-

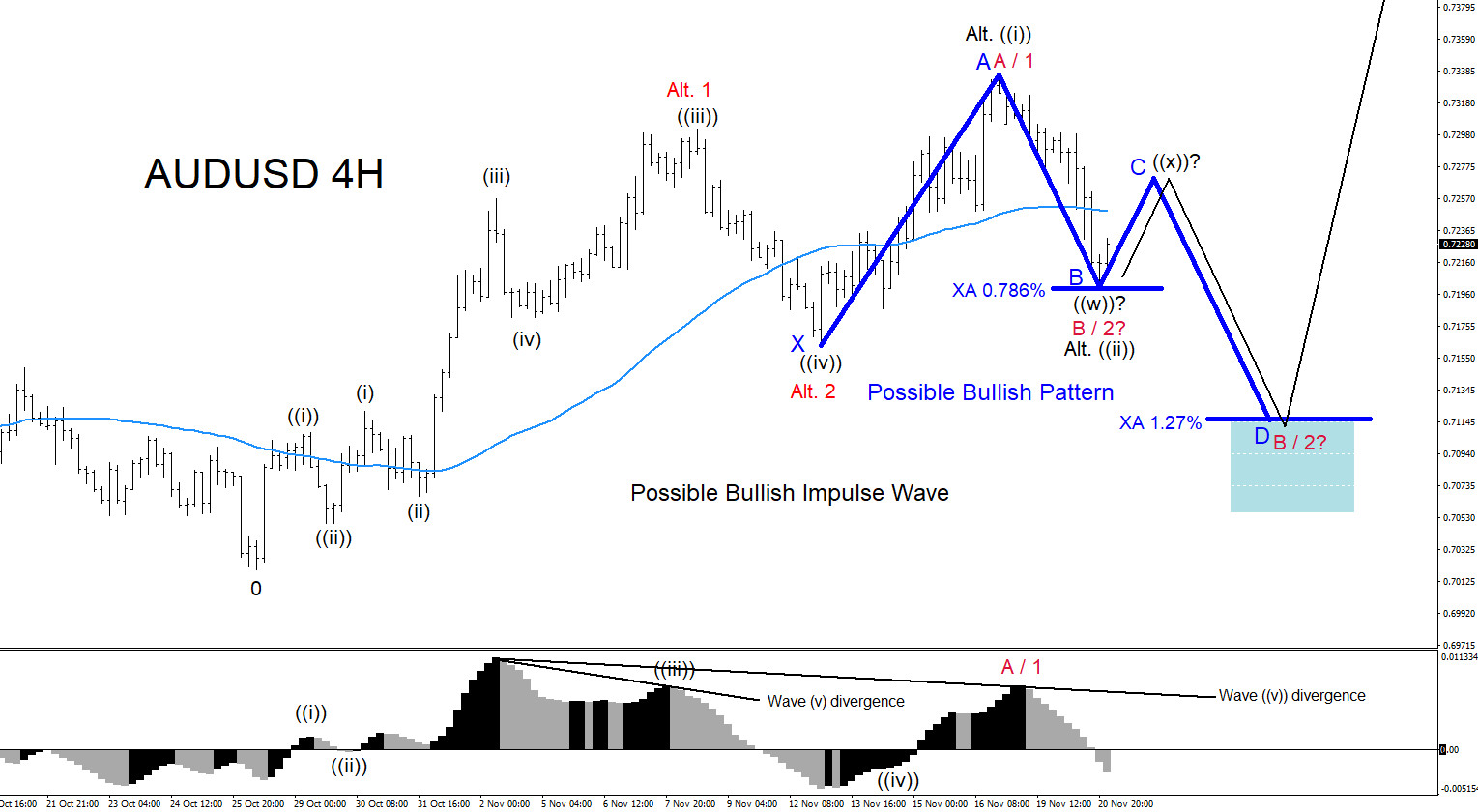

AUDUSD : Another Possible Move Higher?

Read MoreAUDUSD Technical Analysis November 21/2018 AUDUSD BUY/LONG Trade Setup: October 26/2018 AUDUSD found a bottom and bounced higher. The bounce higher is possibly forming a bullish Elliott Wave Impulse Pattern. The current possible wave count higher can now be seen as a five wave move with red wave A or possible red wave 1 terminating […]

-

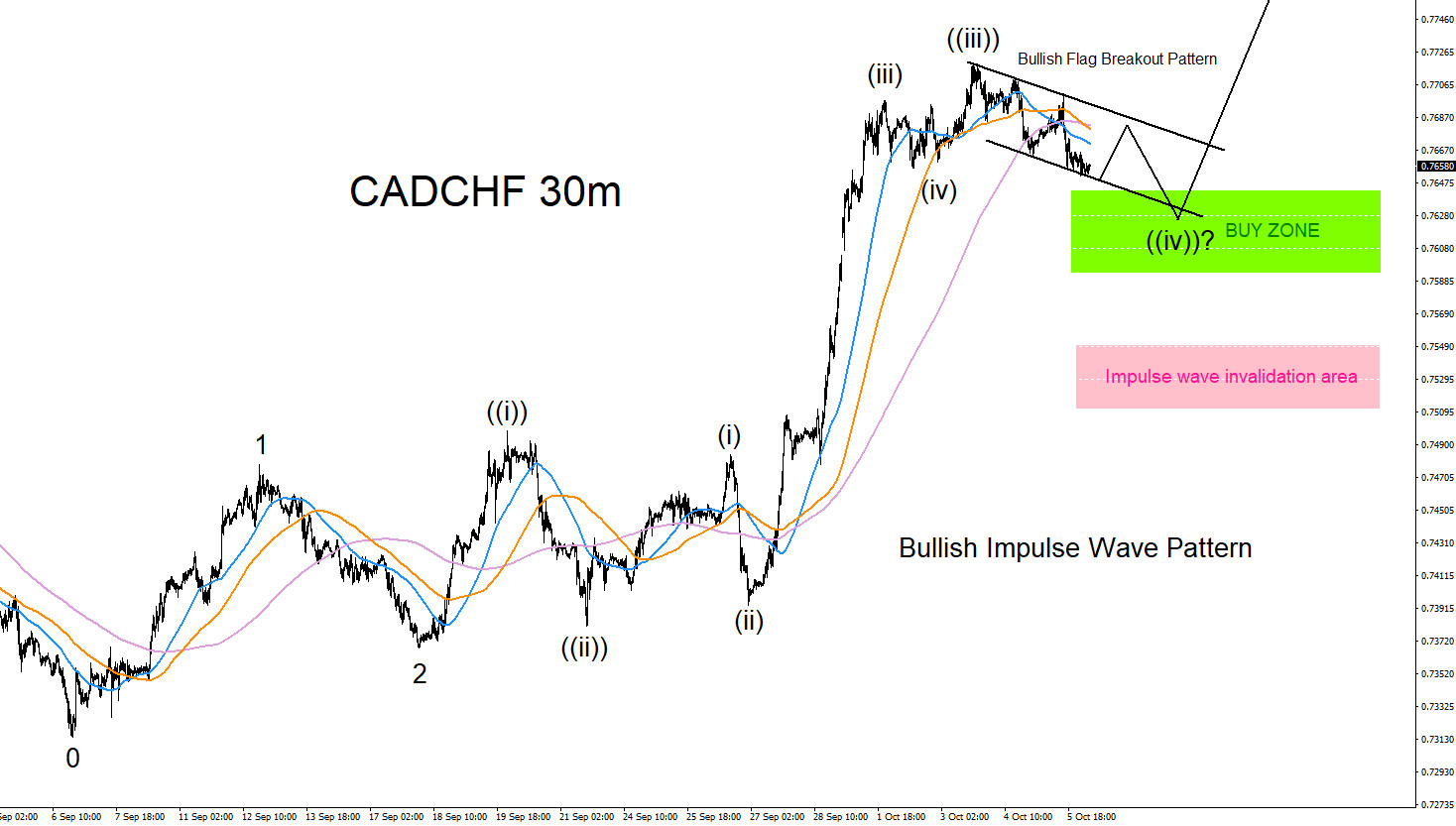

CADCHF : Possible Impulse Wave Pattern?

Read MoreCADCHF Technical Analysis October 8/2018 CADCHF BUY/LONG Trade Setup: September 6/2018 CADCHF found a bottom and bounced higher. The bounce higher is possibly forming a bullish Elliott Wave Impulse Pattern. The current possible wave count higher can now be seen as wave ((iii)) terminating at the October 3/2018 high and is now correcting lower to […]

-

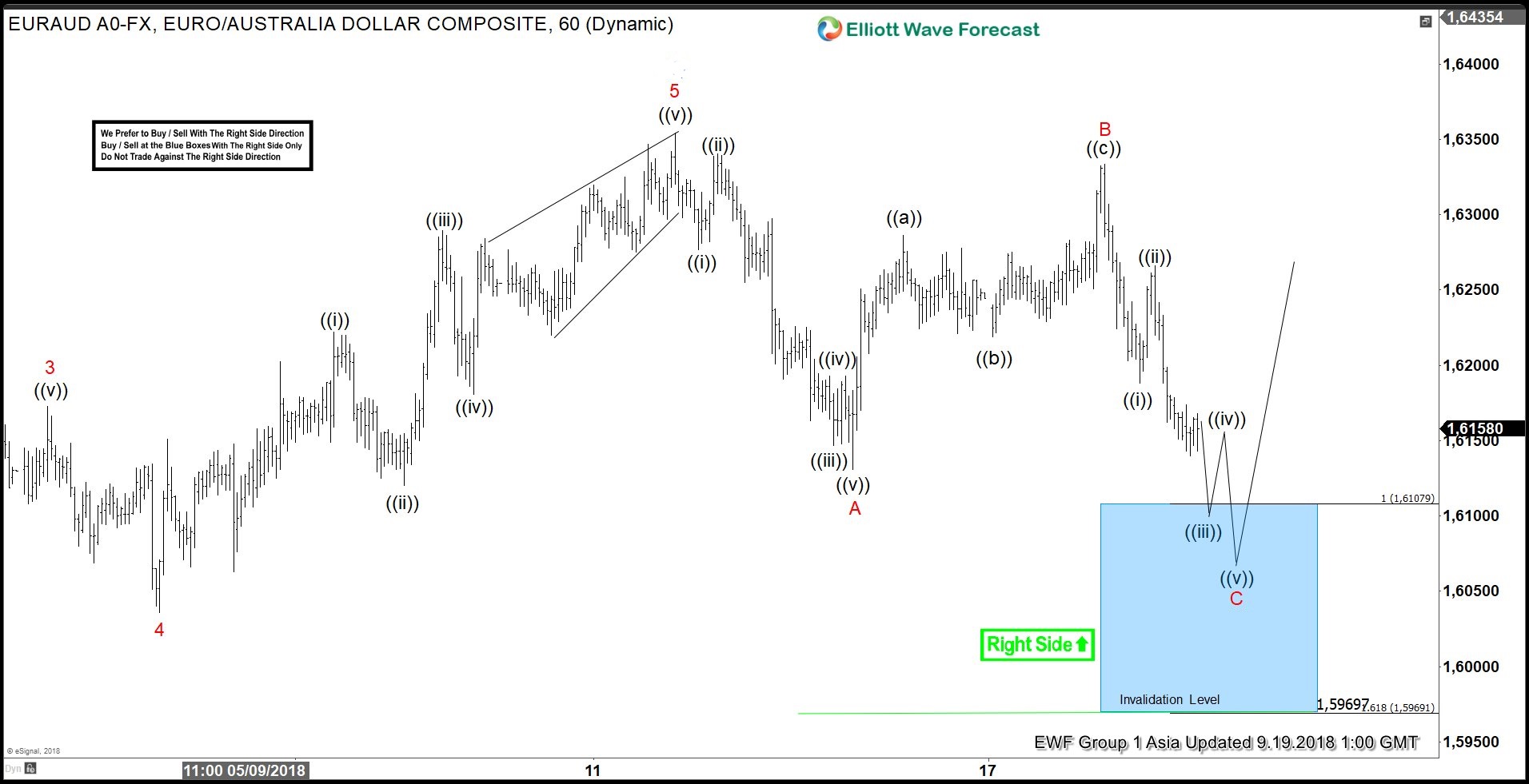

EURAUD : Another Rally Higher?

Read MoreEURAUD Technical Analysis 9.23.2018 EURAUD BUY/LONG Trade Setup: February 2017 EURAUD found a bottom, rallied higher and has been trending higher since. Traders should continue to follow the trend and look for possible signals for any buying opportunities. At the moment the pair can extend higher as long as the September 20/2018 low holds. A […]

-

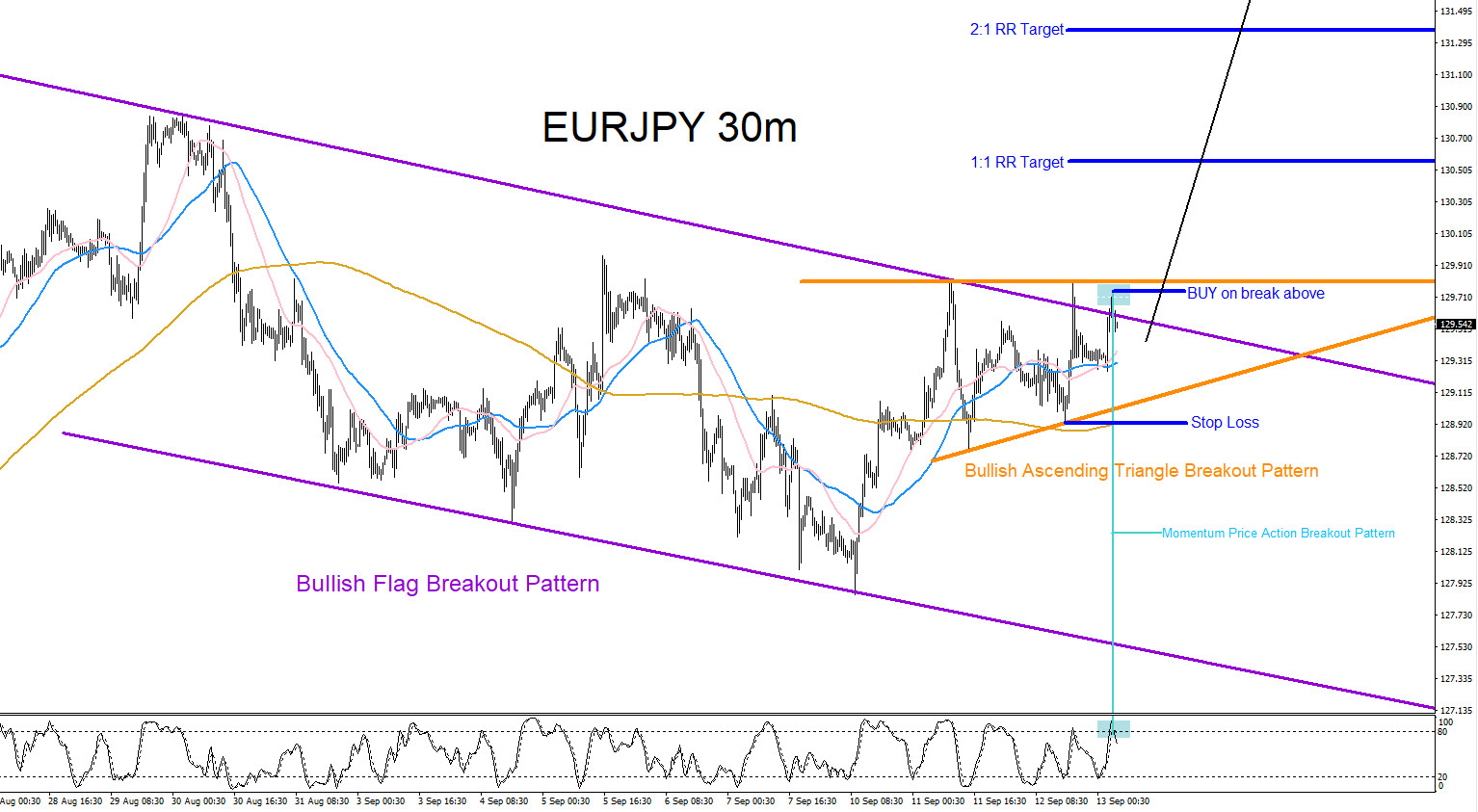

EURJPY : Trading Market Pattern Breakouts

Read MoreEURJPY LONG/BUY Trade Update 9.23.2018 On September 21/2018 I posted on Twitter, @AidanFX , the EURJPY trade setup to look for LONGS/BUYS on the break above two bullish market patterns that was forming. Since September 21/2018 the pair broke above the bullish market patterns and has extended over 300 pips to the upside. The charts […]

-

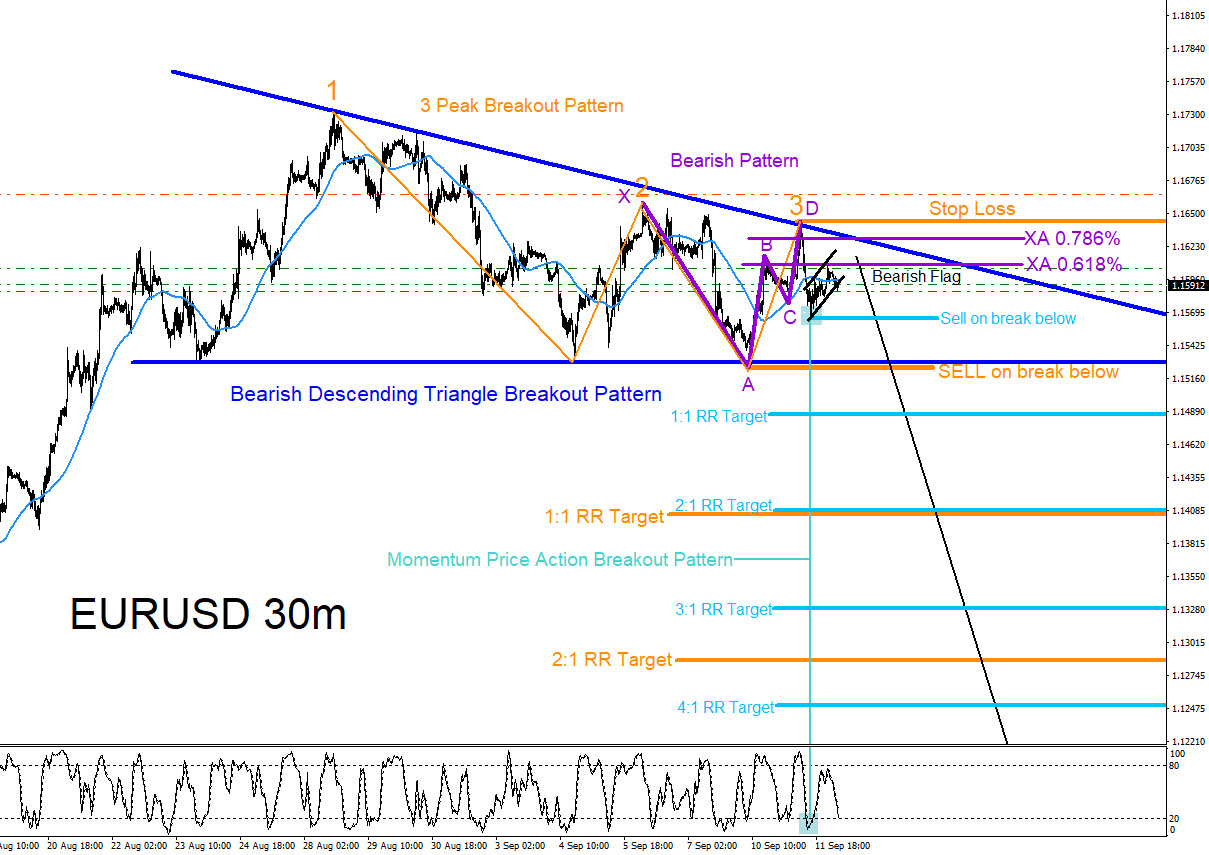

EURUSD : Expecting Move Lower

Read MoreEURUSD Technical Analysis September 12/2018 EURUSD Possible SELL/SHORT Trade Setup: On February 2018 EURUSD topped out, reversed lower and has been pushing lower since. Traders should continue to follow the trend and continue to look for possible signals for any selling opportunities. At the moment EURUSD is currently forming a possible Descending Bearish Triangle Breakout […]

-

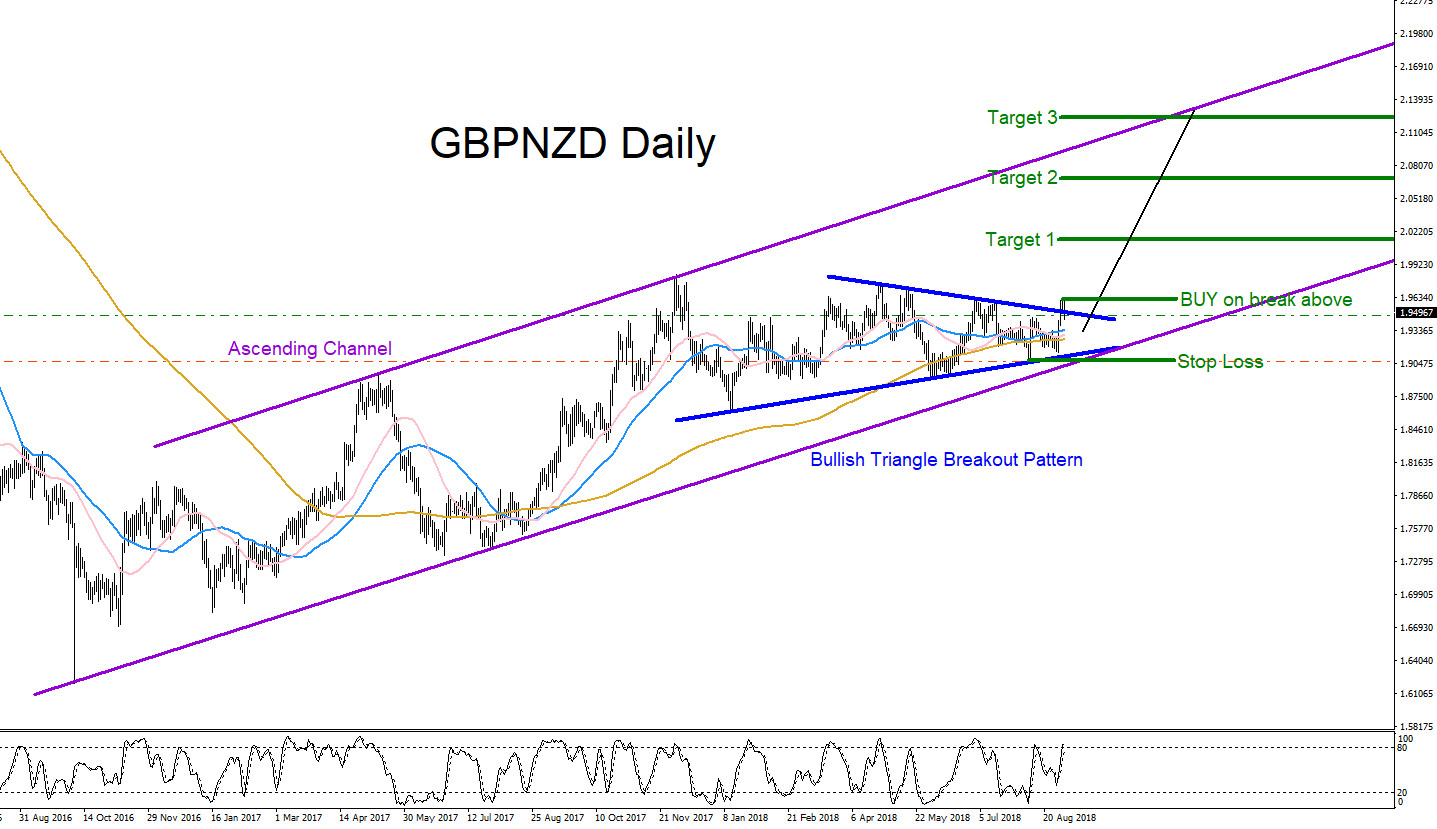

GBPNZD Going to Break Higher?

Read MoreGBPNZD Technical Analysis 9.3.2018 GBPNZD Possible BUY/LONG Trade Setup: Since October 2016 GBPNZD has been trending higher. Traders should continue to follow the trend and look for possible signals for any buying opportunities. At the moment the pair is currently forming a possible Bullish Triangle Breakout Pattern (Blue) on the Daily chart for another possible […]