The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

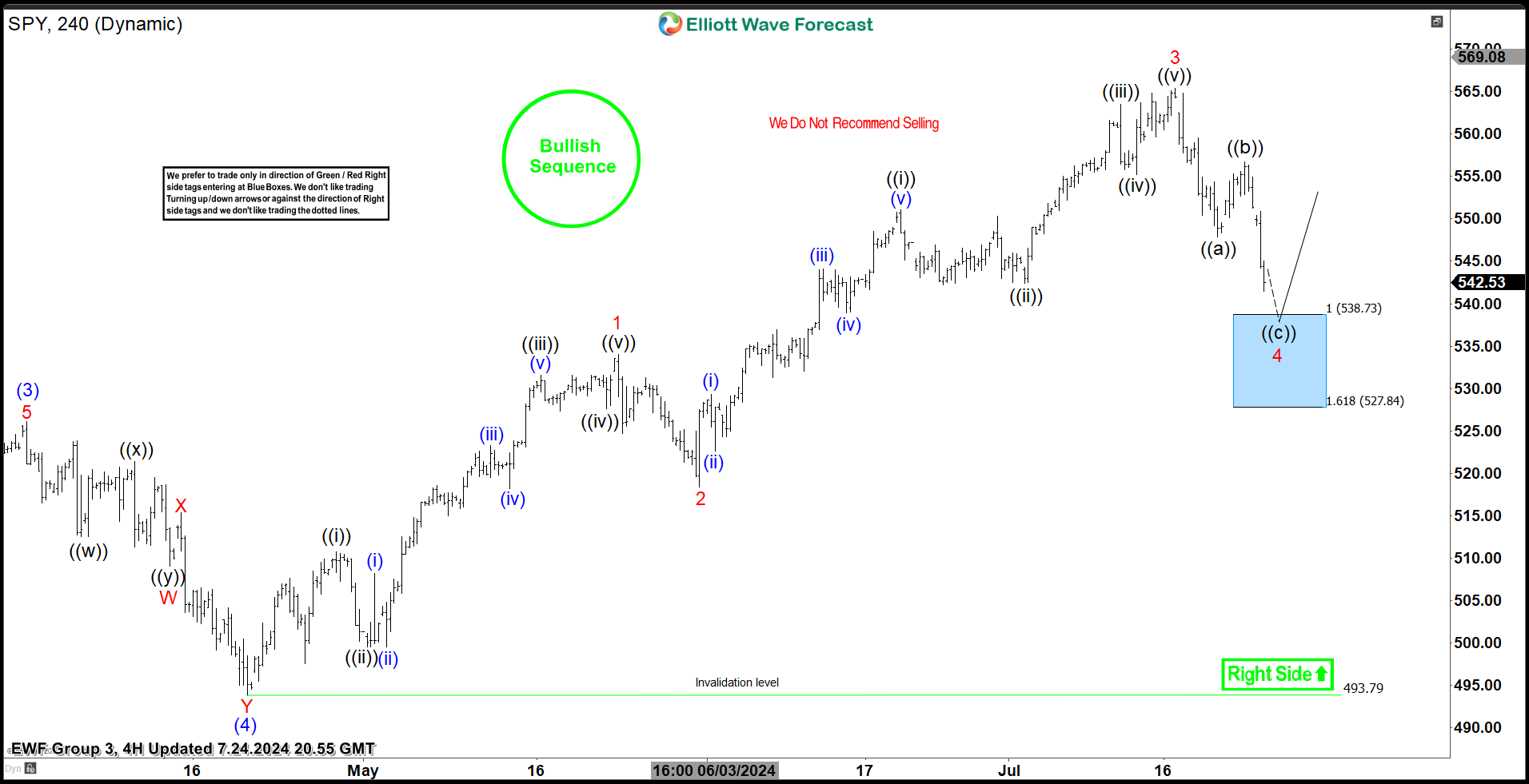

SPDR S&P 500 ETF ( $SPY) Found Buyers At The Blue Box Area As Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 4H Hour Elliott Wave chart of SPDR S&P 500 ETF ($SPY) . The rally from 4.19.2024 low at $493.79 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain […]

-

Token 0x0 Reached The Daily Bullish Turning Point

Read More0x0 is a cryptocurrency project designed to enhance privacy and security featuring a variety of AI-based safety tools. In today’s video bog, we’ll explore Elliott Wave pattern taking place within the daily cycle and explain the potential path based on the theory. Since February 2023, 0x0 rallied into an impulsive 5 waves advance and it ended that cycle in […]

-

Long Term Outlook of S&P 500 (SPX) A Path To 10000, A Nesting On The Making.

Read MoreOn March 4, 1957, the Standard & Poor’s 500 < SPX> was introduced. The S&P 500 index has became synonymous with the term “U.S. stock market.” It is one of the leading benchmarks for the market, even though others, including the Russell and Wilshire indexes, are broader measures of the market. In this video, we […]

-

Silver Miners ETF (SIL) Correction In Progress

Read MoreSIL (Silver Miners ETF) is a financial product designed to mirror the performance of silver mining companies. It offers investors a straightforward way to gain exposure to the silver market without directly purchasing physical silver or individual mining stocks. SIL diversifies risk by spreading investments across multiple companies within the sector, potentially providing a hedge […]

-

Riding the Wave: ($TSLA)’s Impressive Rally and What’s Coming Next

Read MoreHello everyone! In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of Tesla Inc. ($TSLA). The rally from 6.11.2024 low at $167.40 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain the structure & […]

-

WAGMI Games Sitting Within Extreme Reversal Levels

Read MoreWAGMI Games is a pioneering Web3 transmedia entertainment franchise that aims to achieve mass adoption by seamlessly integrating mobile gaming, deep lore, and immersive storytelling. Its mission is to bridge the gap between the worlds of Web3 and Web2 by delivering an unparalleled entertainment experience and fostering a strong community of players and enthusiasts. In […]