-

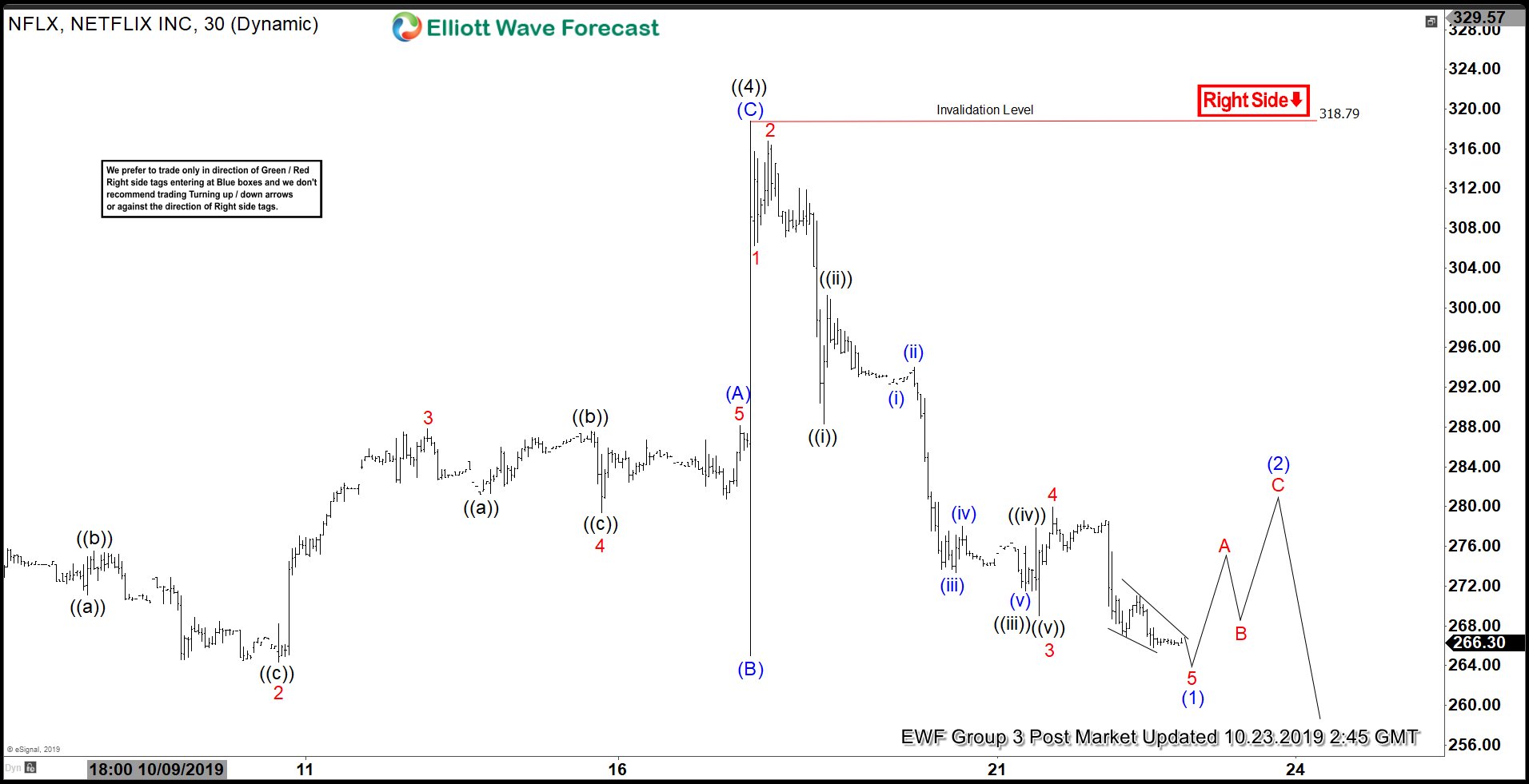

Elliott Wave View: Netflix Looking to Resume Lower

Read MoreShort Term Elliott Wave view on Netflix (Ticker: NFLX) suggests that the spike to $318.79 on October 17, 2019 ended wave ((4)). Internal subdivision of wave ((4)) unfolded as a zigzag Elliott Wave structure where wave (A) ended at 288.17, wave (B) ended at 265, and wave (C) ended at 318.79. Since then, the stock […]

-

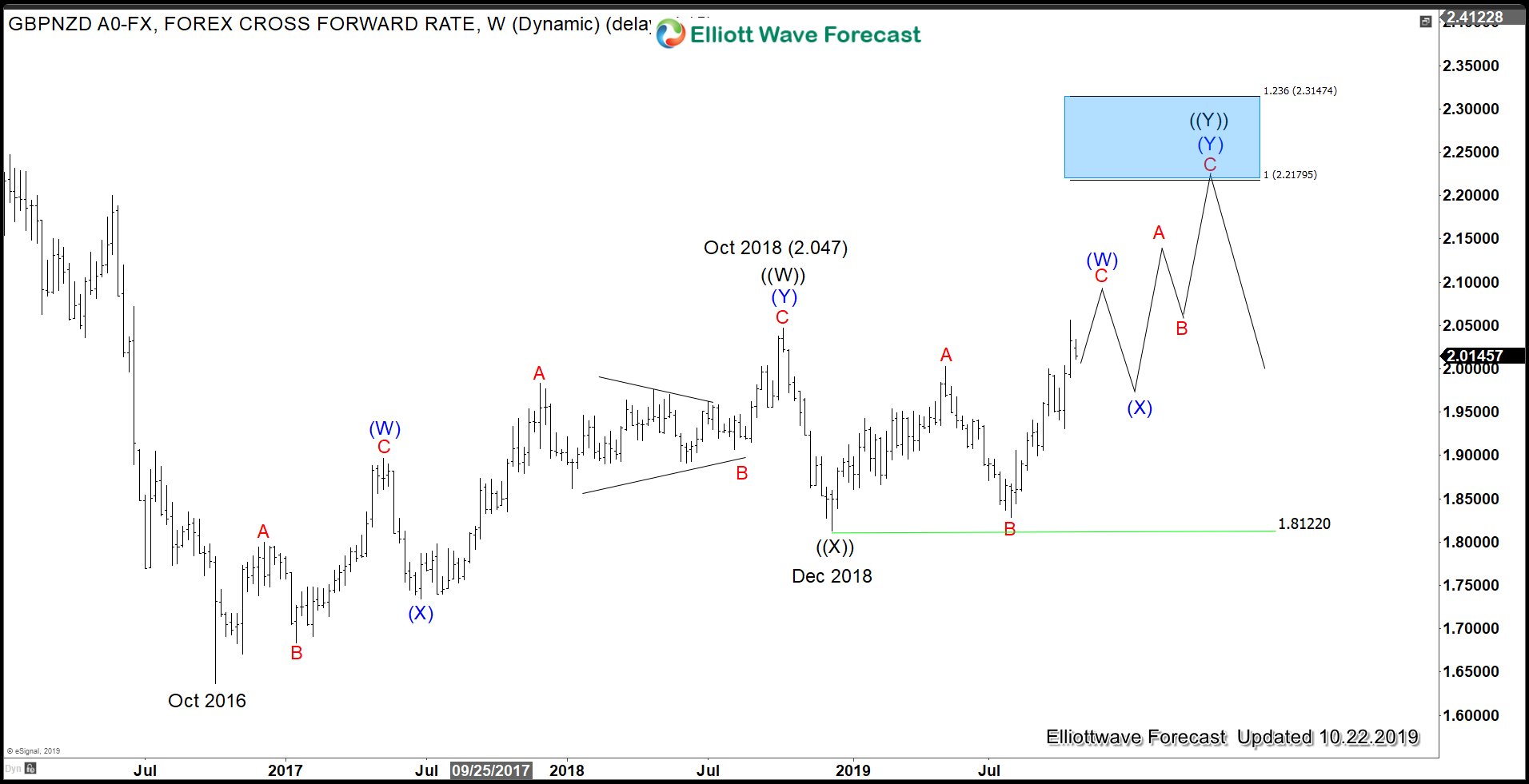

GBPNZD and GBPAUD Elliott Wave Outlook in Crucial Brexit Final Weeks

Read MoreUK Prime Minister Boris Johnson successfully negotiated a new Brexit deal with EU. However, last Saturday the Members of Parliament (MP) rejected his campaign to take Britain out of the EU by the end of the month. Mr. Johnson was instead forced to seek an extension that he had vowed never to pursue. Mr. Johnson […]

-

Elliott Wave View: Nasdaq Pullback Should Continue To Find Support

Read MoreNasdaq shows a bullish sequence from August 6, 2019 low favoring more upside. Near term, while pullback stays above 7480, expect Index to extend higher.

-

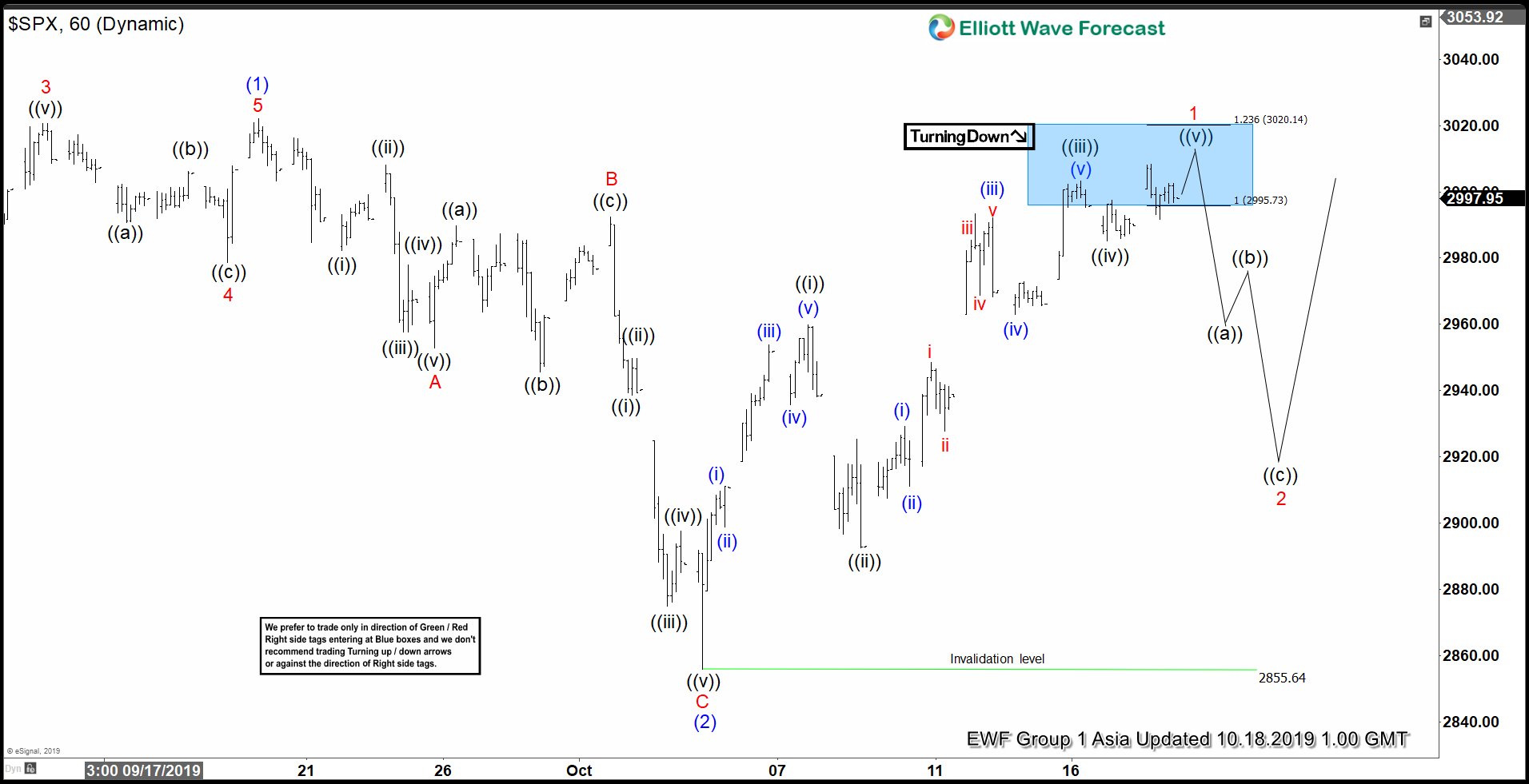

Elliott Wave View: S&P 500 (SPX) Looking to Break to All Time High

Read MoreS&P 500 (SPX) has been sideways since January 2018 and it’s also sideways more recently since July 26 high. After forming peak at January 22, 2018 at 2872, the Index managed to make two more marginal highs. However, each time, the new marginal high lose the momentum and pullback again. Current short term outlook suggests […]

-

Elliott Wave View: BAC Starts the Next Leg Higher

Read MoreBank of America (ticker: BAC) shows an Elliott Wave bullish sequence from August 15, 2019 low, favoring further upside. The decline to 27.19 ended wave (2) and the stock has resumed higher in wave (3). The internal of wave (3) is unfolding as a 5 waves impulse Elliott Wave structure where wave 1 of (3) is […]

-

Elliott Wave View: Nikkei Buyers in Control

Read MoreNikkei shows Elliott Wave bullish sequence from December 26, 2018 low and August 26, 2019 low. This suggests that buyers are in control and favors further upside in the Index. The pullback to 21079 ended wave ((2)) and the Index has resumed higher in wave ((3)). Internal subdivision of wave ((3)) takes the form of […]