-

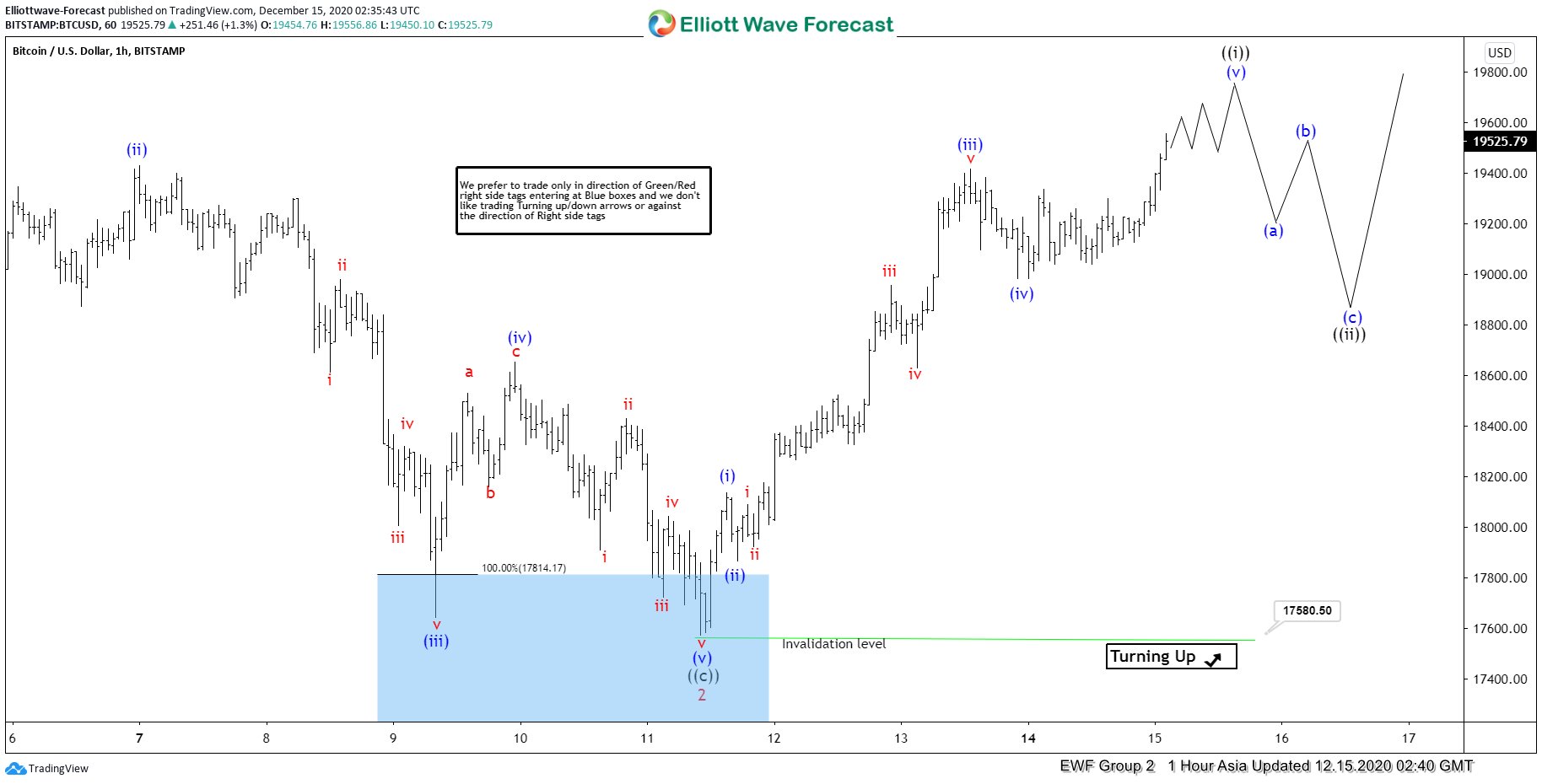

Elliott Wave View: Bitcoin Should Continue To Extend Higher

Read MoreBitcoin continues its march to new all-time high. Pullback should be supported in 3, 7, or 11 swing. This article and video look at the Elliott Wave path.

-

Elliott Wave View: GBPAUD Looking for Further Downside

Read MoreGBPAUD is looking for more downside and rally should fail in 3, 7, 11 swing. This article and video look at the Elliott Wave path.

-

Elliott Wave View: Nike (NKE) Extending to New All-Time High

Read MoreNike (NKE) continues to make a new all-time high and cycle from Oct 30 low is incomplete. DIps should find support in 3, 7, or 11 swing.

-

How the Right Side and Correlation Help Improve Accuracy

Read MoreElliottwave-Forecast.com (EWF) approach to forecasting is unique compared to other services / wavers. Through years of experience, we have developed tools in addition to Elliott Wave to improve the forecasting accuracy. One of the chief complains with Elliott Wave is that the theory provides at least 1 if not more alternative count. The technique is […]

-

Elliott Wave View: S&P 500 (SPX) Pullback Should Be Supported

Read MoreSPX continues to be bullish against mid November low and pullback should be supported in 3, 7, 11 swing. This article and video look at Elliott wave path.

-

Post-Pandemic Future Demand Recovery Supports Oil

Read MoreThe news that Covid-19 vaccines will soon be available to fight the pandemic has boosted the global oil markets. Demand has plummeted since the start of the pandemic. Organization of the Petroleum Exporting Countries (OPEC) projects 2020 oil demand to be 9.8 million bpd (barrels per day) lower than 2019. In 2020, OPEC cut production […]