-

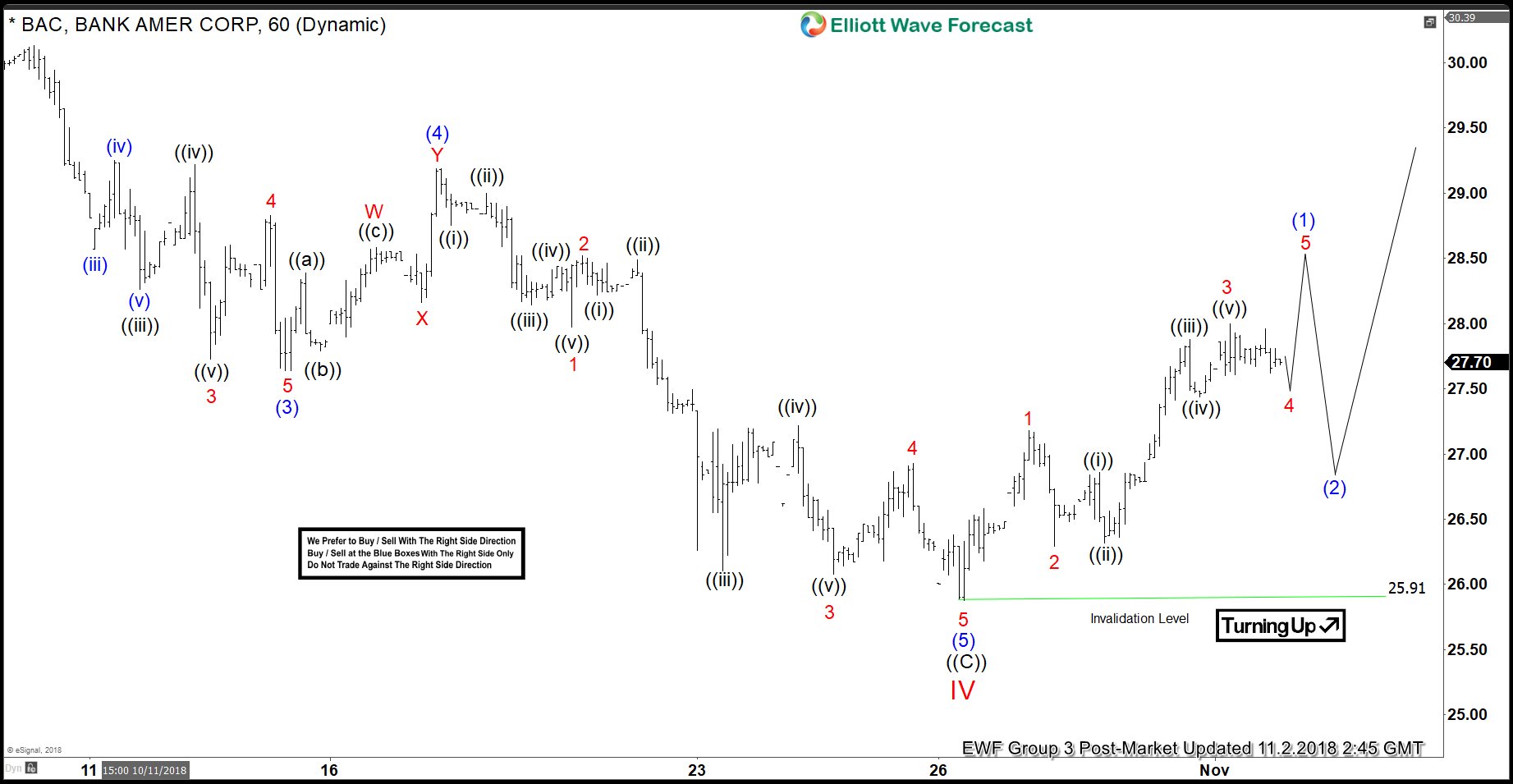

BAC Elliott Wave Analysis: Correction Ended

Read MoreBank of America corporation ticker symbol: BAC short-term Elliott wave analysis suggests that a decline to $27.26 low ended intermediate wave (3). The internals of that decline unfolded in 5 waves impulse structure in lesser degree cycles. Up from there a 3 wave bounce to $29.19 high ended intermediate wave (4) as double three structure. […]

-

Dow Jones Elliott Wave View: Correction Completed

Read MoreDow futures ticker symbol: YM short-term Elliott wave view suggests that a bounce to 25845 high ended cycle degree wave “b”. Down from there, cycle degree wave “c” unfolded as ending diagonal structure i.e lesser degree cycles within primary wave ((1)), ((3)) & ((5)) also unfolded in 3 swings structure. Where primary wave ((1)) ended […]

-

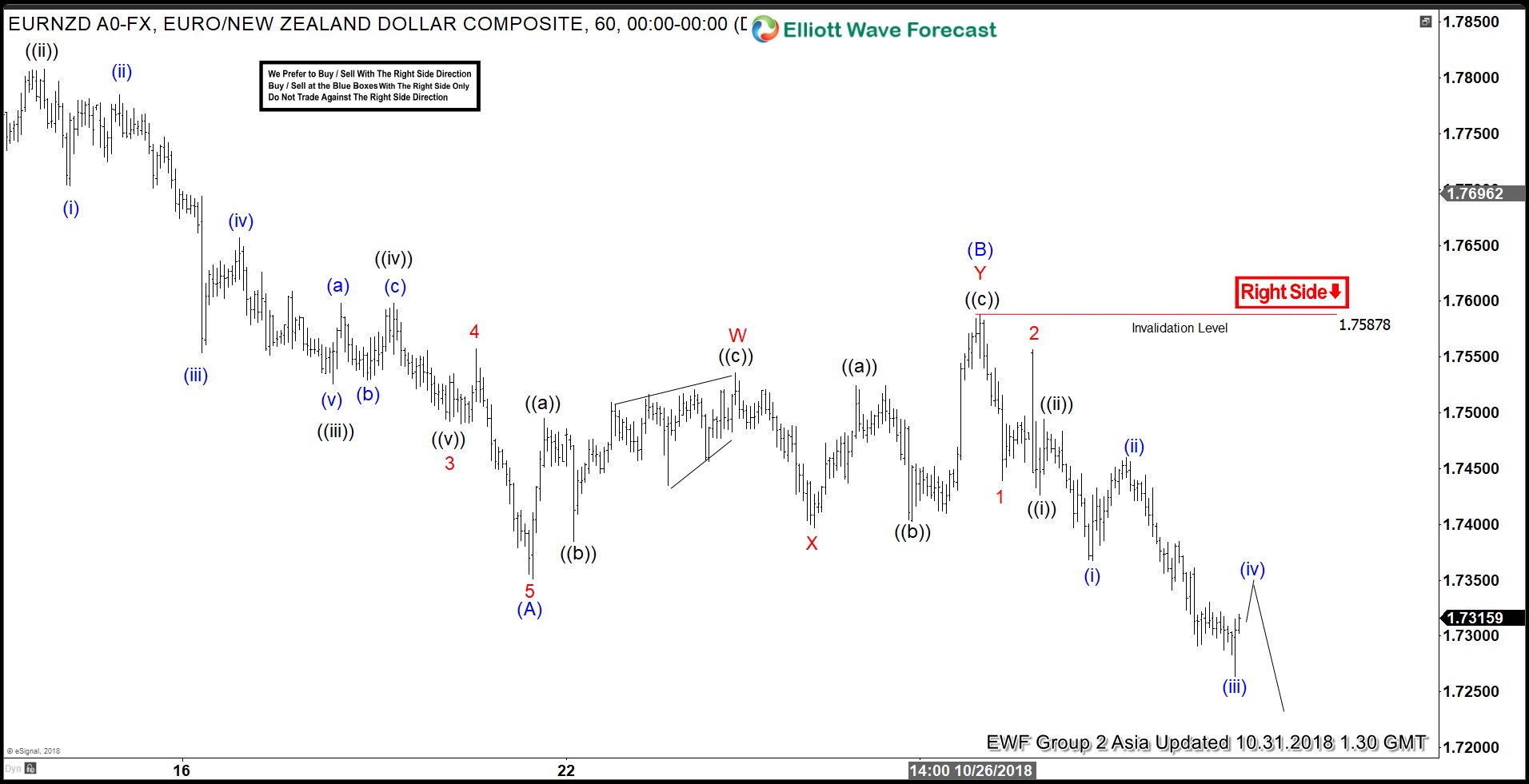

EURNZD: Elliott Wave Showing Incomplete Sequence

Read MoreEURNZD short-term Elliott wave analysis suggests that the decline from 10/08/2018 peak is unfolding as Zigzag structure. Where a bounce to 1.7881 high ended Minute wave ((ii)), Minute wave ((iii)) ended in lesser degree 5 waves at 1.7528 low. Minute wave ((iv)) ended at 1.7596 high. And Minute wave ((v)) ended at 1.7493 low which […]

-

BTCUSD Soon To Break Sideways Consolidation?

Read MoreBitcoin ticker symbol: BTCUSD short-term Elliott wave view suggests that instrument is trapped in a sideways price action since August 2018 lows. Which suggests that pair can be doing a bearish triangle structure. Where lesser degree price action shows Minutte wave (b) ended at 6656.63 as a bearish triangle. Down from there, Minutte wave (c) ended […]

-

Elliott Wave: Further Downside Looming For IBEX?

Read MoreIBEX short-term Elliott wave view suggests that a decline to 8850.20 low ended Minor wave A of a zigzag structure. The internals of that decline unfolded as 5 waves impulse structure where Minute wave ((i)) ended at 9471.20 low. Minute wave ((ii)) ended in 3 swings at 9542.80 high. Minute wave ((iii)) ended in lesser […]

-

Amazon Elliott Wave View: Favoring More Downside

Read MoreAmazon ticker symbol: $AMZN short-term Elliott wave view suggests that a decline to $1685.99 low ended primary wave ((W)). The internals of that decline unfolded as Elliott wave Flat structure. Up from there, a bounce to $1856.92 high ended primary wave ((X)) as Elliott wave zigzag correction. Where intermediate wave (A) ended in lesser degree 5 […]