-

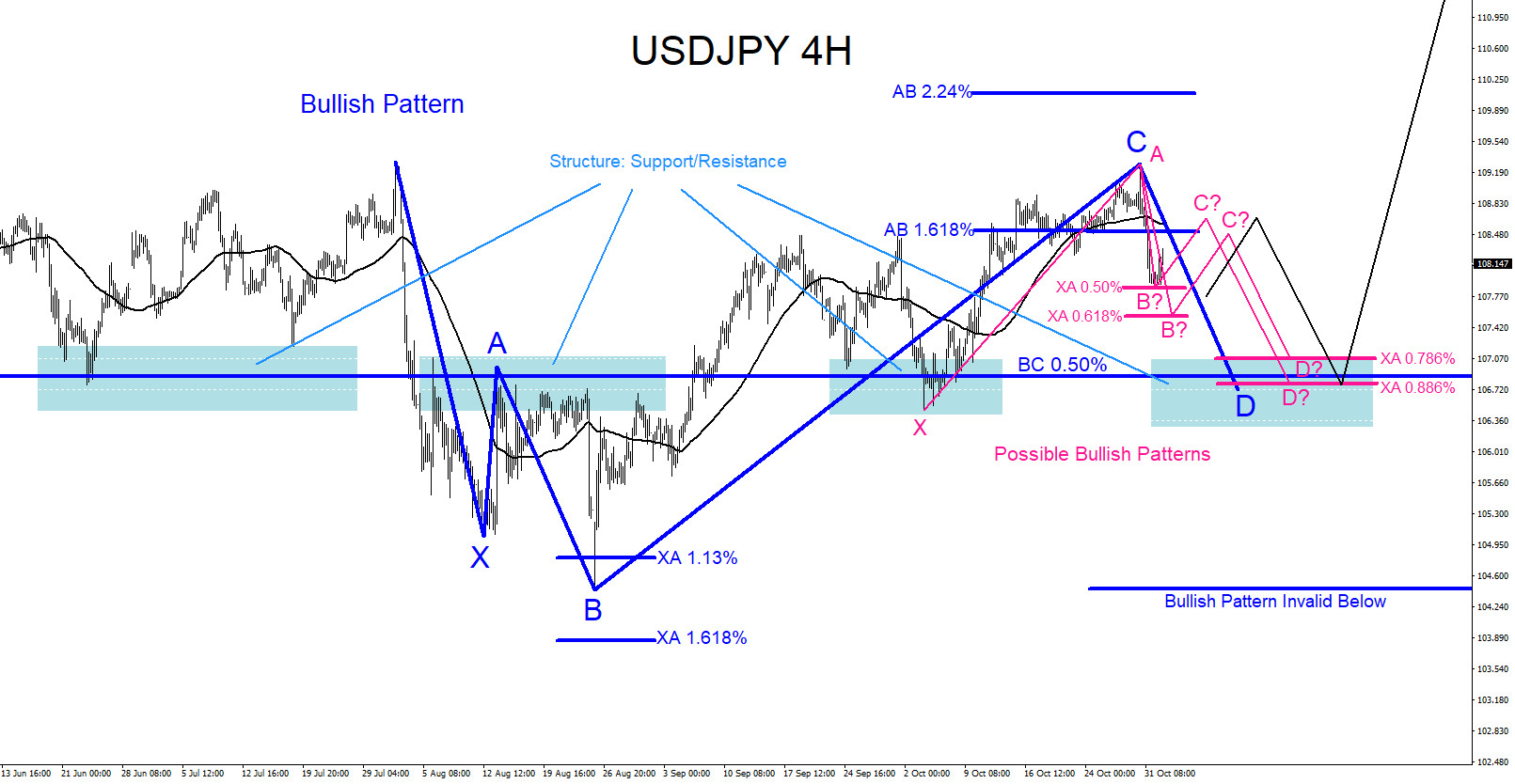

USDJPY : Watch Reversal Zone for Another Move Higher

Read MoreUSDJPY Technical Analysis November 2/2019 USDJPY remains bullish as long as the August 26/2019 low remains untouched. In this analysis of the USDJPY pair, market patterns will be used to determine where price can possibly reverse and bounce higher from. In the chart below, there are 3 possible bullish patterns that can trigger BUYS near […]

-

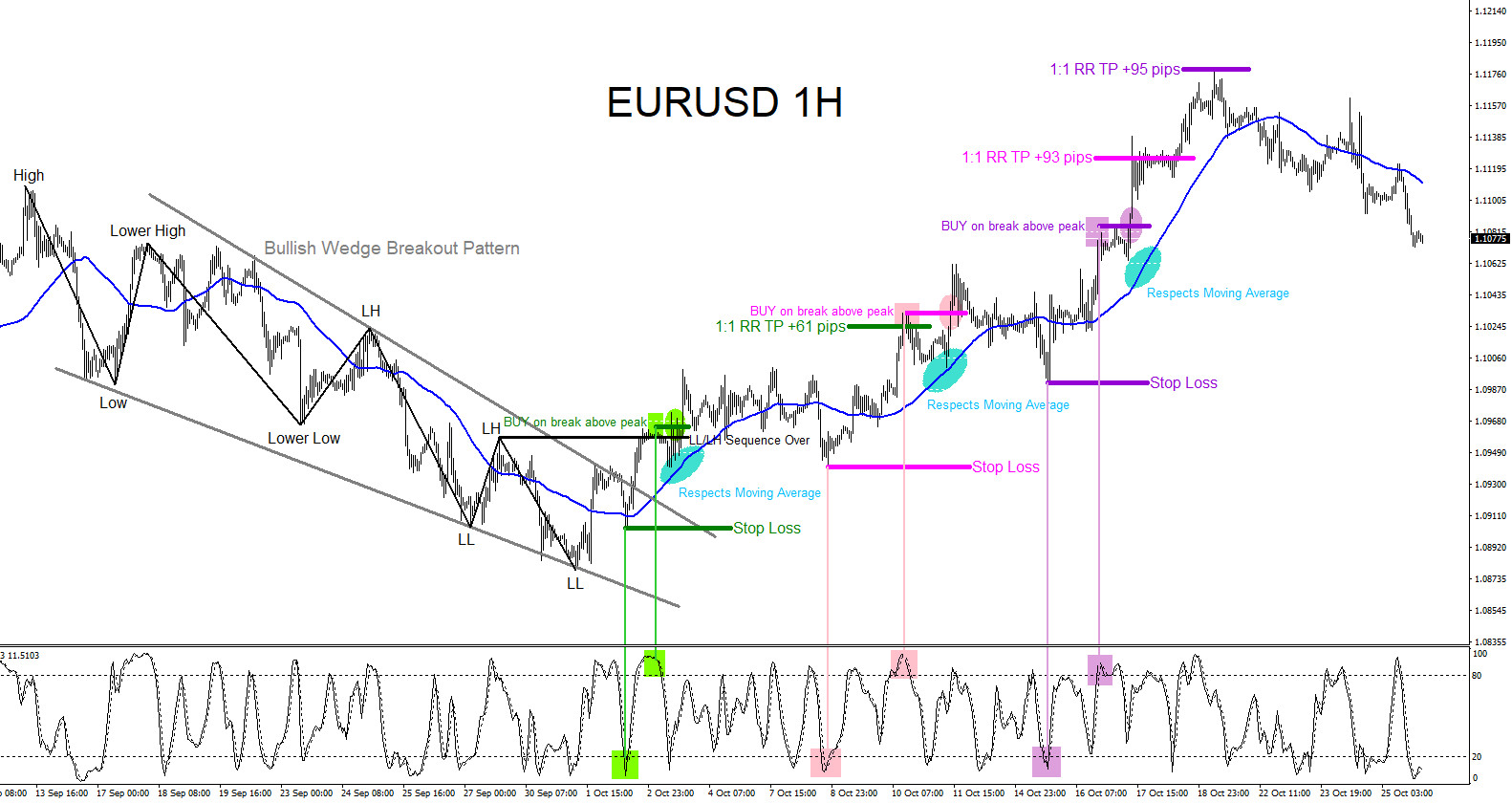

EURUSD : Momentum Buy Breakouts

Read MoreEURUSD Technical Analysis EURUSD : Towards the end of September 2019 the Lower Low and Lower High sequence starting from September 13/2019 high stopped when the bounce off the October 1/2019 lows started a reversal by making higher highs and higher lows. Understanding how a possible short term trend can be terminating is key to […]

-

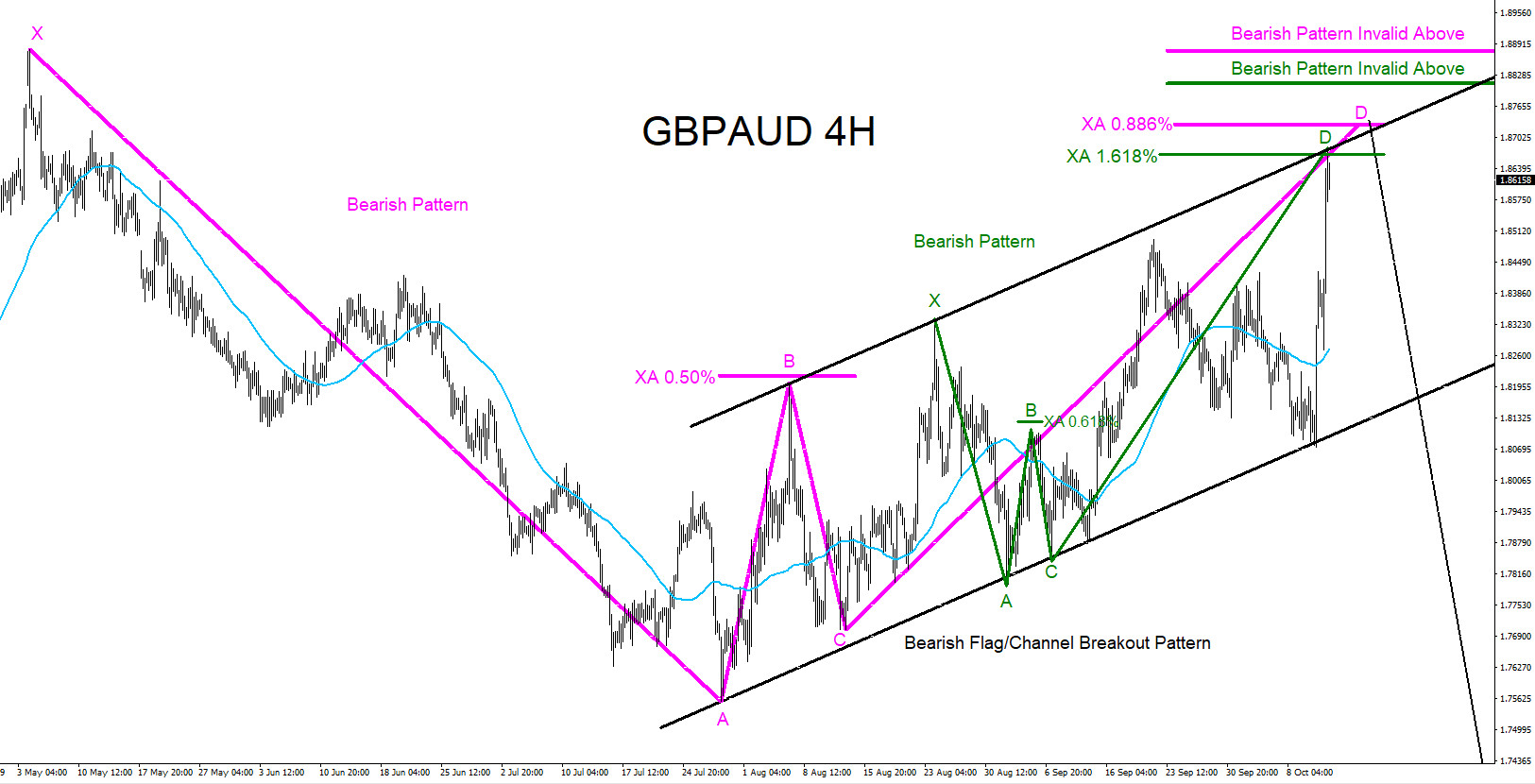

GBPAUD : Watching for Possible Selling Opportunities

Read MoreGBPAUD Technical Analysis October 12/2019 GBPAUD : Possible bearish patterns are visible on the 4 hour chart. Pink bearish pattern triggers SELLS at the point D XA 0.886% Fib. retracement level and the green bearish pattern triggers SELLS at the point D XA 1.618% Fib. retracement level. Traders need to wait and see if price […]

-

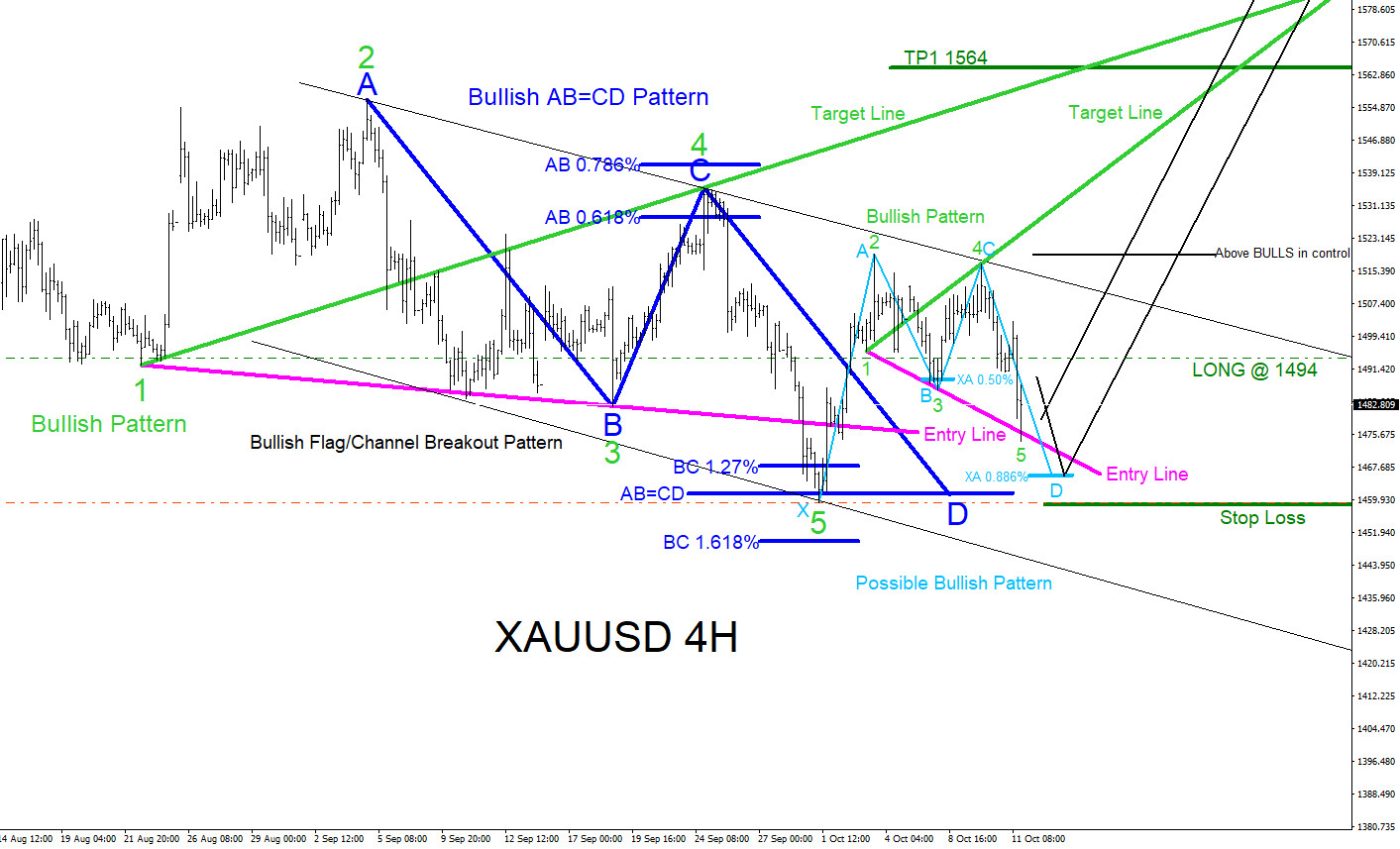

XAUUSD : Bullish Market Patterns

Read MoreXAUUSD Technical Analysis October 12/2019 XAUUSD : Possible bullish patterns are visible on the 4 hour chart. Blue bullish AB=CD pattern already triggered BUYS at the point D AB=CD level on October 1/2019. Price has since bounced higher from this level and is now currently in a correction lower and which can possibly bounce higher […]

-

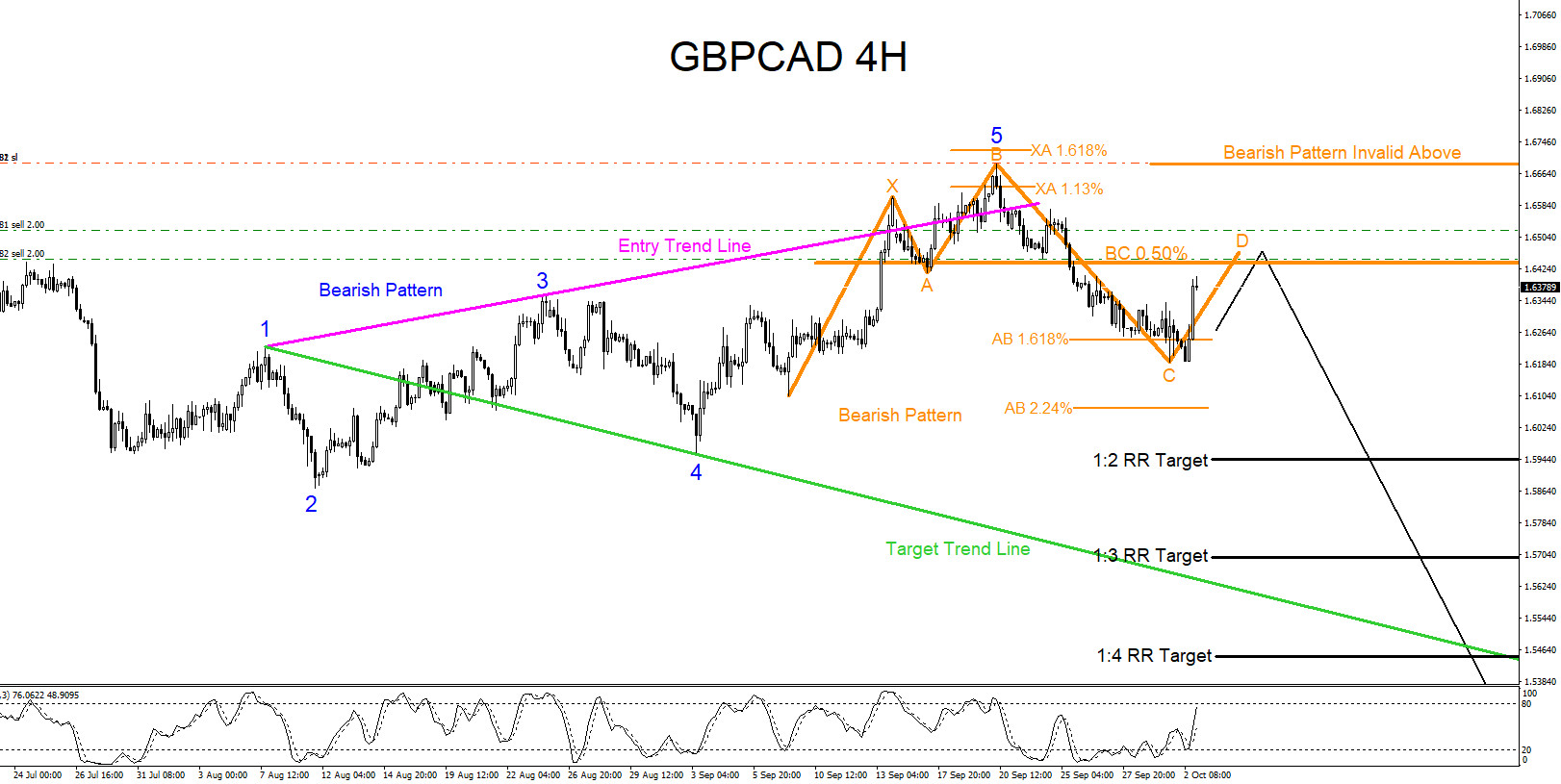

GBPCAD : Bearish Market Patterns Calling for Another Move Lower

Read MoreGBPCAD Technical Analysis October 2/2019 GBPCAD : Possible bearish patterns are visible on the 4 hour chart. The orange bearish pattern still needs to make a push higher to complete point D at the BC 0.50% Fib. retracement level. At the moment traders need to wait for price to reach the the BC 0.50% Fib. […]

-

NZDCAD : Will the Pair Continue Lower?

Read MoreNZDCAD Technical Analysis September 24/2019 NZDCAD : A possible bearish pattern is visible on the 1 hour chart. The green bearish pattern still needs to make a push higher to complete point D at the BC 0.50% Fib. retracement level. At the moment traders need to wait for price to reach the the BC 0.50% […]