-

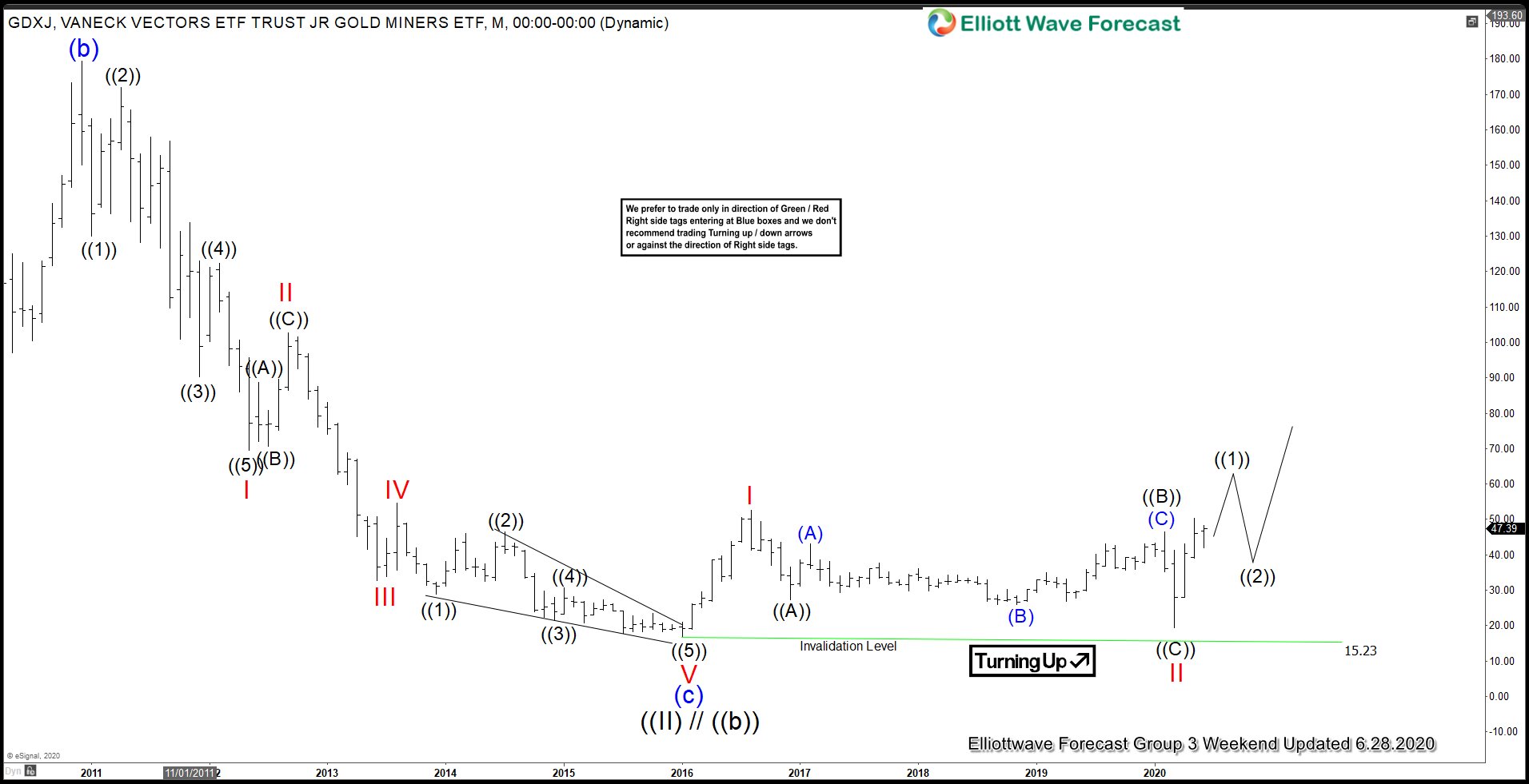

Gold Miners Junior (GDXJ) Breaks 7 Year Base

Read MoreGold prices continue to extend higher as the EU sets to announce a historic €750 billion coronavirus stimulus. The US Congress is also debating for a new aid package to counter the economic effects of the pandemic. With all the unprecedented fiscal and monetary stimulus, market once again seems to expect inflation to make a return. […]

-

Pound Sterling Gains from Positive Brexit Headlines

Read MoreBritish Pound Sterling gained last week against major currencies as positive headlines on Brexit negotiations start to trickle. The chart below shows the gain of Pound Sterling against some major currencies: One of the positive developments came from the European Union’s softening stance on fishing rights. Fishing has been one of the two main stumbling […]

-

Elliott Wave View: Franco Nevada Corp (FNV) Impulsive Move Higher

Read MoreFranco Nevada (ticker: FNV) is a Canada-based company that own royalties and streams in gold mining and other commodity and natural resource investments. The company does not operate mines, develop projects, or conduct explorations. The entire business model of the company focuses on managing the royalties and streams. Shares of the company have rallied > […]

-

Bullish Breakout in GDXJ (Gold Miners Juniors) Imminent

Read MoreGold market continues to extend higher with uncertainties in pandemic and ultra-loose monetary policy by central banks. It has printed a 7 year high of $1779 and shows no sign of stopping. It has broken to new-all time high against many other major currencies, such as Euro, Pound Sterling, and Yen. Gold stocks should benefit […]

-

Elliott Wave View: Pan American Silver (PAAS) Bullish Outlook

Read MorePan American Silver Corporation (ticker: PAAS) is a Canadian mining company with operations in Latin America. The company has mines in Mexico, Peru, Bolivia, and Argentina. It is the world’s second largest primary silver producer worldwide it has the largest silver reserves with more than 550 million ounce reserve. The recent rally in Gold and […]

-

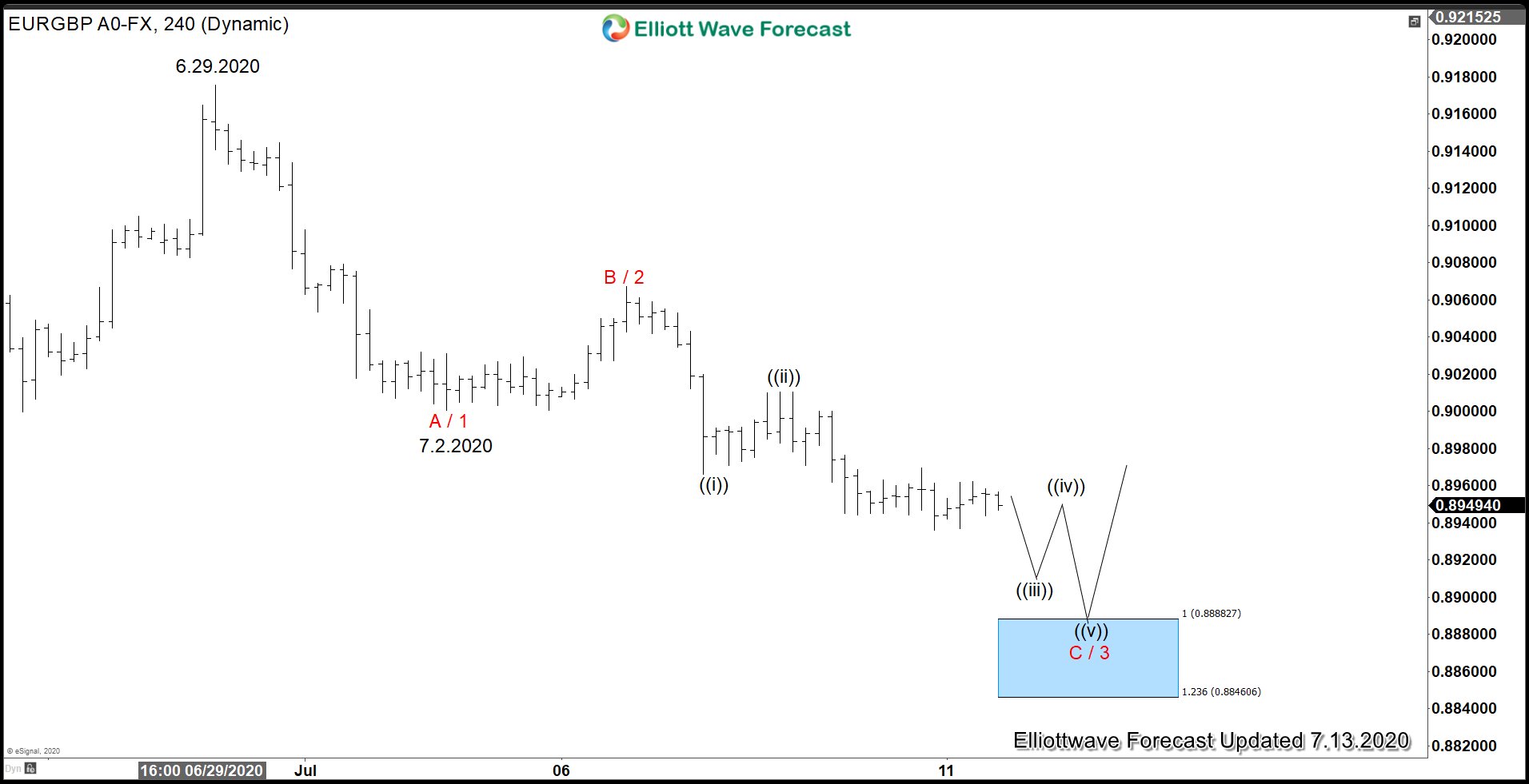

Bullish Sequence in EURGBP Favors More Upside

Read MorePound Sterling declined against a basket of currencies last week after a series of negative news. First of all, Bank of England (BOE) decided to increase quantitative easing by £100BN, putting pressure to Pound Sterling. Secondly, the deadlock in EU and UK trade negotiations over Brexit would likely persist until the year-end. Then finally, Bank of […]