In this technical blog, we will look at the past performance of the 1-hour Elliott Wave Charts of Exxon Mobil Corporation ticker symbol: XOM. In which, the rally from 25 November 2025 low unfolded as an impulse structure. But showed a higher high sequence favored more upside extension to take place. Therefore, we advised members not to sell the stock & buy the dips in 3, 7, or 11 swings at the blue box areas. We will explain the structure & forecast below:

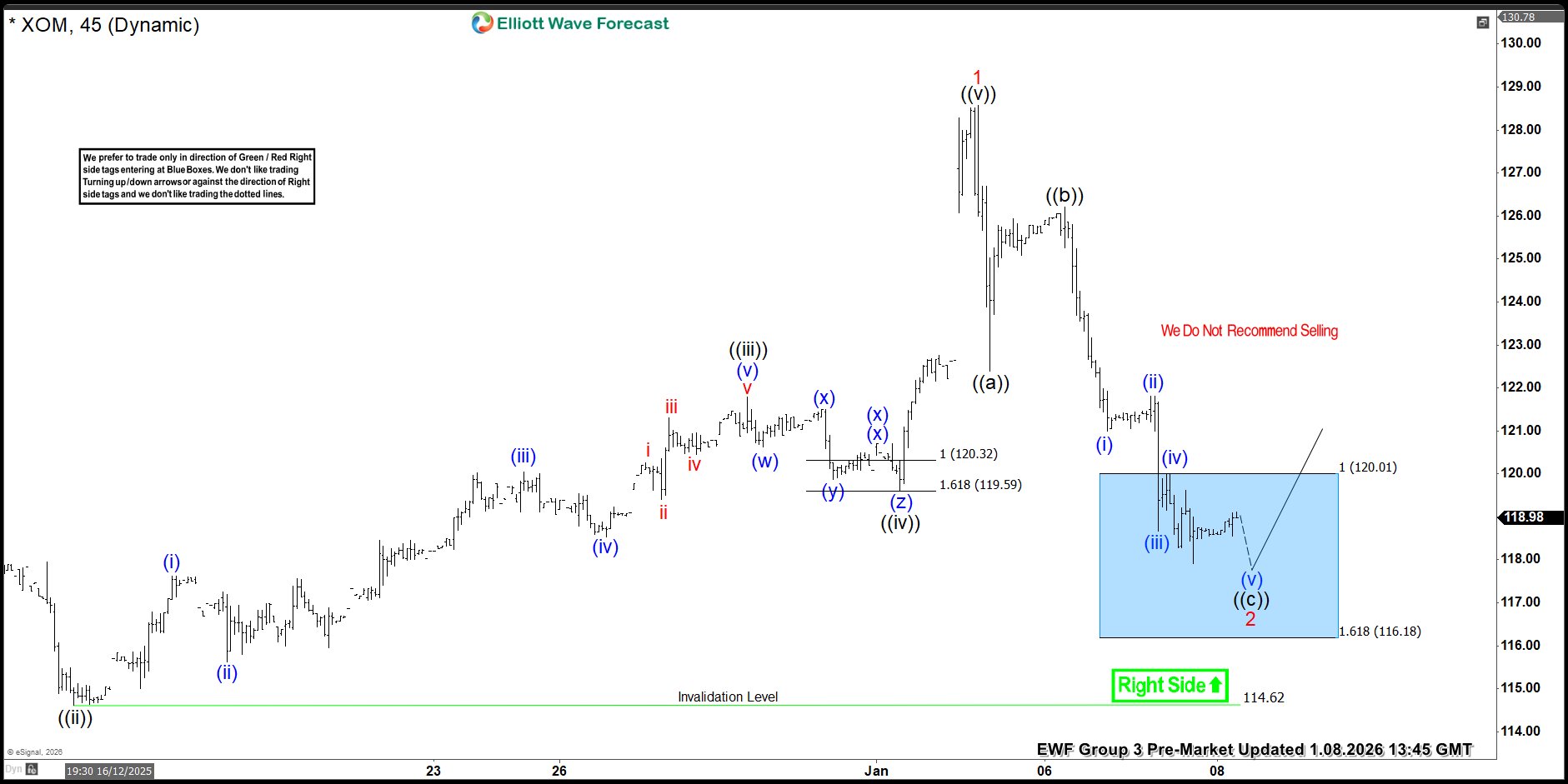

XOM 1-Hour Elliott Wave Chart From 1.08.2026

Here’s the 1-hour Elliott wave chart from the 1.08.2026 Pre-Market update. In which, the cycle from the 25 November 2025 low ended in wave 1 at $128.57 high. Down from there, the stock made a pullback in wave 2. The internals of that pullback unfolded as Elliott wave zigzag correction where wave ((a)) ended at $122.39 low. Then a bounce to $126.20 high ended wave ((b)) & wave ((c)) managed to reach the blue box area at $120.01- $116.18 equal legs area. From there, buyers were expected to appear looking for the next leg higher or for a 3 wave bounce minimum.

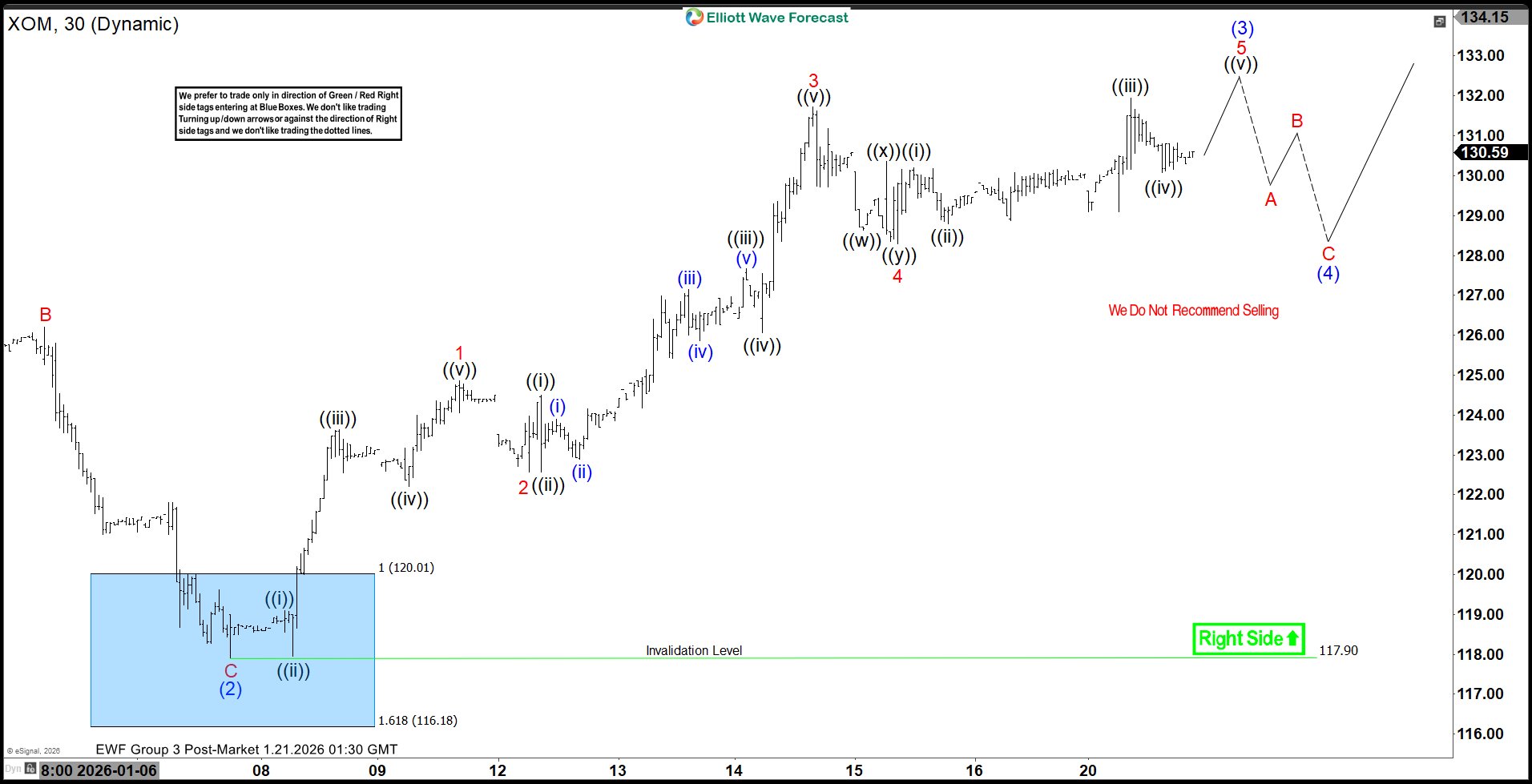

XOM Latest 1-Hour Elliott Wave Chart From 1.21.2026

This is the latest 1-hour Elliott wave Chart from the 1.21.2026 Post-Market update. In which the XOM is showing a very nice reaction higher taking place, right after ending the zigzag correction within the blue box area. Allowed members to create a risk-free position shortly after taking the long position at the blue box area. Since then the stock made a new highs once again confirming the next leg higher towards $132.34- $141.28 target area before profit taking & next pullback takes place.

If you are looking for real-time analysis in XOM along with the other Stocks & ETFs then join us with a 14-Day Trial for the latest updates & price action.

Success in trading requires proper risk and money management as well as an understanding of Elliott Wave theory, cycle analysis, and correlation. We have developed a very good trading strategy that defines the entry.

Stop loss and take profit levels with high accuracy and allow you to take a risk-free position, shortly after taking it by protecting your wallet. If you want to learn all about it and become a professional trader. Then join our service by taking a Trial