The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

iShares 20+ Year Bond ETF ( $TLT) Pullback is Expected to Remain Supported.

Read MoreHello Traders! In this technical blog, we will follow up on the past performance of iShares 20+ Year Bond ETF ($TLT) forecast. We will also review the latest 4H count and explain why the ETF should remain supported. $TLT 4H Elliott Wave View – August 26, 2024: In our last article, we explained that $TLT was showing […]

-

Kaspa (KAS) Found Support at The Blue Box Area

Read MoreKaspa is a proof-of-work (PoW) blockchain that implements the GHOSTDAG protocol with rapid block processing and minimal confirmation durations. It’s ative cryptocurrency KAS is used for on-chain transactions and mining rewards. In today’s video bog, we’ll explore Elliott Wave pattern taking place within the short term cycle and explain the potential path based on the theory. KAS […]

-

SUI Token Ended Corrective Decline & Looking to Turn Higher

Read MoreSUI is the native token of the Sui blockchain network which is a permissionless smart contract platform that uses the Move programming language. SUI tokens can be used to govern the network, pay for gas fees, and participate in staking. In today’s video bog, we’ll explore Elliott Wave pattern taking place within the daily cycle and […]

-

Silver Miners ETF (SIL) Starting the Next Bullish Leg

Read MoreSIL (Silver Miners ETF) is a financial product designed to mirror the performance of silver mining companies. It offers investors a straightforward way to gain exposure to the silver market without directly purchasing physical silver or individual mining stocks. SIL diversifies risk by spreading investments across multiple companies within the sector, potentially providing a hedge […]

-

iShares 20+ Year Bond ETF ( $TLT) Can be Nesting in a Bullish Structure.

Read MoreHello everyone! In today’s article, we will follow up on the past performance of iShares 20+ Year Bond ETF ($TLT) forecast. We will also review the latest 4H count. First, let’s take a look at how we analyzed it back in June 2024. $TLT 4H Elliott Wave View – June 04, 2024: In our last article, we […]

-

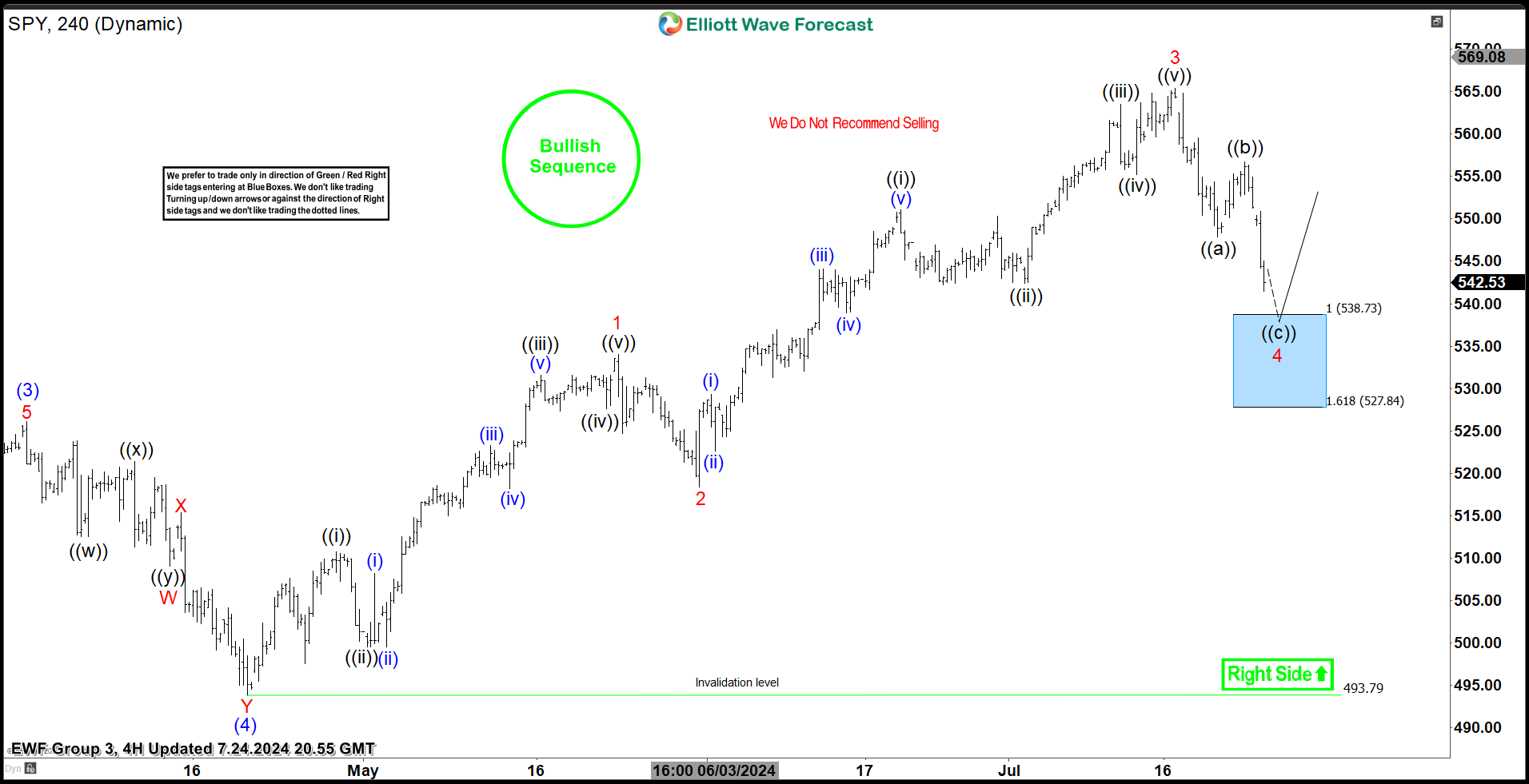

SPDR S&P 500 ETF ( $SPY) Found Buyers At The Blue Box Area As Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 4H Hour Elliott Wave chart of SPDR S&P 500 ETF ($SPY) . The rally from 4.19.2024 low at $493.79 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain […]