-

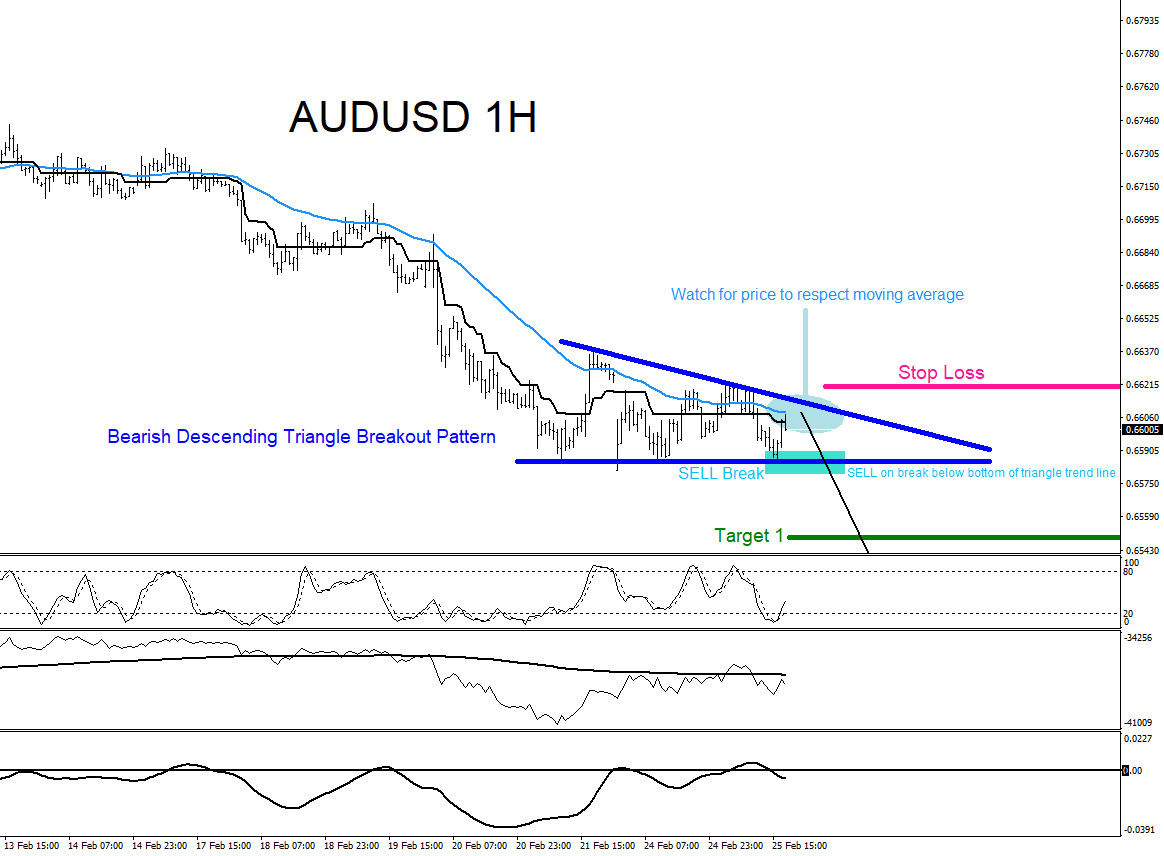

AUDUSD : Trading the Break Lower

Read MoreAUDUSD Technical Analysis On February 25/2020 I posted on social media (Stocktwits/Twitter) @AidanFX “$AUDUSD watch for selling opportunities for extension lower .” AUDUSD 1 Hour Chart 2.25.2020 : The chart below was also posted on social media (StockTwits/Twitter) @AidanFX February 25/2020 showing that a bearish descending triangle breakout pattern (blue) was forming. I called for traders […]

-

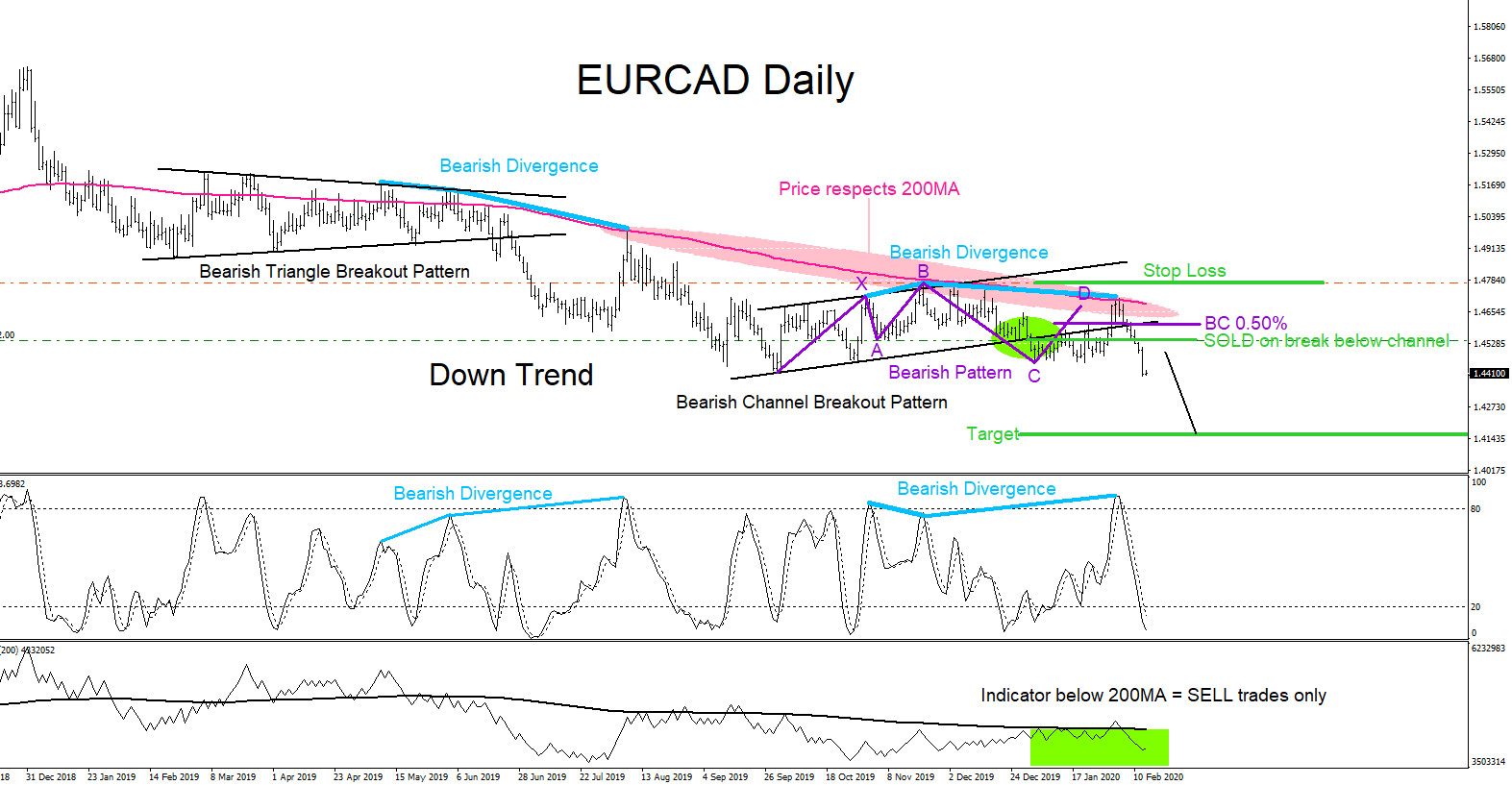

EURCAD : Downside Momentum Remains Active

Read MoreEURCAD Technical Analysis Since March of 2018 EURCAD has been trending lower. The pair at the moment remains bearish and we expect price to continue lower towards the 1.4150 area. Since November 2019 till now I been posting on Twitter/StockTwits the right side to trade was selling the pair. Bearish market patterns are visible signalling […]

-

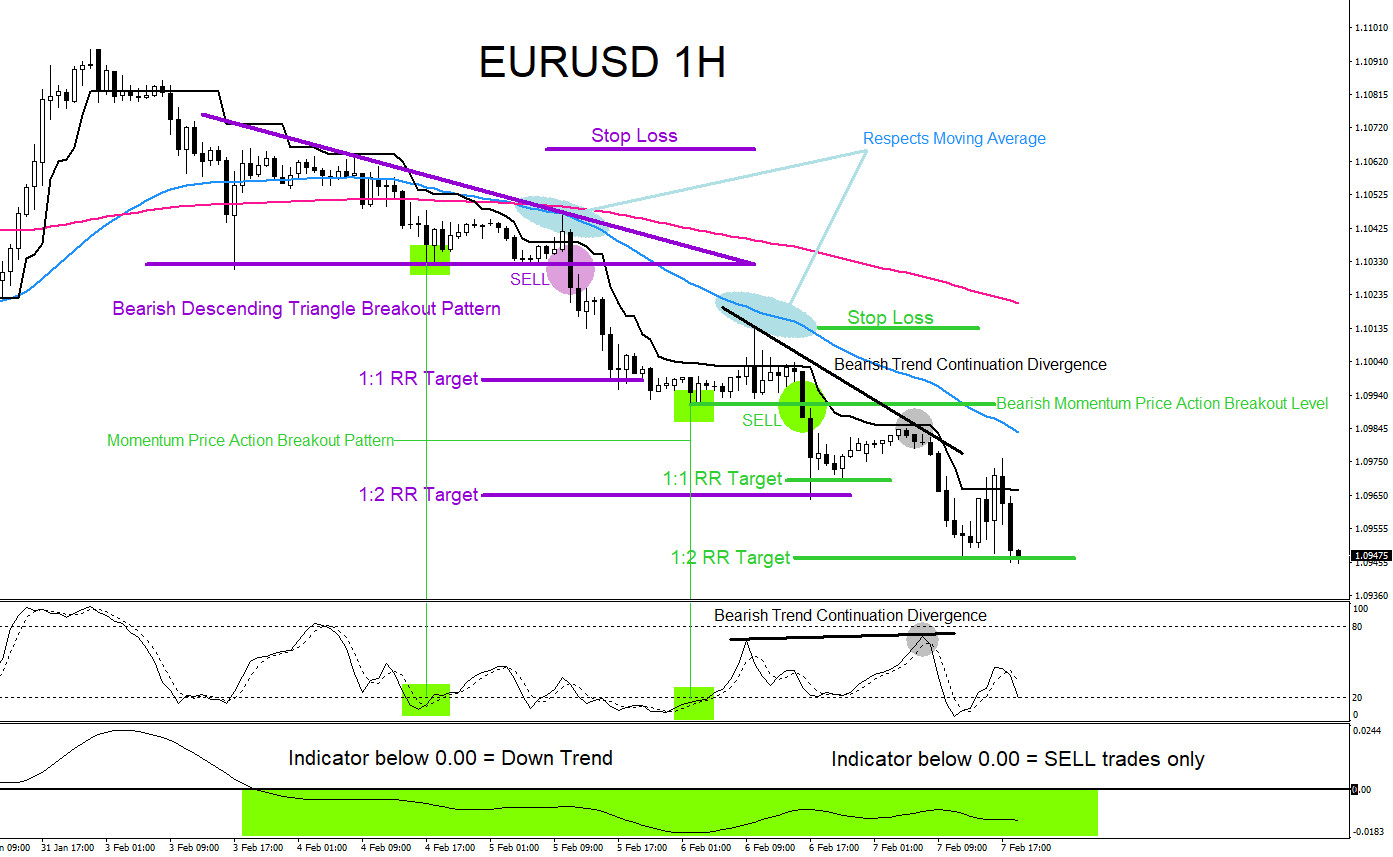

Trading Momentum Breakout Patterns

Read MoreTrading filters/confirmations is key to determine and to signal a trader on which side to trade the market. Trading filters/confirmations are strategies used to analyze the market. A trader should never trade off one strategy and should always combine strategies together to get a better read of the market. Trading filters/confirmations allows a trader to […]

-

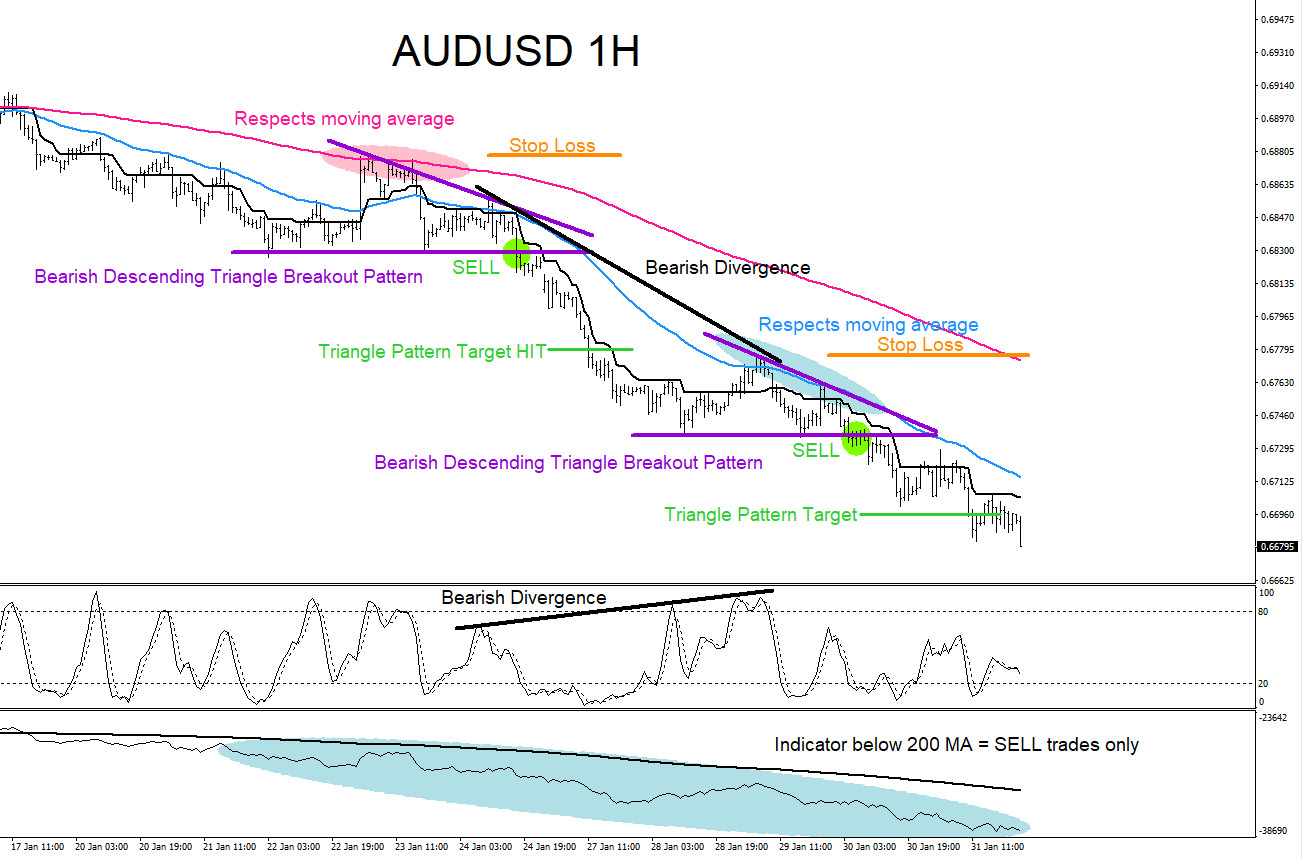

Trading the Aussie Basket

Read MoreTrading a currency basket allows a trader to see the overall strength or weakness of the certain currency. Tracking a currency basket also allows a trader to search and enter multiple trading entries, meaning if a certain currency is showing strength or weakness, you can be sure that it is showing it’s strength or weakness […]

-

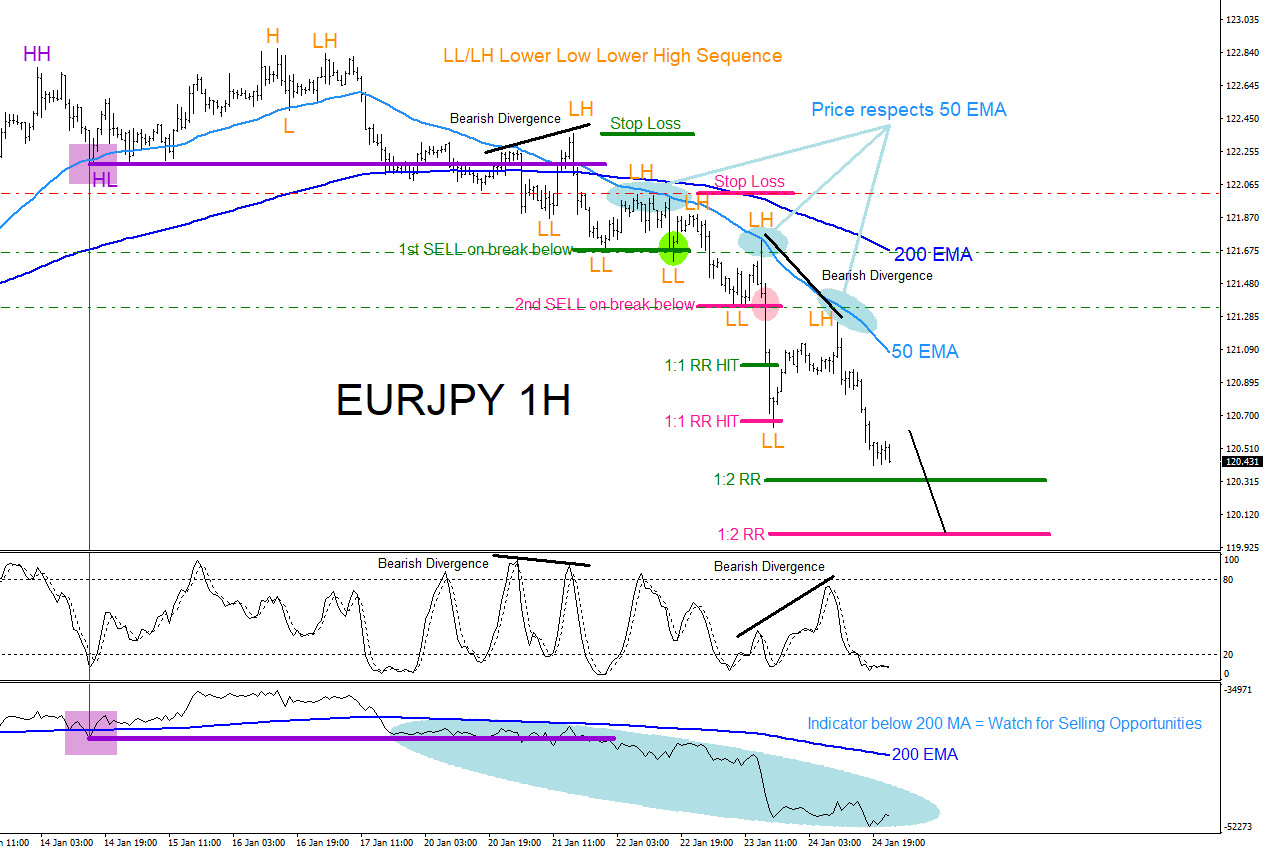

EURJPY : Trading the Breakout Lower

Read MoreEURJPY Technical Analysis EURJPY : Using trading filters/confirmations is key to determine and to signal a trader on which side to trade the market. Trading filters/confirmations are strategies used to analyze the market. A trader should never trade off one strategy and should always combine strategies together to get a better read of the market. […]

-

EURUSD : Trading with the Trend

Read MoreEURUSD Trading with the trend : The pair remained in a lower low/lower high sequence this past trading week (Jan.19/2020-Jan.24/2020) meaning EURUSD was still in a down trend. On January 18/2020 I published this article on > EURUSD : Selling the Breakout Lower explaining the pair was in a LL/LH sequence lower. Traders should always […]