The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

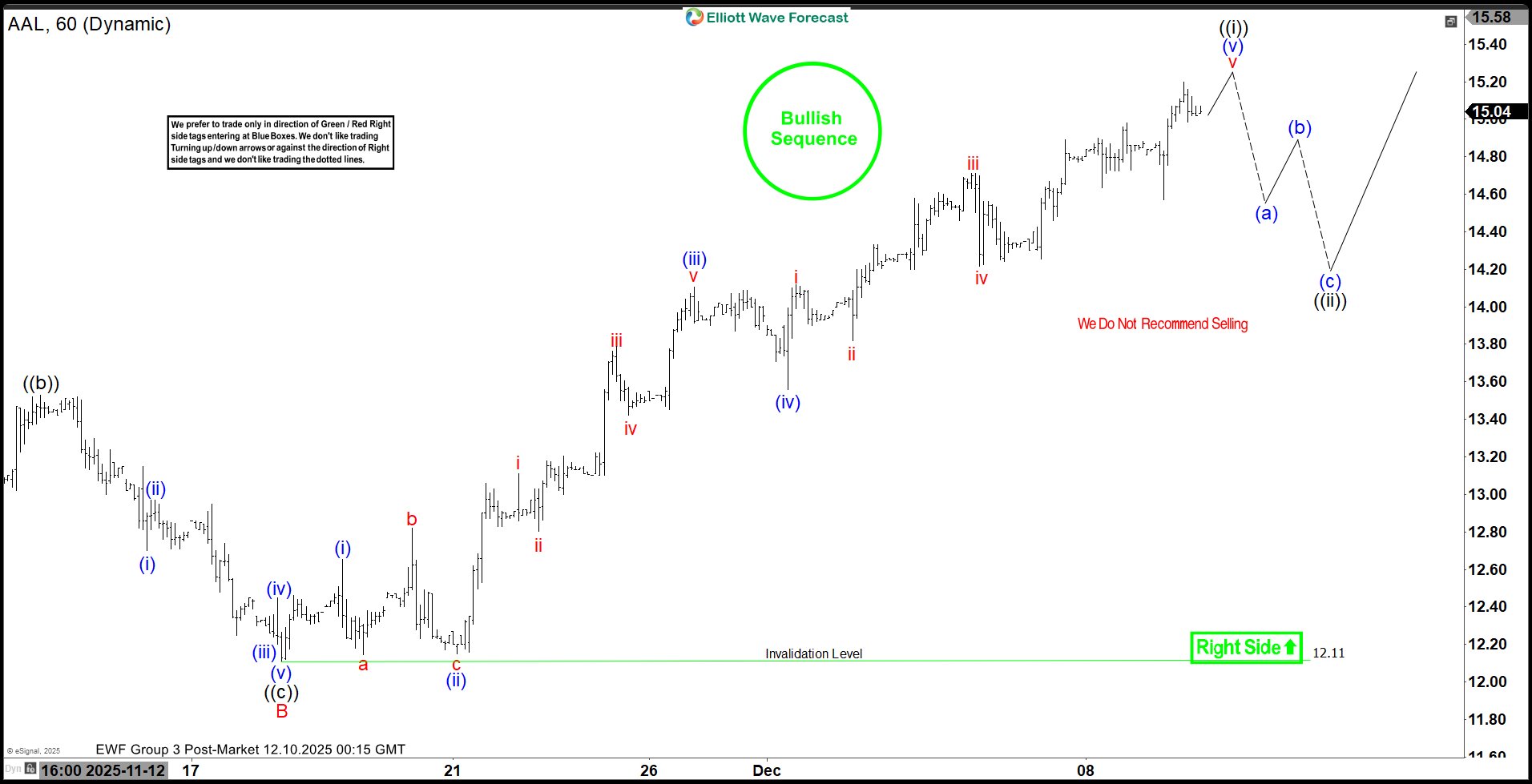

American Airlines (AAL) Bullish Trend Signals Opportunity on Retracement

Read MoreAmerican Airlines (AAL) shows a bullish sequence from October 1 low favoring more upside. This article and video look at the Elliott Wave path.

-

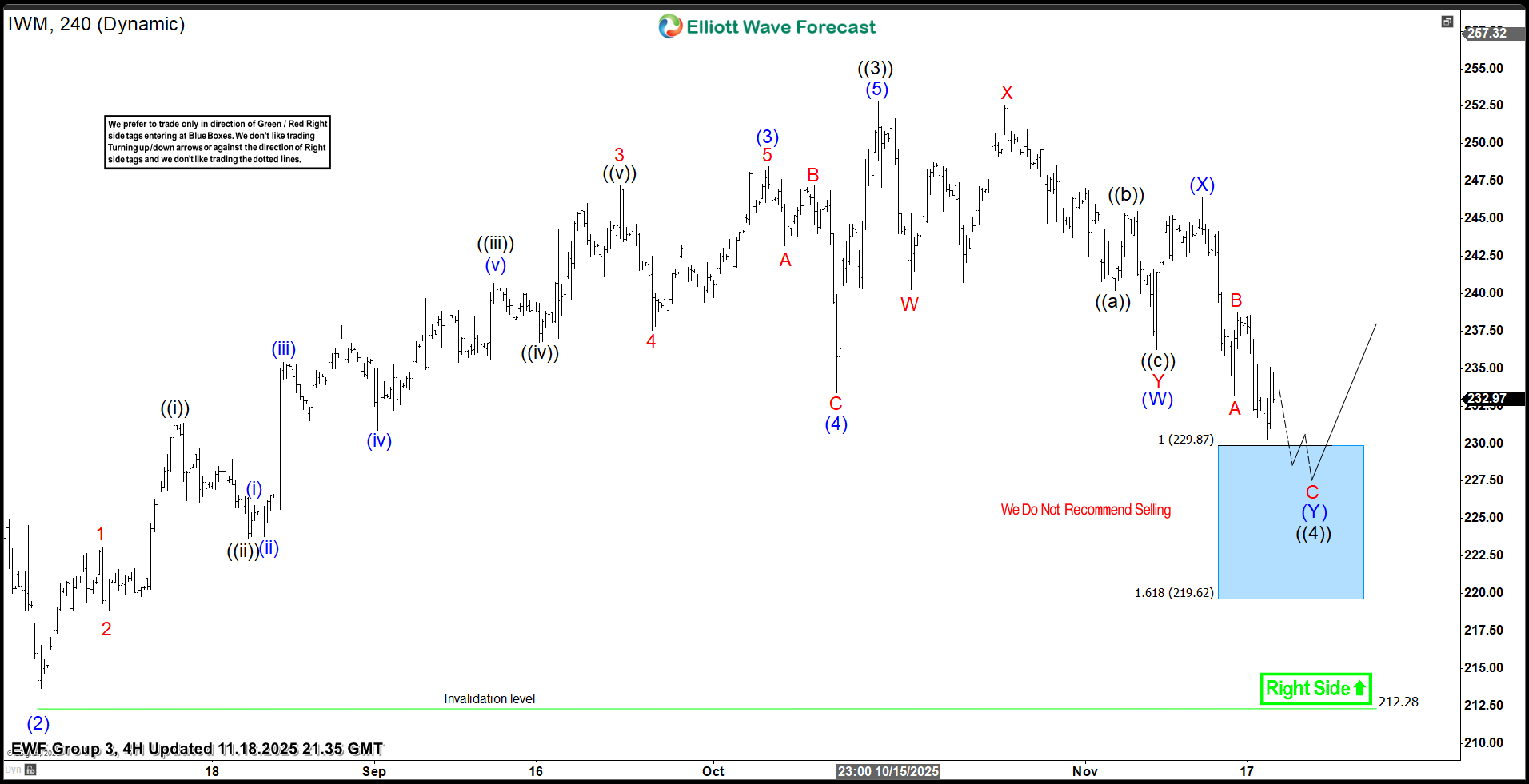

Russell 2000 ETF $IWM Soars 11% from Blue Box Area, With $258 Target Still Ahead

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Russell 2000 ETF ($IWM) through the lens of Elliott Wave Theory. We’ll review how the powerful rally from the November 2025 low unfolded as a textbook 5-wave impulse and discuss our evolving forecast for the next move. Let’s dive into the structure and expectations for this tech […]

-

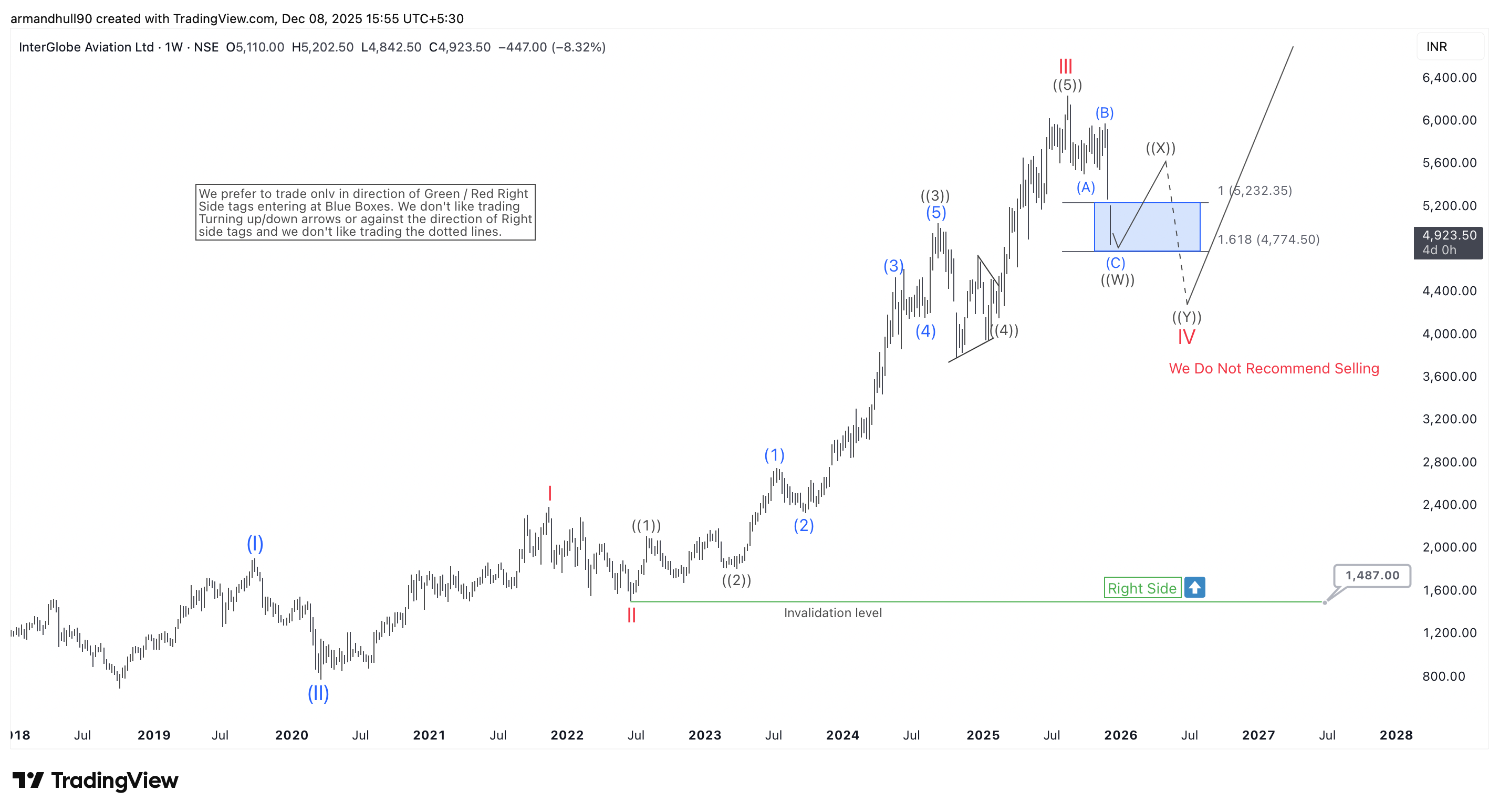

Has IndiGo Finished Its Pullback? Wave V Rally Next?

Read MoreA detailed weekly Elliott Wave analysis of IndiGo highlighting the Wave IV blue-box zone, right-side bullish outlook, and long-term upside potential. InterGlobe Aviation Ltd (NSE: INDIGO) remains in a strong long-term uptrend. The weekly chart shows a clean Elliott Wave structure that supports this view. The stock recently completed a higher-degree Wave III near the […]

-

Vertiv Holdings (VRT) Eyes New High Between $215.3 – $232.75

Read MoreVertiv Holdings Co., (VRT) is an American multinational provider of critical infrastructure & services for data centers, communication networks & commercial & industrial environments. It comes under Industrials sector & trades as “VRT” ticket for NYSE. VRT favors bullish sequence in weekly & expects push higher against 11.21.2025 low. It favors rally between $215.3 – […]

-

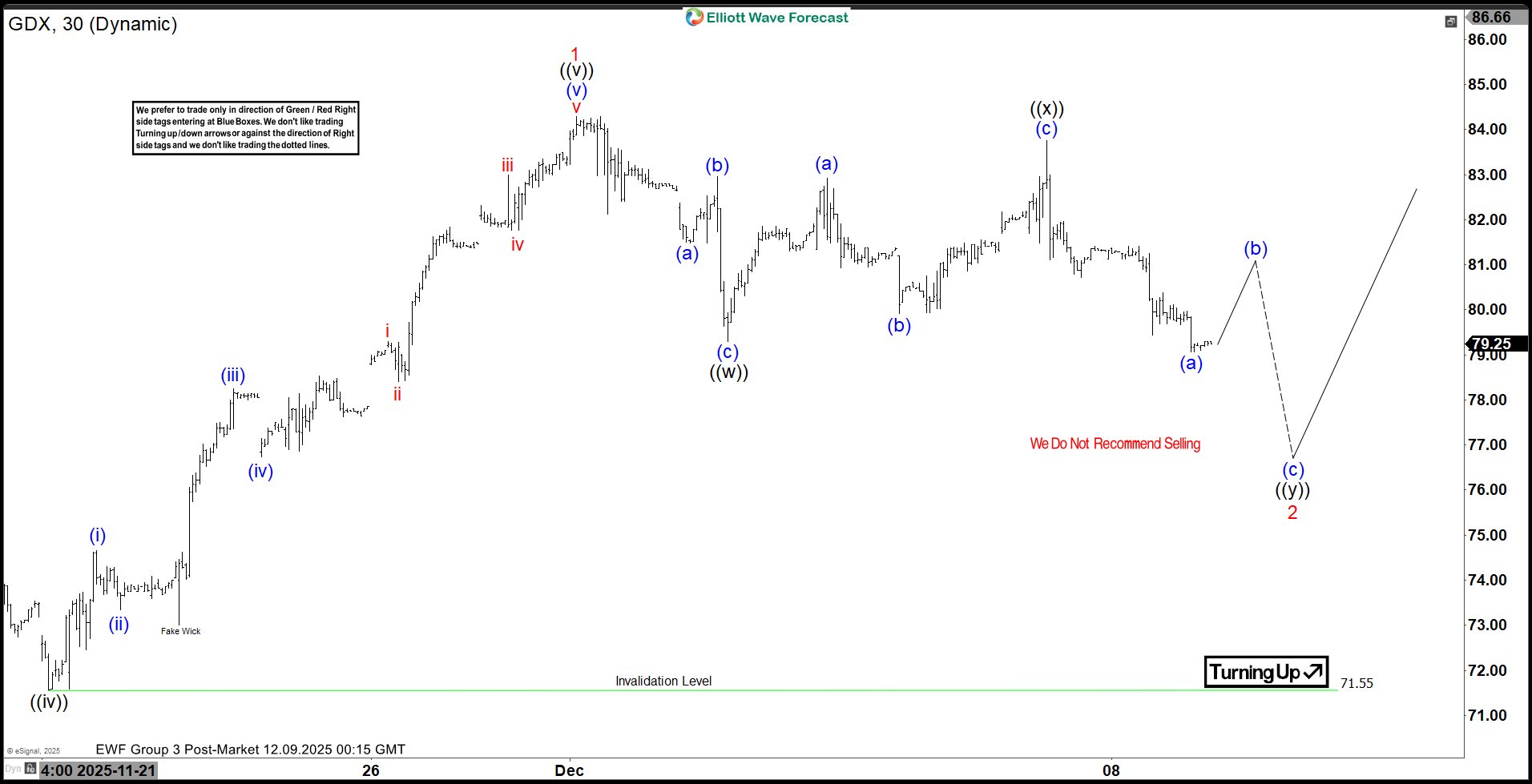

GDX Anticipates a Double Correction Within Sustained Bullish Trend

Read MoreGold Miners ETF (GDX) is looking to correct cycle from Oct 28 low as a double three. This article and video look at the Elliott Wave path.

-

BlackRock (BLK) Next Buying Opportunity Below $1,000

Read MoreWe previously mapped BlackRock’s (NYSE: BLK) bullish weekly path earlier this year. Today, our analysis continues with the Elliott Wave structure behind its rally from the 2022 low. This update highlights the next high-probability buying opportunity emerging for the stock. Elliott Wave Analysis BlackRock‘s April 2025 correction marked wave ((4)), finding support in the Blue Box […]