The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

FTSE Elliott Wave Analysis: Ended Correction

Read MoreFTSE Elliott Wave view suggests that decline to 7199.5 ended Primary wave ((4)). Up from there, the rally is unfolding as an impulse Elliott Wave structure where Minor wave 1 ended at 7327.5 and pullback to 7289.75 ended Minor wave 2. Rally to 7494.34 ended Minor wave 3, and pullback to 7473.12 ended Minor wave […]

-

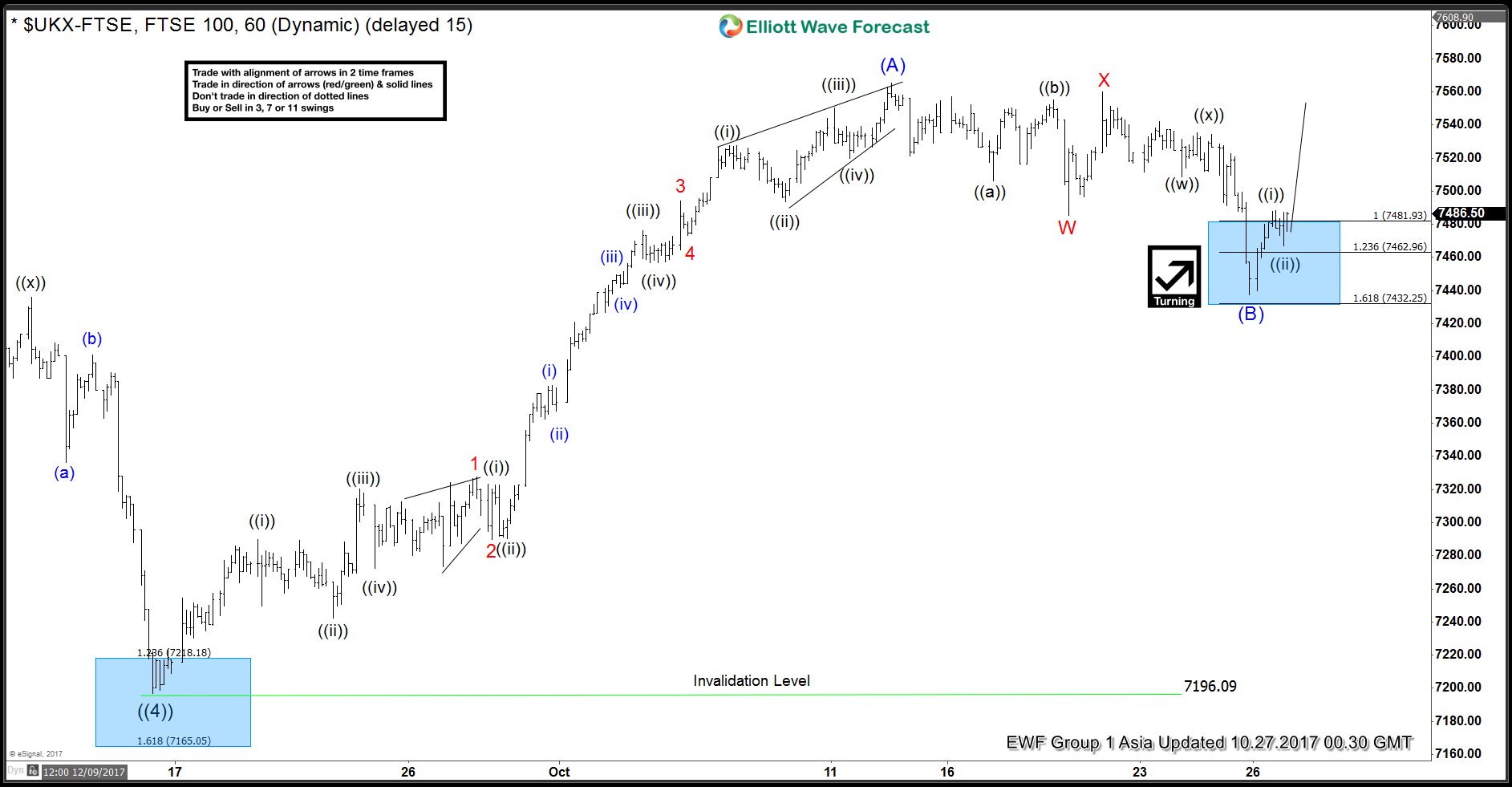

FTSE Elliott Wave Analysis 10.26.2017

Read MoreFTSE Short-Term Elliott Wave view suggests that the Index ended Primary wave ((4)) with the decline to 7199.5. The rally from there is unfolding as an impulse Elliott Wave structure where Minor wave 1 ended at 7327.5 and Minor wave 2 ended at 7289.75. Minor wave 3 rally ended at 7494.34, and Minor wave 4 […]

-

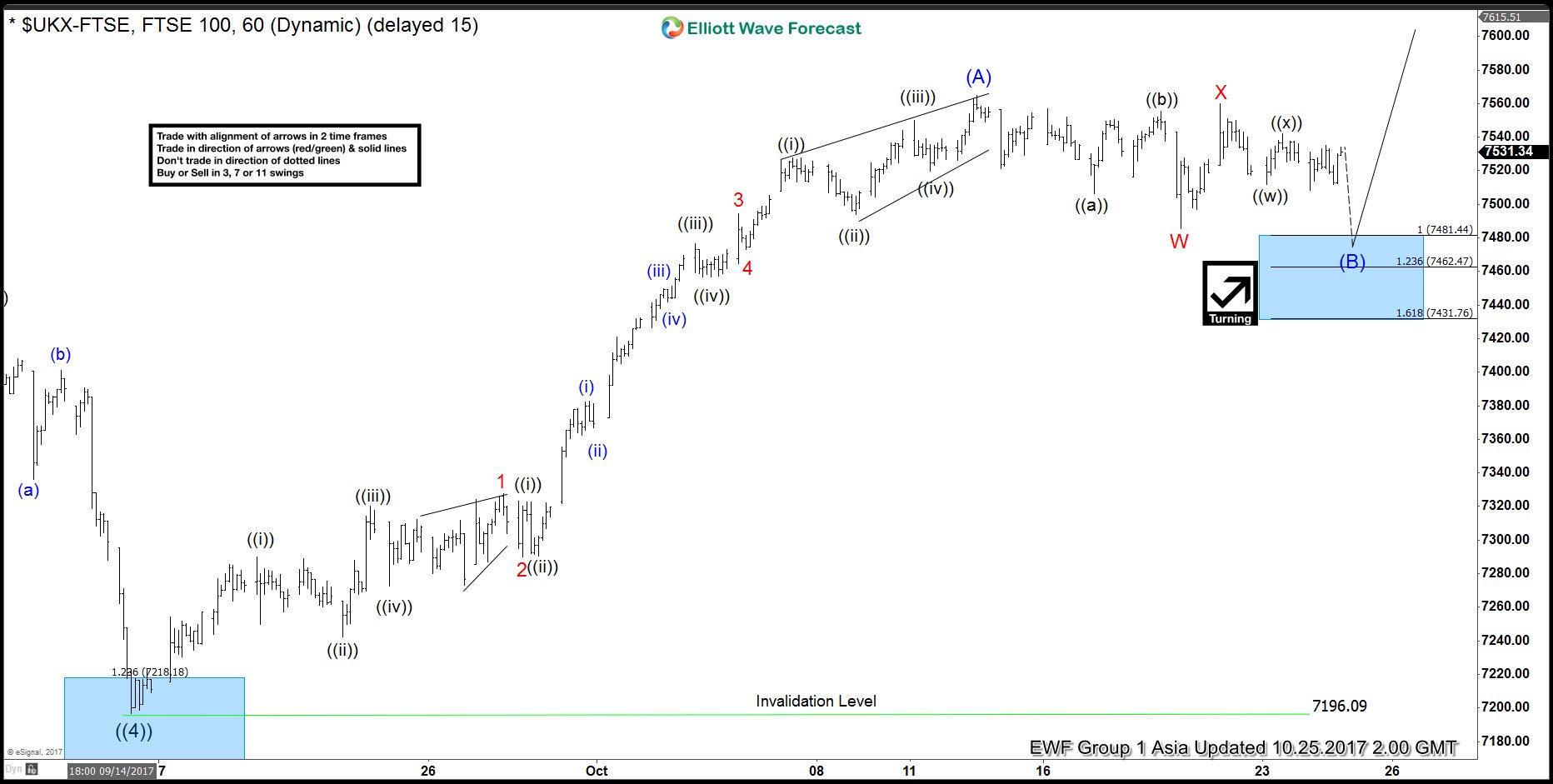

FTSE Intra Day Elliott Wave Analysis

Read MoreFTSE Elliott Wave view suggests that Primary wave ((4)) ended with the decline to 7199.5. Up from there, rally is unfolding as an impulse Elliott Wave structure where Minor wave 1 ended at 7327.5 and Minor wave 2 ended at 7289.75. Rally to 7494.34 ended Minor wave 3, and pullback to 7473.12 ended Minor wave […]

-

FTSE Short Term Elliottwave Analysis

Read MoreFTSE Short term Elliott Wave view suggests that the decline to 7199.5 ended Primary wave ((4)). Rally from there is unfolding as an impulse Elliott Wave structure where Minor wave 1 ended at 7327.5 and pullback to 7289.75 ended Minor wave 2. Subsequent rally to 7494.34 ended Minor wave 3, Minor wave 4 ended at 7473.12, and […]

-

Will Trump Really “Totally Destroy” North Korea?

Read MoreUS President, Donald Trump, threatened to “Totally Destroy” North Korea during his speech in United Nations assembly on 19th September 2017 and further added that “Rocket Man” is on a suicide mission for himself and for his regime. “The US has great strength and patience,” Trump said. But he added: “If it is forced to defend […]

-

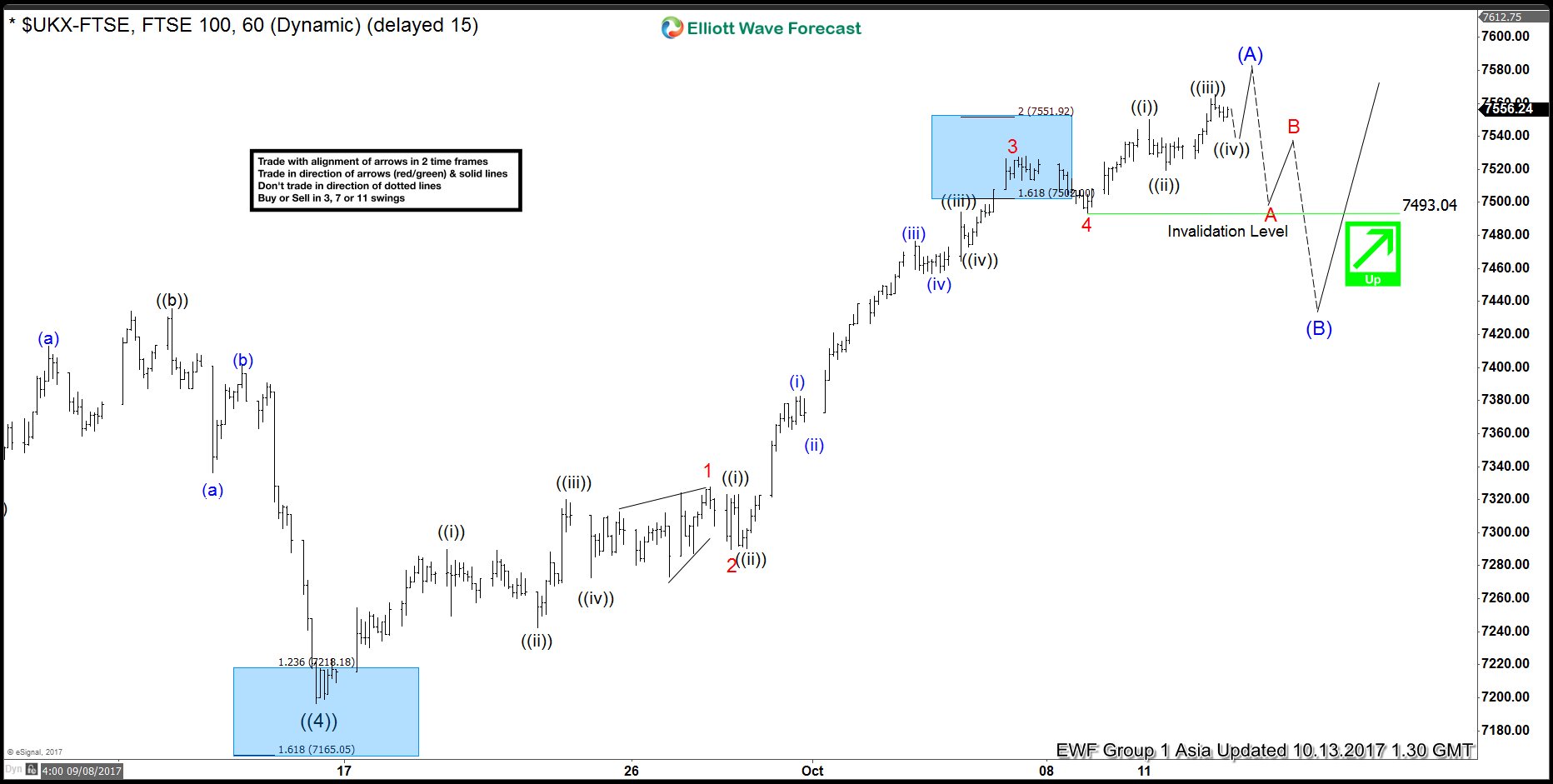

FTSE Intra-day Elliott Wave Analysis

Read MoreFTSE Short term Elliott Wave analysis suggests decline to 7196.58 ended Primary wave ((4)) on 9/15 low. Up from there, rally in Primary wave ((5)) is unfolding as a zigzag Elliott Wave structure. Intermediate wave (A) of this zigzag structure remains in progress as 5 waves impulse where Minor wave 1 ended at 7327.50 and Minor wave 2 ended at […]