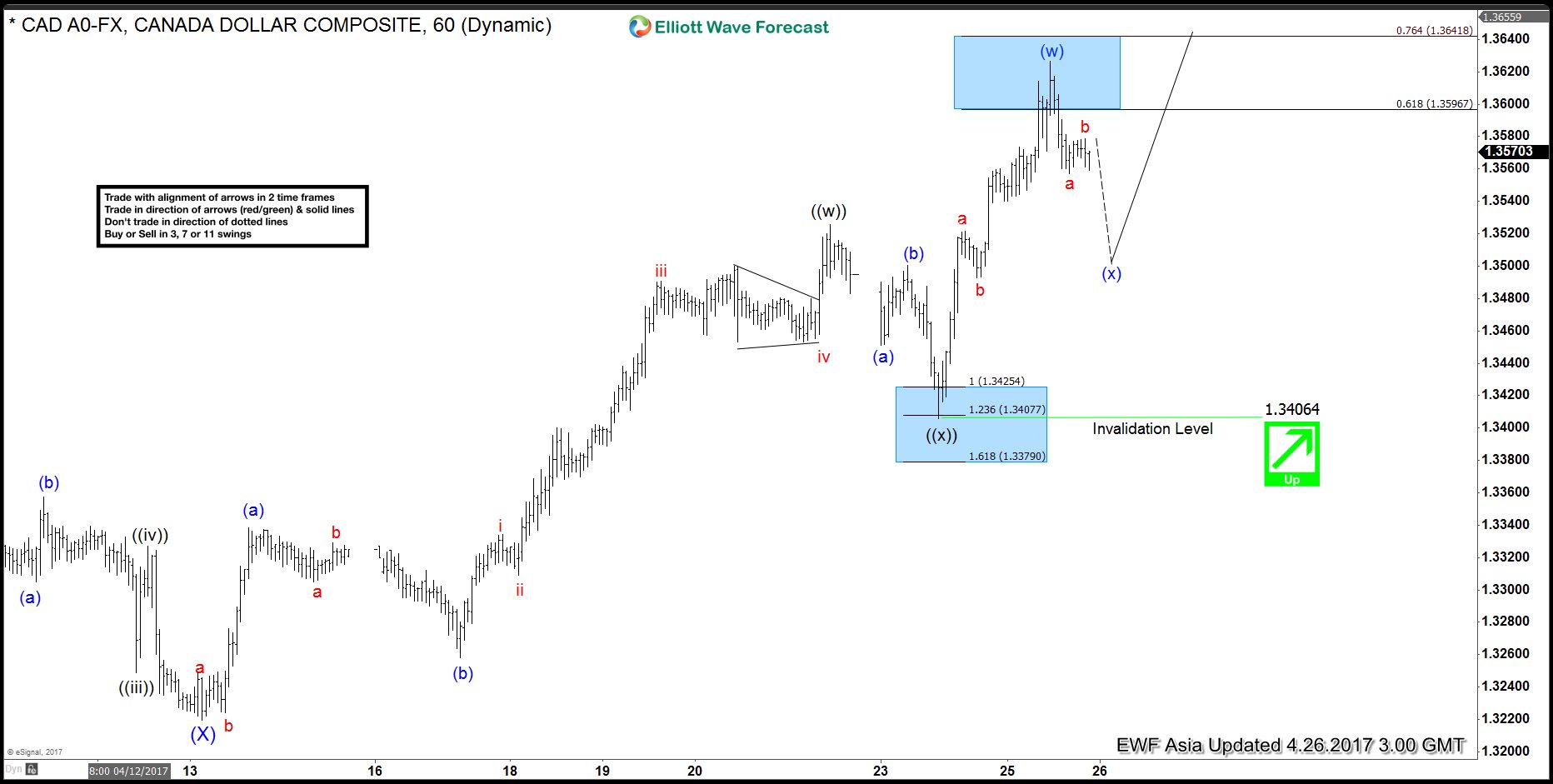

USDCAD Elliott Wave View: More Upside

Read MoreShort term Elliott Wave view in USDCAD suggest the decline to 1.322 ended Intermediate wave (X). Revised view suggests that the rally from there is unfolding as a double three Elliott Wave structure where Minute wave ((w)) ended at 1.3525 and Minute wave ((x)) ended at 1.3406. Minute wave ((w)) is subdivided as a Flat Elliott […]

-

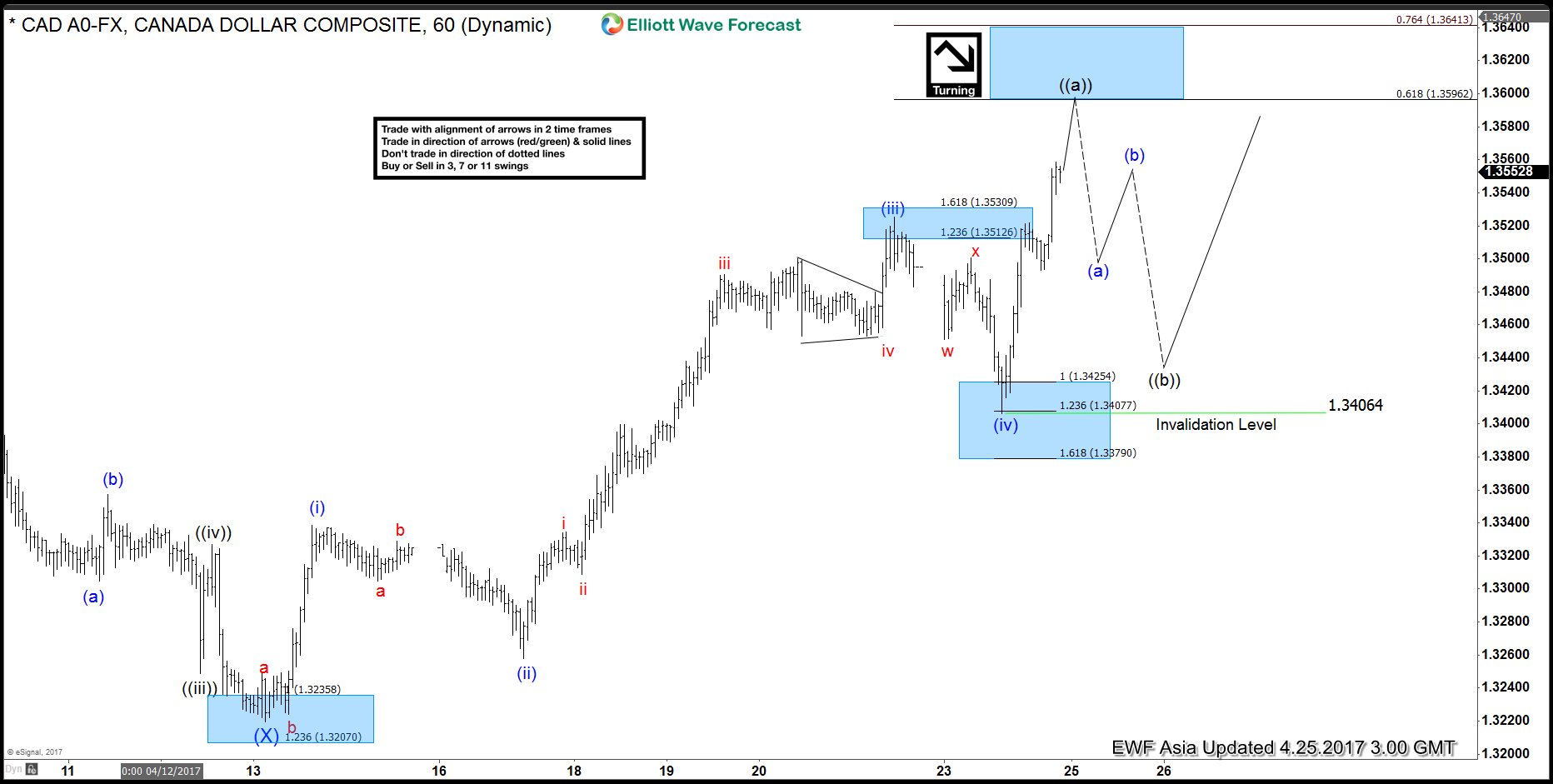

USDCAD Elliott Wave Analysis: Ending an impulse

Read MoreShort term Elliott Wave view in USDCAD suggest the decline to 1.322 ended Intermediate wave (X). Up from there, the pair is showing 5 waves impulse structure where Minutte wave (i) ended at 1.3338, Minutte wave (ii) ended at 1.3258, Minutte wave (iii) ended at 1.3525, and Minutte wave (iv) ended at 1.3406. Near term focus is on […]

-

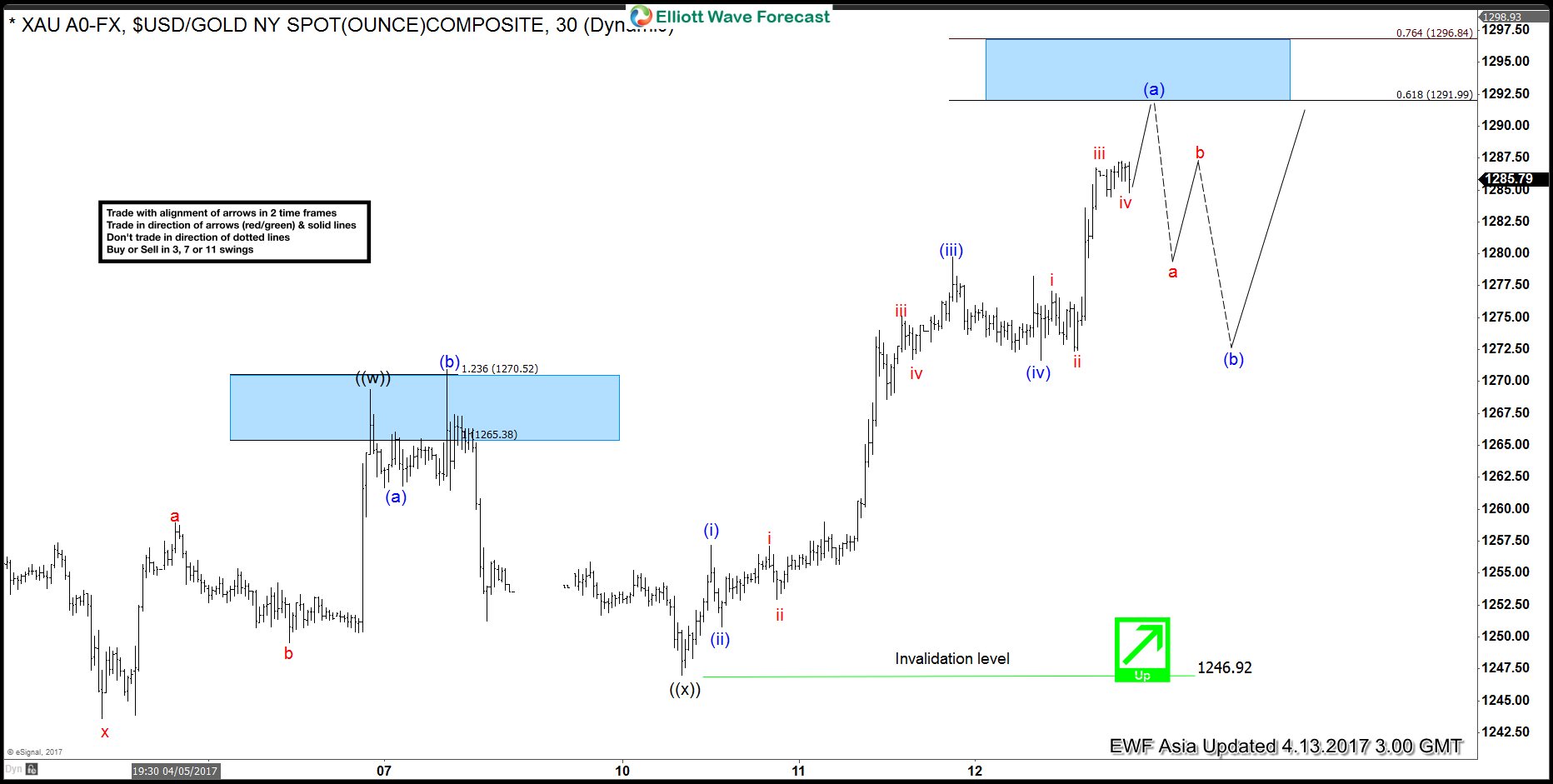

Gold Elliott Wave View : Ending Impulse

Read MoreShort term Elliott Wave view in Gold ( XAUUSD ) suggests that cycle from 4/10 low (1246.92) is unfolding as an impulse Elliott wave structure where Minutte wave ((i)) ended at 1257.2, Minutte wave (ii) ended at 1250.8, Minute wave (iii) ended at 1279.75, Minute wave (iv) ended at 1271.69 and Minute wave (v) of (a) is in progress […]

-

CL_F Elliott Wave View: Mature Cycle 04/12/17 – Elliott Wave Forecast

Read MoreShort term Elliott Wave view in Crude Oil (CL_F) suggests that cycle from 3/22 low (47.01) is unfolding as a double three Elliott wave structure where Minute wave ((w)) ended at 50.85 and Minute wave ((x)) ended at 49.88. Minute wave ((y)) is in progress and the internal is unfolding also as a double three Elliott wave […]