The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Future of Airlines and Transportation Sector After Global Pandemic

Read MoreWe conducted a Free Webinar about Future of Airlines and Transportation sector after Global Pandemic on Friday, 12th June 2020 and below is the recording of that webinar. Future of Airlines and Transportation Sector After Global Pandemic Webinar Recording

-

American Airlines (AAL): A Turn Higher Taking Place

Read MoreIn this article, we will take a look at American Airlines (AAL). Currently, the instrument could be within the process of turning to much higher levels. American Airlines (AAL) was hit with selling pressure during the financial market sell-off in March 2020. Nevertheless, the whole Transportation Sector was already within a correction cycle before Covid-19 […]

-

($TRAN) Dow Jones Transportation Holding A Bullish Pattern

Read MoreThe Dow Jones Transportation Average ($TRAN) is a running average of the stock prices of twenty transportation companies with each stock’s price-weighted to adjust for stocks and other factors. As a result, it can change at any time the markets are open. The figure mentioned in news reports is usually the figure derived from the prices […]

-

Silver (XAGUSD): Getting Ready For A Huge Rally.

Read MoreEvery trader around the World relates trading XAGUSD with XAUUSD. Most of the time, they trade in what we call direct correlation, which means they agree in both swings and overall direction. Since 2015 something very interesting has happened. Gold has rallied and provided a nice impulse rally. But on the other hand, Silver has been sideways […]

-

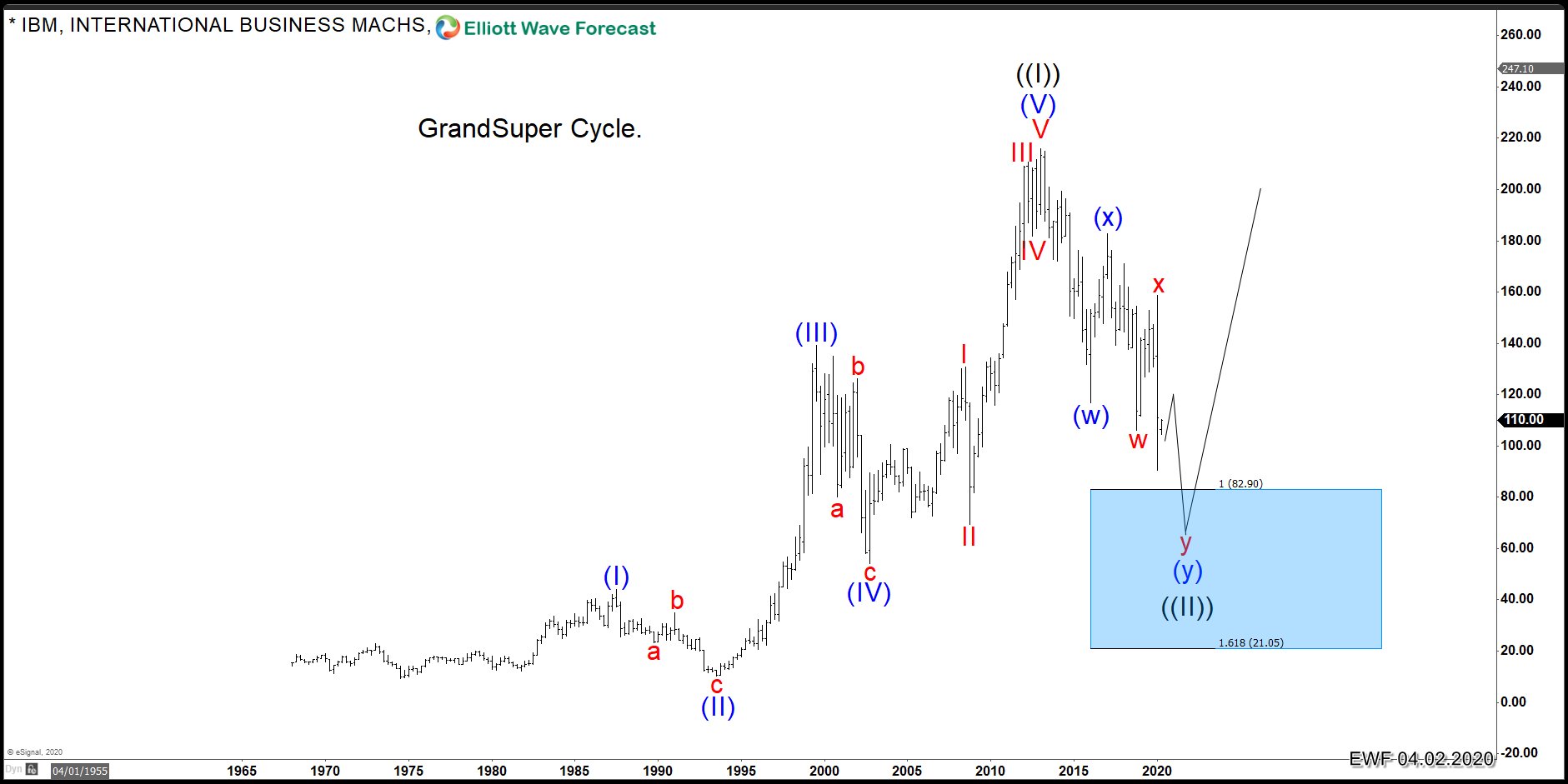

IBM: A Long-Term Investment Opportunity Could Be On The Horizon

Read MoreIn this article, we look at the long-term view of IBM which we believe ended an Elliott Wave Grand Super Cycle from all time the low and is currently correcting that cycle. We will look at the preferred structure of the pull back, where we are within the correction, what is the swing sequence suggesting […]

-

Seminar: Are World Indices Entering into A Crash Territory?

Read MoreSeminar; Are World Indices Entering into a Crash Territory? We conducted a Free webinar on Friday, 20th March 2020 in which we explained whether the World Indices have entered a Crash Territory or not and why we were expecting 2009 cycle to end this year and a larger decline in the Indices to take place. […]