The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

The CAC 40 Index Long Term Bullish Cycles

Read MoreThe CAC 40 Index Long Term Bullish Cycles Firstly the CAC 40 index long term bullish cycles have been trending higher with other world indices. In September 2000 it put in an all time high. From there it followed the rest of the world indices lower into the March 2003 lows which was a larger […]

-

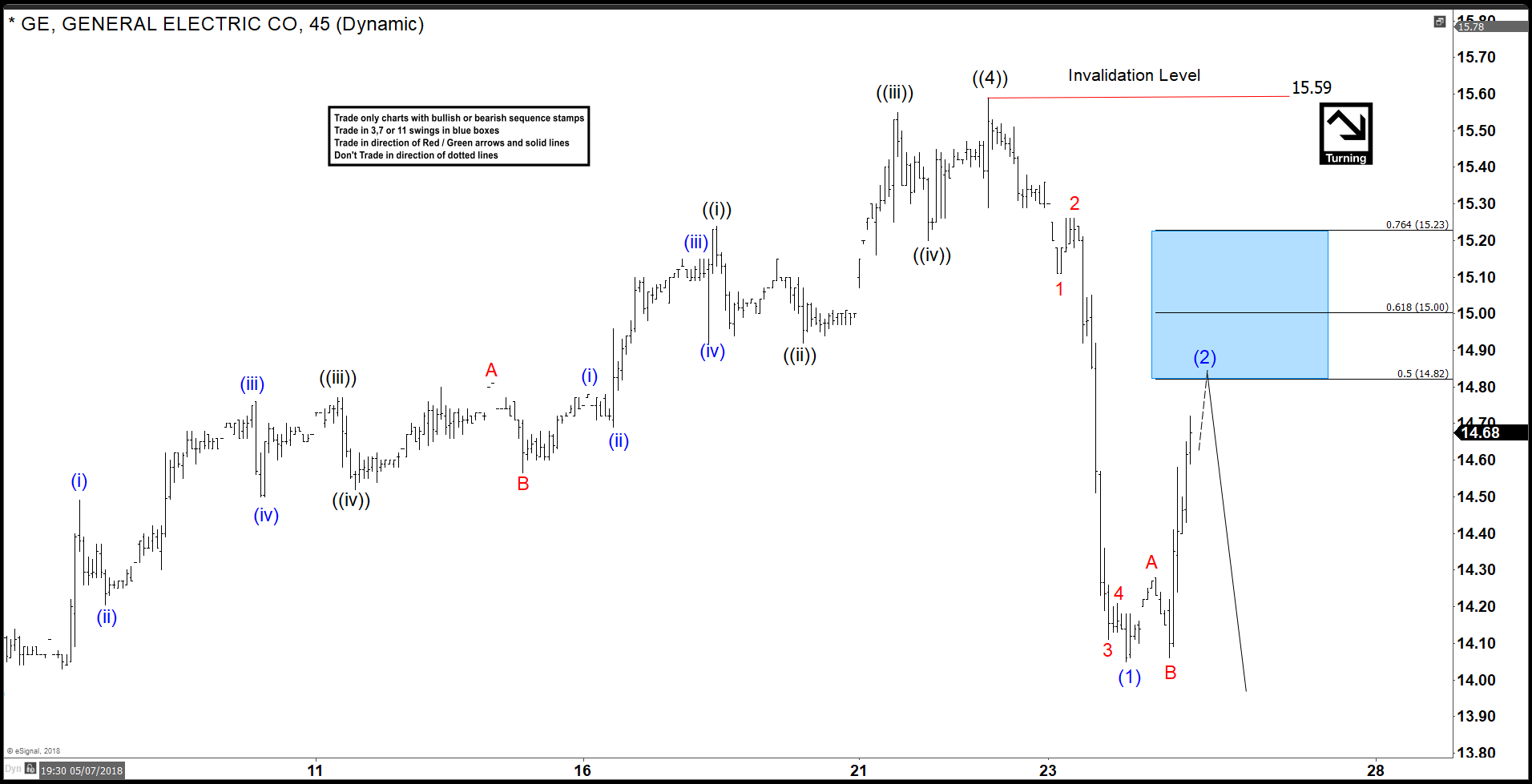

General Electric (GE) Ending Elliott Wave Impulse Soon

Read MoreGeneral Electric ticker symbol: GE short-term Elliott Wave view suggests that the rally to 5/22/2018 high 15.59 ended primary wave ((4)). When intermediate degree wave (Y) of ((4)) ended as a Zigzag correction with Minor wave A ended at 14.79 and Minor wave B ended at 14.58 low. Down from 15.59 high, the decline unfolded […]

-

The Hang Seng Index Larger Bullish Cycles

Read MoreThe Hang Seng Index Larger Bullish Cycles. Firstly the Hang Seng index larger bullish cycles has been trending higher with other world indices. In April 2003 it put in a huge degree pullback low. From there the index rallied with other world indices again until October 2007. It then corrected the rally as did most […]

-

HFC HollyFrontier Corporation Impulsive Elliott Wave Rally

Read MoreHolly Corporation and Frontier Oil merged in July 2011 to form HollyFrontier Corporation (NYSE: HFC). The company is a petroleum refiner and distributor of petroleum products, from gasoline to petroleum-based lubricants and waxes. Over the past 2 years, Hollyfrontier Corp performed better than majority of its peers in the Oil & Gas Refining and Basic Materials sector. Its […]

-

DAX Elliott Wave Analysis: Wave 3 Remains In Progress

Read MoreDAX short-term Elliott Wave view suggests that the rally from March 26.2018 low (11704) is unfolding as Impulse Elliott Wave structure. As an impulse, the internals of Minor degree wave 1, 3 & 5 should have subdivision of 5 waves impulse of lesser degree. In the case of DAX, Minute wave ((i)), ((iii)) & ((v)) are all impulsive. […]

-

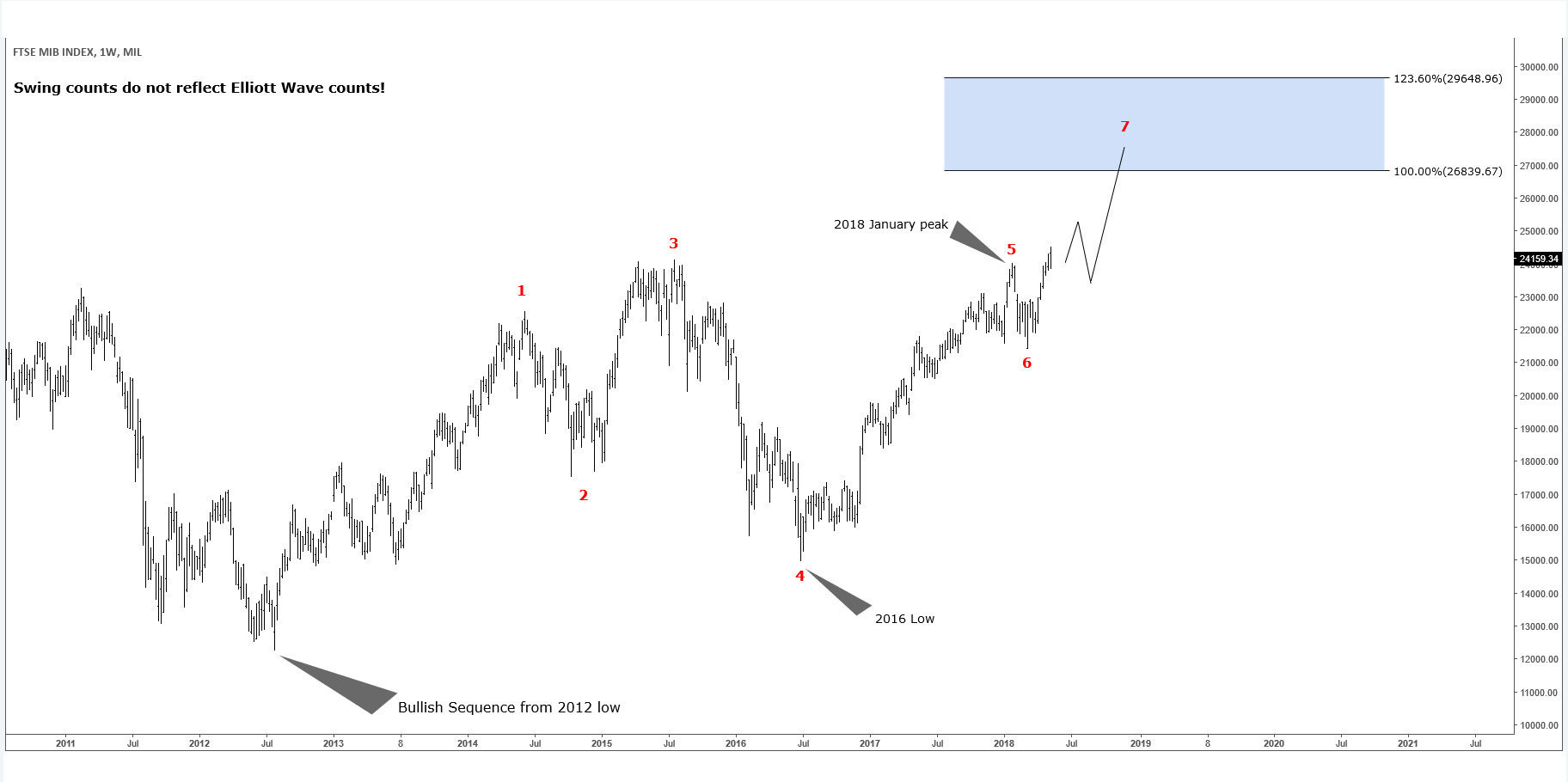

FTSE MIB Index – Bullish Extension Higher Started

Read MoreIn this blog, we will have a look at a European index called FTSE MIB. It is the stock market index for the Borsa Italiana. Which is traded in Italy. It has a market capitalization of around 4 Trillion €. The index consists of the 40 most-traded stocks in Italy. This index has a very interesting swing structure. Having a […]