-

Elliott Wave View: GBPUSD Impulse Looking for Further Upside

Read MoreGBPUSD shows a 5 waves impulse structure from June 18 low favoring more upside. This article and video shows the short term Elliott Wave path.

-

Elliott Wave View: Coffee Shows Bullish Sequence

Read MoreCoffee shows a 5 swing sequence from April 17 low favoring further upside. This article & video shows the Elliott Wave path.

-

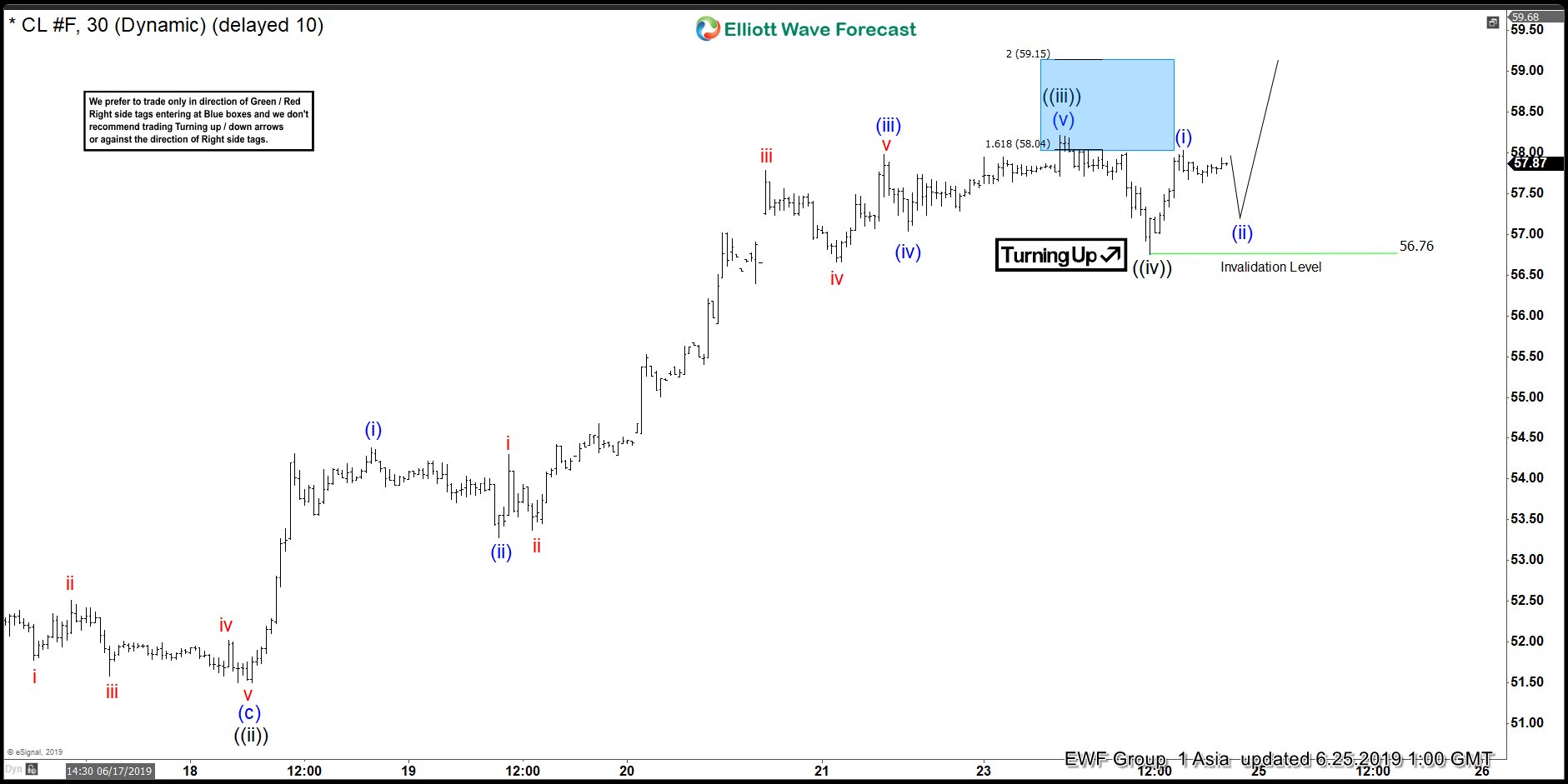

Oil Elliott Wave View: Impulsive Rally in Progress

Read MoreOil rallies impulsively from June 5 low & extension higher is expected. This article & video show short term Elliot Wave path.

-

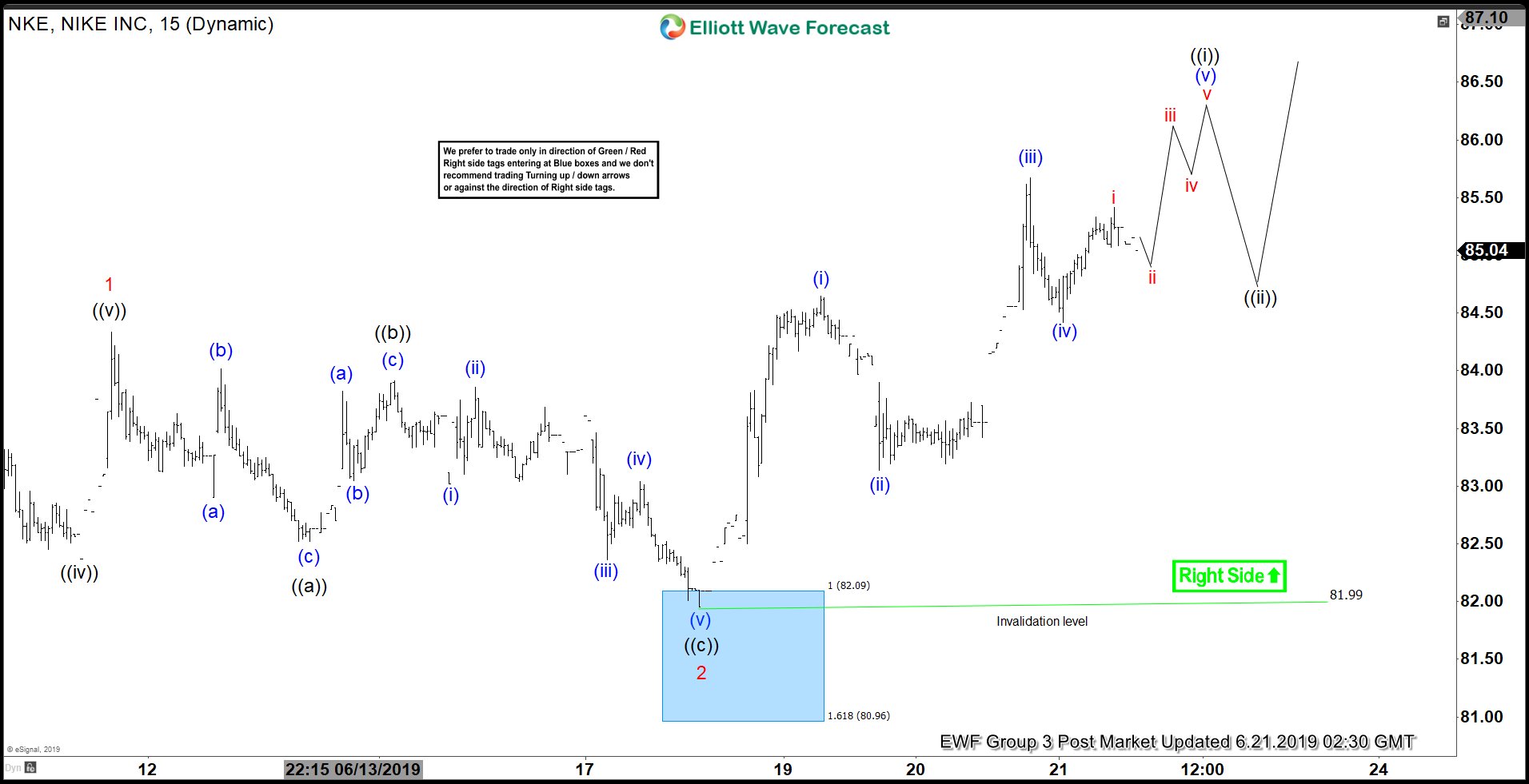

Elliott Wave View: Nike Resumes Rally Higher

Read MoreNike has resumed the rally higher. As far as dips stay above June 18, it can extend higher. This article & video looks at the short term Elliott Wave path.

-

Elliott Wave View Calling for More Upside in Nasdaq

Read MoreNasdaq Futures (NQ_F) shows a higher high sequence from June 4 low, favoring further upside. Short term, rally to 7600.75 ended wave (1) and pullback to 7421.48 ended wave (2). Wave (3) rally is in progress as an impulse Elliott Wave structure. Up from 7421.48, wave ((i)) ended at 7536 and wave ((ii)) pullback ended […]

-

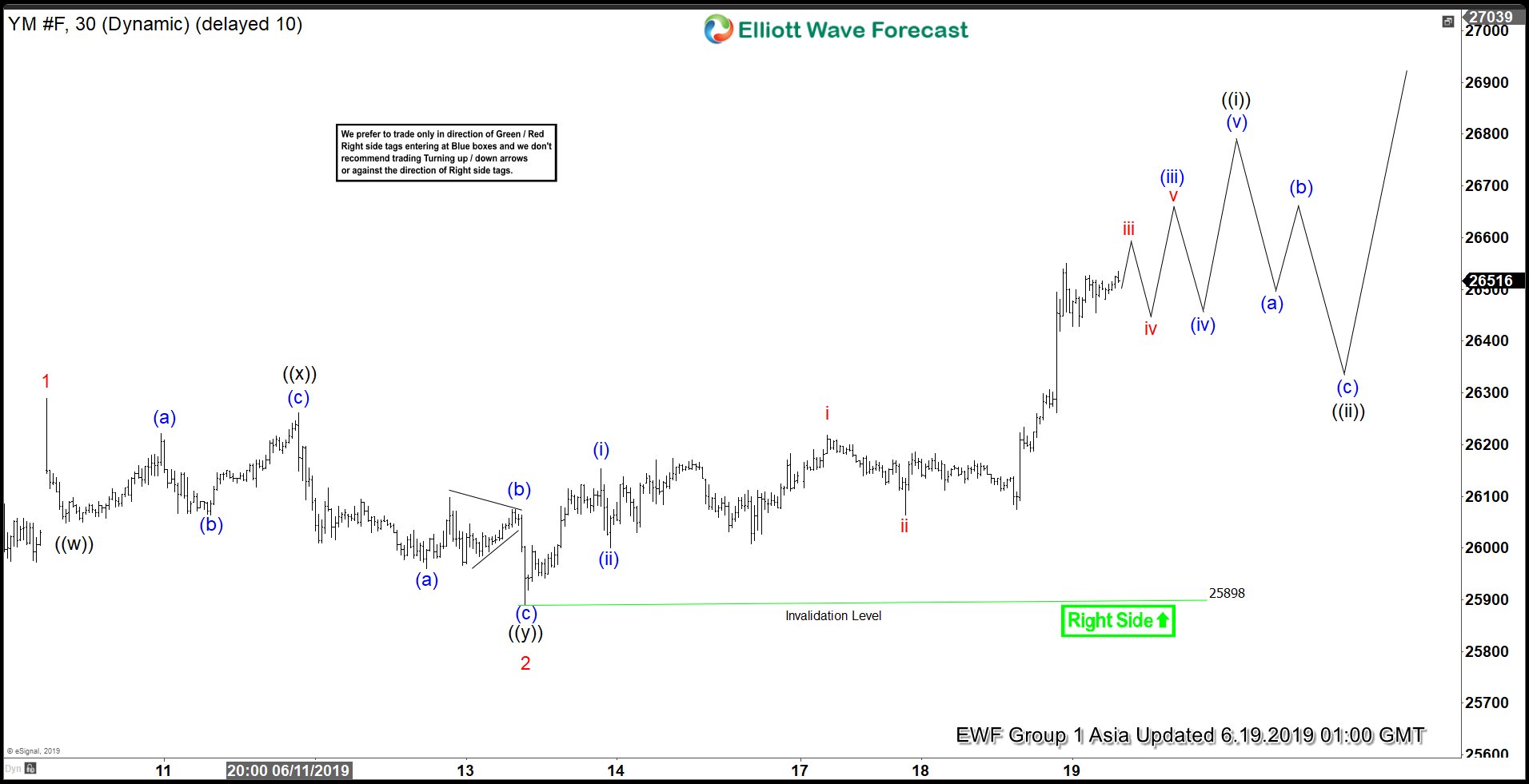

Elliott Wave View: Dow Jones Futures (YM_F) Has Resumed Higher

Read MoreDow Jones Futures (YM_F) shows incomplete sequence from June 3 low favoring more upside. This article and video shows the Elliott Wave path.