-

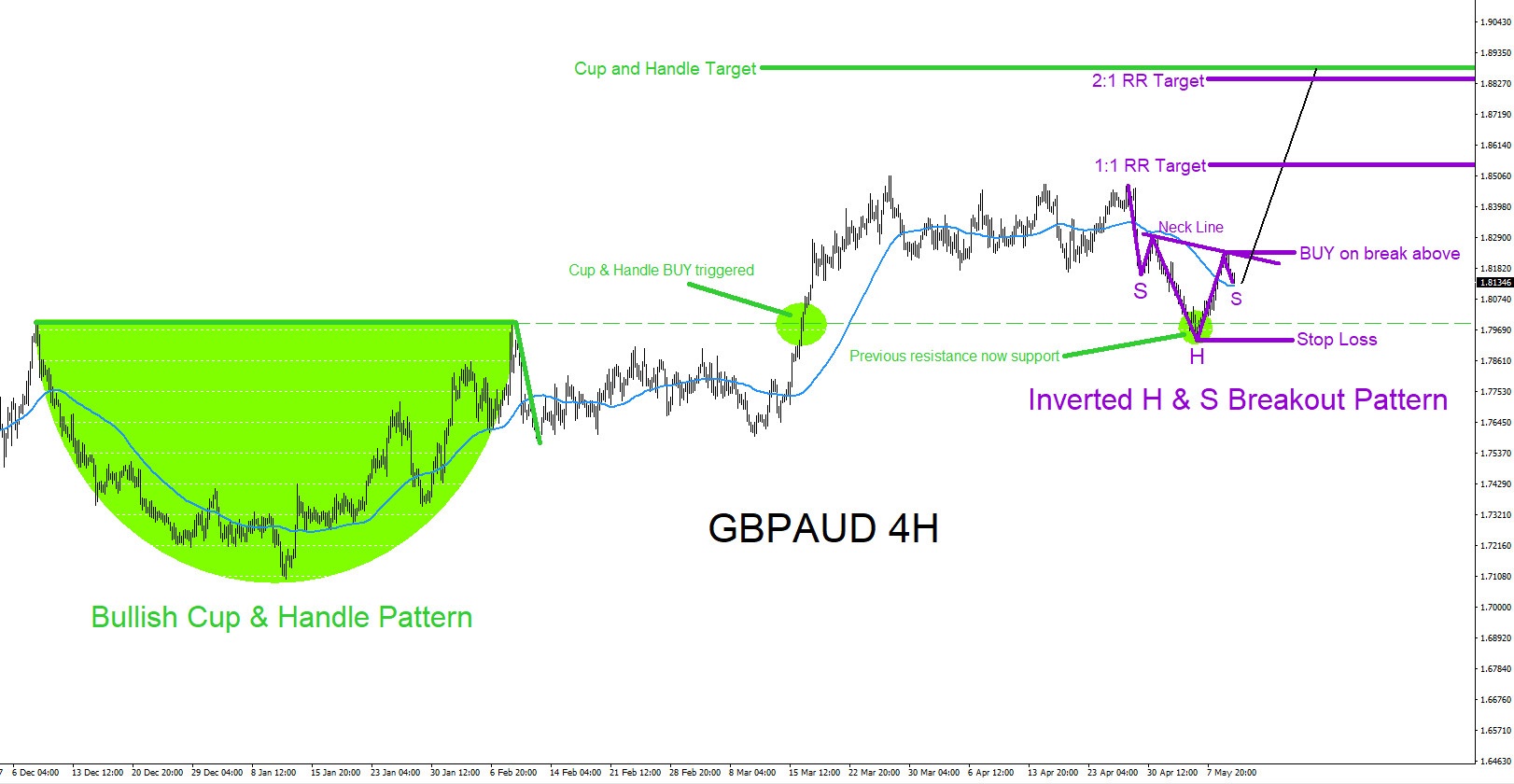

GBPAUD : Eyeing the Possible Breakout Higher

Read MoreGBPAUD Technical Analysis 5.10.2018 GBPAUD Possible BUY/LONG Trade Setup: GBPAUD is forming a possible bullish inverted Head and Shoulders pattern (Purple). Traders should watch for a good strong break above the purple BUY breakout trend line. A good break above this level will send GBPAUD higher and can extend possibly to newer highs above the March […]

-

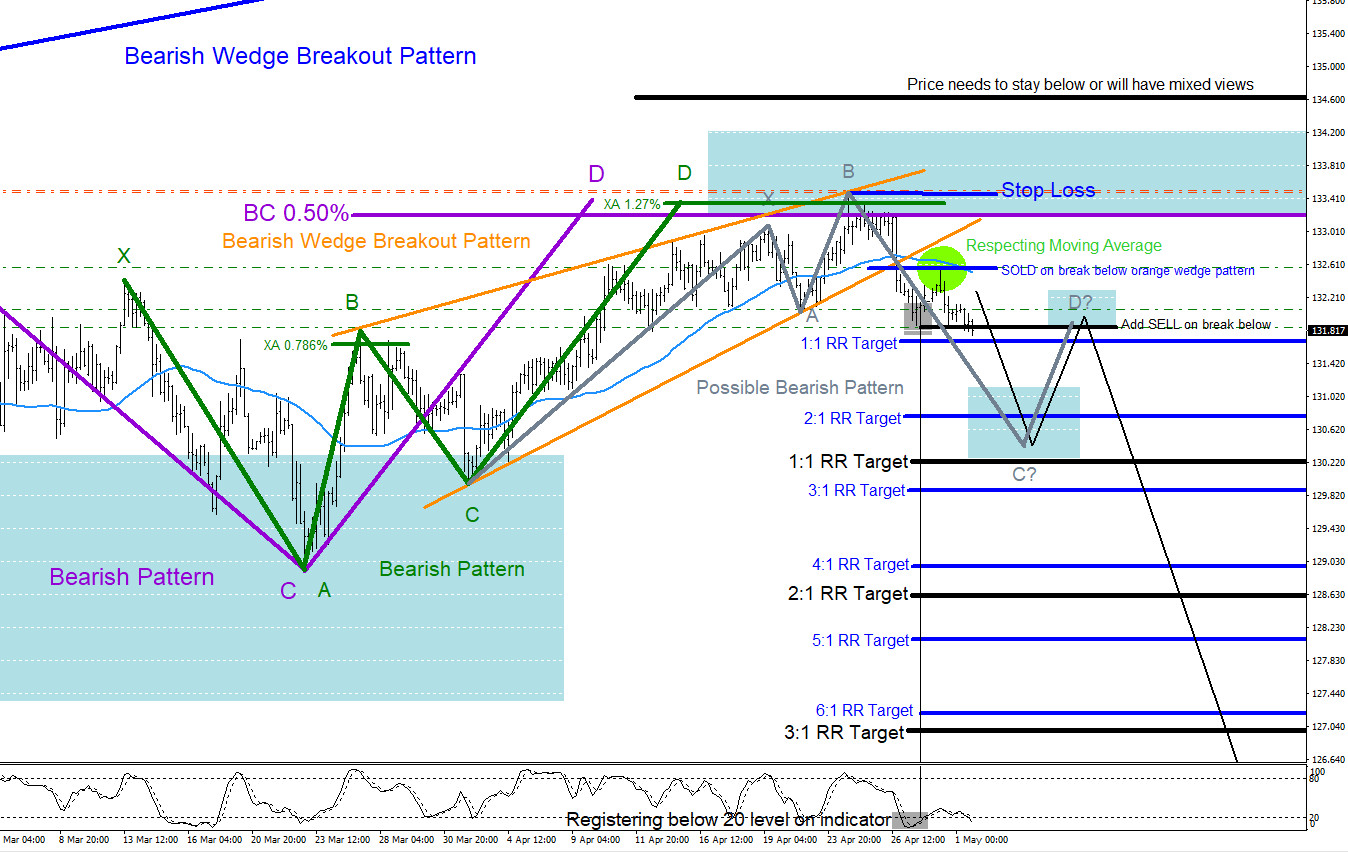

EURJPY : Possible Move Lower

Read MoreEURJPY Technical Analysis 5.1.2018 EURJPY has possibly formed a temporary top on April 24/2018 and has since reversed lower. On April 11/2018 I published this article calling for a possible reversal lower coming in the near future > EURJPY : Possible Bearish Scenarios . On the chart below there are 5 bearish pattern setups that are […]

-

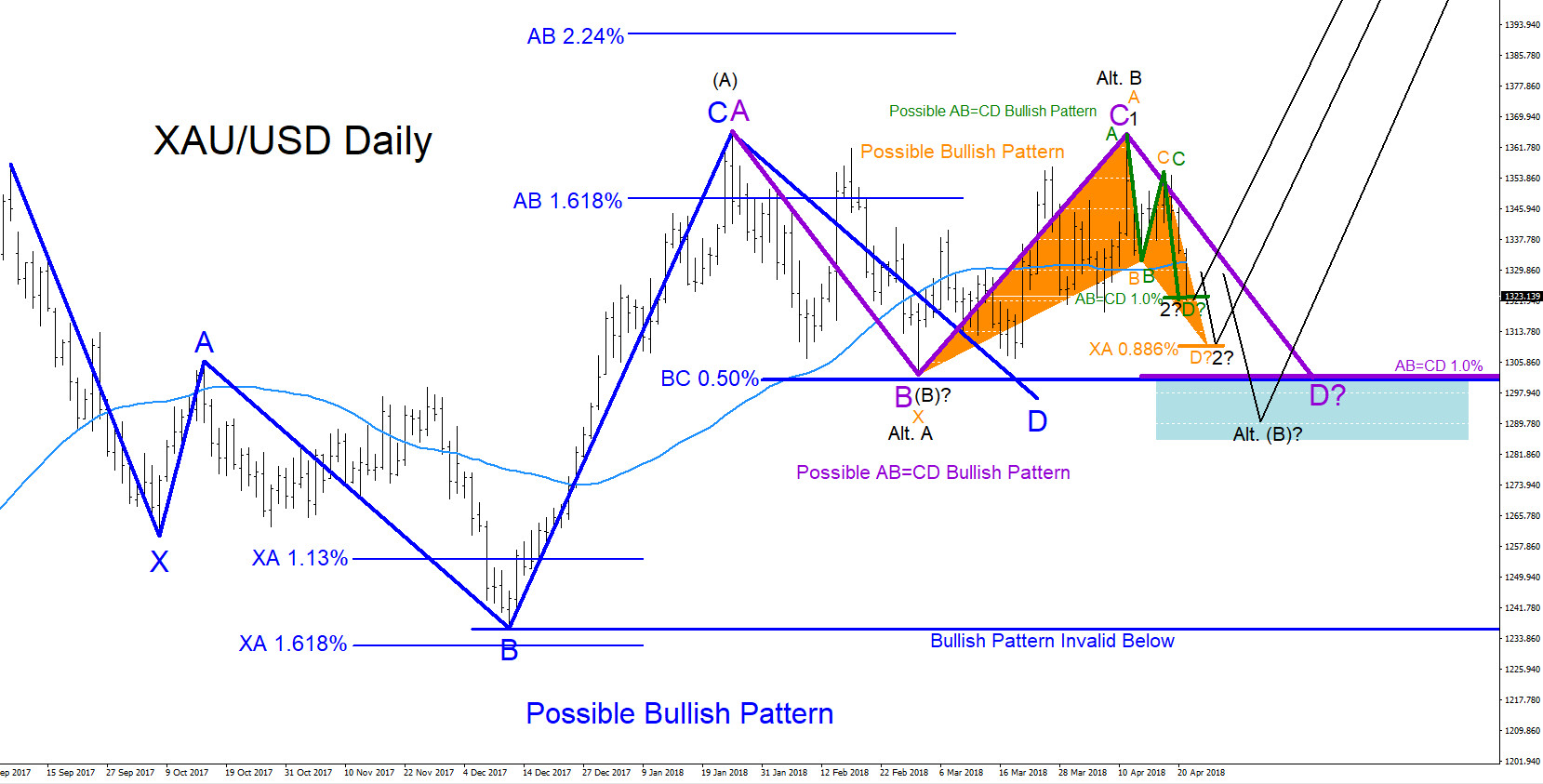

XAUUSD : Will Gold Rally Higher?

Read MoreXAUUSD (Gold) Technical Analysis 4.25.2018 XAUUSD (Gold) remains bullish as long as the December 12/2017 low remains untouched. On the Daily chart there are clear visible bullish patterns that can be seen. Bullish Elliott Wave counts can also add more reasons that a possible rally higher can be seen in the near future. In the […]

-

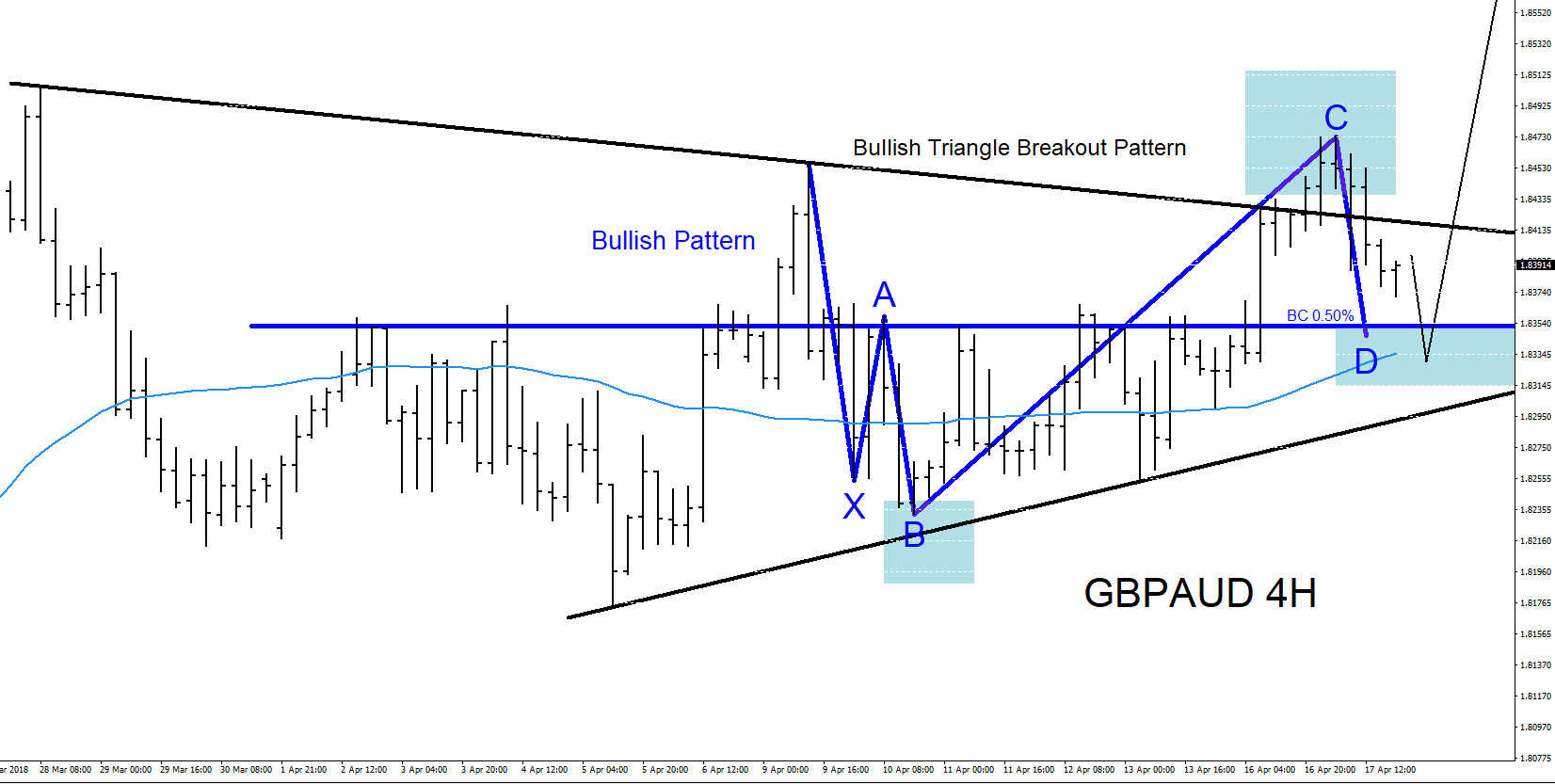

GBPAUD : Bullish Scenario Higher

Read MoreGBPAUD Technical Analysis 4.17.2018 GBPAUD has been trending higher since the pair found a bottom at the October 7/2016 low where GBPAUD reversed and bounced higher. Traders should remain looking for setups to BUY GBPAUD and should continue trading with the trend not against it. At the current moment there are a couple signs that […]

-

EURJPY : Possible Bearish Scenarios

Read MoreEURJPY Technical Analysis 4.11.2018 EURJPY has possibly formed a temporary top at the February 2/2018 high. As long as the pair stays below this high EURJPY can start another move lower below the March 23/2018 low. In the chart below, EURJPY is showing four bearish patterns that are clearly visible. On the 4 hour chart […]

-

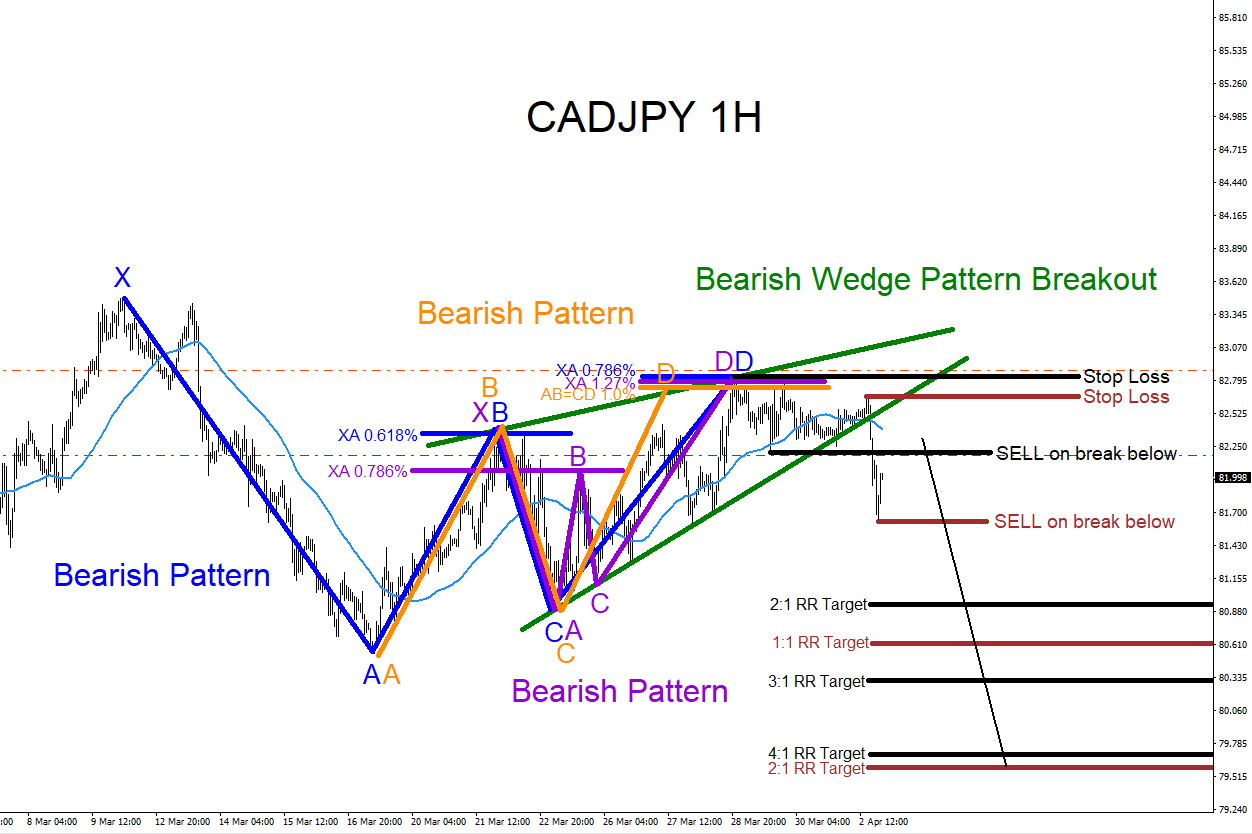

CADJPY : Bearish Patterns Calling Lower

Read MoreCADJPY Technical Analysis 4.3.2018 CADJPY has possibly formed a temporary top at the March 28/2018 high. As long as the pair stays below this high CADJPY can start another move lower below the March 19/2018 low. In the chart below, CADJPY is showing four bearish patterns that are clearly visible. Blue bearish pattern already triggered […]