The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Nike ($NKE) Kicks the Market from our Blue Box

Read MoreLast week the movement of the stock market was overtaken by the elections in the United States and the narrow margin in votes that they had in some States. However, at www.elliottwave-forecast.com we ignore the noise and focus on our Elliott Wave trading system and technical analysis. What happened with the actions of Nike ($NKE) […]

-

Fiverr International ($FVRR) Trending Higher

Read MoreFiverr International is another online marketplace name that shows a promising future. When taking a look at the chart since the IPO in 2019, a strong bullish trend has emerged. In which, the price action is very constructive for the bulls. Before I get into the charts, lets take a look at what the company […]

-

Elliott Wave View: S&P 500 E-Mini Futures (ES) Resumes Rally Higher

Read MoreS&P 500 E-Mini Futures (ES) has resumed the rally higher in wave 5 from March low high. This video and article look at the Elliottwave Path.

-

$XLV Elliott Wave Forecasting The Rally From The Blue Box Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of $XLV published in members area of the website. We’ve been calling for further rally in $XLV within the cycle from the March 73.86 low. Recently we got 3 waves pull back in wave ((4)) that […]

-

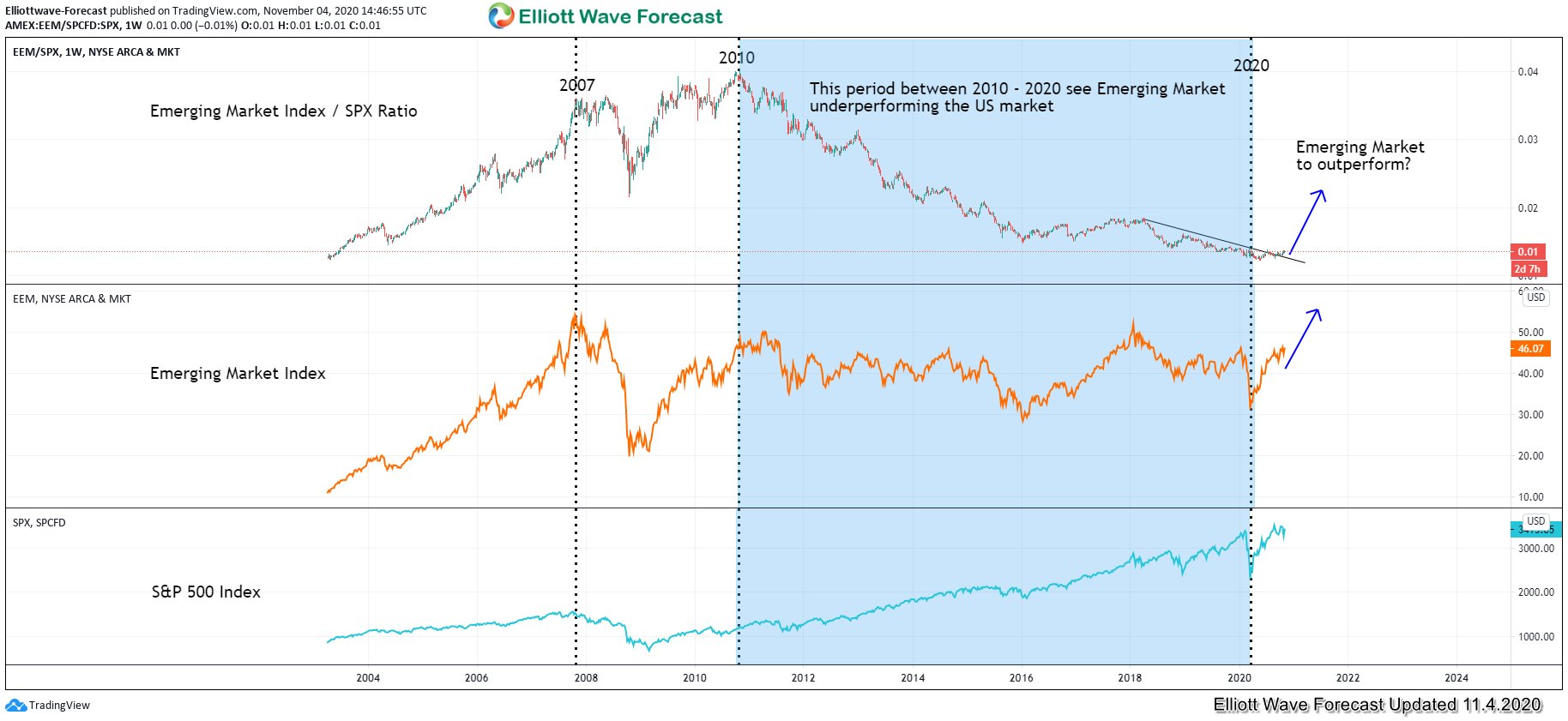

Emerging Market (EEM) Looking to Outperform US Indices

Read MoreEmerging Market has been lagging the US market in the past 10 years. One ETF which tracks the Emerging Market’s performance is iShares MSCI Emerging Market (EEM). The ETF gives exposure to large and mid-sized companies in emerging markets. Currently, the largest three holdings in the ETF are all technology-based companies, including Alibaba, Tencent, and […]

-

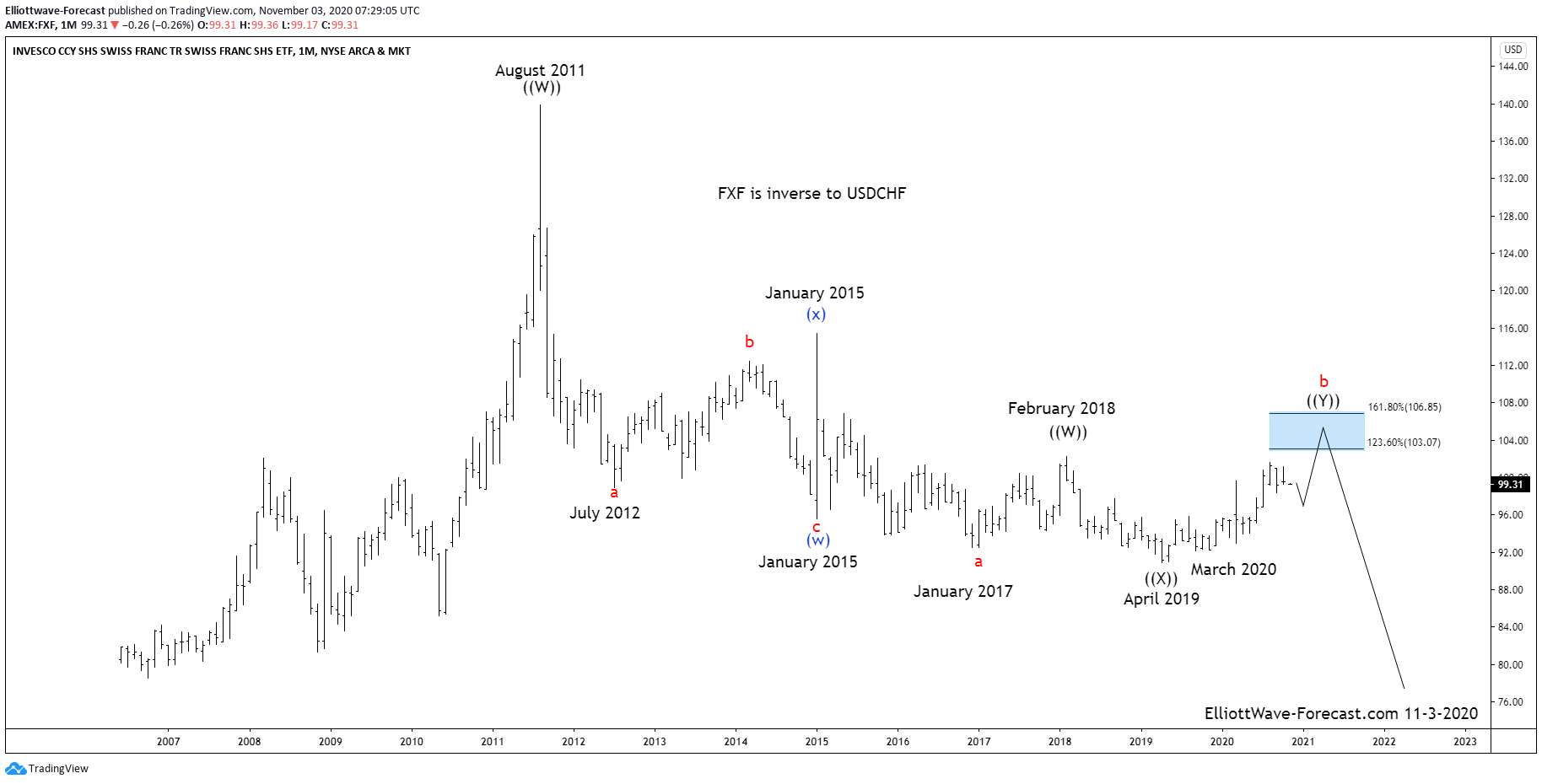

$FXF Elliott Wave and Longer Term Cycles

Read More$FXF Elliott Wave and Longer Term Cycles Firstly there is data back to when the ETF fund began in 2006 as low as 78.43. Data correlated in the USDCHF foreign exchange pair suggests the FXF high in August 2011 is also the lows of a cycle lower from the all time in the USDCHF. In this instrument there […]