The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

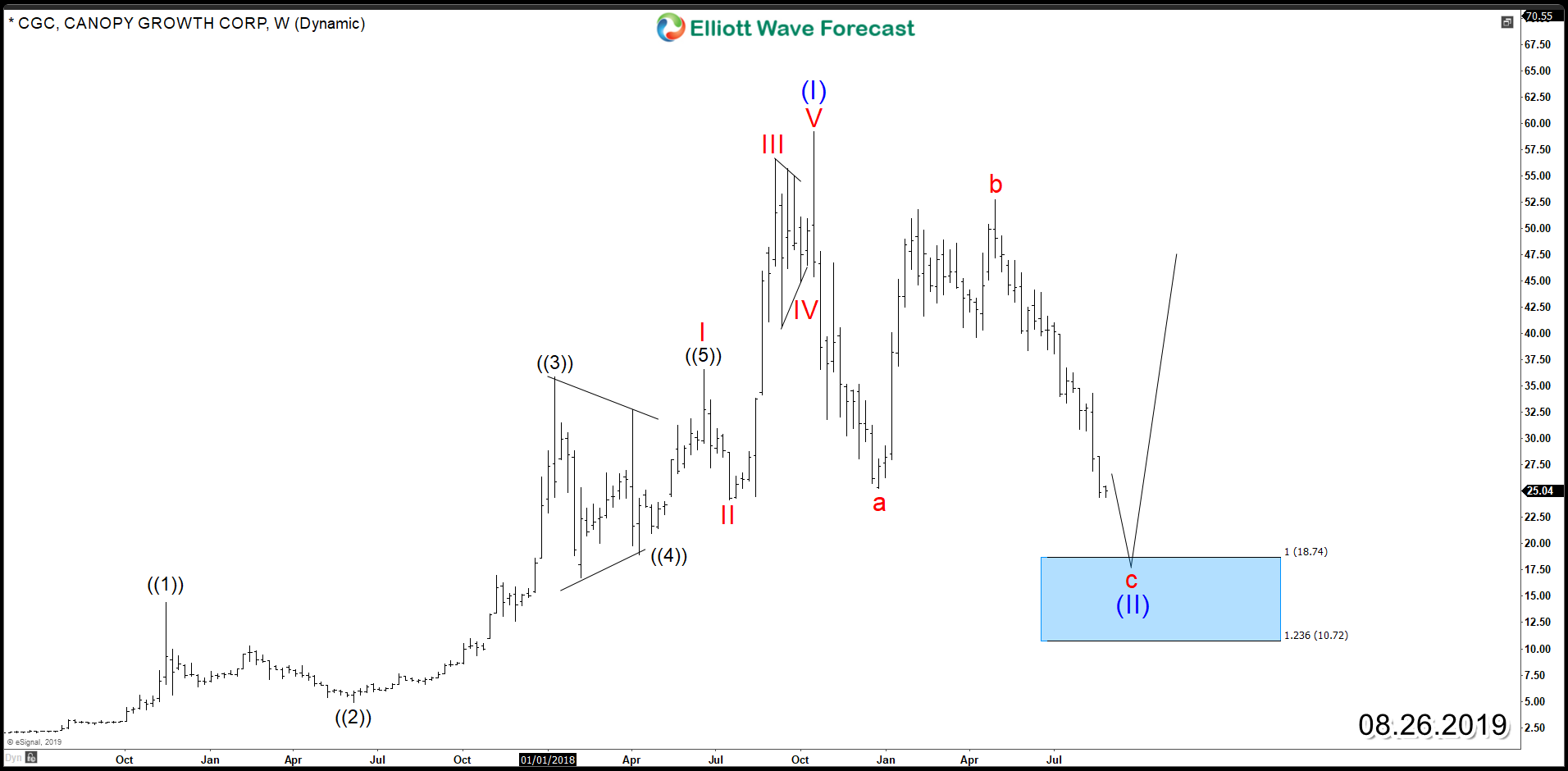

Canopy Growth Corporation – Investment Opportunity Around the Corner

Read MoreThe world’s largest medical cannabis producer by market cap, Canopy Growth (NYSE : CGC) reported earning two weeks ago. While revenue surged by nearly 250% year over year to 90.5 million Canadian dollars, it was down 59% from the previous quarter and more than 20 million Canadian dollars below the average analyst estimate which raised some concerns. The company managed […]

-

BMW AG Stock Sending Warning To German Automobile Sector

Read MoreHello fellow traders. In today’s blog, we will have a look at the BMW stock. In my previous blog, we discussed the possibility in the Daimler stock and why the biggest rival is under pressure and should remain lower. Today, we will have a look at the BMW stock which is the counterpart of Daimler (Mercedes). […]

-

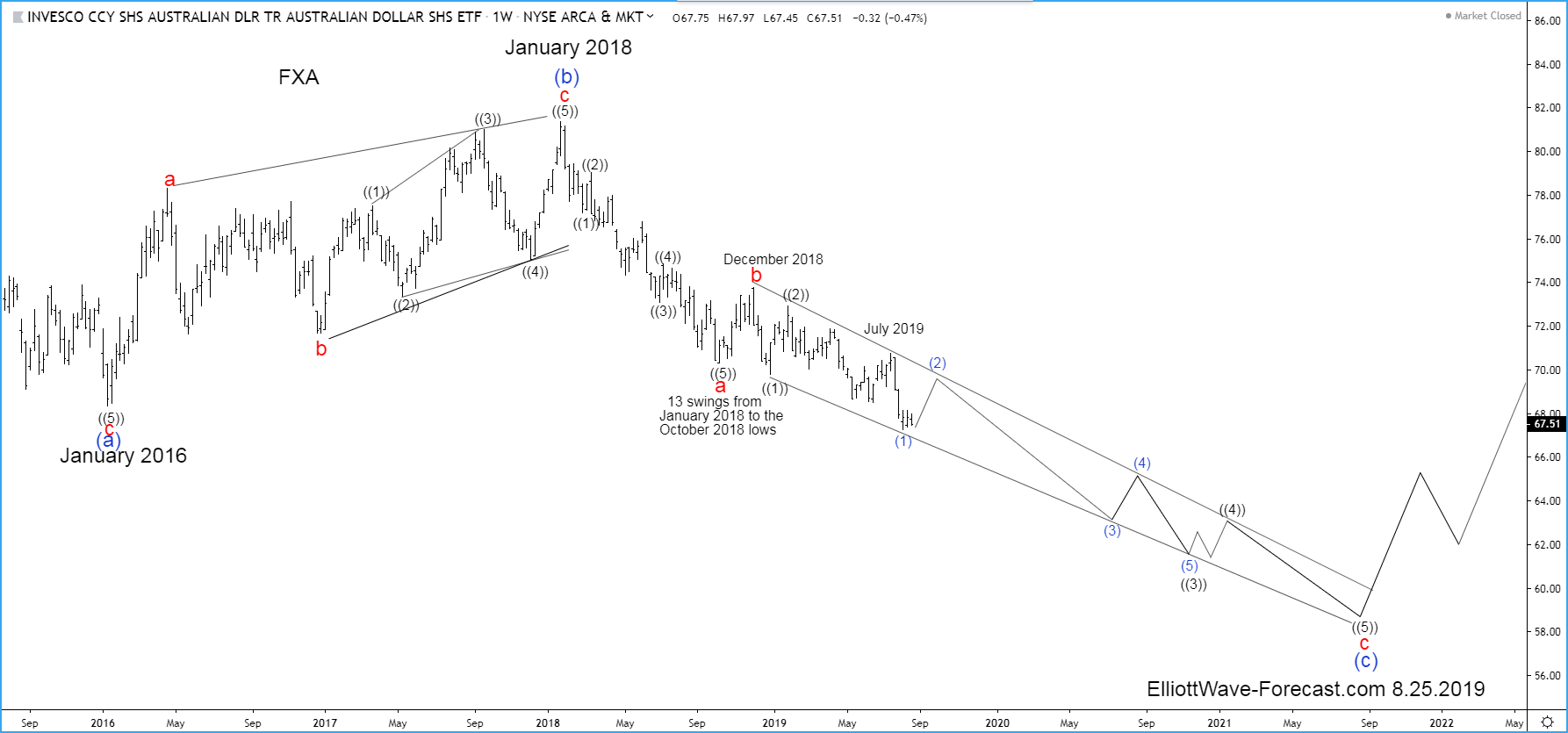

FXA Bearish Cycle From The July 2011 Highs

Read MoreFXA Bearish Cycle From The July 2011 Highs Firstly the FXA ETF fund is the Australian dollar tracking fund that has an Inception Date of 06/21/2006. With that said the fund mainly reflects the currency spot price of the AUDUSD forex pair. The data available from the Reserve Bank of Australia at their website suggests the spot price […]

-

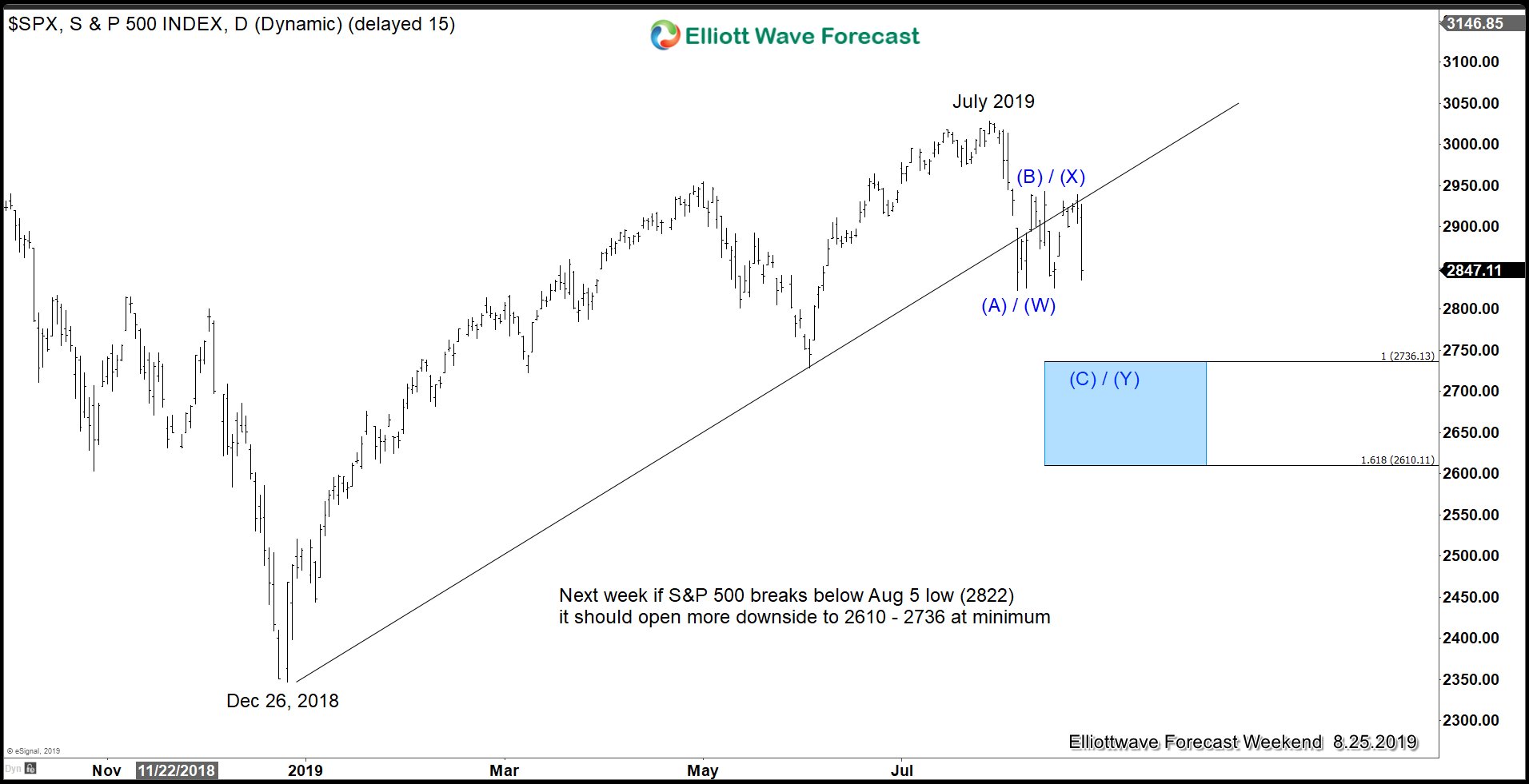

Trade War Escalation Put Selling Pressure to S&P 500 (SPX)

Read MoreLast week, there was anticipation of market volatility as the Fed’s Chairman Jerome Powell was scheduled to speak at Jackson Hole. President Trump and China however stole the show. China introduced fresh retaliatory tariffs on $75 billion of U.S. imports, targeting politically sensitive products. President Trump immediately responded. Trump announced in twitter the existing 25% […]

-

Elliott Wave View: Netflix Structure Looking Further Downside

Read MoreNetflix shows an incomplete bearish sequence favoring more downside while rally fails below Aug 9 high in 3, 7, 11 swing.

-

German Daimler AG Stock Under Serious Pressure, Whats Next?

Read MoreHello fellow traders. In today’s blog, we will have a look at the Daimler AG stock. The stock is listed in the DAX 30 and in the EURO Stoxx 50. Daimler AG is a German multinational automotive company which has its Headquarter in Stuttgart Germany. Daimler AG is one of the biggest car manufacturers in the […]