-

Elliott Wave View: DAX Structure Remains Bullish As Pullback In Progress

Read MoreThis article and video explains the short term Elliott Wave path for DAX. The Index remains bullish and dips should find buyers in 3, 7, or 11 swing.

-

Elliott Wave View: Further Strength in EURAUD

Read MoreThis article and video explains the short term Elliott Wave path for EURAUD. Pair is expected to continue higher to end 5 waves diagonal from Feb 21 low.

-

Elliott Wave View: S&P 500 (SPX) Correction Should Find Buyers Again

Read MoreThis article and video explain the short term Elliottwave path for S&P 500 (SPX). The Index is in wave ((4)) correction but should find buyers again for more upside.

-

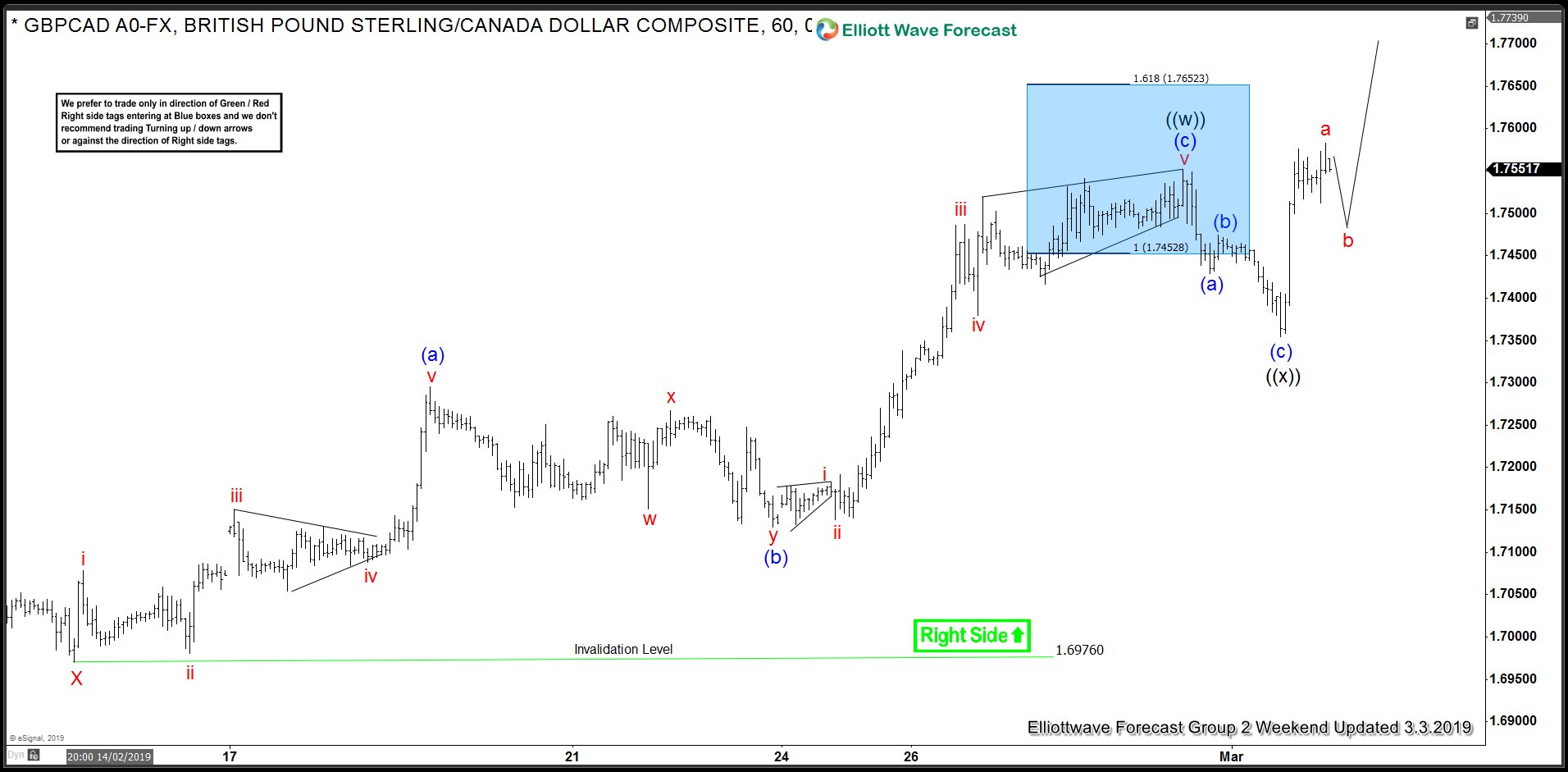

Bleak Canada’s GDP Pummeled Loonie

Read MoreCanada’s Dollar slumped last Friday due to worse-than-expected gross domestic product data. Canada’s economy practically grinds to a halt at the end of 2018. Real GDP grew by just 0.1 percent in the fourth quarter of 2018. This equals to 0.4% annualized rate, which is significantly lower than analyst expectations of around 1%. This is […]

-

Elliott Wave View: Short Term Bullish in Alibaba

Read MoreThis article & video explains the short term Elliott Wave path of Alibaba. The Stock is still missing 100% extension from Jan 2019 low favoring more upside.

-

Elliott Wave View: Crude Oil on the Verge of a Breakout

Read MoreThis article and video explains the short term Elliott Wave path of Oil. Oil is on the verge of a breakout to the upside & soon will get confirmation.