The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

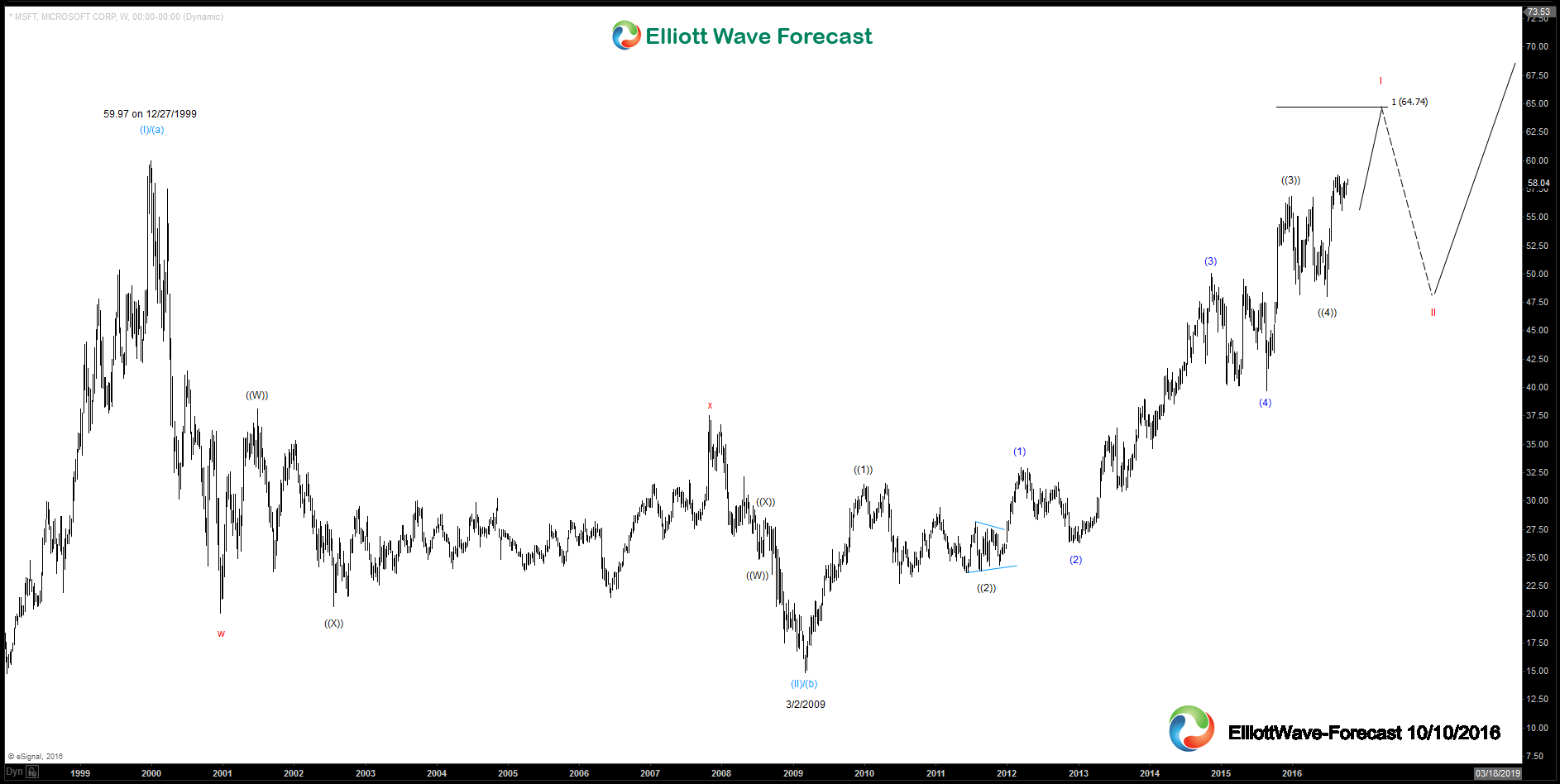

Microsoft Weekly and Daily Elliott Wave Analysis $MSFT

Read MoreMicrosoft Corporation is of course a very well known organization and has it’s large capitalization stock MSFT listed on the Nasdaq and is a component of the Dow Jones Industrial Average, the S&P 500 as well as the Nasdaq 100. In March 1986 the initial public offering price was $21.00 per share. After many stock splits over the […]

-

TWTR (Twitter Inc) close to a bounce ?

Read MoreThe company was founded in 2006, Twitter is a social media platform that allows its users to post their thoughts in 140 characters or less, known as tweets. Twitter also allows users to broadcast and live-stream videos through its Vine and Periscope mobile applications. The company’s promoted products including promoted tweets, accounts, and trends help advertisers to […]

-

Technical outlook for BJRI stock

Read MoreBJRI The California chain BJ’s Restaurants was founded in 1978 and went public in 1996 by raising $9.4 million . In 2010 , the National Retail Federation named it as one of the 10 fastest growing restaurants in the U.S. based on year-over-year sales as it keeps expanding by adding new locations and offering new services. Technical analysis of BJRI is showing […]

-

$FTSE Short-term Elliott Wave Analysis 10.6.2016

Read MoreShort term Elliott wave count suggests that pullback to 6640.3 at 9/15 ended wave (X). The rally from there is unfolding as a double three where wave (w) ended at 6899.5, wave (x) ended at 6728.5, and wave (y) of ((w)) is proposed complete at 7091.5. Near term, while bounces stay below 7091.5, expect the Index to […]

-

$FTSE Short-term Elliott Wave Analysis 10.5.2016

Read MoreShort term Elliott wave count suggests that pullback to 6640 at 9/15 ended wave (X). The rally from there is unfolding as a double three where wave (w) ended at 6899.5, wave (x) ended at 6728.5, and wave (y) of ((w)) is proposed complete at 7091.5. Near term, while bounces stay below 7091.5, expect wave ((x)) pullback in 3, […]

-

$FTSE Short-term Elliott Wave Analysis 10.4.2016

Read MoreShort term Elliott wave count suggests that pullback to 6640 at 9/15 ended wave (X). The rally from there is unfolding as a zigzag where wave (a) ended at 6899.5, wave (b) ended at 6728.5, and wave (c) is in progress as 5 waves. Wave iii of (c) is proposed complete at 6958.5 and a pullback in wave […]