The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Ford (F) Stock: A Temporary Rebound Before Further Declines?

Read MoreFord’s stock finally rebounded after months of decline. Earlier, we predicted a failed rally that would push prices lower. Instead, the stock kept falling. Now, it’s bouncing back—but will it last? According to Elliott Wave analysis, this rally seems weak. Ford’s stock will likely drop again, sinking below $8 soon. Several issues weigh on Ford. […]

-

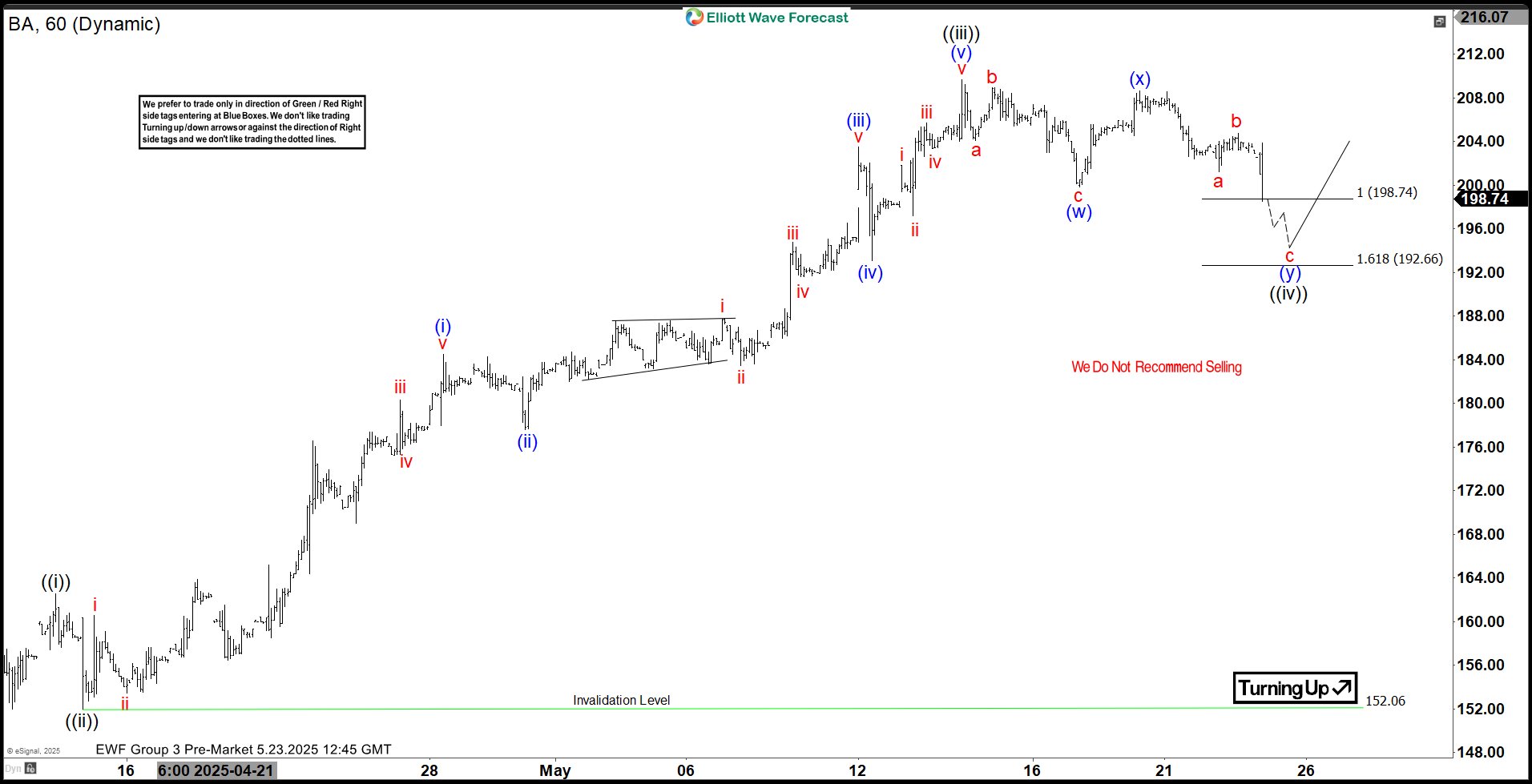

Boeing Co. $BA Extreme Areas Offering Buying Opportunities

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Boeing Co. ($BA) through the lens of Elliott Wave Theory. We’ll review how the rally from the April 15, 2025 low unfolded as a 5-wave impulse followed by a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. 5 […]

-

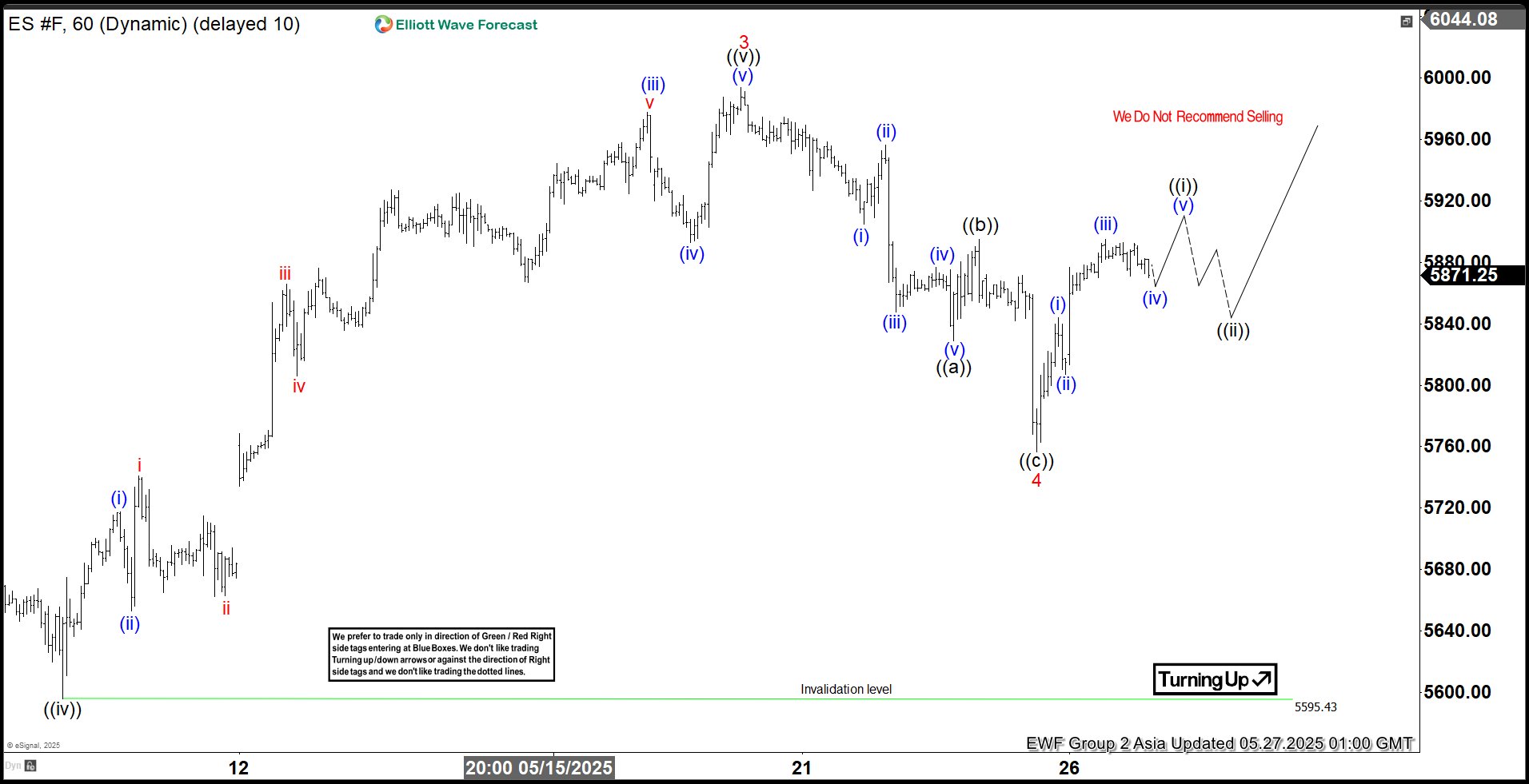

Elliott Wave Analysis: Will S&P 500 Futures (ES) Form Five Waves to Provide Market Clarity?

Read MoreS&P 500 Futures (ES) is looking to extend in wave 5 which will confirm the next leg higher. This article and video look at the Elliott Wave path.

-

Microsoft ($MSFT) Up 27% Since April Entry at the Blue Box Area

Read MoreAs our members know, we’ve been long in Microsoft ($MSFT) since April. The stock has made a solid rally, gaining 27% since our entry last month. In this technical article, we are going to present Elliott Wave trading setup of MSFT. The stock completed its corrective decline precisely at the Equal Legs area, also known […]

-

Uranium Miners ETF (URA) Back on Bullish Path

Read MoreThe ticker symbol URA corresponds to the Global X Uranium ETF, an exchange-traded fund (ETF) listed on the NYSE Arca. Launched on November 4, 2010, and managed by Global X Management Company, this fund aims to provide investors with exposure to the uranium industry by tracking the Solactive Global Uranium & Nuclear Components Total Return Index. […]

-

TMUS Bullish Sequence Finding Blue Box Support, Targeting $400

Read MoreT-Mobile US Inc., TMUS, corrects against the long-term bullish sequence. Meanwhile, the pullback is evolving in a 7-swing structure and is close to the blue box. In this article, we will discuss the blue box where buyers will be waiting to buy the stock again. T-Mobile US (NASDAQ: TMUS) is a leading U.S. wireless carrier, […]