The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

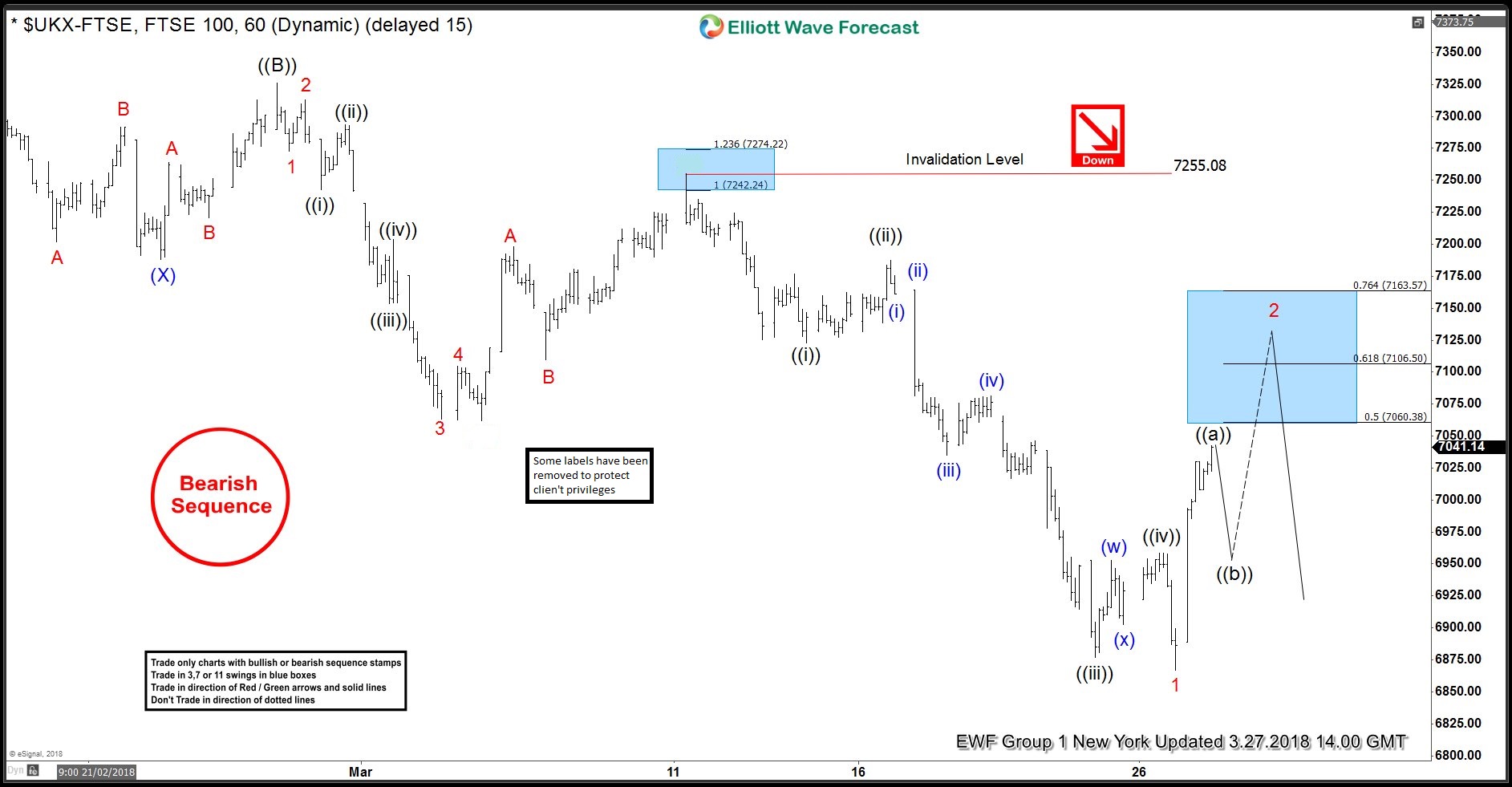

FTSE Elliott Wave Analysis: Inflection Area for Next Leg Lower

Read MoreLatest Elliott Wave view in FTSE suggests that the Index ended Primary wave ((B)) at 7326.02 on 2/27/2018 high. From there, Index starts a decline which is unfolding as a 5 waves impulse Elliott Wave structure with an extension in wave (3). Down from 2/27/2018 high, Intermediate wave (1) ended at 7062.13, Intermediate wave (2) ended at 7256.33, […]

-

DAX Elliott Wave: Where Is The Next Selling Area ?

Read MoreDAX Elliott Wave view suggests Index decline from 12434 was in 5 waves which we have labelled as wave (1) of ((C)) down from 1.23.2018 (13596) peak. Drop to 12160 completed wave 1, bounce to 12375 was wave 2 which was followed by a very sharp decline to 11827 to complete wave 3. Wave 4 […]

-

FTSE Elliott Wave View: Suggesting More Downside

Read MoreFTSE the index from UK, is correcting the larger degree cycle from February 2016 lows. While FTSE Elliott Wave Short-term price action suggests that the rally to February 27 high (7333.50) ended primary wave ((B)) bounce. Below from there, the decline is unfolding as a 5 waves Elliott Wave Impulse Sequence within primary ((C)) leg lower. Where each leg lower […]

-

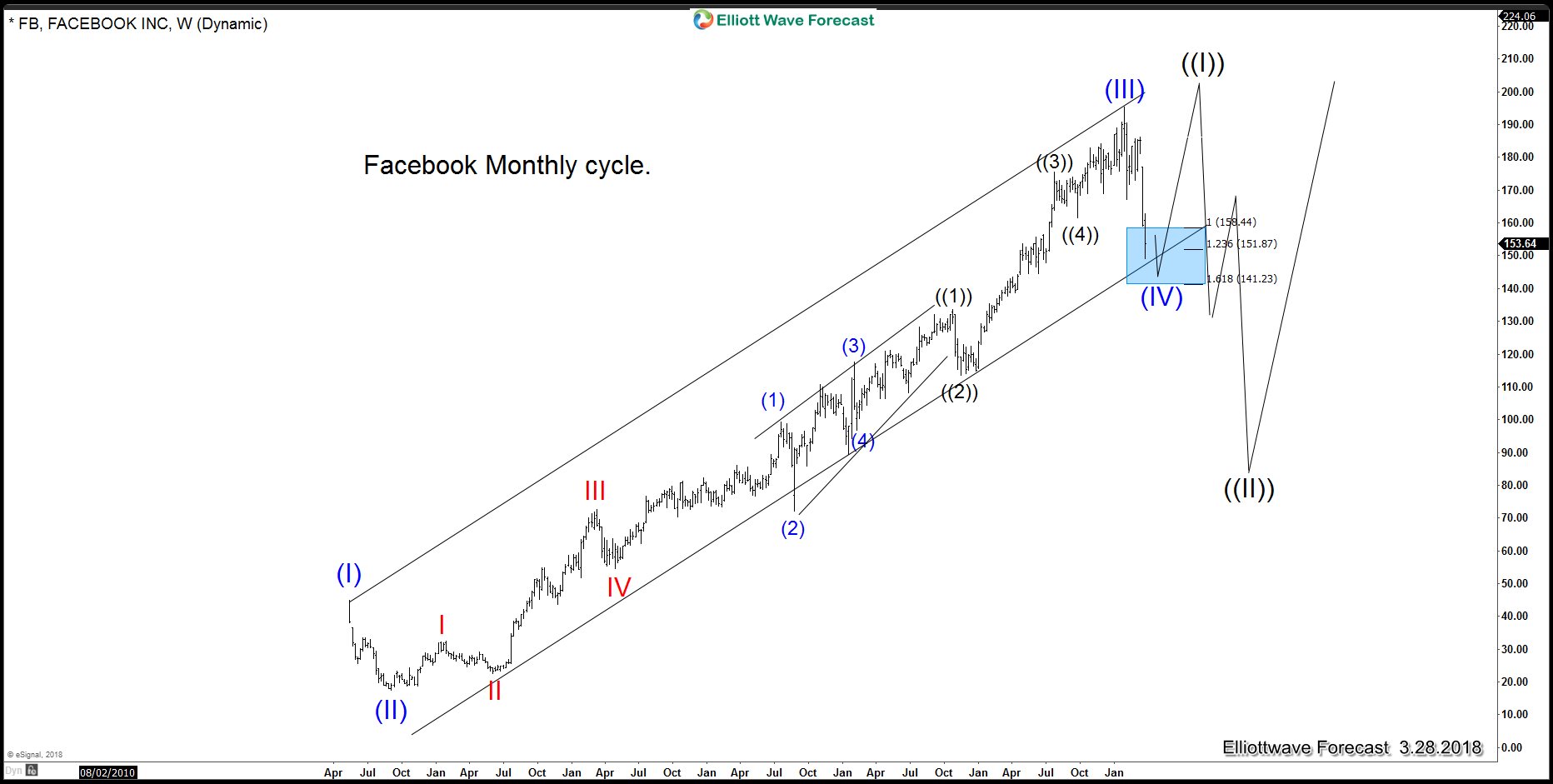

Did Data scandal Sink Facebook, The Social Networking Website?

Read MoreFacebook has been on the news lately when the world discovered that more than 50 million users had their personal data breached with the downloading of Kogan’s Application, a data harvesting route, which due to the lax of structure of Facebook’s APIs at the time, allowed the foreign political consultancy firm to acquire information on […]

-

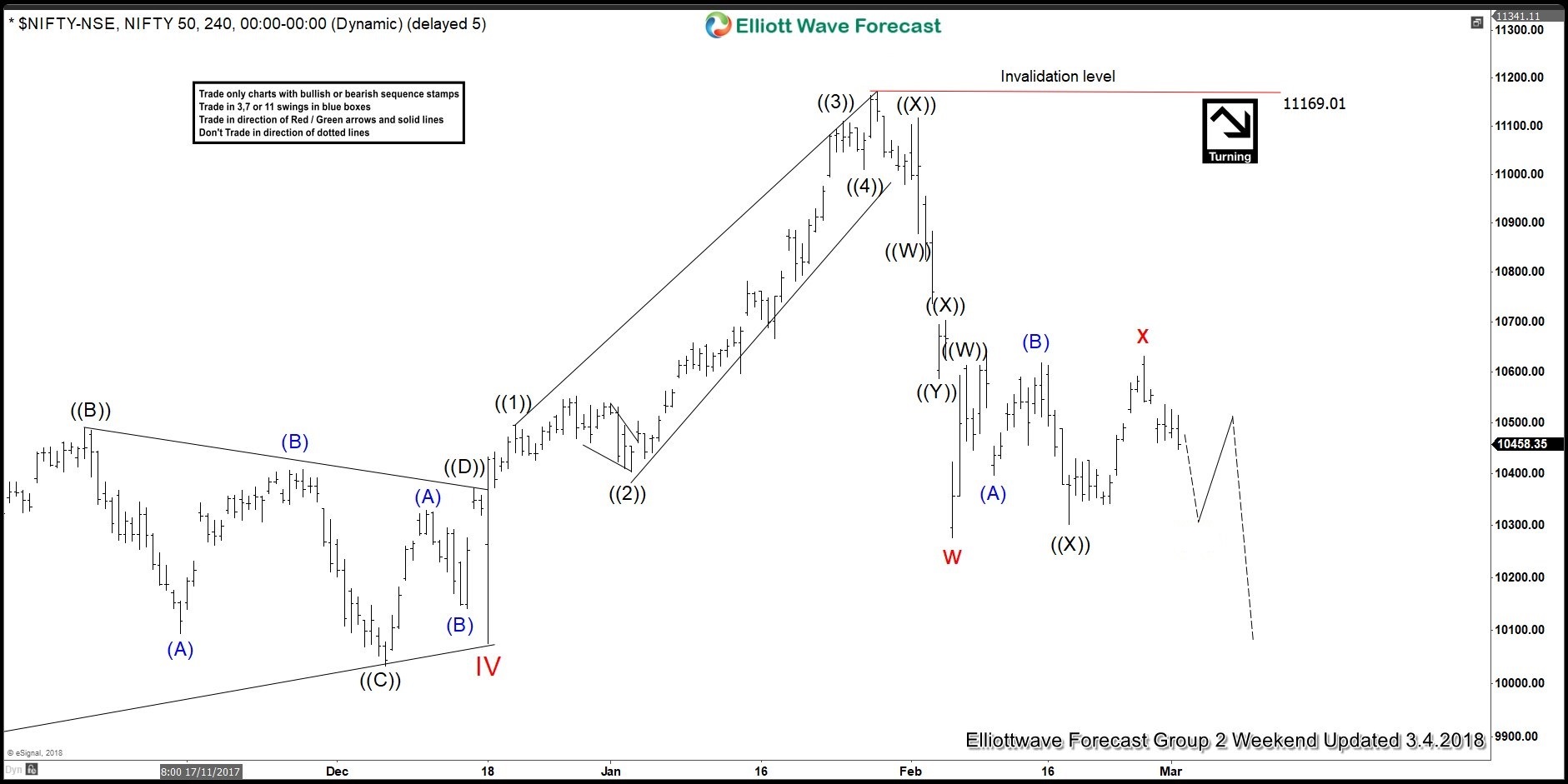

Elliott Wave Analysis: Calling The Weakness In Nifty

Read MoreToday, we will have a look at some Elliott Wave structures of Nifty which we presented to our members in the past at in the members area. Below, I attached our 4-hour weekend update chart presented to our members on the 03/04/18. Calling more downside after a double three Elliott wave correction. We suggested to […]

-

$NKD_F Nikkei Correcting Cycle Up from 2/12/2016

Read More$NKD_F Nikkei Correcting Cycle Up from 2/12/2016 The Nikkei Index has a bullish daily sequence and trend however it currently is correcting the cycle up from the 2/12/2016 lows in 3, 7 or 11 swings. For now and due to other correlated markets structures we will presume this will be a 7 swing declining pullback. […]