-

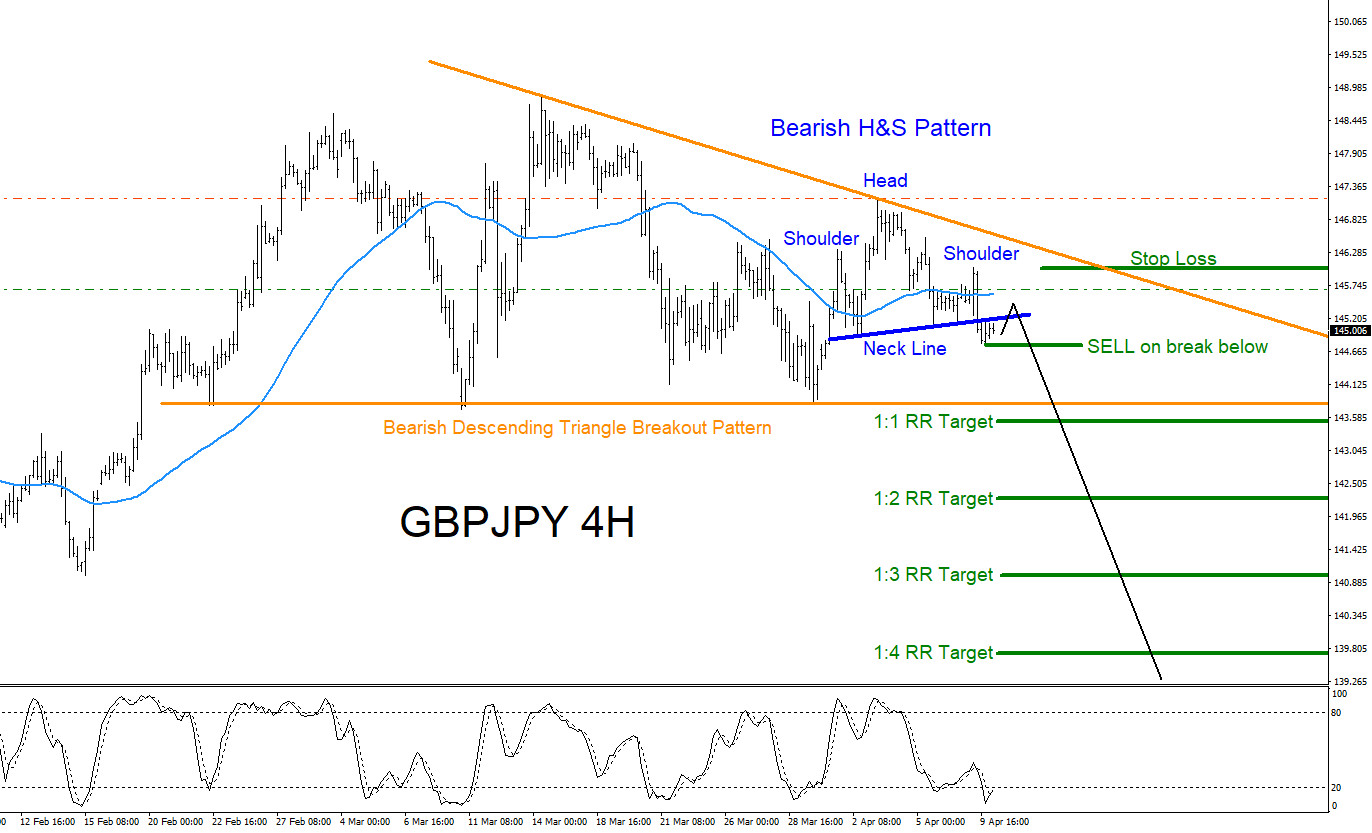

GBPJPY : Will Pair Continue Lower?

Read MoreGBPJPY Technical Analysis April 10/2019 GBPJPY : Bearish market patterns can be seen on the GBPJPY 4 hour chart. In the chart below a blue bearish Head and Shoulders pattern is visible and price has already broken below the Neck Line which can be signalling for more possible downside in the coming trading sessions. As […]

-

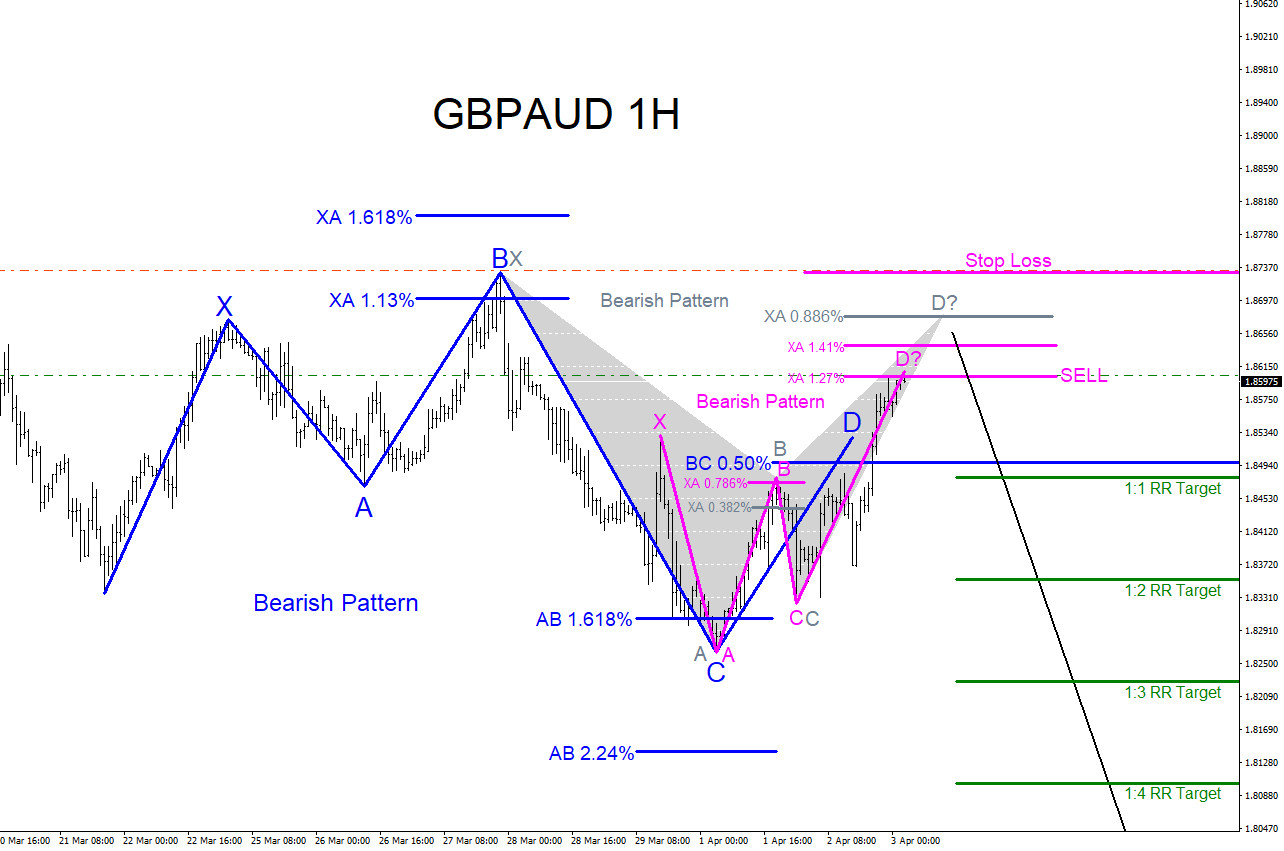

GBPAUD : Market Patterns Calling More Downside?

Read MoreGBPAUD Technical Analysis April 2/2019 GBPAUD : Bearish market patterns can be seen on the GBPAUD 1 hour chart. In the chart below both the blue and pink bearish patterns already triggered SELLS. Blue bearish pattern triggered SELLS at the BC 0.50% Fib. retracement level and the pink bearish pattern triggered SELLS at the XA […]

-

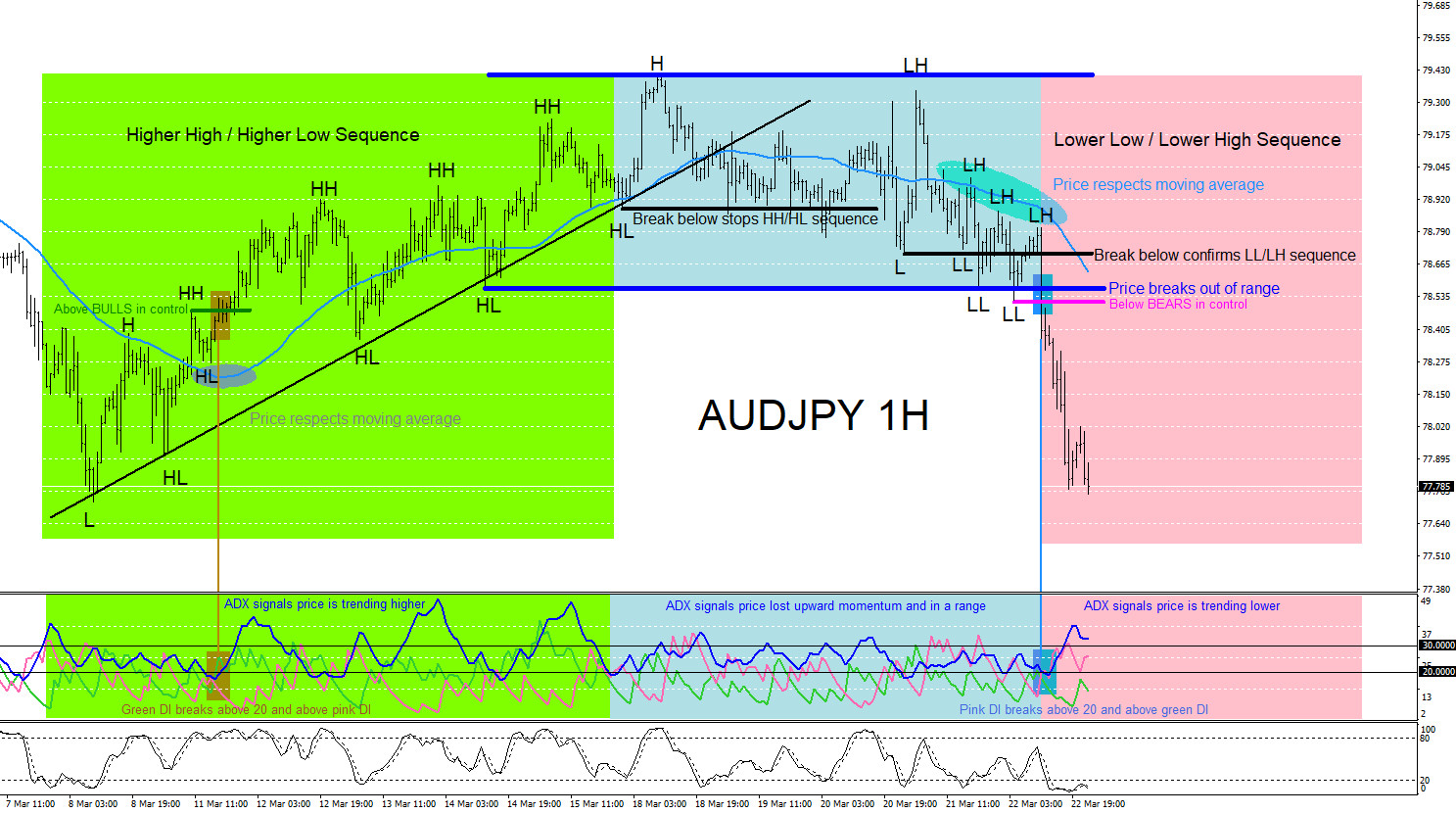

AUDJPY : Catching the Trend Lower

Read MoreAUDJPY Short Term Technical Analysis AUDJPY on March 8/2019 the pair bounced and traded higher. Price started a Higher High/Higher Low sequence and trended higher for the entire trading week of March 11-15/2019. In the chart below the ADX (Average Directional Movement Index) signalled that the move to the upside was losing momentum at the start […]

-

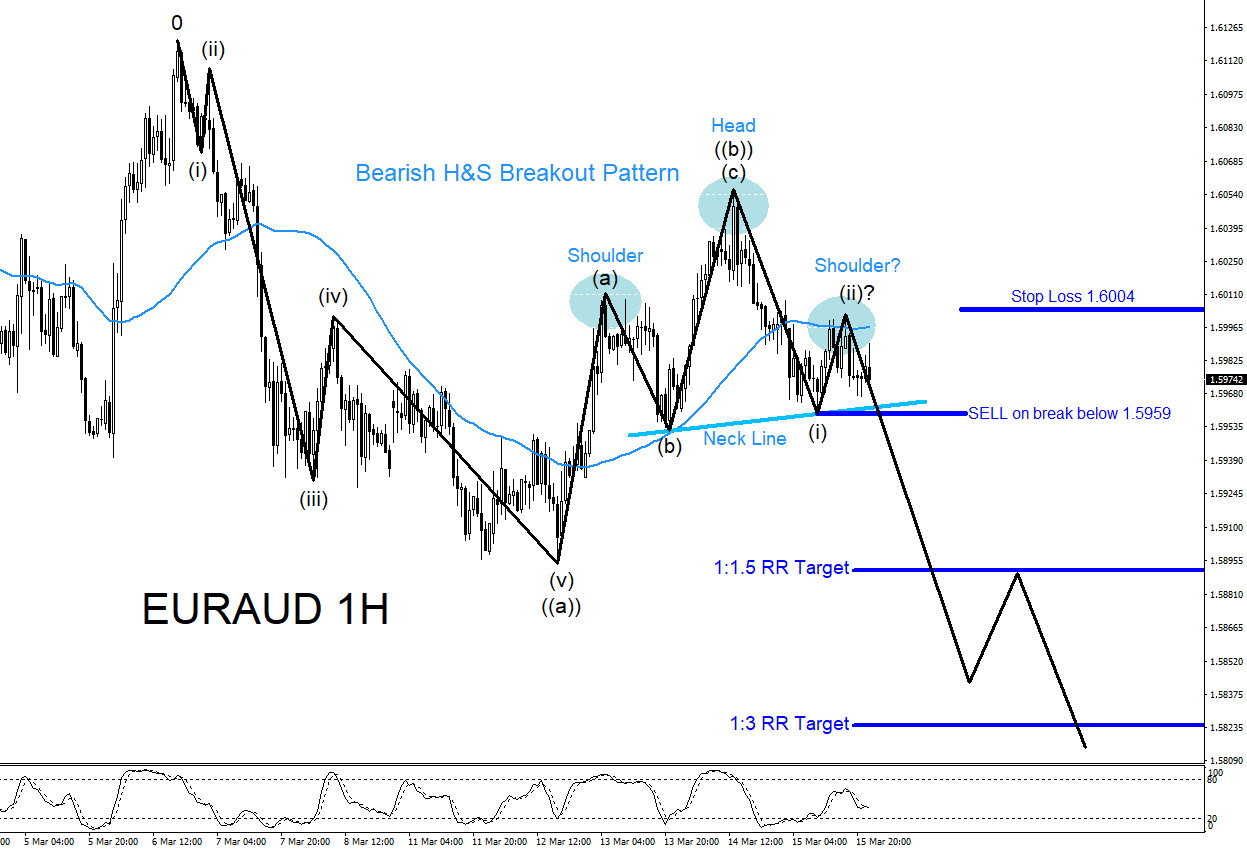

EURAUD : Trading Elliott Waves with Market Patterns

Read MoreEURAUD Technical Analysis March 17/2019 EURAUD SELL/SHORT Trade : Elliott Wave count for EURAUD shows wave ((a)) completed starting from the March 6/2019 highs and has since corrected higher to terminate possibly the wave ((b)) at the March 14/2019 high. Using Market Patterns together with a working Elliott Wave count allows traders to get more […]

-

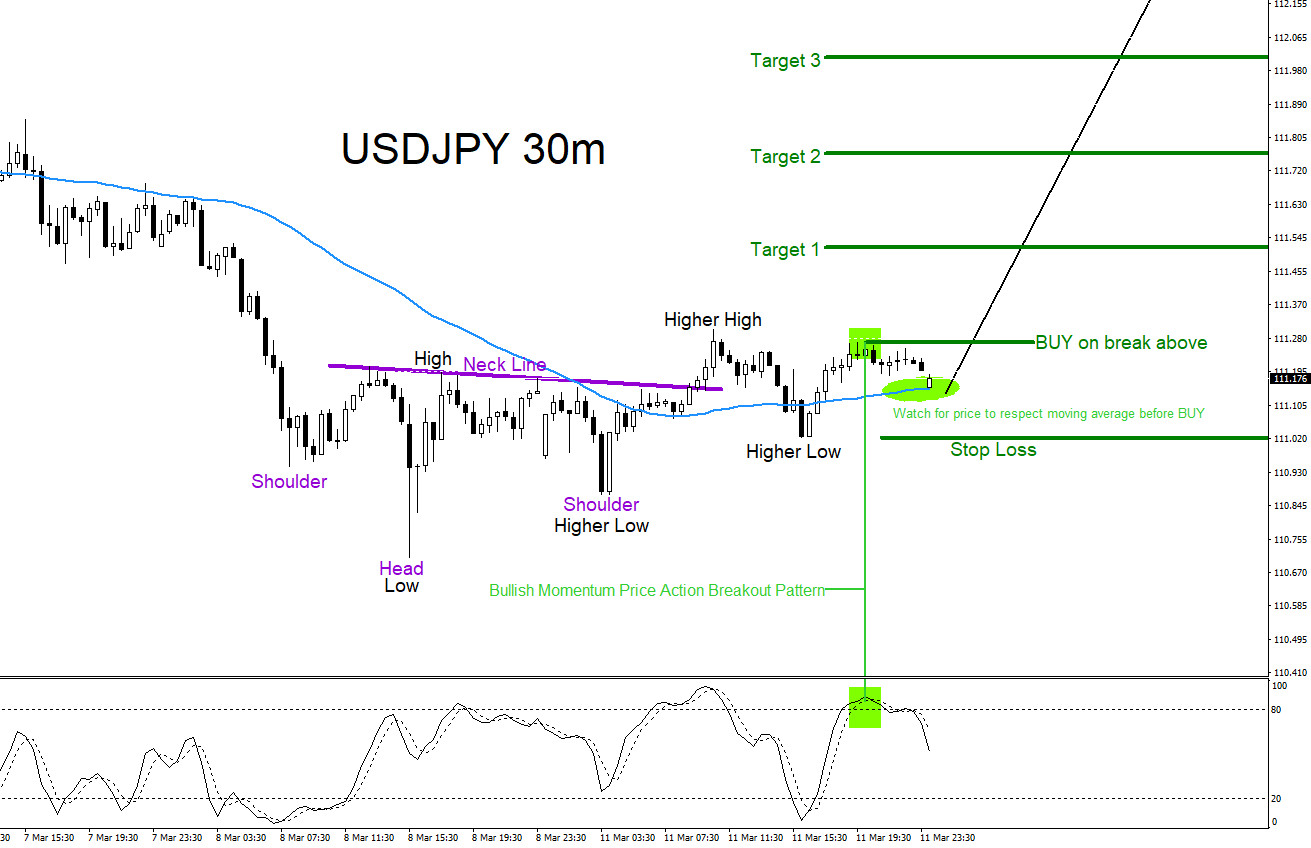

USDJPY : Higher High / Higher Low Sequence Trade Setup

Read MoreUSDJPY Technical Analysis March 11/2019 USDJPY BUY/LONG Trade Setup: USDJPY has formed a bullish inverted Head and Shoulders market breakout pattern (purple) and has already broken above the neck line BUY entry so we will expect more possible upside in the following days. A Higher High / Higher Low Sequence has started signalling that the […]

-

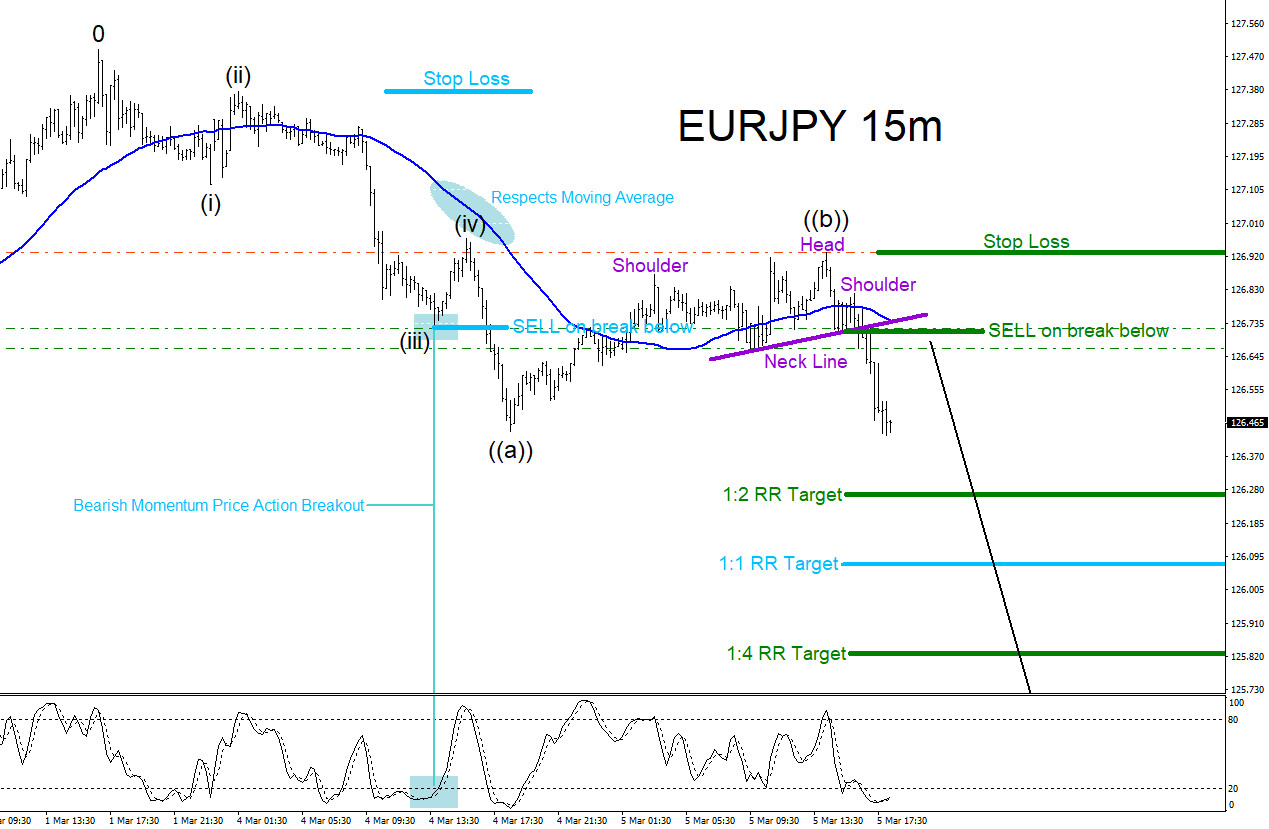

EURJPY : Trading Elliott Waves with Market Patterns

Read MoreEURJPY Technical Analysis March 5/2019 EURJPY SELL/SHORT Trade : Elliott Wave count for EURJPY shows wave ((a)) completed starting from the March 1/2019 highs and has since corrected higher to terminate possibly the wave ((b)) at the March 5/2019 high. Using Market Patterns together with a working Elliott Wave count allows traders to get more […]