-

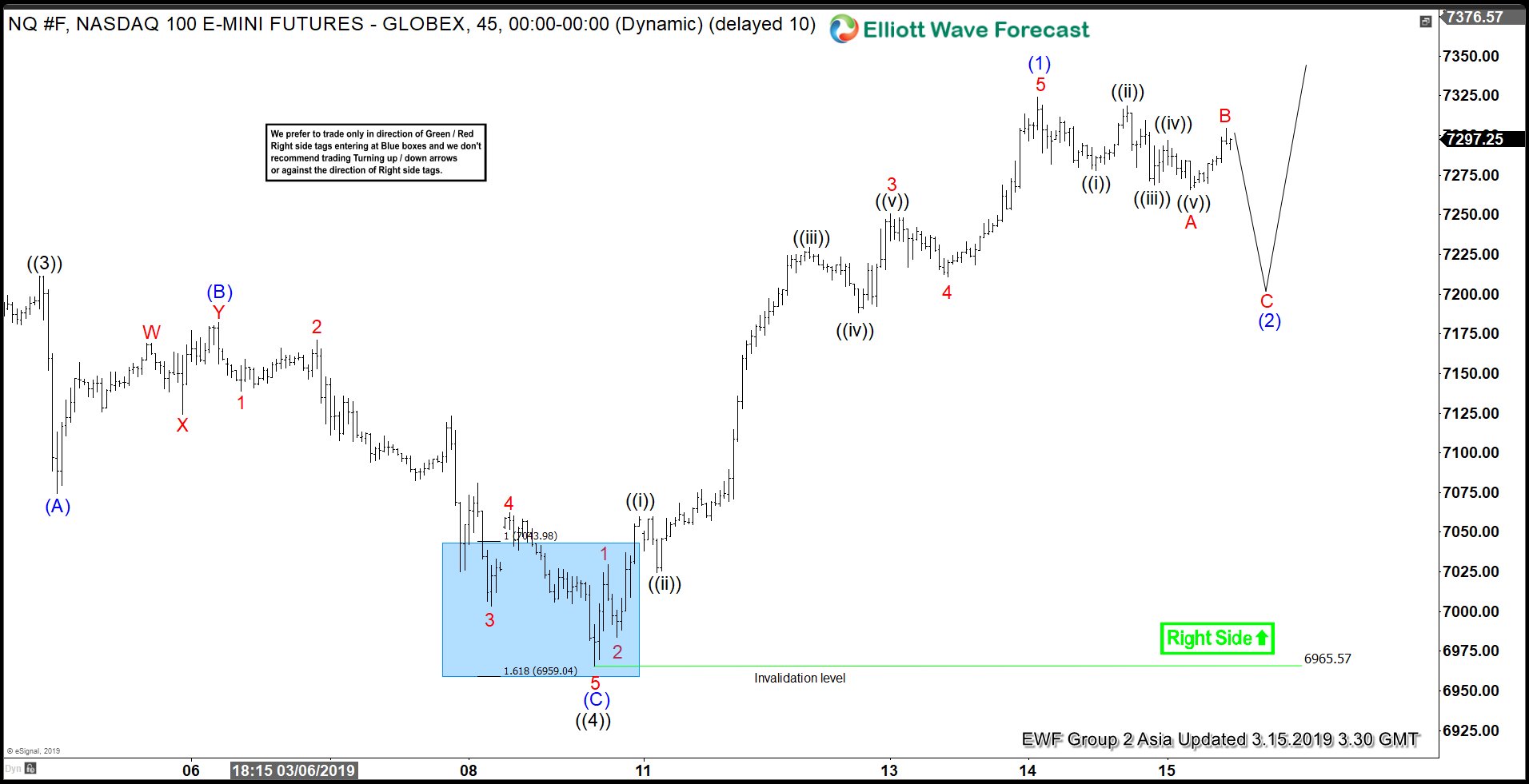

Elliott Wave View: Nasdaq Correction In Progress

Read MoreThis article and video explains the short term Elliott Wave path for Nasdaq. The Index is correcting cycle from March 8 low and more upside can be seen once the pullback is complete.

-

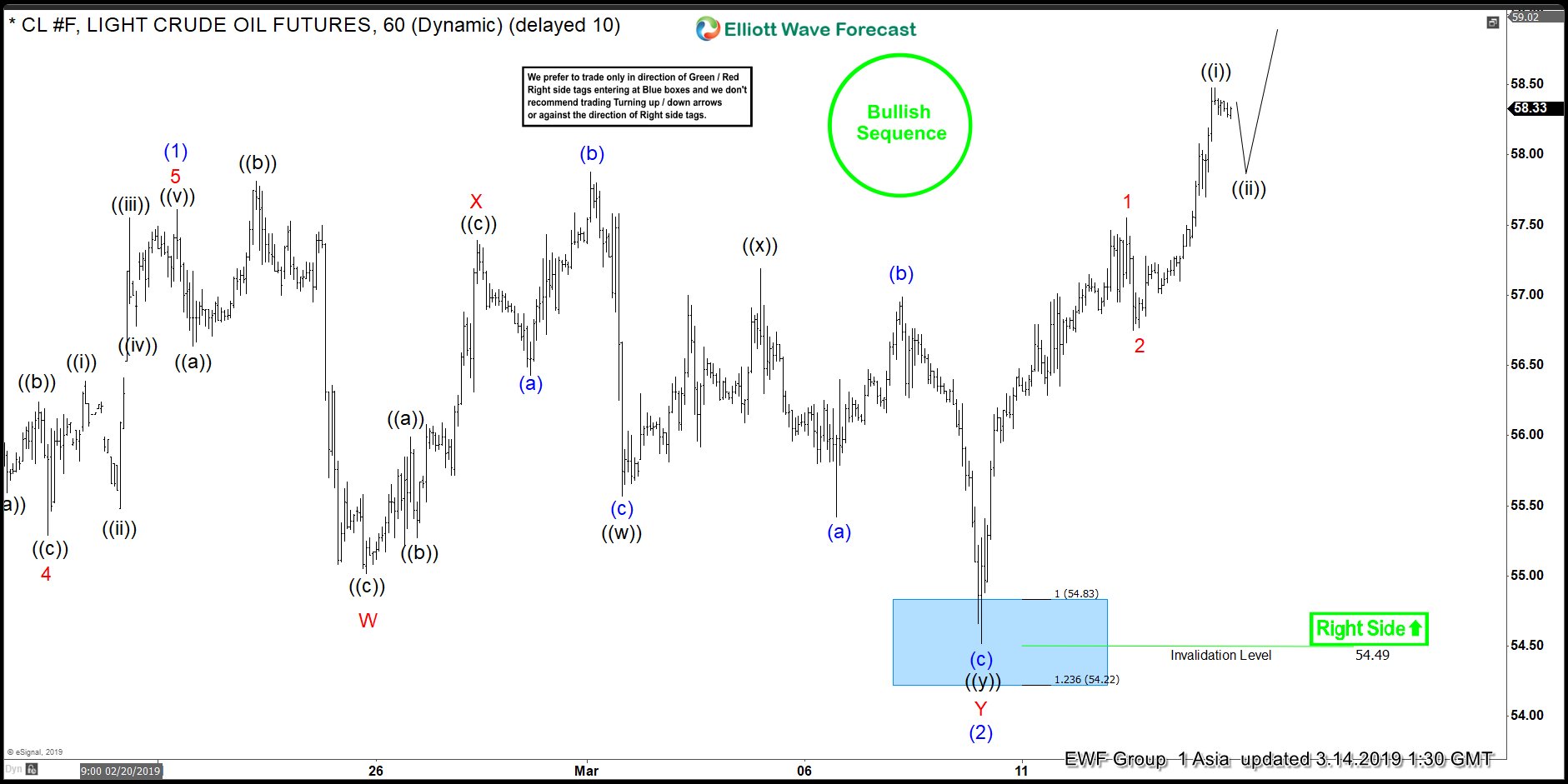

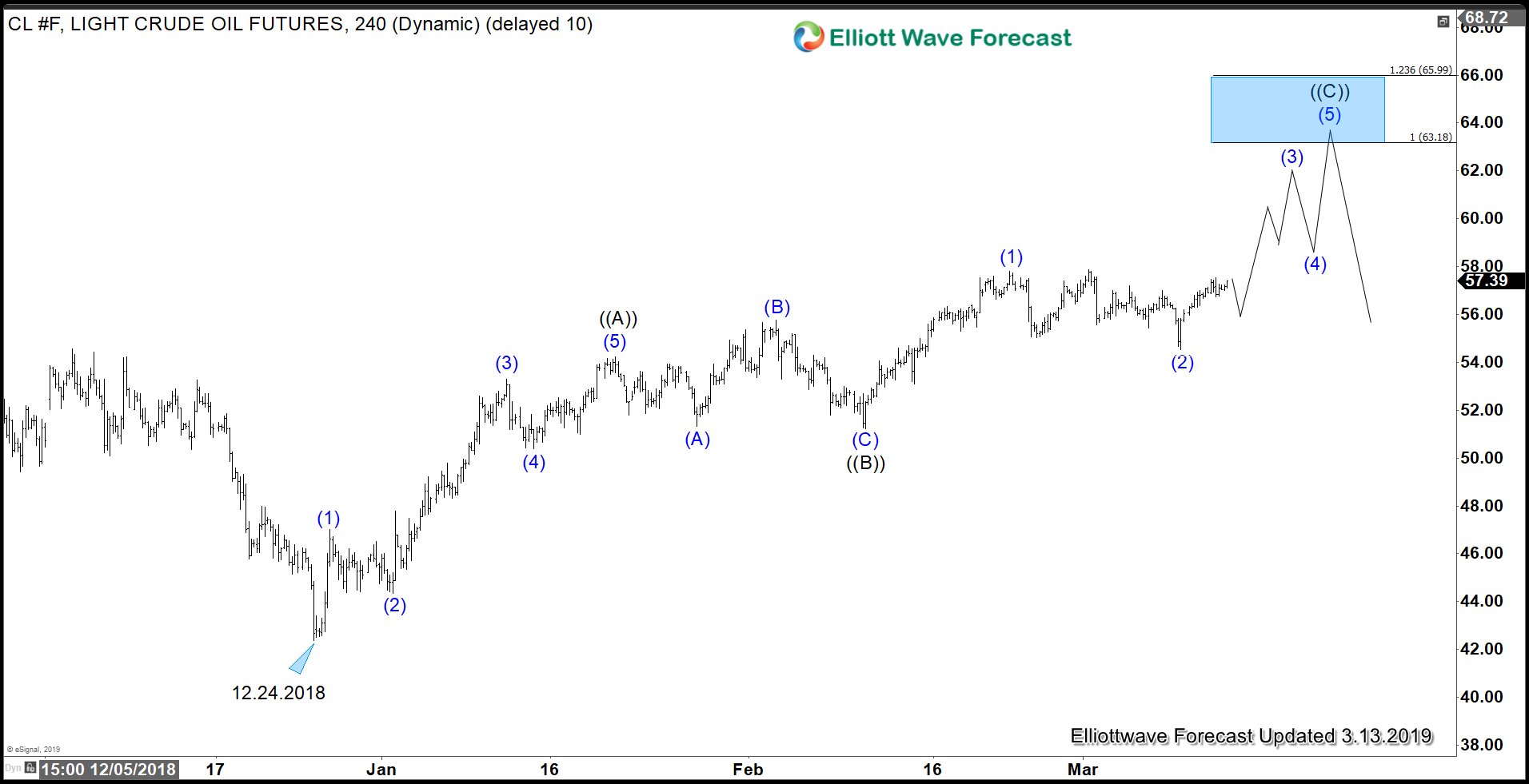

Elliott Wave View: Crude Oil Breakout In Progress

Read MoreOil has broken above March 1 high to suggest that the next bullish leg is underway. This article & video explains the Elliott Wave path of Oil.

-

OPEC Supply Cuts Continue To Support Oil Prices

Read MoreOil prices rose 1 percent on Monday after Saudi Arabia reiterated that OPEC will continue to maintain the production curb. Riyadh plans to keep output well below 10 million barrels per day and reduces export to below 7 million barrels a day. Saudi’s Minister has said it’s too early to change the policy until at […]

-

Elliott Wave View: Gold Can See Profit Taking

Read MoreGold is correcting cycle from August 2018 low & another leg lower can’t be ruled out. This article & video explains the short term Elliott Wave path.

-

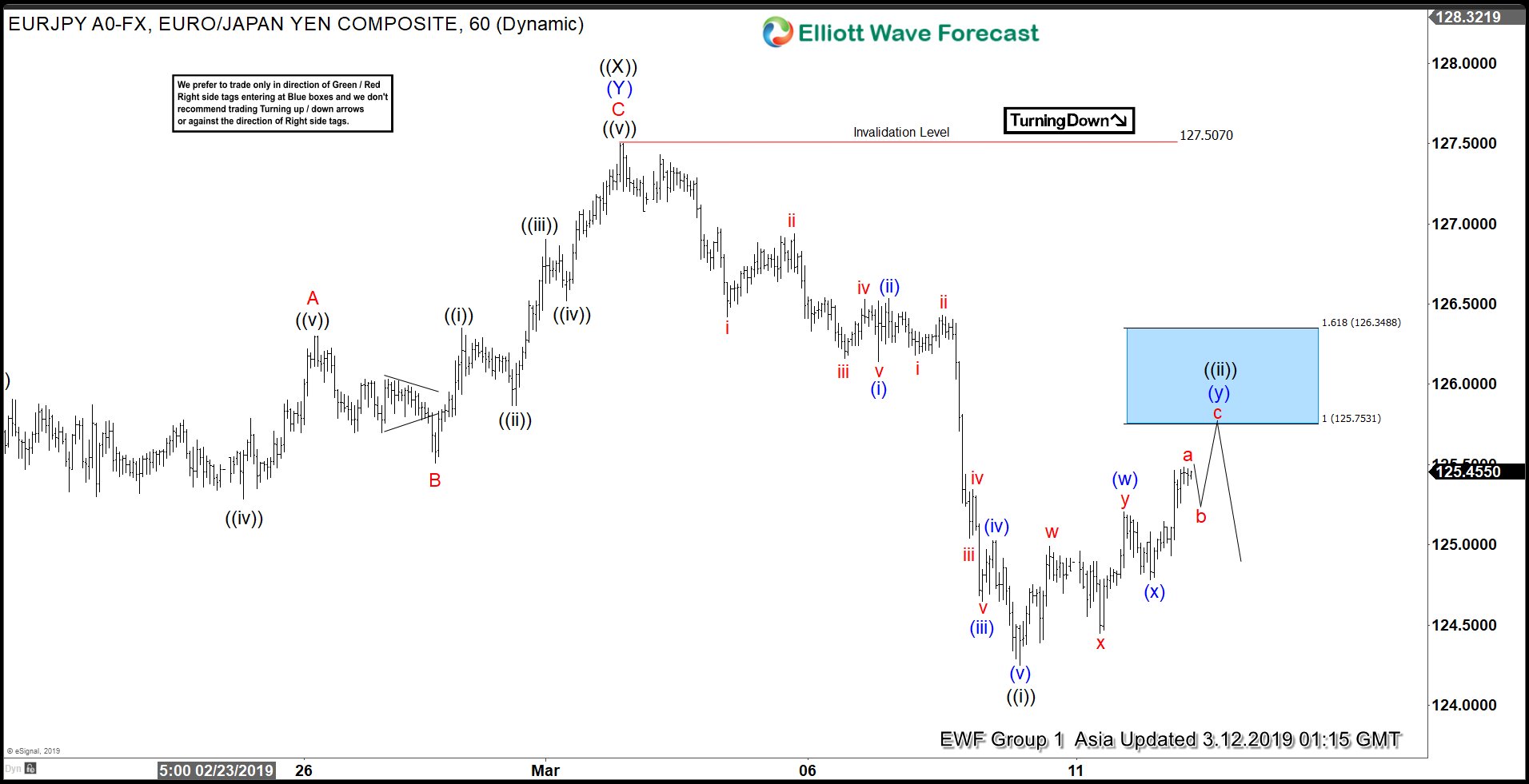

Elliott Wave View: EURJPY Should Extend Lower

Read More$EURJPY has ended cycle from Jan 2019 low, and pair can be in early process of turning lower. This article and video explains the Elliott Wave path.

-

Elliott Wave View: EURUSD Breaks Down After ECB Meeting. What’s Next?

Read MoreThis article and video explains the short term Elliott Wave path for EURUSD. The pair now shows bearish sequence favoring further downside.