Swing Trading is a style of investment where investors buy and hold stocks in anticipation of price movement. The objective of the Swing Trading style is to earn from any potential price movement or possible swing in the market. Profit on each trade is substantially smaller as the holding period is smaller. But these small profits can add up to a good overall return.

Swing Trading is a style of investment where investors buy and hold stocks in anticipation of price movement. The objective of the Swing Trading style is to earn from any potential price movement or possible swing in the market. Profit on each trade is substantially smaller as the holding period is smaller. But these small profits can add up to a good overall return.

Technical analysis is a major tool used by investors to practice swing trading. Technical analysis is a study of statistical trends and patterns which help investors spot investment opportunities. The dependence of historical trading activity and price movements is always not a good stock indicator, hence it is risky investment style.

Managing risk in swing trading is the key to successful trading. For this, swing traders should choose liquid stocks and should aim to diversify their investment portfolio amongst different sectors. Also, using the stop loss option is very important in managing risk.

Swing Trading Strategies

Traders can use many strategies for swing trading. The most commonly used strategies are:

- Moving Averages

- Support and Resistance Triggers

- Moving Average Convergence/Divergence (MACD) crossovers

- Fibonacci retracement pattern

- Head and Shoulders Pattern

A swing trader has to design a strategy that suits his/her investment plan and earns his positive returns. For this the investor looks out for trades setups that can help him/her predict movement in the market and the particular security he/she plans to invest in. No one trade setup suits all. Hence, there is no confirmation about profits. Get to know about RSI trading strategies.

Pros and Cons of Swing Trading

| Pros | Cons |

| Swing Trading does not require much time. Hence you can do it as a part-time job | Swing Traders are exposed to the risk of price changes during the after-hour market. |

| Swing Trading can earn maximum profit by profiting from swings in the market. | Swing traders always face the chance of missing out on a possible profit whenever a pullback happens on their selected security. |

| Since swing trading is short-term. Therefore, it gives greater flexibility to investors in managing their funds. | Timing the market swings is one of the most difficult tasks amongst swing traders. |

| An investor can make use of technical analysis and count on it for all trades. | Swing traders miss out on long-term opportunities. |

Best Swing Trading Stocks in 2023

- Apple

- Caterpillar

- Bank of Montreal

- Stanley Black & Decker

- Advanced Micro Devices, Inc.

- Arch Resources Inc.

Apple

Apple is a trillion-dollar company with huge global brand recognition. The company that introduced the revolutionary iPhone has grown tremendously over the years. Apple has secured a spot as one of the techs Big Four. From the latest iPhone to the original Apple computer, the company has been an ingenious innovator of consumer technologies. The tech sector is huge and increasing by the moment. We have a list of best tech stocks to buy now.

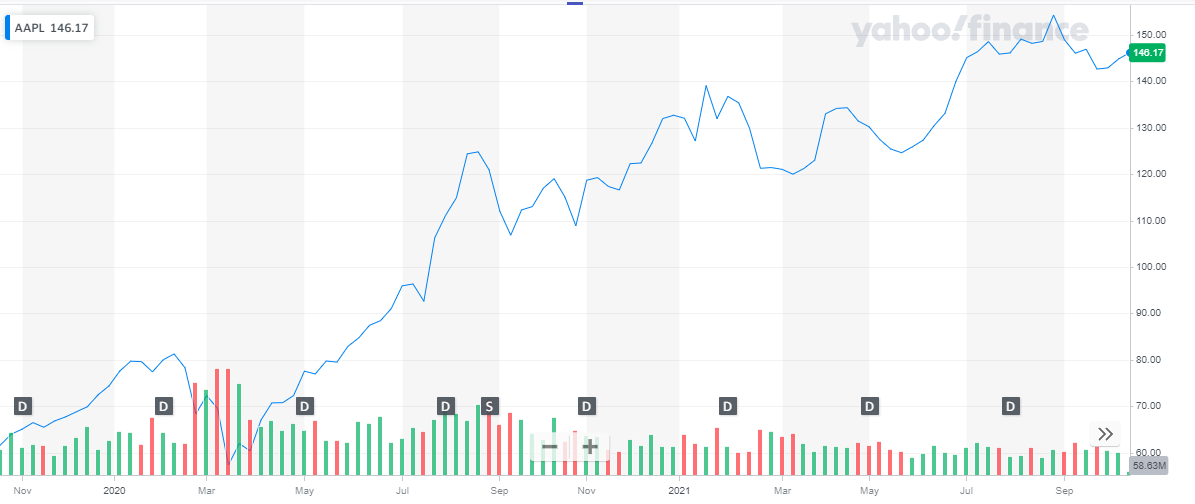

Apple has strengthened as a company since the pandemic. With a market cap of approx. $2.4 trillion, the company’s stock has huge opportunities for swing traders to benefit from. The below chart shows the outstanding stock performance of Apple stock over the past two years. For swing traders this stock journey holds multiple profiting opportunities as seen in the graph below in form of multiple peaks.

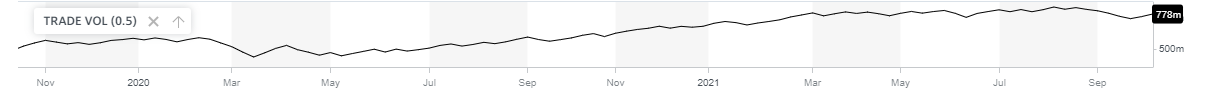

The trading volume of Apple stock has been considerably high. The trading volumes stand in billions.

The trading volume of Apple stock has been considerably high. The trading volumes stand in billions.

In its recent quarterly report, Apple reported record revenue of $81.4 billion, up 36 percent year over year. This growth was powered by unmatched innovating products offered to consumers at a time when the use of technology was at its peak and it was the prime source of connection amongst people everywhere.

In its recent quarterly report, Apple reported record revenue of $81.4 billion, up 36 percent year over year. This growth was powered by unmatched innovating products offered to consumers at a time when the use of technology was at its peak and it was the prime source of connection amongst people everywhere.

Facebook, is an American company offering online social networking services. Founded in 2004, it has very quickly reached the top by becoming the largest social networking site. Facebook’s name being listed amongst the top companies of the U.S.

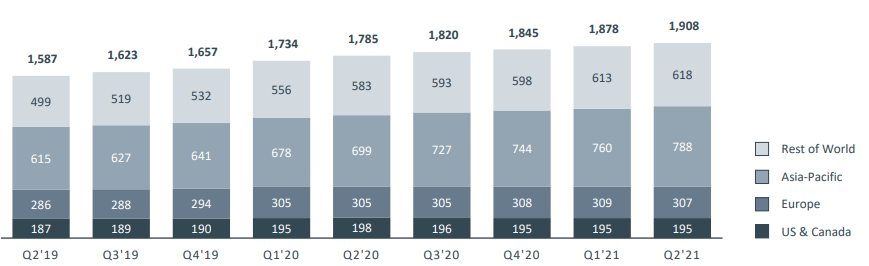

Being a social networking site, daily active users is the key measure to gauge the company’s progress and success. The below graph shows the daily active users, in million, over the last two years.

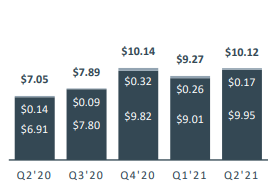

The below chart shows the average revenue per user, Facebook earns:

The below chart shows the average revenue per user, Facebook earns:

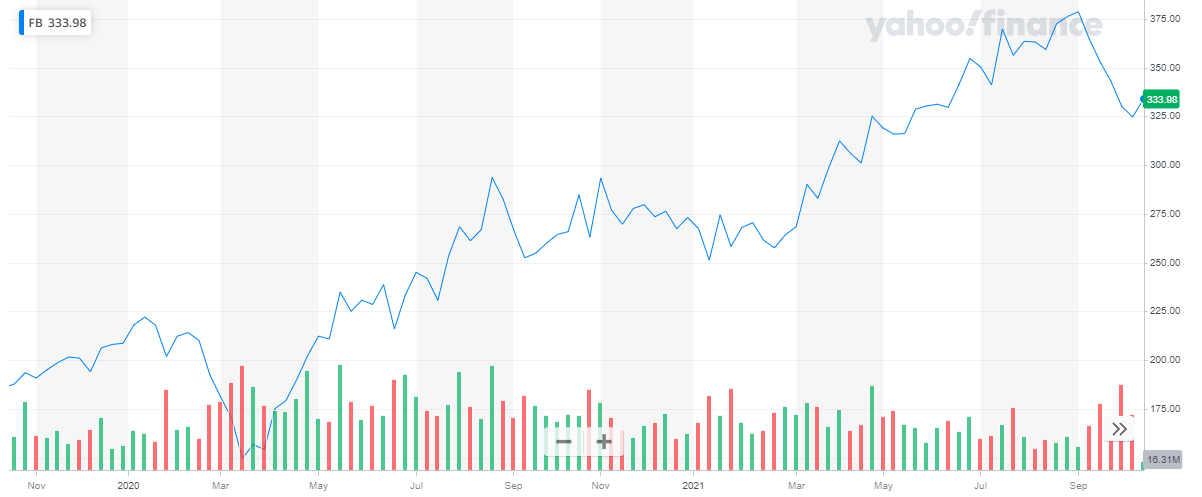

Facebook as a market capitalization of around $943 billion and its share is currently trading at $334.3. The stock of Facebook has spiked tremendously over the past two years. It has been an excellent choice for swing traders to earn profit from the multiple trading pockets as shown in the graph below.

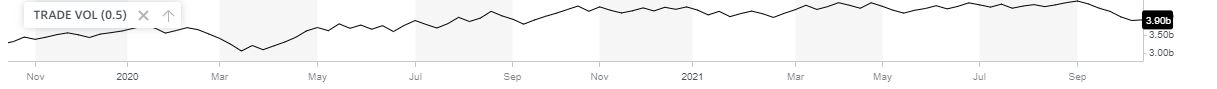

A high trading volume is one of the prime indicators of swing trading stocks. The Facebook stock also has a very high trading volume as shown in the graph below:

A high trading volume is one of the prime indicators of swing trading stocks. The Facebook stock also has a very high trading volume as shown in the graph below:

Also check out our list of best cryptocurrencies.

Also check out our list of best cryptocurrencies.

Caterpillar Inc.

Caterpillar Inc. is the world’s leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives. For almost 100 years, this company is driving sustainable progress and contributing towards a better tomorrow by producing innovative products and services.

The company makes use of cutting-edge technology and decades of product expertise. This combined with their global dealer network has earned the company the leading position in the business. Caterpillar has three business segments: Construction Industries, Resource Industries, and Energy & Transportation.

With a market capitalization of around $109 billion, the share of Caterpillar is trading at $199. In its second-quarter report, the company reported a 29% increase in sales, with sales recorded at $12.9 billion. The increase in sales was majorly due to high user demand, favorable impact from changes in dealer inventories, and favorable currency and price realization impacts.

The below graph shows the share price performance of Caterpillar stock. Throughout its bullish journey, there are multiple pockets of profits before pullback from which swing traders can earn profits.

A stock that is good for swing trading has a very high trade volume. A high trade volume means the stock is easy to buy and sell which makes it an excellent choice for swing traders. The trade volume index of Caterpillar is shown in the below graph. The trade volume of Caterpillar stock has been particularly high throughout the upward journey.

A stock that is good for swing trading has a very high trade volume. A high trade volume means the stock is easy to buy and sell which makes it an excellent choice for swing traders. The trade volume index of Caterpillar is shown in the below graph. The trade volume of Caterpillar stock has been particularly high throughout the upward journey.

Read more:

Bank of Montreal

Bank of Montreal is a leading investment bank and financial services company. It has a network of more than 12 million customers globally, 8 million commercial and personal customers in Canada and 2 million-plus personal, small business and commercial customers in the United States. Moreover, with an asset value of $971 billion, Bank of Montreal is the 8th largest bank by assets in North America.

The bank has three operating business areas:

- Personal and Commercial Banking

- BMO Wealth Management

- BMO Capital Markets

Bank of Montreal has the longest-running dividend payout record of any company in Canada, at 192 years. Moreover, Bank of Montreal’s common shares had an annual dividend yield of 5.3% at October 31, 2020.

With a market valuation at $69 billion, the stock of Bank of Montreal is currently trading around $107. In its recent quarterly report, the bank reported Net Income of $2.3 billion and EPS of $3.44. The quarter was marked with: strong digital foundation accelerated digital engagement and by delivering speed efficacy and scale.

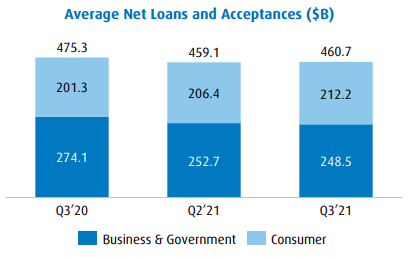

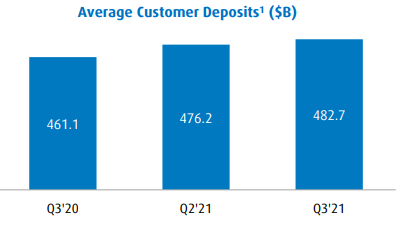

For a bank, the loans and deposits position is the key to financial success. The below graphs show the average net loans and average customer deposits in $:

The below chart shows the stock performance of the Bank of Montreal over the past two years. The stock performance clearly shows the rising periods followed by the pullback of the stock. These time frames are the opportunities for swing traders to take advantage of.

Bank of Montreal has a high trading volume, as shown in the below chart. This is a positive indicator for swing trading.

Bank of Montreal has a high trading volume, as shown in the below chart. This is a positive indicator for swing trading.

Stanley Black & Decker

Stanley Black & Decker

Stanley Black & Decker, Inc. is a global provider of hand tools, power tools, and related accessories, engineered fastening systems and products, services and equipment for oil and gas, and infrastructure applications, commercial electronic security and monitoring systems, healthcare solutions, and automatic doors. In terms of Revenue, Stanley Black and Decker is a leading global diversified industrial; it is number 1 in tools and storage, number 2 in security services and a global leader in engineered fastenings. The Company’s business segments include Tools & Storage, Security, and Industrial.

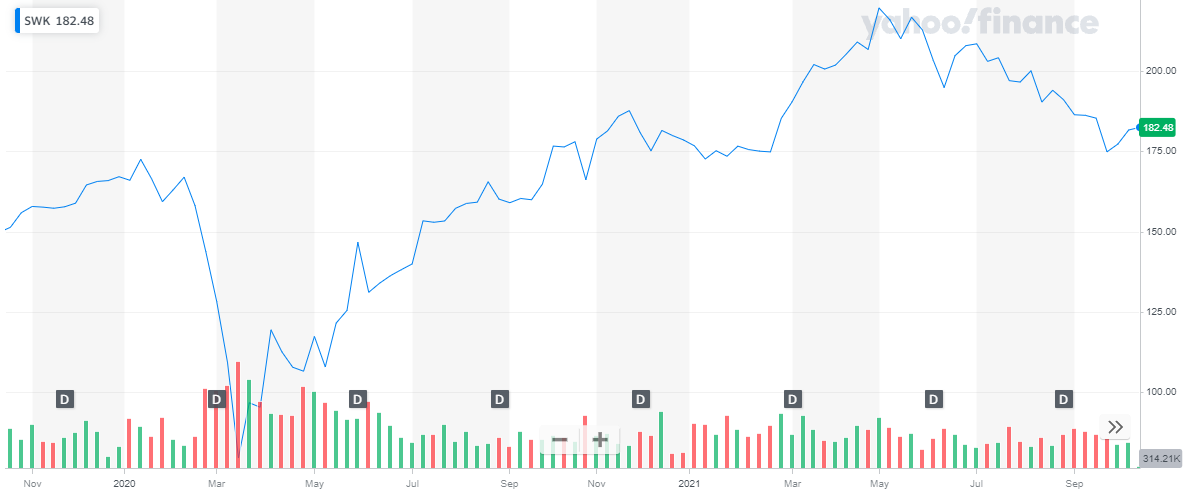

Stanley Black & Decker has a market valuation of around $29.7 billion. Its share is currently trading at $182. The below graph shows the stock performance of Stanley Black and Decker over the past two years.

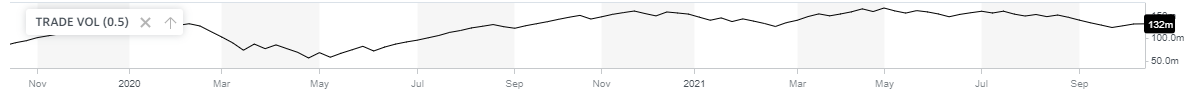

The trade volume of Stanley Black & Decker has been consistently high over the past years, making it an attractive swing trading stock.

In its last quarterly report, Stanley Black & Decker reported revenues of $4.3 Billion reflecting a 37%. All business segments reflect double-digit growth and overall the business has shown 33% organic growth. This growth is fueled by a robust stream of innovation, positive secular trends, and a strong market. These growth factors coupled with the company’s ability to leverage margin resiliency to deliver significant gross and operating margin expansion and record adjusted EPS

In its last quarterly report, Stanley Black & Decker reported revenues of $4.3 Billion reflecting a 37%. All business segments reflect double-digit growth and overall the business has shown 33% organic growth. This growth is fueled by a robust stream of innovation, positive secular trends, and a strong market. These growth factors coupled with the company’s ability to leverage margin resiliency to deliver significant gross and operating margin expansion and record adjusted EPS

Advanced Micro Devices, Inc.

Advanced Micro Devices, Inc. is a global company that specializes in manufacturing semiconductor devices used in computer processing. The company also produces flash memories, graphics processors, motherboard chipsets, and a variety of components used in consumer electronics goods. The company is a major supplier of microprocessors (computer chips). The company has two business segments: Computing and Graphics Segment and Enterprise, Embedded, and Semi-Custom segment.

The company has a market capitalization of over $141 billion and its stock is currently trading at $116.23. In its recent quarterly report, the company reported a 99% increase in revenue year-on-year, with revenue recorded at $3.85 billion. The growth in revenue was fueled by higher client and graphics processor sales of the Computing and Graphics Segment and higher EPYC processor revenue and semi-custom product sales in the Enterprise, Embedded, and Semi-Custom segments. Also, the quarter’s profitability has increased by approx. three-fold, recorded at $710 million. Get to know the best trading and forex signal providers.

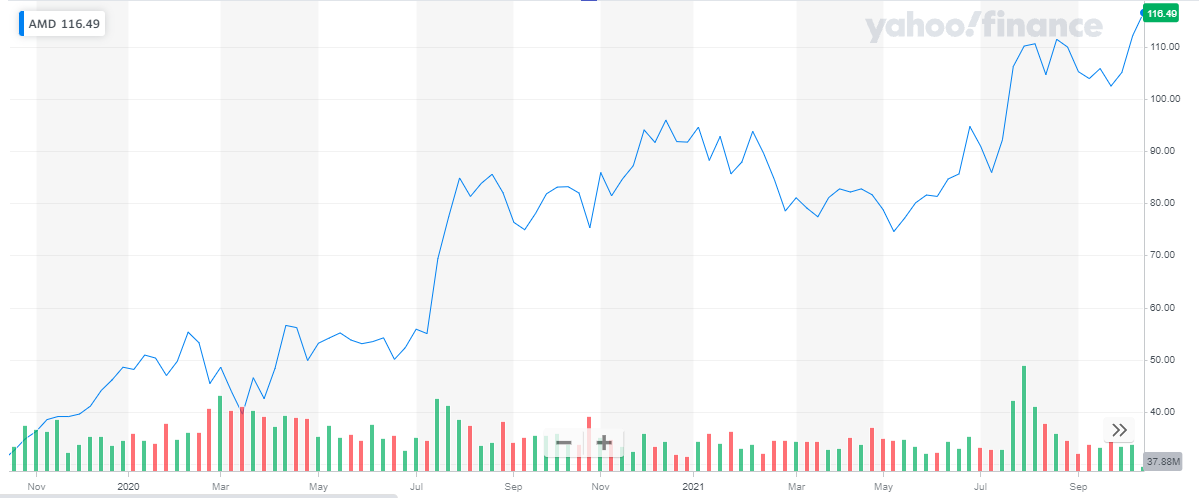

The below graph shows the share performance of the semiconductor company. The graph shows multiple trenches and peaks throughout the past two years, making it an excellent investment opportunity for swing traders.

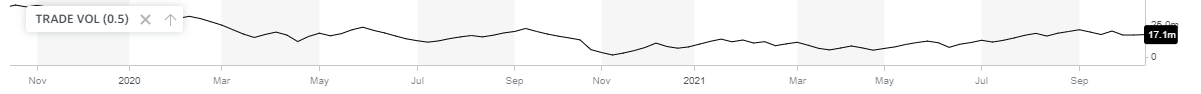

The trade volume index reflects the very high trading volume of the company. The trading volume is in billion over the past two years as shown in the graph below:

The trade volume index reflects the very high trading volume of the company. The trading volume is in billion over the past two years as shown in the graph below:

Also read: Best Stocks to Day Trade

Arch Resources Inc.

Arch Resources is an American coal mining and processing company. It is a premier producer of premium metallurgical products for an increasingly high-speed, increasingly vertical world. Arch Resources is the second-largest supplier of coal in the United States.

Arch Resources has a market capitalization of over $1.5 billion. Its stock is currently trading at $99. The below chart shows the stock performance of the company over the past two years. The graph illustrates some excellent opportunities for swing traders to earn profit from.

Arch Resources Inc is comparatively small in size to other companies mentioned here. As a result, its trading volume is comparatively low but still pretty high. Swing traders can find an excellent opportunity in this stock to earn profit.

Arch Resources Inc is comparatively small in size to other companies mentioned here. As a result, its trading volume is comparatively low but still pretty high. Swing traders can find an excellent opportunity in this stock to earn profit.

In its recent quarterly report, the company reported a net income of $27.9 million, compared with a net loss of $49.3 million, in the prior-year period. The company’s core coking coal segment was executed with efficiency and precision during the second quarter. This resulted in the company being able to deliver higher volumes, outstanding cost performance, which leads to improved margins. With the global economy in recovery mode, infrastructure-driven stimulus efforts gaining momentum around the world, and an intensifying focus on the build-out of a new, low-carbon economy, the company expect demand for steel and its premium metallurgical coal to continue to increase. There is a vast array of trading courses available online which you can join, each with its own merits and every course suitable for different types of traders.

In its recent quarterly report, the company reported a net income of $27.9 million, compared with a net loss of $49.3 million, in the prior-year period. The company’s core coking coal segment was executed with efficiency and precision during the second quarter. This resulted in the company being able to deliver higher volumes, outstanding cost performance, which leads to improved margins. With the global economy in recovery mode, infrastructure-driven stimulus efforts gaining momentum around the world, and an intensifying focus on the build-out of a new, low-carbon economy, the company expect demand for steel and its premium metallurgical coal to continue to increase. There is a vast array of trading courses available online which you can join, each with its own merits and every course suitable for different types of traders.

Conclusion

Swing Trading is an excellent profitable investment style. Through multiple small trading sessions, investors can earn substantially if their forecast is correct. The above-listed companies have shown great potential in the past as the best swing trading stocks. With the expected future outlook of the company, and the global economy improving and resuming the normal routine, these companies are excellent swing trade stocks to invest in.

Disclaimer: None of the information published in this article should be construed as investment advice. Article is based on author’s independent research, we strongly advise our readers to always do their due diligence before investing.

You may also like reading: