-

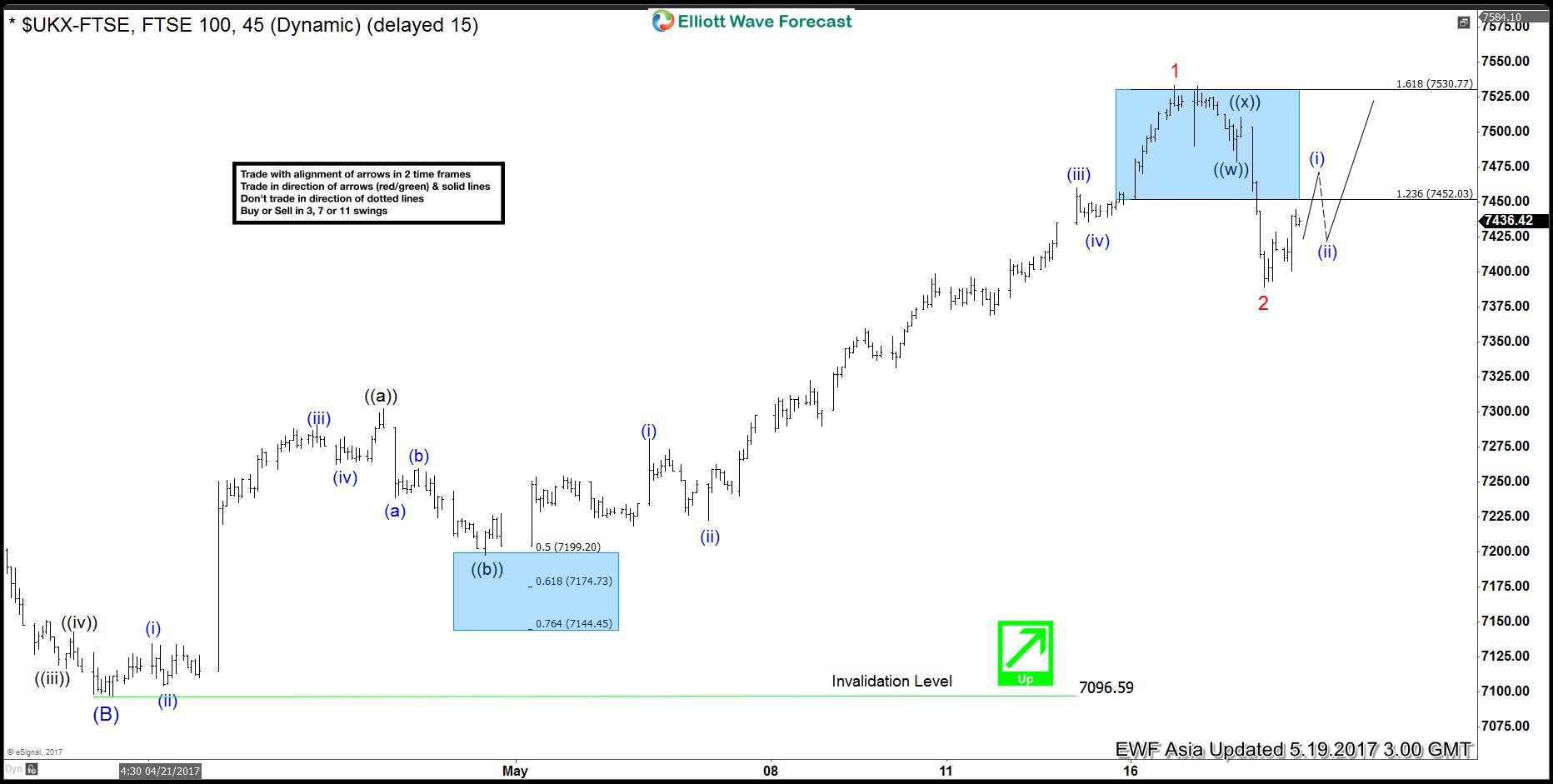

FTSE Elliott Wave View: Extending Higher

Read MoreShort Term Elliott Wave view in FTSE suggests the rally from 4/20 low (7096.6) is unfolding as a zigzag Elliott Wave structure where Minute wave ((a)) ended at 7302.57 and Minute wave ((b)) ended at 7197.28. Subdivision of Minute wave ((a)) unfolded as an impulse where Minuttte wave (i) ended at 7134.53, Minutte wave (ii) ended at 7104.22, […]

-

WXY and ABC Elliott Wave Structure : Key Differences

Read MoreIn the video below, we explain the wxy Elliott Wave structure, often called a double three, double correction, or 7 swing Elliott Wave structure. We also compare this wxy structure with abc structure, explaining the similarities and differences. Double Three Elliott Wave Structure (WXY) A double three structure, or also called a double correction, or […]

-

FTSE 100 Index Elliott Wave: Correction Ended

Read MoreShort Term Elliott Wave view in FTSE 100 Index suggests the rally from 4/20 low (7096.6) is unfolding as a zigzag Elliott Wave structure where Minute wave ((a)) ended at 7302.57 and Minute wave ((b)) ended at 7197.28. Subdivision of Minute wave ((a)) is unfolding as an impulse where Minuttte wave (i) ended at 7134.53, Minutte wave (ii) […]

-

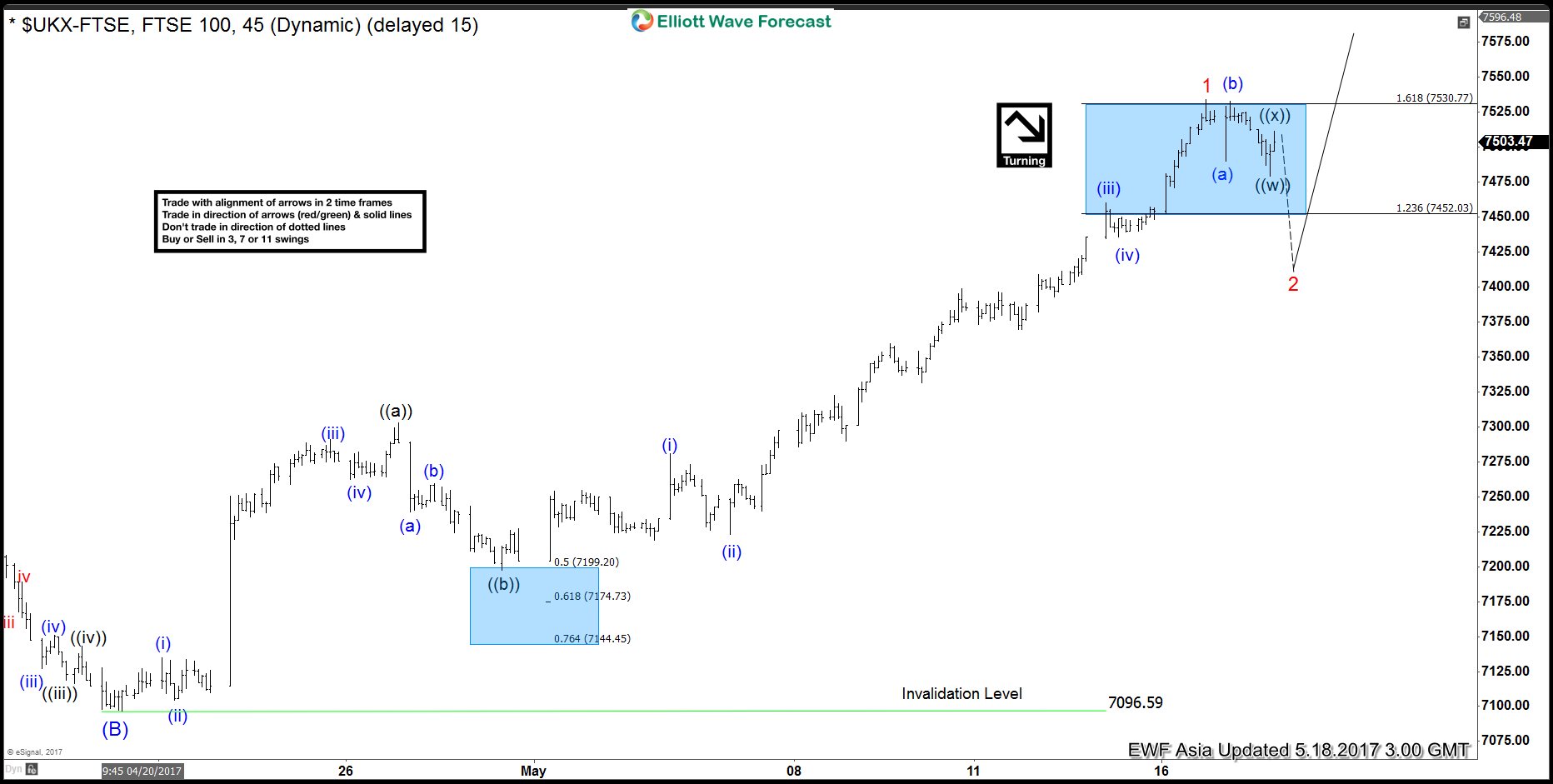

FTSE 100 Elliott Wave View: Turning Lower

Read MoreShort Term Elliott Wave view in FTSE 100 suggests the rally from 4/20 low (7096.6) is unfolding as a zigzag Elliott Wave structure where Minute wave ((a)) ended at 7302.57 and Minute wave ((b)) ended at 7197.28. Subdivision of Minute wave ((a)) is unfolding as an impulse where Minuttte wave (i) ended at 7134.53, Minutte wave (ii) ended […]

-

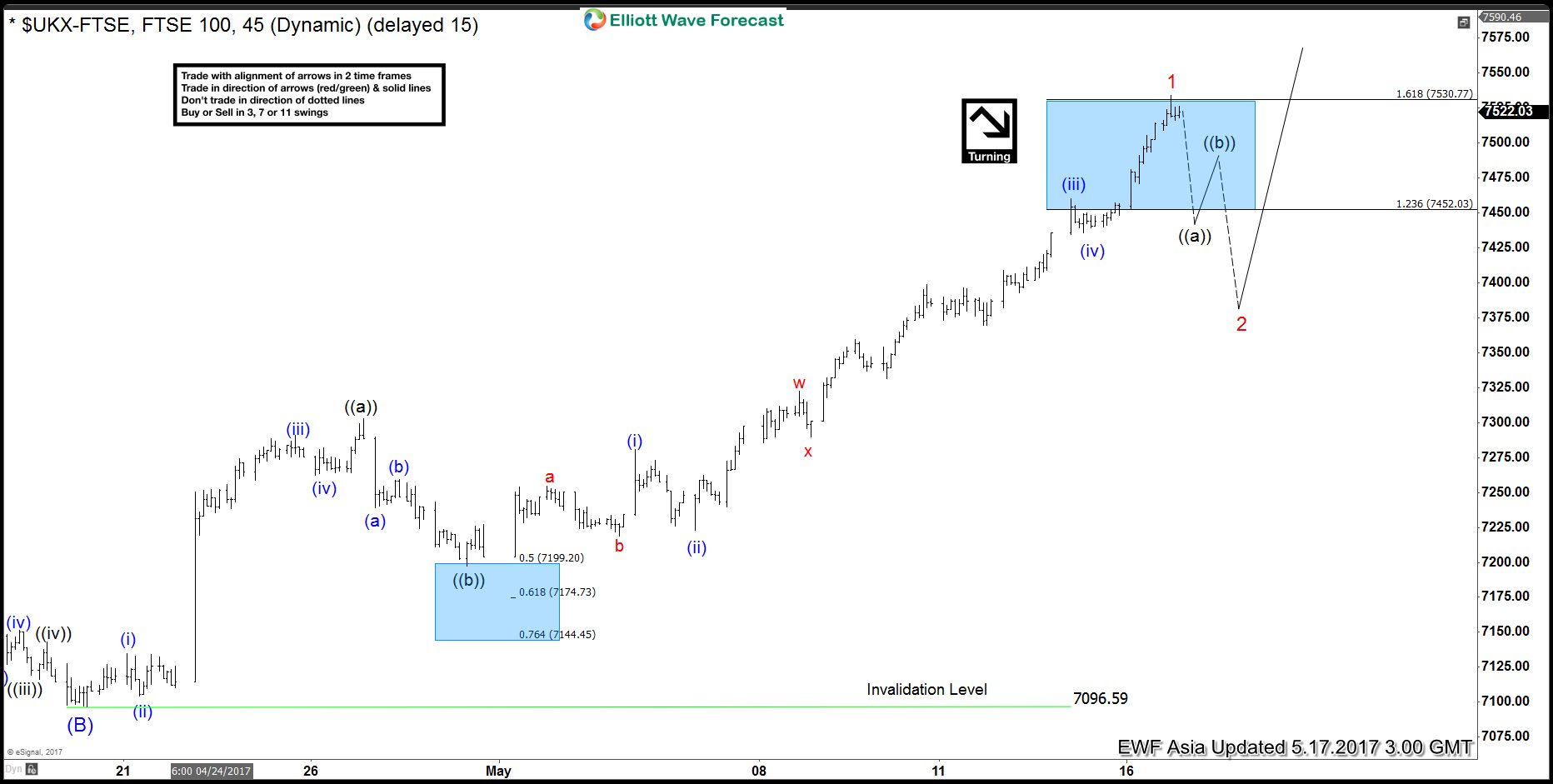

FTSE Index Elliott Wave View: Ending A Cycle

Read MoreShort Term Elliott Wave view in FTSE Index suggests the rally from 4/20 low (7096.6) is unfolding as a zigzag Elliott Wave structure where Minute wave ((a)) ended at 7302.57 and Minute wave ((b)) ended at 7197.28. Subdivision of Minute wave ((a)) is unfolding as an impulse where Minuttte wave (i) ended at 7134.53, Minutte wave (ii) ended […]

-

FTSE Elliott Wave View: Mature Cycle

Read MoreShort Term Elliott Wave view in FTSE suggests the rally from 4/20 low (7096.6) is unfolding as a zigzag Elliott Wave structure where Minute wave ((a)) ended at 7302.57 and Minute wave ((b)) ended at 7197.28. Subdivision of Minute wave ((a)) is unfolding as an impulse where Minuttte wave (i) ended at 7134.53, Minutte wave (ii) ended at […]