The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

S&P 500 E-Mini (ES_F) Elliott Wave: Blue Box Buy Setup Explained

Read MoreHello fellow traders, As our members know we have had many profitable trading setups recently. In this technical article, we are going to present another Elliott Wave trading setup we got in SPX E-Mini ( ES_F ) . ES_F completed this correction precisely at the Equal Legs zone, referred to as the Blue Box Area. […]

-

S&P 500 ETF (SPY) Resumes Advance Towards All-Time High

Read MoreS&P 500 ETF (SPY) has ended the correction in a double three and turned higher. This article and video look at the Elliott Wave path.

-

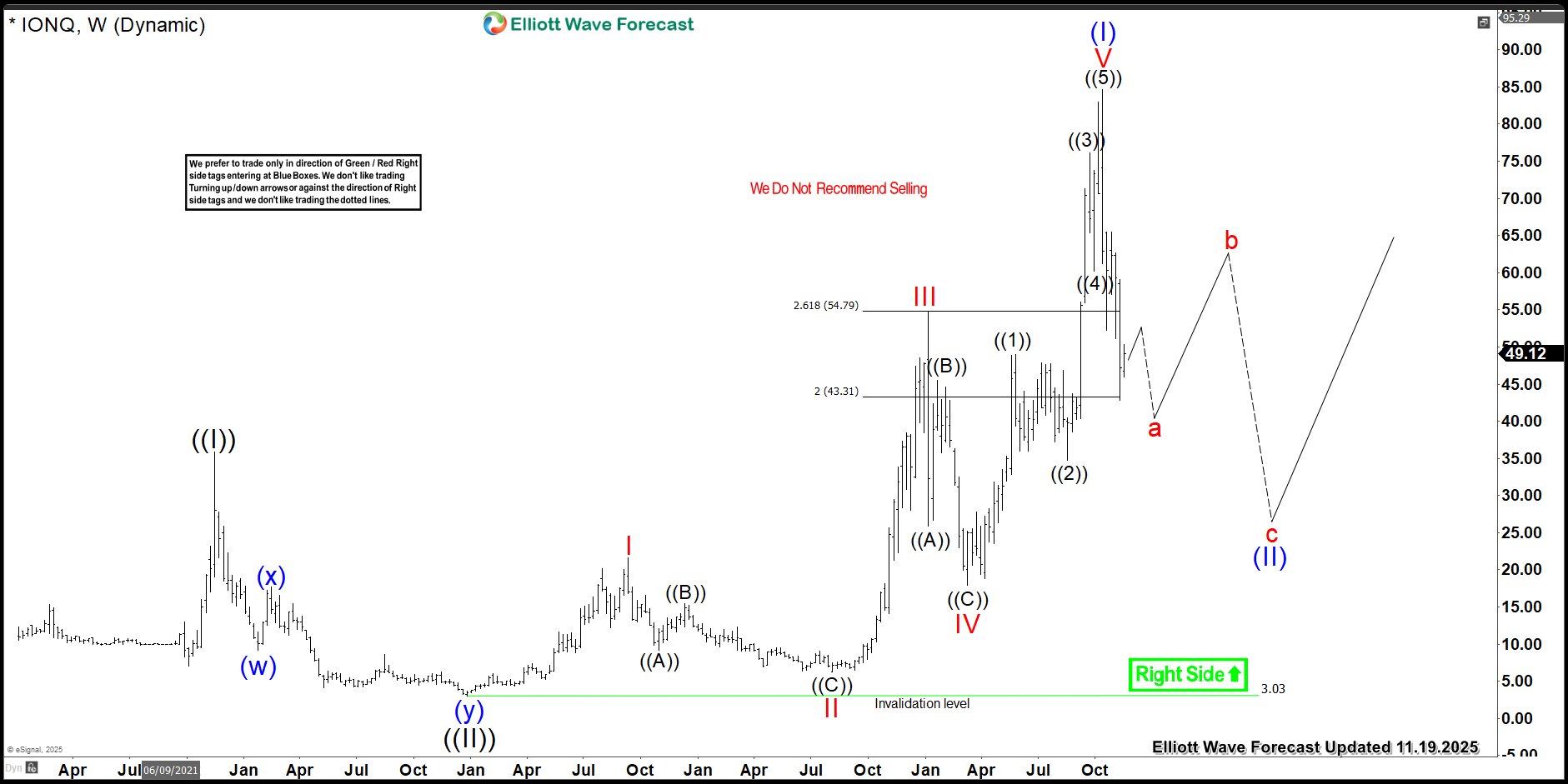

Temporary Pause, Tactical Opportunity: IONQ ABC Setup in Focus

Read MoreThis technical blog explores the potential temporary pause in IONQ and highlights a possible larger 3-wave pullback currently in focus.

-

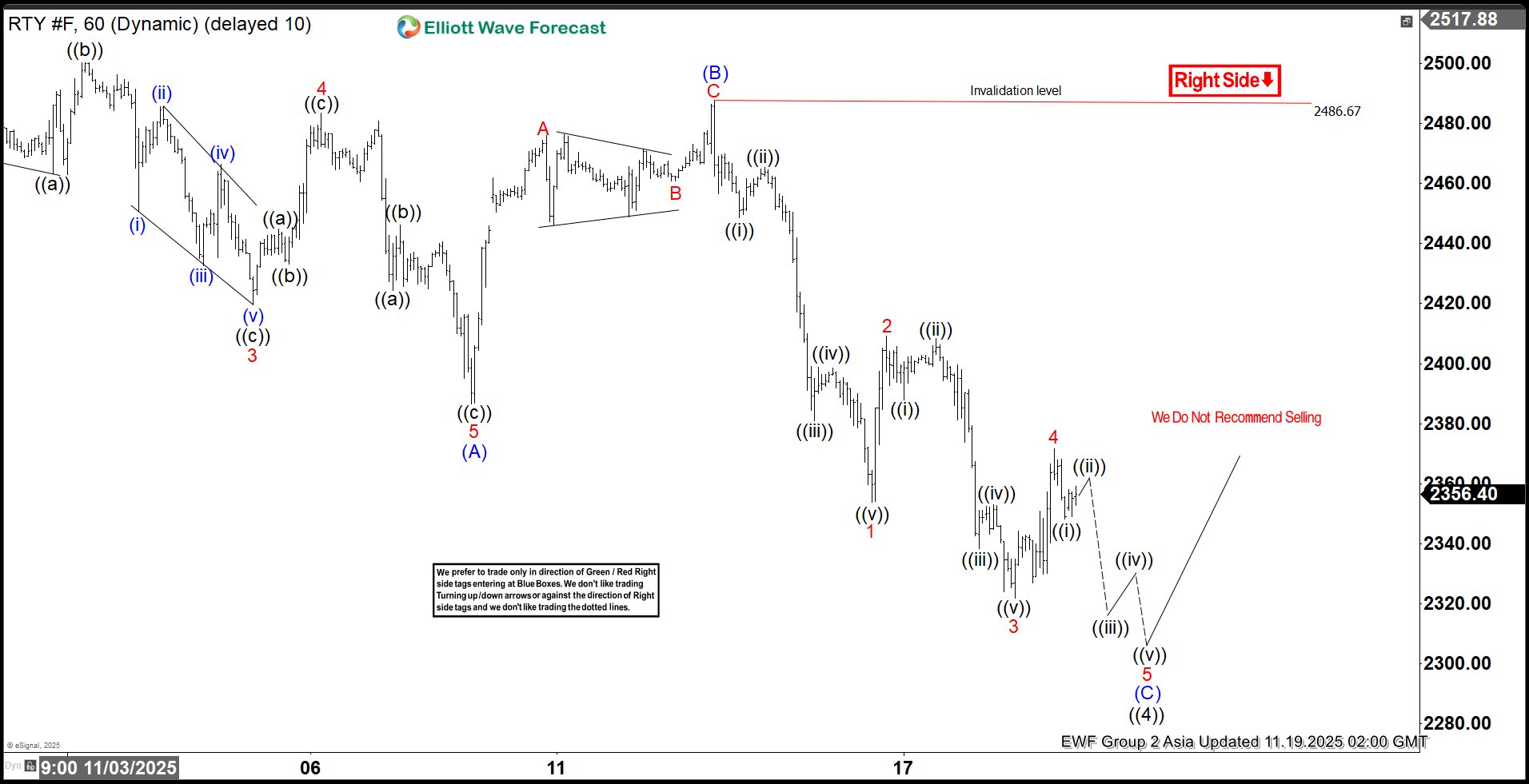

Zigzag Structure in Russell Futures (RTY) Nears Resolution Around 2300

Read MoreRussell 2000 (RTY) is correcting in a zigzag structure and should soon see support at 2300 area. This article and video look at the Elliott Wave path.

-

Bitfarms Ltd. $BITF Update: Zig-Zag Correction Offers a Blue Box Area

Read MoreHello Traders! In today’s update, we’ll revisit the Elliott Wave structure of Bitfarms Ltd. ($BITF) and provide insights into the next phase of its price action. You can check the last article here. As anticipated, a Zig-Zag (ABC) pattern is unfolding, approaching a critical support zone where buyers have historically stepped in. Let’s break down the key developments. 5 Wave Impulse Structure + […]

-

Volatility Before Opportunity: AT&T (T) Correction Sets Up Rally

Read MoreAnalysts still maintain a Moderate Buy consensus with an average price target of about $30.6, implying nearly 20% upside from current levels. However, forecasts suggest short‑term weakness: AT&T (T) could dip toward $23.4 by the end of November and $22.1 in December, reflecting a potential 10% decline. This near‑term pressure stems from market fatigue and […]