In this technical blog, we have looked at the past performance of USDCHF charts, in which the pair reaches new lows from the blue box zone.

USDCHF : Moves Lower as Expected

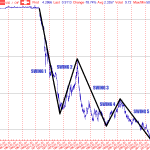

On April 21 2021 I posted on social media @AidanFX “USDCHF as long as price stays below 0.9215 the pair can still make another move lower towards 0.91 handle.” The chart below was also posted on social media @AidanFX April 23 2021 showing the possible bearish patterns. Pink bearish pattern triggered SELLS perfectly in the […]

Possible Long Term Elliott Wave Structures for USDCHF

The Swiss franc is a currency that is always in the hurricane of the Forex because on several occasions the Swiss National Bank has intervened to prevent a continued appreciation of the currency against the dollar. The last time we saw a clear consequence for USDCHF intervention was in early 2015 when the pair lost […]

Elliott Wave Forecast: USDCHF Dips Can See Support

USDCHF rally from March 28 low is impulsive and while dips stay above there, pair can see further upside.This article & video look at the Elliott Wave path.

$EURCHF : Euro Swissy soon to end correcting the 2015 cycle

Here, I am going to take a look on weekly and daily charts of Euro Swissy $EURCHF. In a quiet natural way, this cross is a ratio of two pairs: $EURUSD and $USDCHF. In weekly time frame, the pair $EURCHF shows a strong positive correlation to $USDCHF which is currently turning up. We expect the latter to […]

USDCHF: Sellers defended Elliott Wave Blue Box For New Lows

We keep mentioning to our members are in our Social Media feeds that blue boxes shown on our charts are High-Frequency areas which are based in a relationship of sequences, cycles and calculated using extensions. When ever market gets a bit volatile like we have seen for the last couple of weeks due to Corona […]