The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

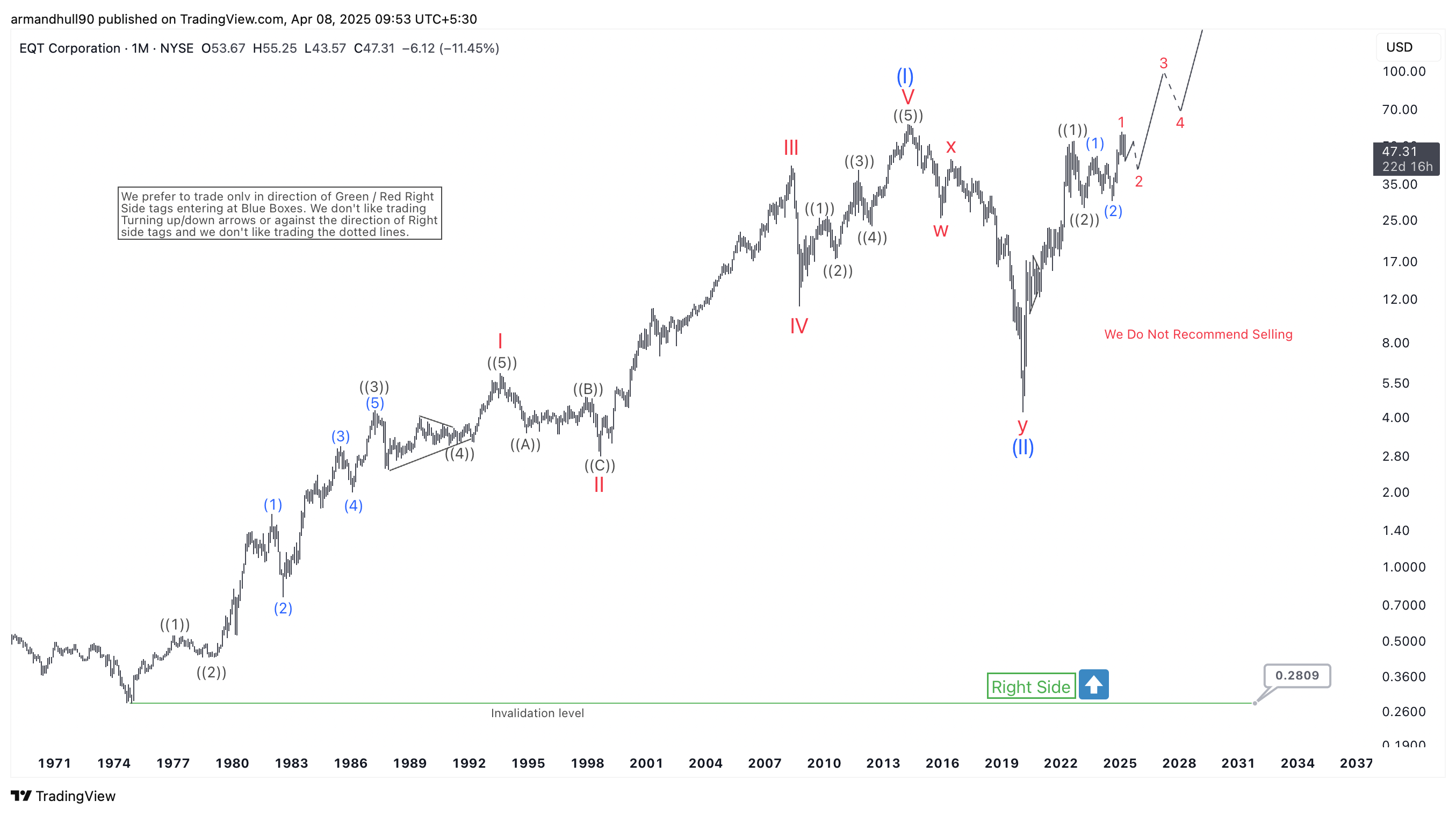

EQT Corporation (EQT) Elliott Wave Analysis: A Bullish Path Ahead

Read MoreElliott Wave analysis suggests EQT Corporation is poised for a major bullish breakout, with multiple impulsive sequences unfolding across timeframes. EQT Corporation (EQT) continues to show strong potential for further gains based on its long-term and short-term Elliott Wave structures. The monthly and daily charts both suggest that the stock is entering an impulsive phase […]

-

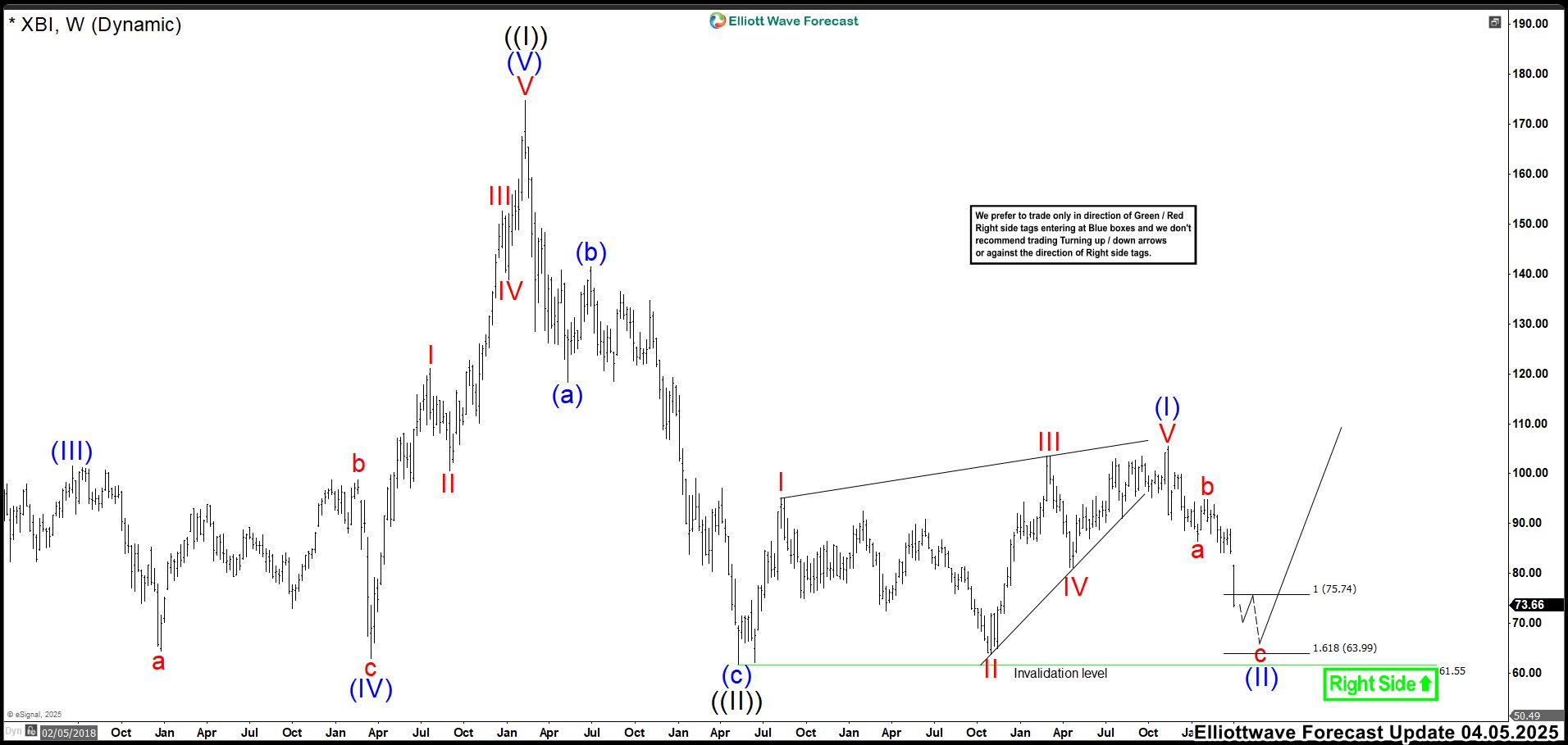

Will XBI Crash 61.78 Low? Analyzing the Biotech ETF’s Correction

Read MoreThe SPDR S&P Biotech ETF (XBI) is an exchange-traded fund that tracks the biotechnology segment of the S&P Total Market Index. This ETF allows investors to gain exposure to large, mid, and small-cap biotech stocks. If you’re interested in biotechnology, XBI could be worth exploring further. Here are some of its top holdings and their percentage weights: United Therapeutics […]

-

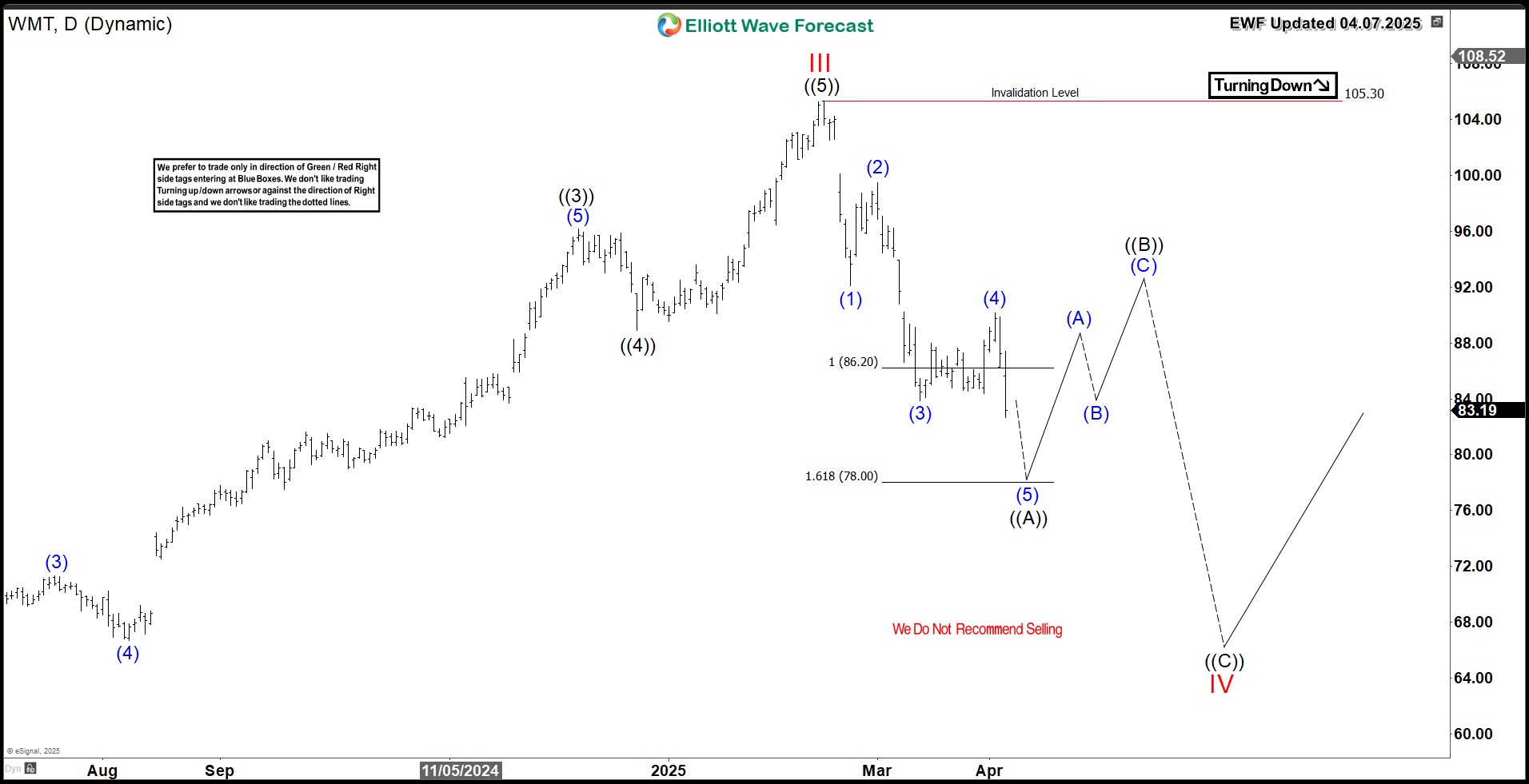

Walmart Stock (WMT) Heading for More Pain as Trouble Mounts

Read MoreWalmart (NYSE: WMT) is down 20% from the peak but is it the right time to start buying the stock at current levels ? In this article we’ll go over the Elliott Wave structure for the current move and explain the potential expected path. WMT is current currently showing an impulsive 5 waves decline from […]

-

Elliott Wave Forecast: Silver Miners ETF (SIL) Eyes a Double Correction Scenario

Read MoreSIL (Silver Miners ETF) appears to be correcting its cycle since Sept 2022 in a double-three. This article investigates the Elliott Wave trajectory.

-

The Nikkei (NKD) appears poised to continue its broader corrective trend

Read MoreNikkei (NKD) is looking to extend lower in a larger correction. This article and video look at the Elliott Wave path of the Index.

-

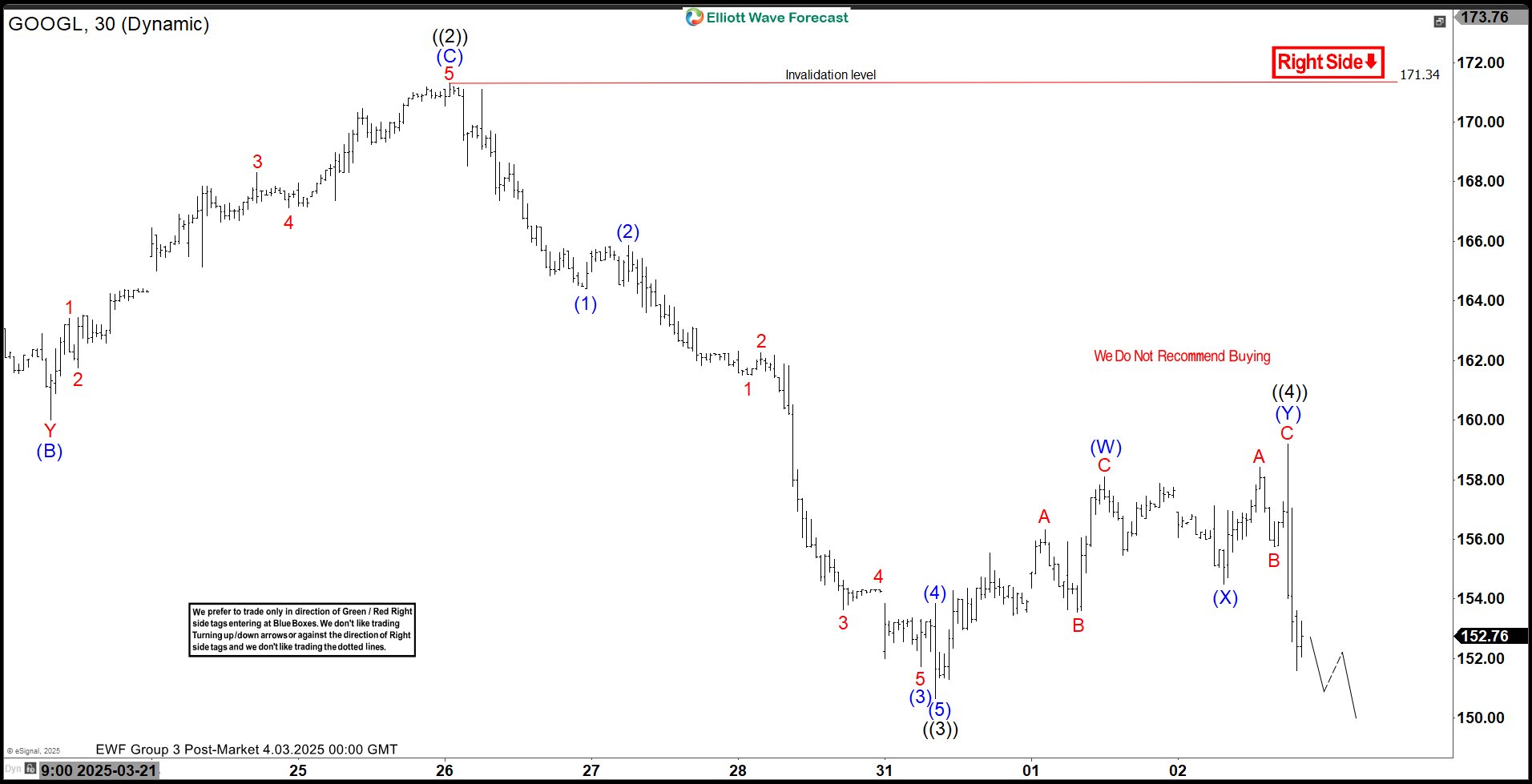

Elliott Wave Analysis: Alphabet ($GOOGL) Nearing Completion of 5-Wave Decline

Read MoreAlphabet (GOOGL) is ending 5 waves decline from 2.4.2025 high before 3 waves rally. This article and video look at the Elliott Wave path.