The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Don’t rush buying MasterCard (MA)

Read MoreMasterCard shares (NYSE: MA) failed to break above the all-time highs made last month even with the “Trump Rally” which started 3 weeks ago pushing the stock market strongly to the upside , this doesn’t seems to had any impact on MasterCard so with investors looking to cash-out before Christmas and some stocks reaching extremes like American Express that […]

-

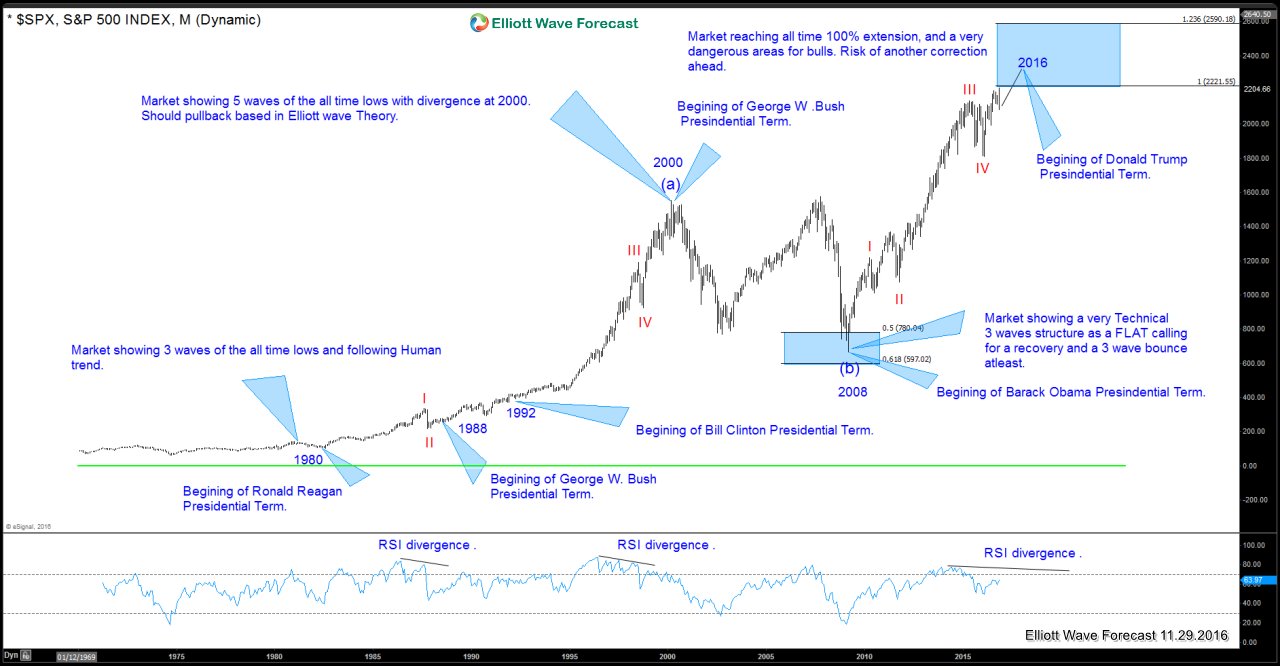

SPX and The Presidential Cycles

Read MoreThe Market, for years, has been seen as a reaction to a series of events around the world and how investors react to those events. Without any question, the United States of America presidential election is one of most watched events around the World. We at Elliottwave-Forecast.com, believe in the idea that the Technical trade […]

-

Time to Take some Profits in American Express ( AXP )

Read MoreAmerican Express There was no market crash after the US Election results , ” Trump Rally ” that’s what everybody is calling it as US indices and US Dollar surged higher doing the best rally that market have seen in years with many instruments hitting new all time highs like ( SPX & DJIA ) and others […]

-

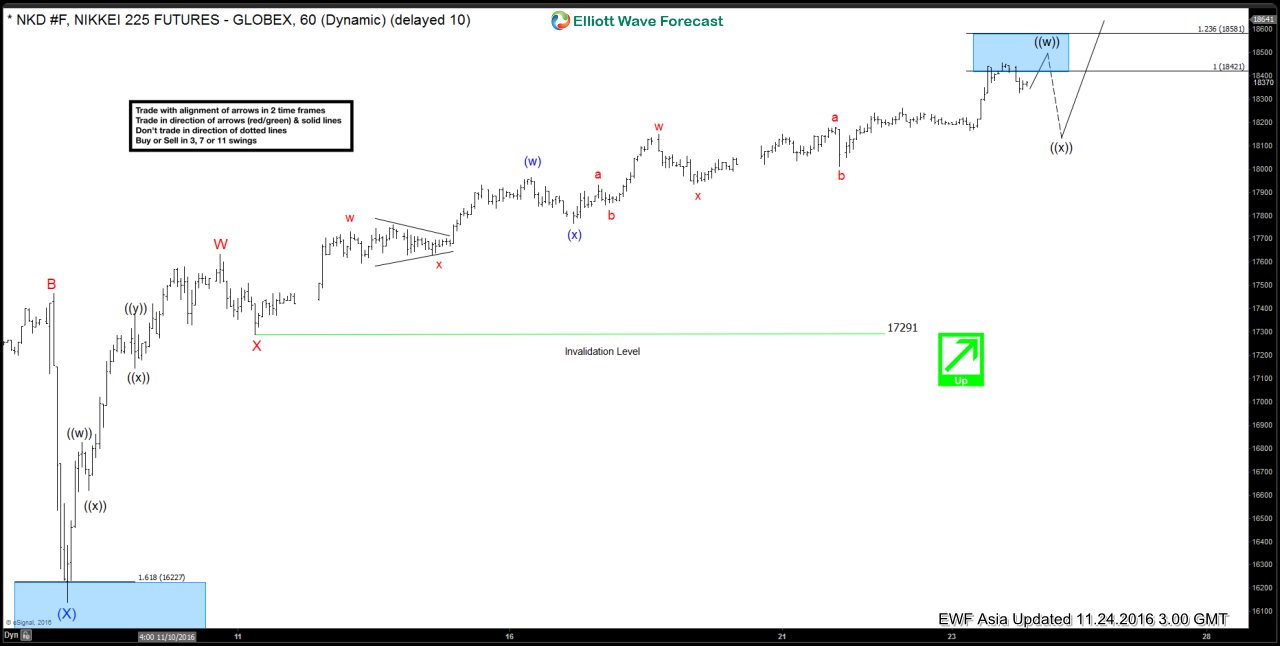

Nikkei Short-term Elliott Wave Analysis 11.25.2016

Read MoreNikkei Short Term Elliott wave cycles suggests that decline to 16140 ended wave (X). Rally from there is unfolding as double three where wave W ended at 17635 and wave X ended at 17291. Near term, wave ((w)) is expected to complete at 18421 – 18581 area, and Nikkei index should ideally pullback in wave ((x)) in 3, 7, or 11 swing […]

-

Nikkei Short-term Elliott Wave Analysis 11.24.2016

Read MoreNikkei Short Term Elliott wave cycles suggests that decline to 16140 ended wave (X). Rally from there is unfolding as double three where wave W ended at 17635 and wave X ended at 17291. Near term, wave ((w)) is expected to complete at 18421 – 18581 area, and Nikkei index should ideally pullback in wave ((x)) in 3, 7, or 11 swing […]

-

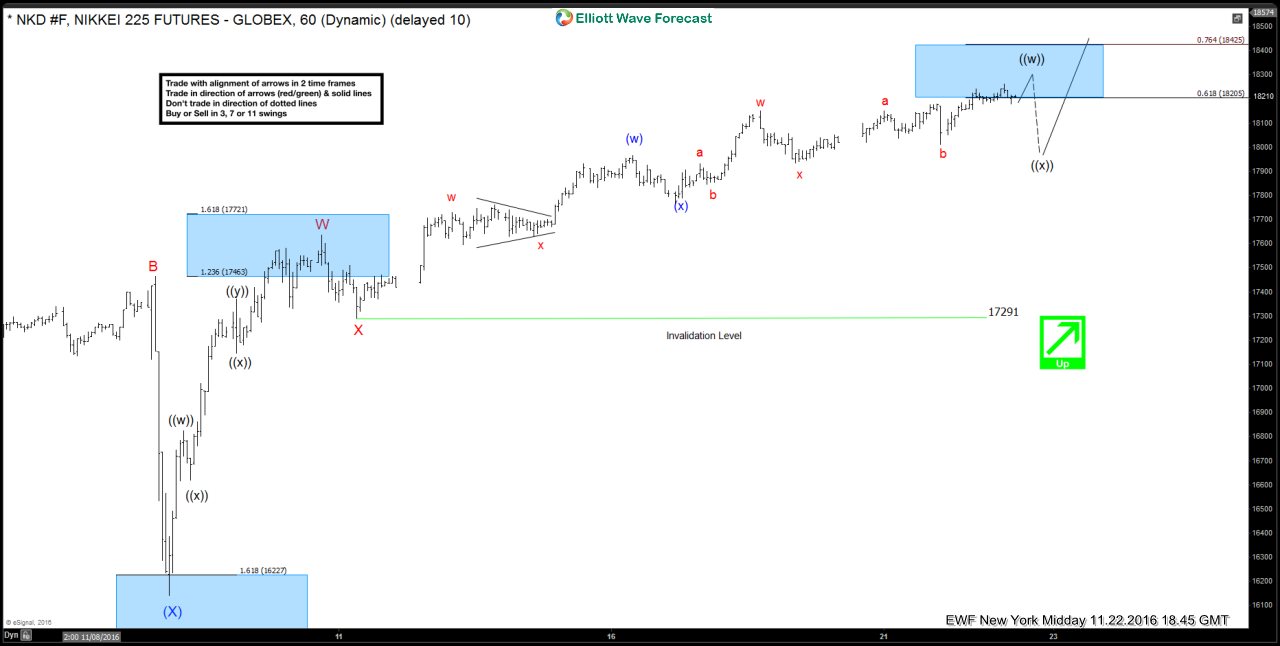

Nikkei Short-term Elliott Wave Analysis 11.23.2016

Read MoreNikkei Short Term Elliott wave cycles suggests that decline to 16140 ended wave (X). Rally from there is unfolding as double three where wave W ended at 17635 and wave X ended at 17291. Near term focus is on 18205 – 18425 area to complete wave ((w)), then it should pullback in wave ((x)) in 3, 7, or 11 […]