The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

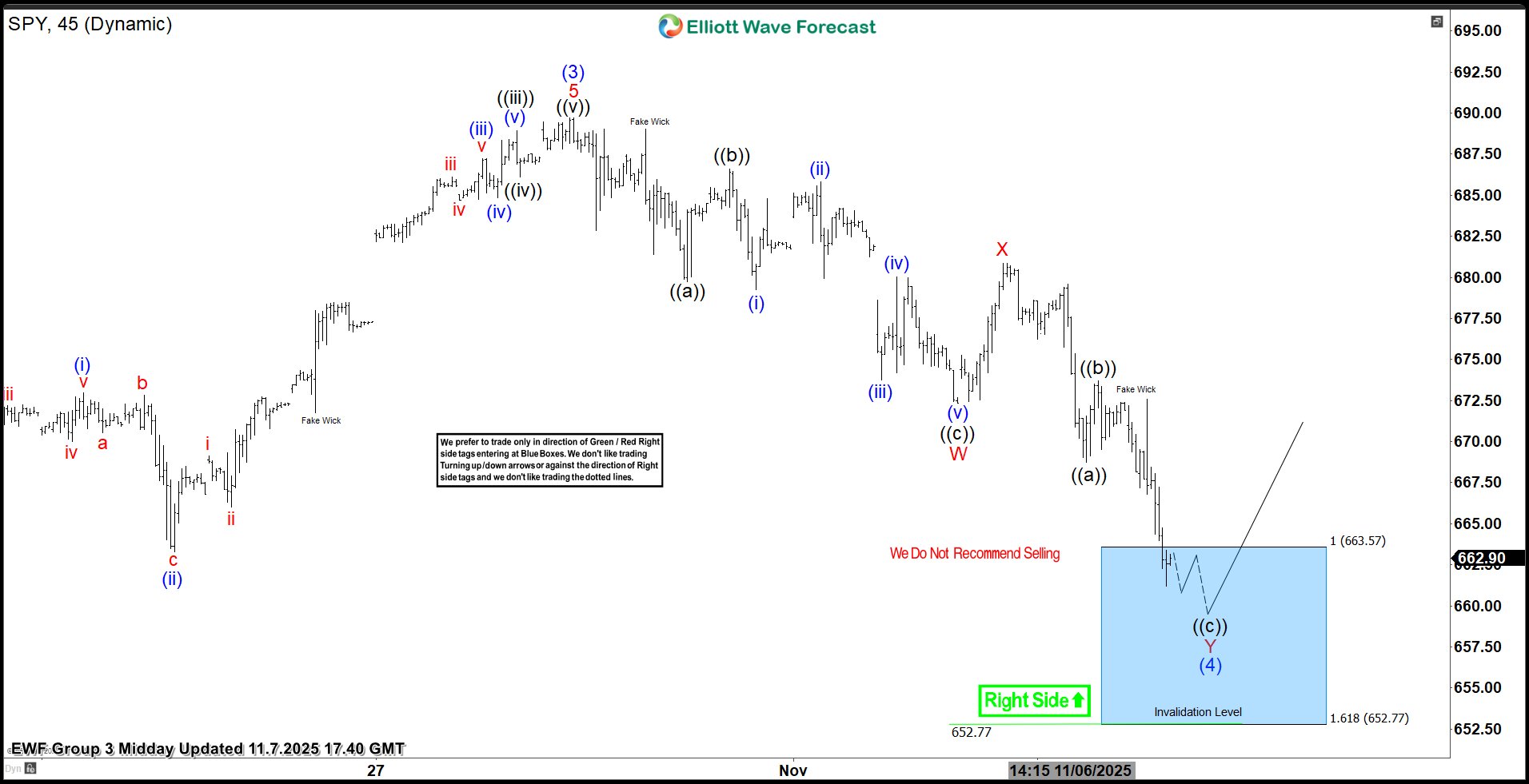

S&P 500 ETF SPY Elliott Wave Trading Setup Explained

Read MoreHello fellow traders ! As our members know we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in S&P 500 ETF. SPY has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. […]

-

Elliott Wave Analysis of Nasdaq (NQ) Forecasts New All Time High, Targeting at Least 26793

Read MoreNasdaq (NQ) has ended correction in wave (4) and turned higher aiming for new high. This article and video look at the Elliott Wave path.

-

MicroStrategy (MSTR) Bearish Shift: The Case for Further Weakness

Read MoreStrategy Inc (NASDAQ: MSTR), formerly known as MicroStrategy, remains Bitcoin’s largest corporate holder. However, a stark divergence has emerged throughout 2025. While Bitcoin consistently notches new all-time highs, MSTR stock displays persistent weakness and failing momentum. This disconnect signals underlying technical damage. Today, we analyze the bearish Elliott Wave sequence explaining this underperformance. Our analysis […]

-

NVDA Delivers Risk-Free Setup from Blue Box Area

Read MoreIn this blog, we take a look at the past performance of NVDA charts. In which, the stock reacts higher from blue box area delivers risk-free setup.

-

Chennai Petroleum Corporation Limited (NSE: CHENNPETRO) Elliott Wave Analysis: Bullish Cycle Poised to Continue

Read MoreWave (III) Set to Unfold as Chennai Petroleum Targets New Highs in the Next Bullish Cycle. Chennai Petroleum Corporation Ltd (NSE: CHENNPETRO) shows a strong long-term bullish setup on its monthly Elliott Wave chart. The price completed a clear five-wave advance, forming wave (I), followed by a deep correction in wave (II). This correction ended […]

-

RY (Royal Bank of Canada) Favors Final Push Before Pullback

Read MoreRoyal Bank of Canada., (RY) operates as diversified financial service company worldwide. It operates through personal finance, commercial banking, wealth management & Insurance segments. It comes under Financial services sector & trades as “RY” ticker at NYSE. RY favors rally within April-2025 sequence as showing in (1) discussed in last article. It expects further upside […]