The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

GOOGL Breaks Out: New Highs from Blue Box Precision

Read MoreIn this blog, we take a look at the past performance of GOOGL charts. In which, the google breaks out into new high from blue box area.

-

Alnylam Pharmaceuticals (ALNY) Extending Rally In Final Stage From April-2025 Low

Read MoreAlnylam Pharmaceuticals Inc., (ALNY) discovers, develops & commercializes therapeutics based on ribonucleic acid interference. It comes under Healthcare – Biotech sector & trades as “ALNY” ticker at Nasdaq. As discussed in the last article, ALNY ended (4) pullback at $442.51 low & resume higher in (5). It favors rally in (5) towards $494.95 – $511.13 […]

-

S&P 500 ETF (SPY) Advances with Nested Structure in Wave (5)

Read MoreS&P 500 ETF (SPY) extends higher in wave (5) from April 2025 low. This article and video look at the Elliott Wave path for the ETF.

-

AIZ’s 17-Year Bullish Cycle Attract Buyers From Blue Box

Read MoreAssurant Inc. AIZ has maintained a bullish cycle since November 2008, characterized by higher highs and lows. In such a price action sequence, traders should look to buy dips. This post will analyze the current price position within the trend and potential higher targets for traders. Assurant Inc. (NYSE: AIZ) is a leading global provider […]

-

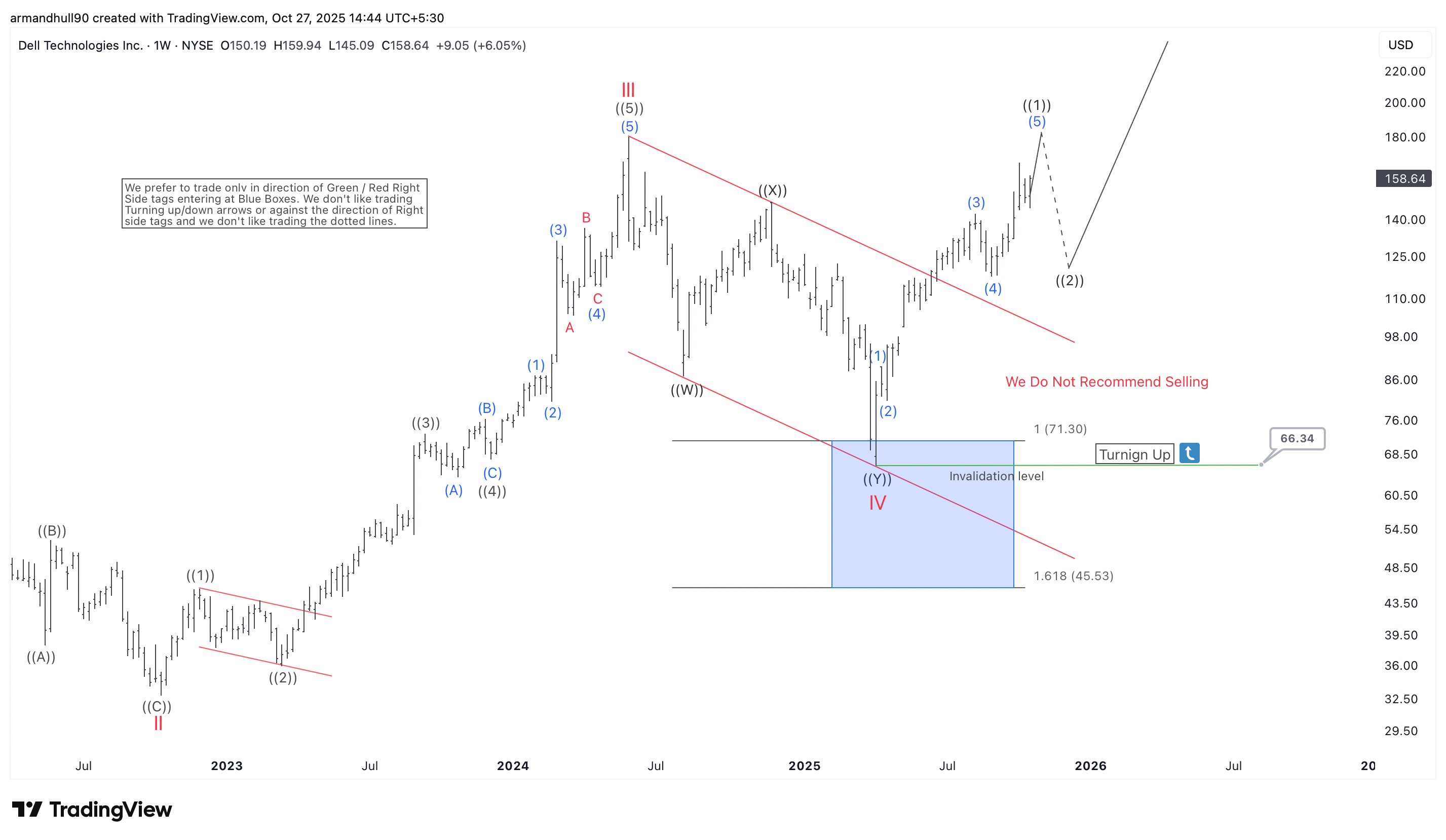

Dell Technologies Elliott Wave Analysis: Wave IV Completion Signals Start of a New Bullish Cycle

Read MoreAfter completing a three-leg correction within the blue box and breaking out of the red channel, Dell Technologies (NYSE: DELL) resumes its next impulsive bullish phase. Dell Technologies (NYSE: DELL) shows a strong Elliott Wave structure on the weekly chart, suggesting that a long-term uptrend is in progress. The larger count reveals that the stock […]

-

PLTR Last Leg? Why Palantir Could Be Approaching a Critical Correction

Read MorePalantir Technologies Inc. (PLTR) continues to dominate the AI-driven data analytics space, recently surging over 130% year-to-date to trade near $184.63. Investors have responded enthusiastically to its expanding government contracts, including a $10 billion U.S. Army deal and a £1.5 billion defense partnership with the U.K. These wins have propelled Palantir’s Q2 earnings past expectations, […]