The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

$GLD Elliott Wave Analysis and Long Term Cycles

Read More$GLD Elliott Wave Analysis and Long Term Cycles Firstly the GLD ETF fund is one of the largest as well as one of the oldest Gold tracking funds out there since it’s inception date of November 18, 2004. From there on up into the September 2011 highs it ended a larger bullish cycle as did […]

-

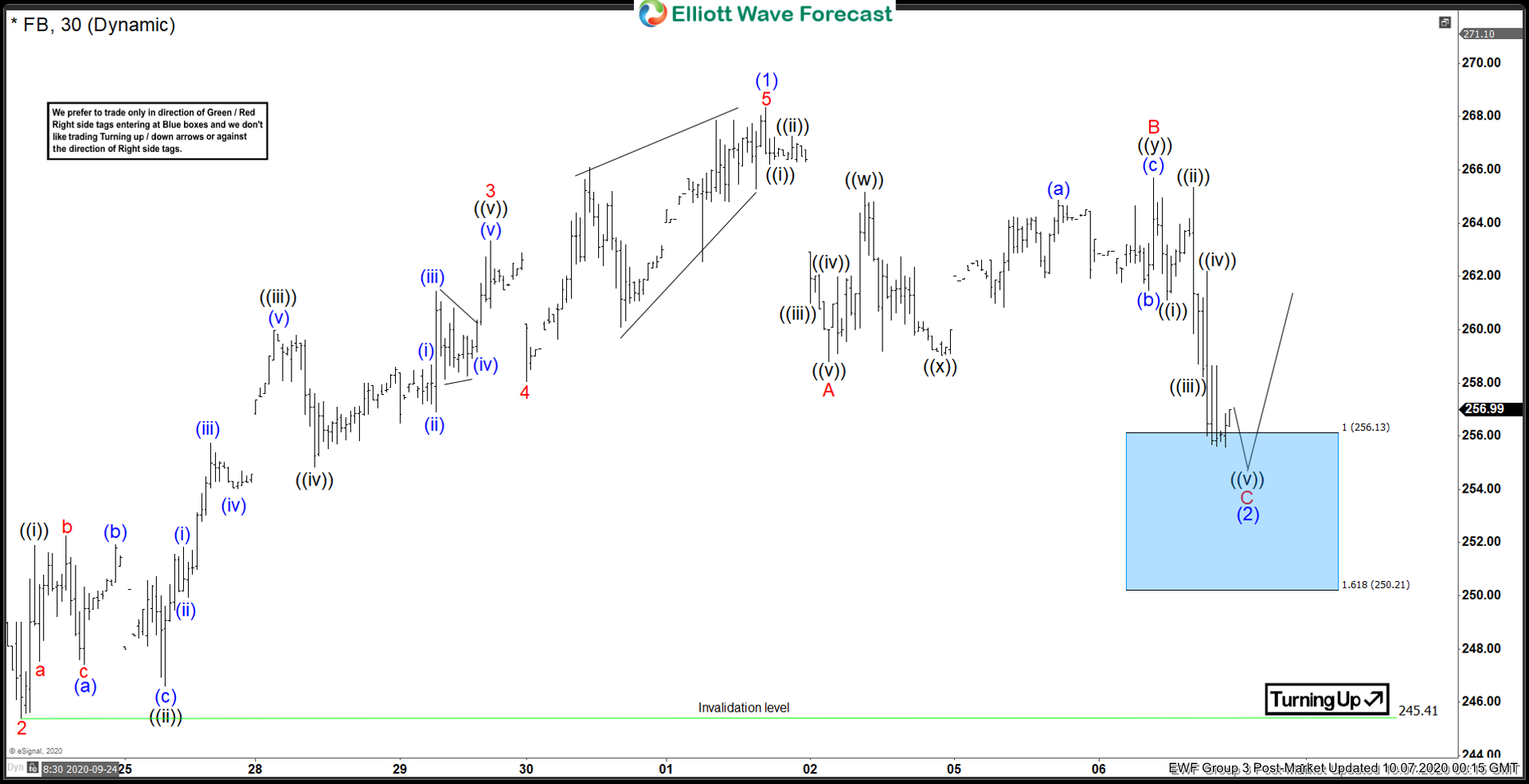

Facebook: Forecasting The Bounce From Blue Box Area

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of Facebook, In which our members took advantage of the blue box areas.

-

Elliott Wave View: Near Term Support for Russell 2000 Futures (RTY)

Read MoreRussell Futures (RTY) is doing a zigzag correction and can soon see support. This aricle and video look at the Elliott Wave path.

-

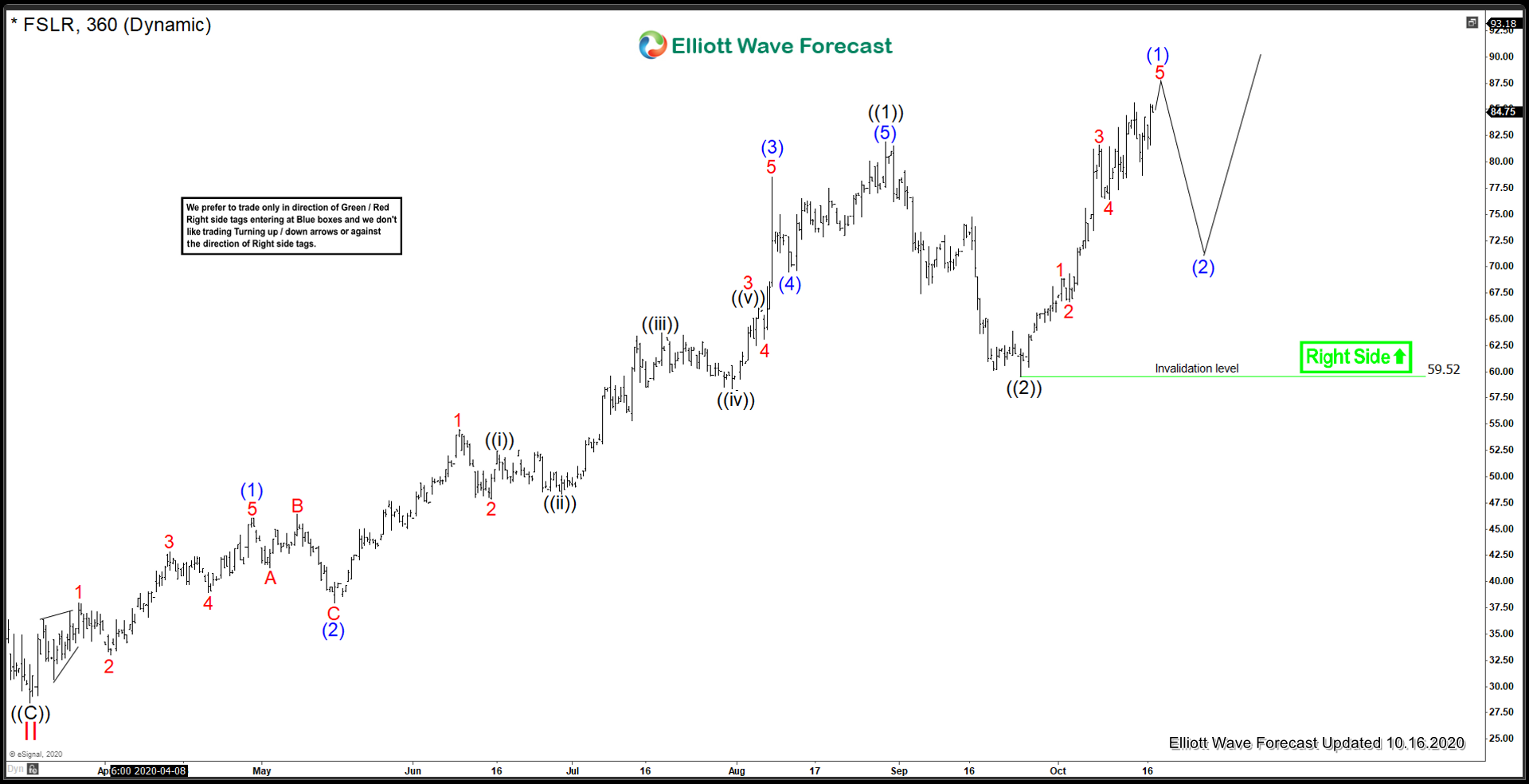

First Solar Inc. ($FSLR) Priming An Explosive Move

Read MoreAnother sector that has really taken off since the March low is Solar Energy. The ETF $TAN is up an astonishing 266% since the March low. This sector is hot, and trying to find value in a sector that has already had an explosive move is tough to do. Enter First Solar Inc. It has […]

-

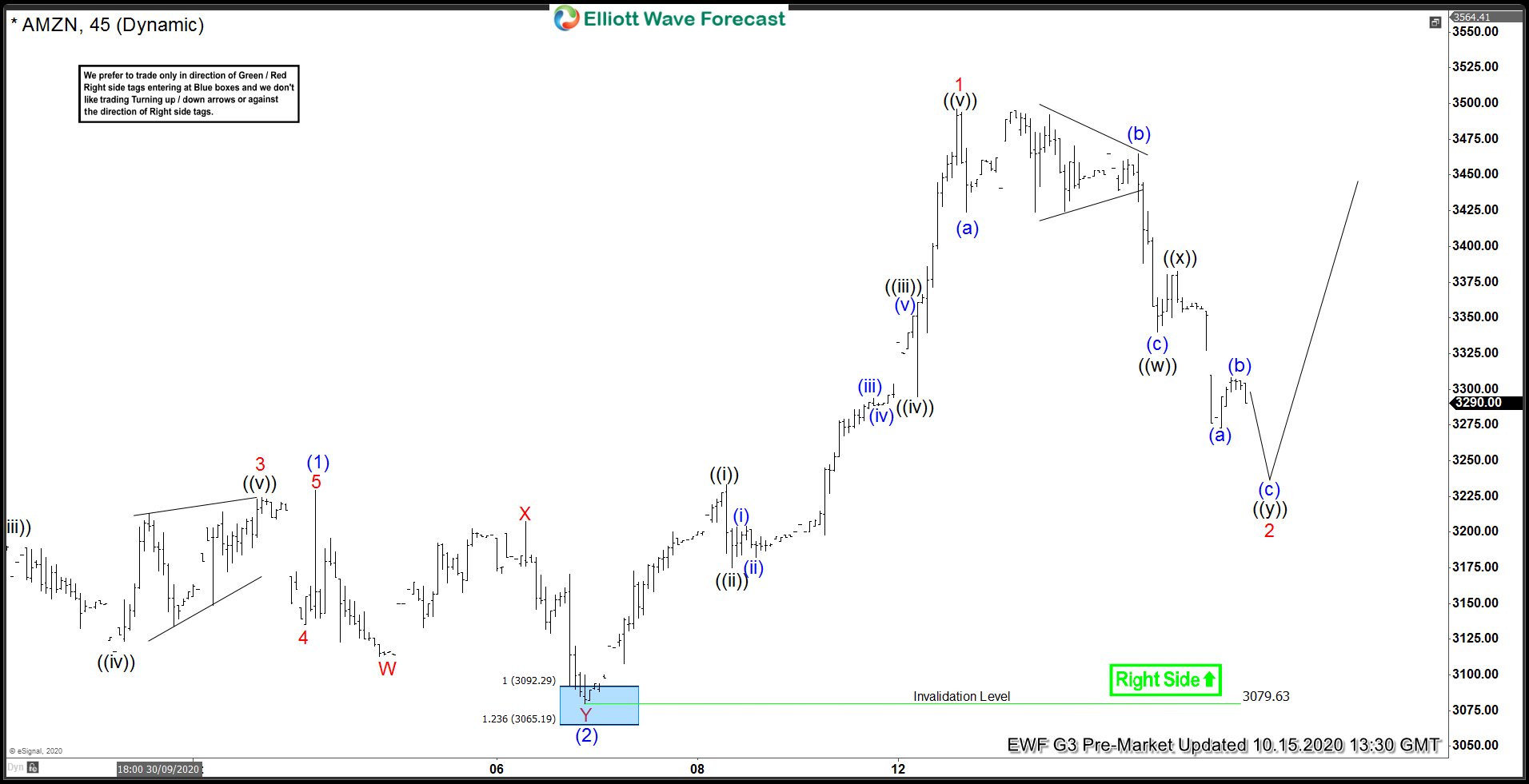

Amazon ( $AMZN ) Forecasting The Rally From The Blue Box Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of Amazon $AMZN stock, published in members area of the website. We’ve been calling for further rally in AMZN within the cycle from the September 2867.08 low. Recently we got 3 waves pull back that has […]

-

Elliott Wave View: Amazon ( $AMZN) Extending In Pullback

Read MoreAmazon ( $AMZN) rally from the 9/21/2020 low in nesting higher as an impulse sequence. This article and video look at the Elliott wave path.