The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

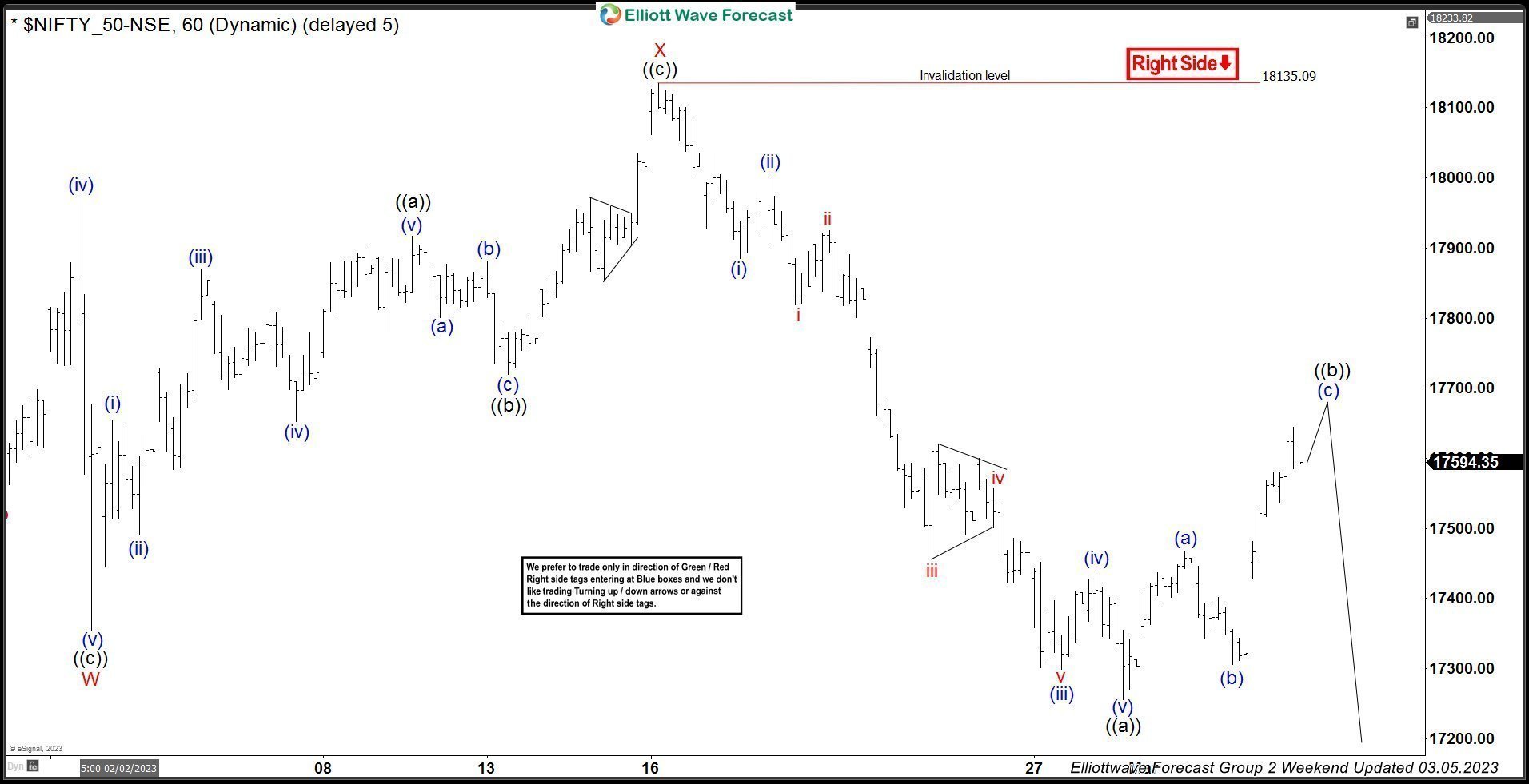

NIFTY Elliott Wave: Calling The Decline After 3 Waves Bounce

Read MoreHello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of NIFTY Index published in members area of the website. As our members know NIFTY is showing incomplete sequences from the 18887.6 peak. Recently the index made short term recovery against the 18135 high. It made […]

-

Further Downside in DAX Impulsive Elliott Wave Decline

Read MoreDAX is correcting cycle from October 2022 low before it resumes higher. This article and video look at the Elliott Wave path.

-

Bank of America (BAC) Shows Bearish Elliott Wave Sequence

Read MoreBank of America (BAC) shows bearish sequence from January 2022 high favoring further downside. This article and video look at the Elliott Wave path.

-

$MTX: MTU Aero Engines Trading in Bullish Sequence

Read MoreMTU Aero Engines AG is a German aircraft engine manufacturer. It develops, manufactures and provides service support for civil and military aircraft engines. Founded in 1934 and headquartered in Munich, Germany, it can be traded under the ticker $MTX at XETRA in Frankfurt. MTU is a part of DAX40 index. In the initial article back in April […]

-

Best Material Stocks to Invest In Now

Read MoreMaterials-sector companies are involved in activities such as mining, producing refined metals, and manufacturing chemicals. Their products are effective building blocks used in developing a variety of goods. Examples of such products are steel, which is used to create buildings, fertilizers are used to grow food, and coal which is used for energy production. List […]

-

Best Large Cap Stocks 2024

Read MoreLarge-cap stocks are typically mature companies with moderate to high growth prospects. Investors seeking high growth potential may prefer to invest in smaller companies at the lower end of the market cap range. CATEGORY MARKET CAPITALIZATION Micro-cap companies Less than $300 million Small-cap companies $300 million to $2 billion Mid-cap companies $2 billion to $10 […]