The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Sprott Physical Silver Trust (PSLV) Surges to a New All‑Time High

Read MoreSprott Physical Silver Trust (PSLV) breaks to new all-time high and expected to continue higher. This article and video look at the Elliott Wave path.

-

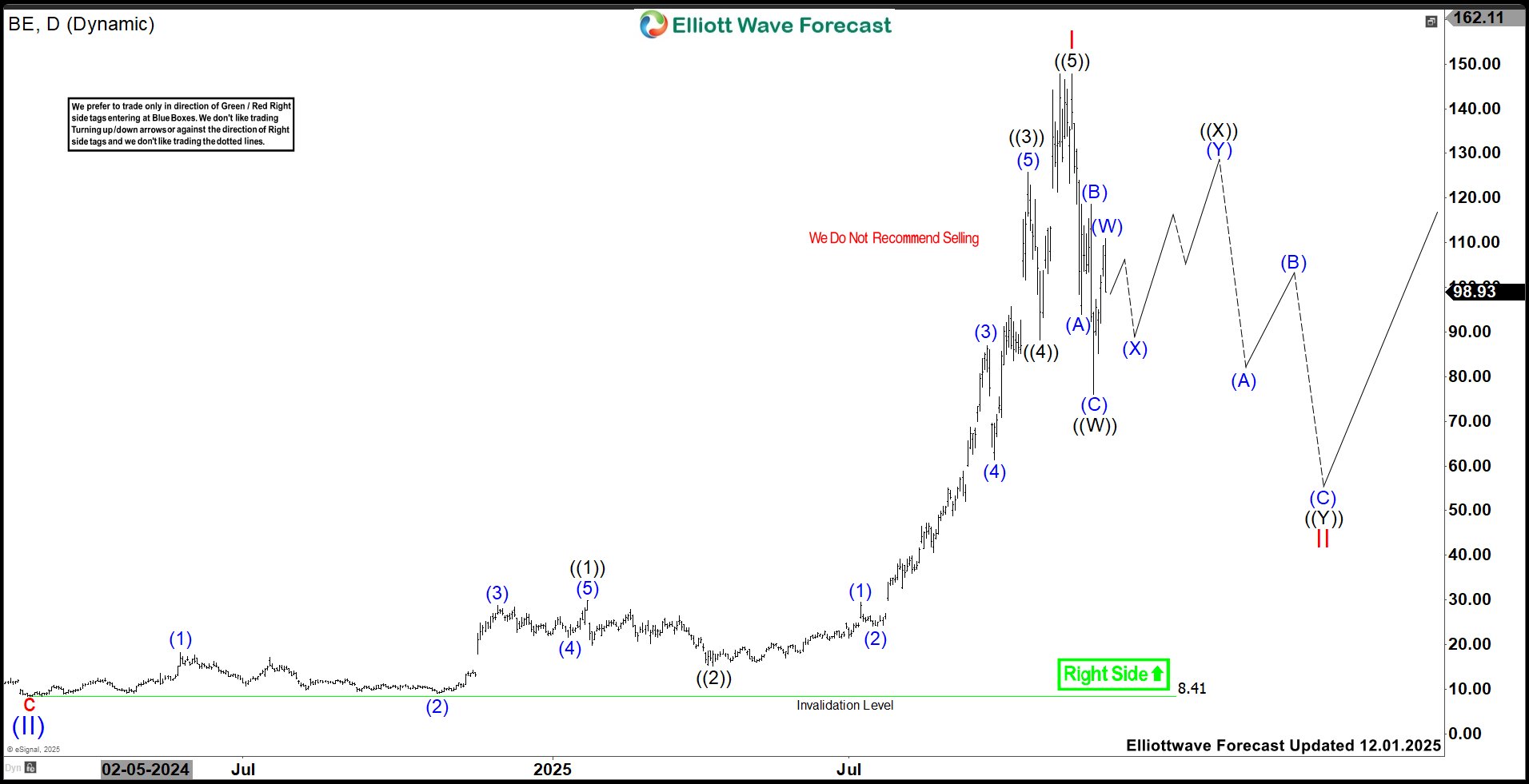

Bloom Energy (BE) Favors Bounce Towards $120.2 Before Lower

Read MoreBloom Energy Corporation., (BE) designs, manufactures, sells & install solid-oxide fuel cell systems for on-site power generation in the United States & globally. It offers Bloom Energy Server, a power generation platform to convert different fuels like Natural gas, Biogas, Hydrogen or blended fuel into electricity through electrochemical process. It comes under Industrials sector & […]

-

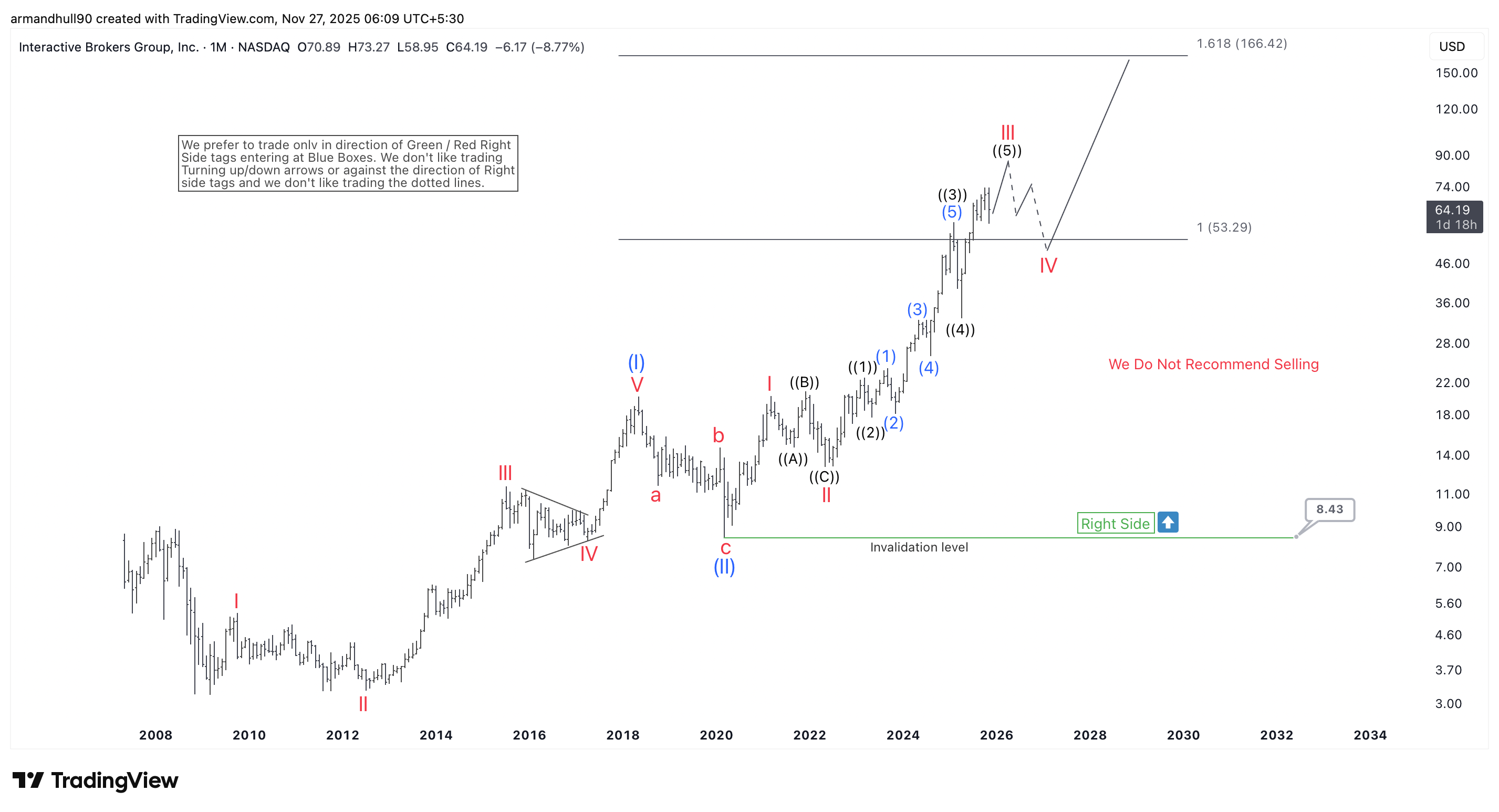

IBKR Wave Forecast: Wave III Targets 86 Next, With Long-Term Bullish Aim Toward 166

Read MoreIBKR advances in a powerful Wave III structure, with Fibonacci projections pointing toward 86 in the near term and a long-term target of 166 USD—while maintaining bullish validation above 8.43. Interactive Brokers Group (NASDAQ: IBKR) continues to maintain a resilient bullish structure, supported by a clear Elliott Wave progression. The stock has recently completed a […]

-

S&P 500 (SPX) Elliott Wave: Buying the Dips in a Blue Box

Read MoreHello fellow traders, As our members know we have had many profitable trading setups recently. In this technical article, we are going to present another Elliott Wave trading setup we got in S&P 500 Index . SPX completed this correction precisely at the Equal Legs zone, referred to as the Blue Box Area. In the […]

-

Micron MU Rockets Toward $300: Is This the AI Supercycle You Can’t Afford to Miss?

Read MoreMicron Technology MU has surged recently up nearly 7.9% from its previous close. Analysts remain broadly bullish, with Wells Fargo, Mizuho, and UBS all raising price targets into the $265–$300 range, citing strong demand for high-bandwidth memory (HBM) and DRAM pricing momentum. This optimism reflects Micron’s positioning in the AI-driven data center cycle, where memory content […]

-

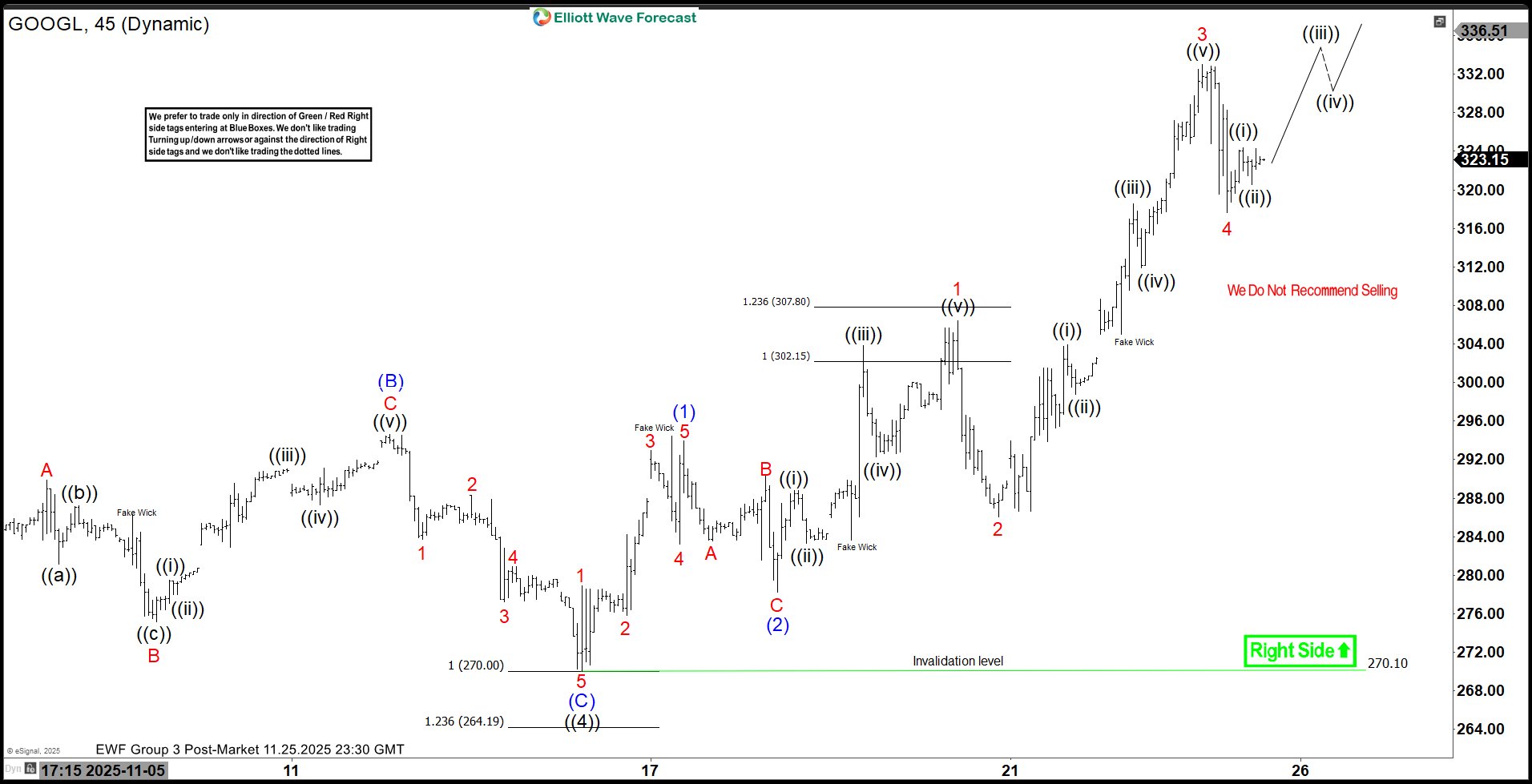

Google Stock (GOOGL) Approaches Historic Peak, $336 in Sight

Read MoreGoogle (GOOGL) is in the final wave ((5)) higher to complete impulsive rally from April 2025 low. This article and video look at the Elliott Wave path.