The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

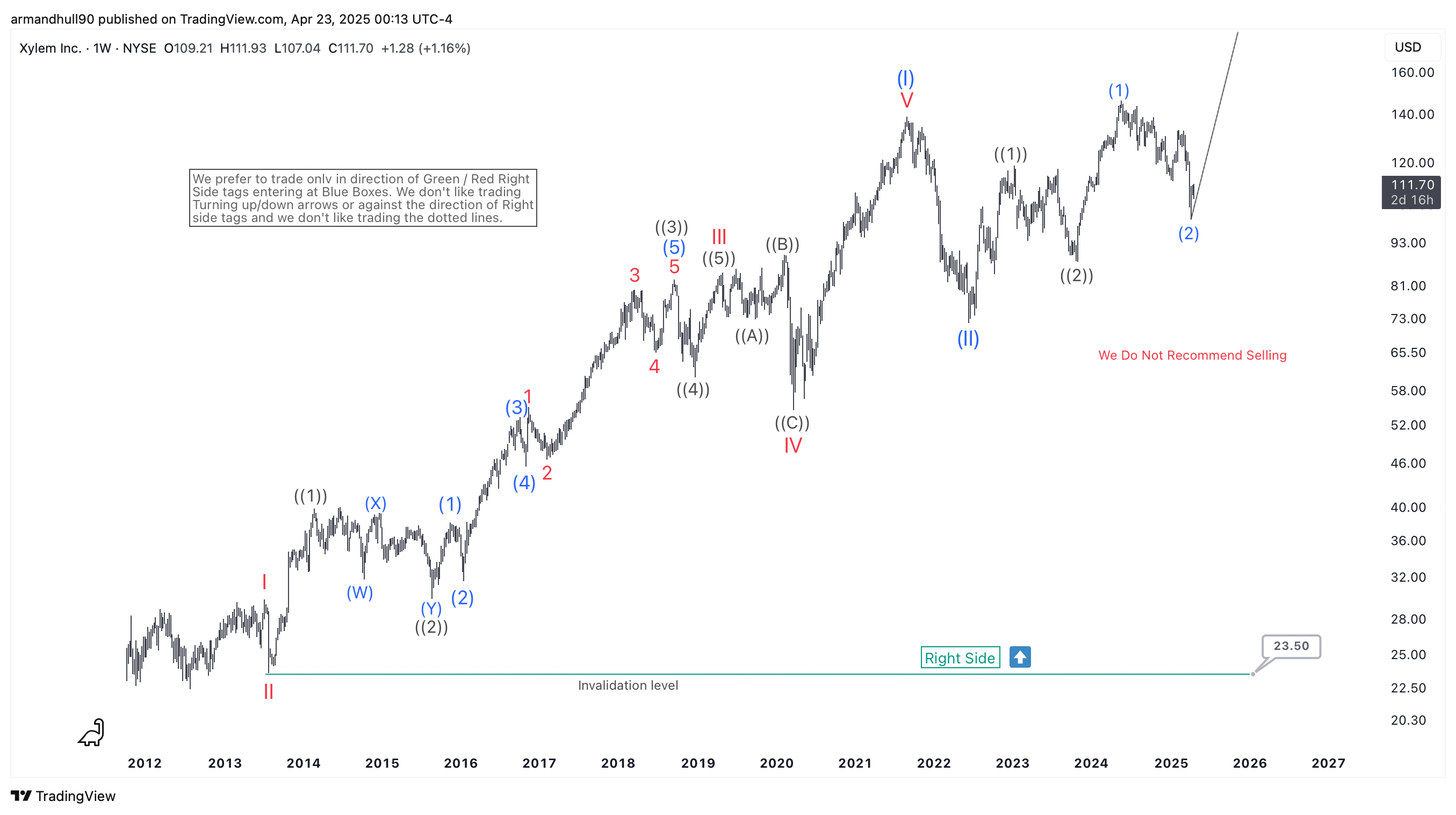

Xylem Inc. (XYL) Begins A New Elliott Wave Bullish Cycle

Read MoreXylem Inc. (XYL) has completed its wave (2) correction and is now poised to rally in wave (3) of (III), according to Elliott Wave analysis Xylem Inc. (NYSE: XYL) continues to respect its long-term Elliott Wave structure with impressive precision. As seen in the weekly chart, the stock recently completed a corrective wave (2) and […]

-

FTSE Elliott Wave Update: Short-Term 5 Swing Pattern Favors Additional Gains

Read MoreFTSE 5-swing Elliott Wave move from the 4/7/2025 low points to continued upside. This article and video break down the Elliott Wave path.

-

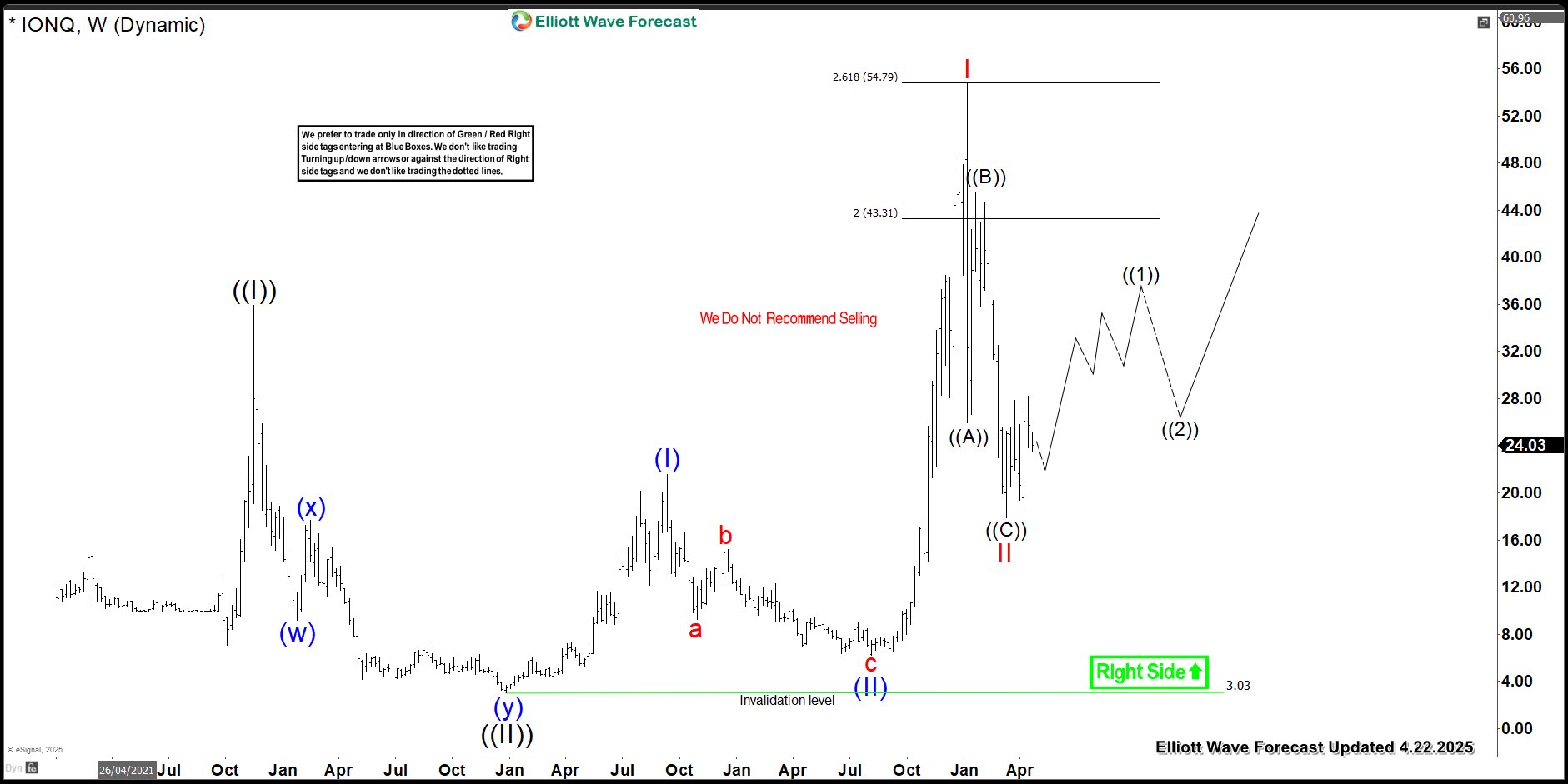

IONQ Analysis: 3-Wave Pullback Complete, Next Stop Higher?

Read MoreIONQ inc. is a pioneer in the development and manufacturing of quantum computers, focusing on quantum computing and quantum information processing. Founded in 2015 by Christopher Monroe and Jung Sang Kim, the company is headquartered in College Park, MD. This blog post provides an in-depth technical analysis of IONQ’s stock performance, specifically its weekly chart. Key […]

-

Vertiv Holdings (VRT) Eyes Next Rally From Blue Box Area

Read MoreVertiv Holdings Co., is an American multinational provider of critical infrastructure & services for data centers, communication networks & commercial & industrial environments. It comes under Industrials sector & trades as “VRT” ticket for NYSE. As expected in the previous article, VRT ended impulse sequence (I) at $155.84 high in January-2025. Below there, it favors […]

-

Dollar Index (DXY) Faces Continued Downtrend in Elliott Wave Bearish Pattern

Read MoreDollar Index (DXY) continues to decline in impulsive structure and rally should fail in 3, 7, 11 swing. This article and video look at the Elliottwave path.

-

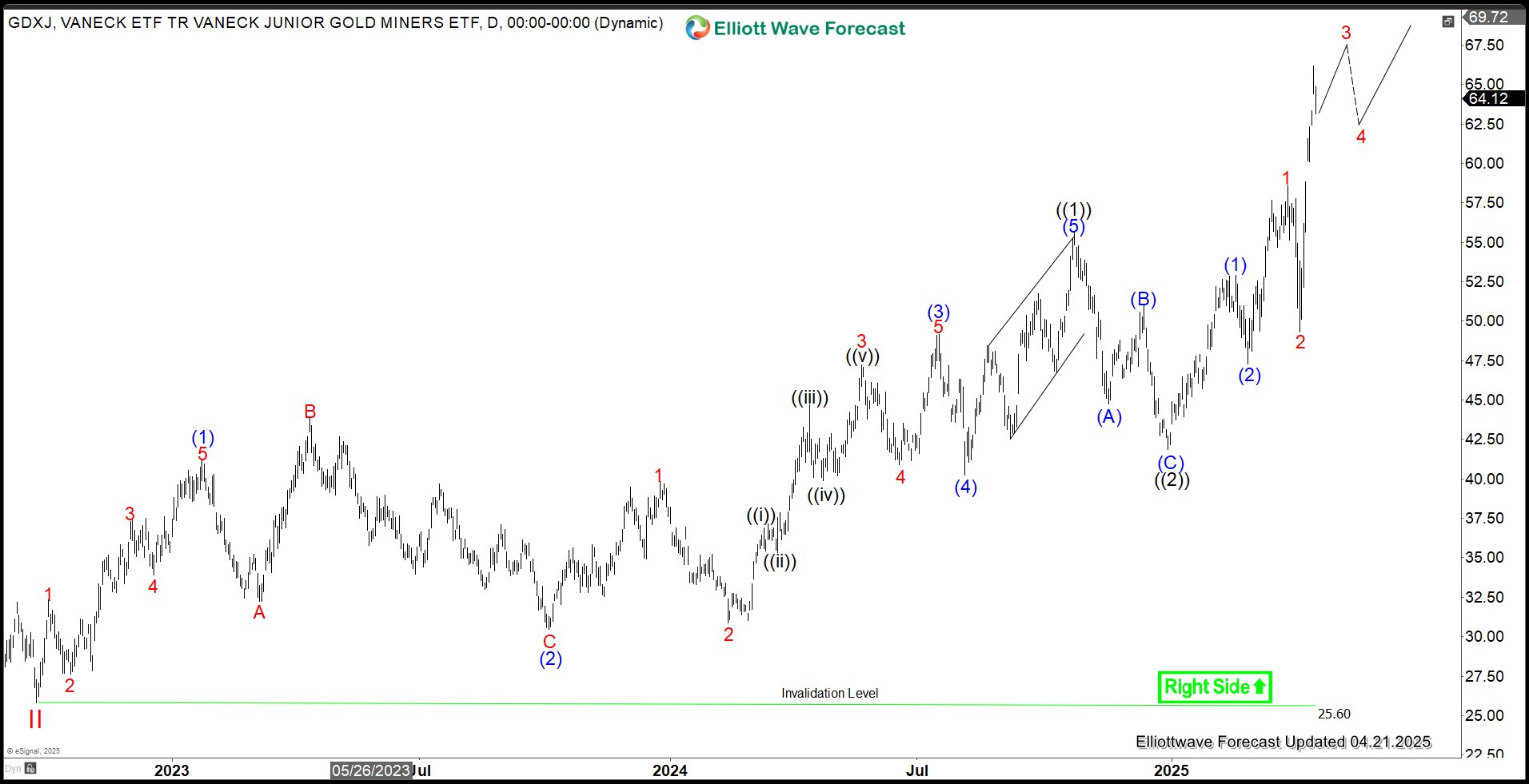

Gold Miners Junior ETF (GDXJ) Extending Higher in Impulsive Structure

Read MoreThe VanEck Junior Gold Miners ETF (GDXJ), launched in 2009, focuses on small- and mid-cap gold and silver mining companies, primarily those generating most of their revenue from mining or related activities. Popular among investors chasing high-risk, high-reward opportunities in precious metals, the ETF offers targeted exposure. Below, we explore its Elliott Wave outlook. GDXJ […]