-

GBPNZD : Catching the Move Higher

Read MoreGBPNZD Technical Analysis On January 20/2020 I posted on social media (Stocktwits/Twitter) @AidanFX that GBPNZD was setting up to rally higher and for traders to watch for possible buying opportunities. GBPNZD 1 Hour Chart 1.20.2020 : The pair formed a bullish market pattern (blue) and price reacted higher off the point D XA 0.786% Fib. retracement […]

-

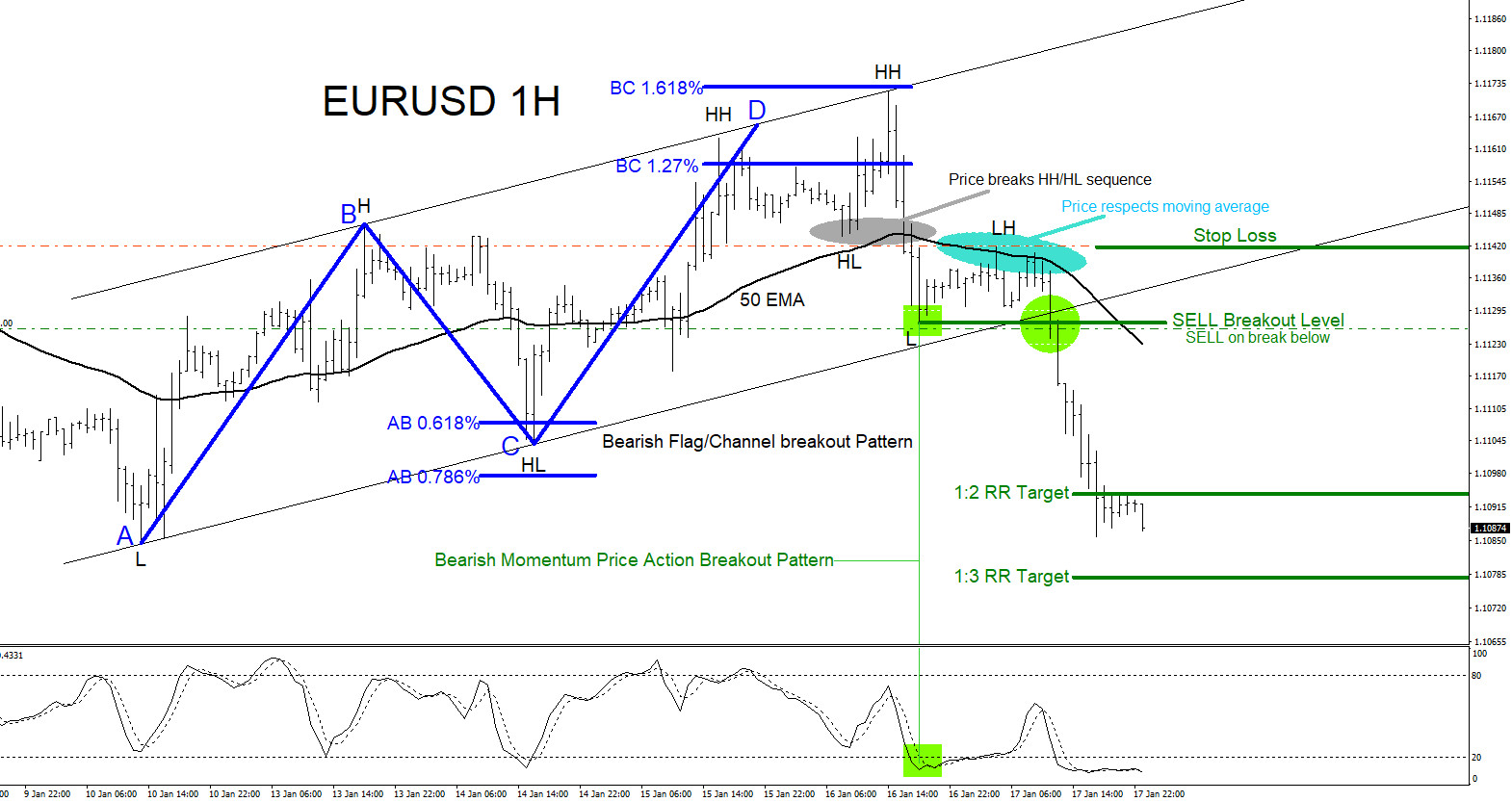

EURUSD : Selling the Breakout Lower

Read MoreEURUSD Technical Analysis EURUSD : Since the start of 2020 the pair has been pushing lower. Using trading filters/confirmations is key to determine and to signal a trader on which side to trade the market. Trading filters/confirmations are strategies used to analyze the market. A trader should never trade off one strategy and should always […]

-

USDCAD : Market Patterns Calling the Move Lower

Read MoreUSDCAD Technical Analysis The USDCAD pair since end of 2018 has been moving lower. The July 2019 low confirmed a lower low/lower high sequence. The possibility of the pair continuing the trend lower was visible but traders needed to wait on other signals/patterns to add more confirmation. In the charts below, clear bearish market patterns […]

-

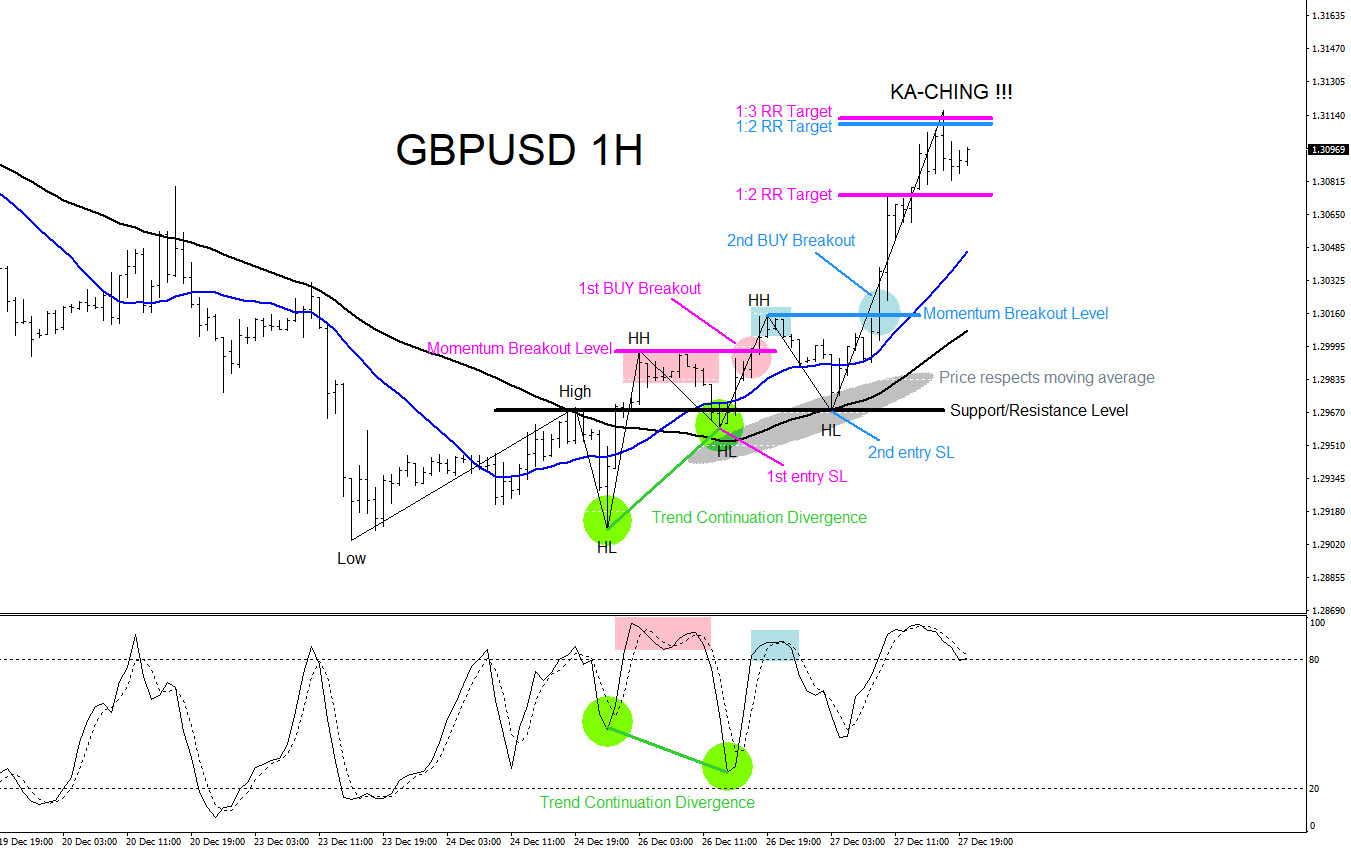

GBPUSD : Buying the Breakout Higher

Read MoreGBPUSD Technical Analysis GBPUSD : In the chart below, the pair made a bounce higher on December 23 2019. The pair found a temporary bottom and started a reversal by making higher highs and higher lows. Understanding how a possible short term trend can be forming is key to catching trade possibilities. Using trading filters/confirmations […]

-

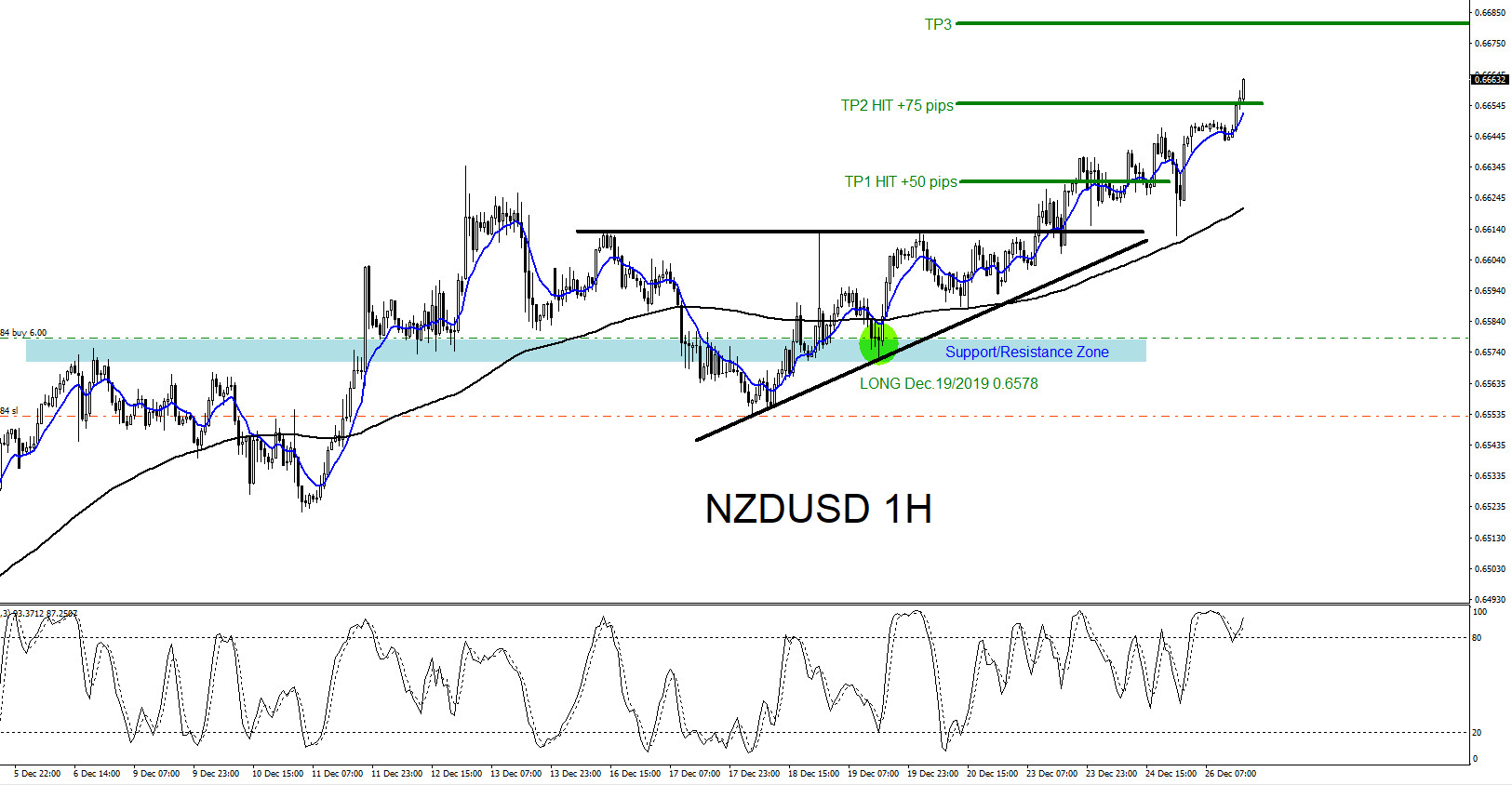

NZDUSD : Trading the Move Higher

Read MoreNZDUSD Technical Analysis On December 17/2019 EWF clients/members were advised that NZDUSD would bounce/rally higher. We use blue boxes to advise clients of potential reversal areas. In the chart below there is a clear Elliott Wave bullish impulse wave forming and we showed our clients the wave (4) termination in the blue box. Our clients […]

-

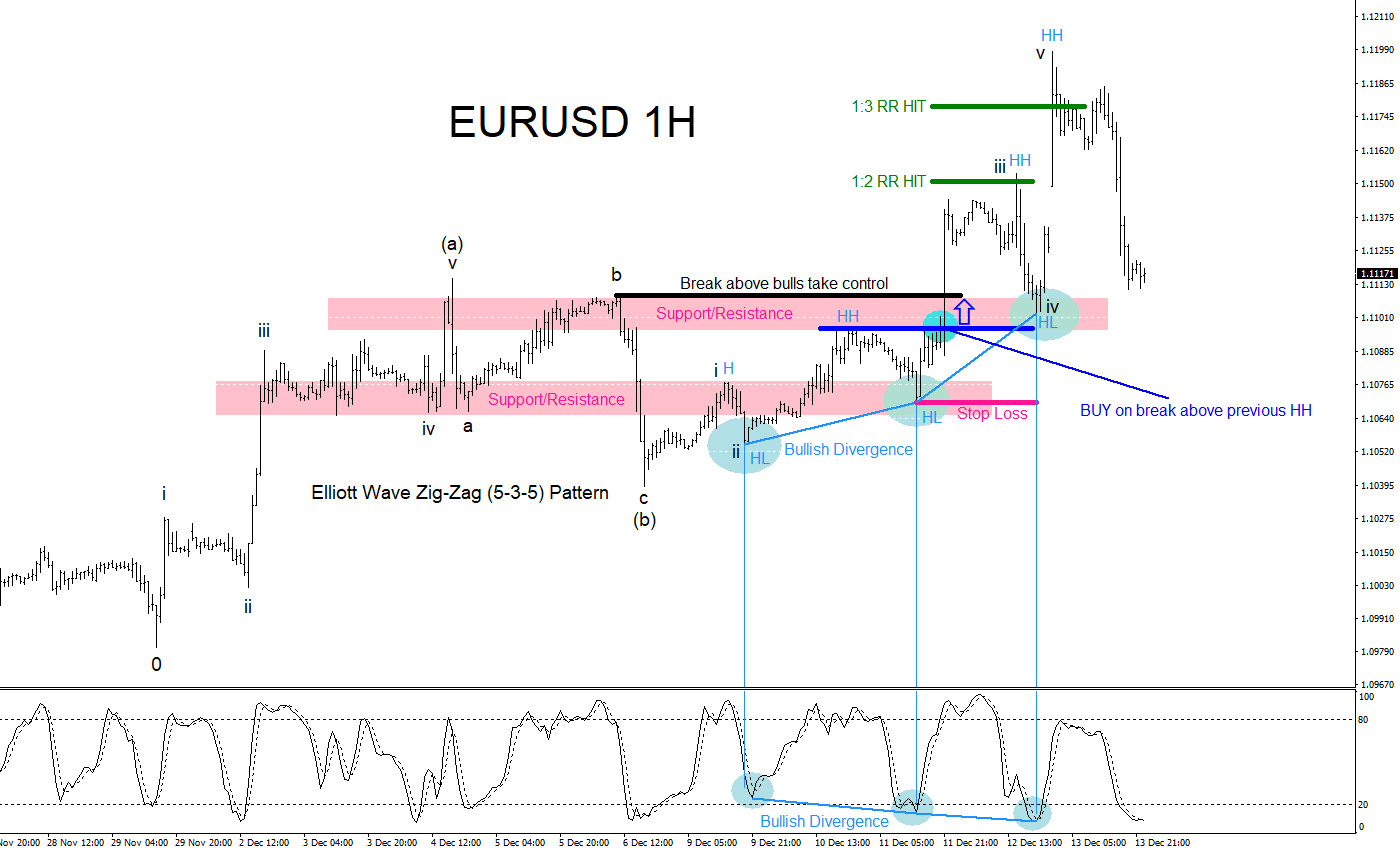

EURUSD : Identifying and Trading the Elliott Wave Zig Zag Pattern

Read MoreEURUSD Technical Analysis EURUSD : An Elliott Wave Zig-Zag pattern is a 3 wave (A,B,C) pattern consisting of a 5-3-5 wave structure. 5 waves for the wave A, followed by 3 waves for wave B and finally another 5 waves for wave C to complete the Zig Zag pattern. The Zig Zag pattern is a […]