The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Newmont Mining (NEM) Leads Miners with Strong Bullish Momentum

Read MoreNewmont Mining (NEM) has a powerful breakout to new all-time high. This article looks at the Elliott Wave path for the stock.

-

From Setup to Payoff: AMD ’s Explosive $100 Rally

Read MoreAdvanced Micro Devices (AMD) drives substantial growth as it expands into artificial intelligence and data center markets. OpenAI and Oracle validate its roadmap, confirming plans to deploy tens of thousands of MI450 and MI350 accelerators. These chips deliver superior performance and cost efficiency for AI inference, positioning AMD as a strong alternative to NVIDIA. Consequently, […]

-

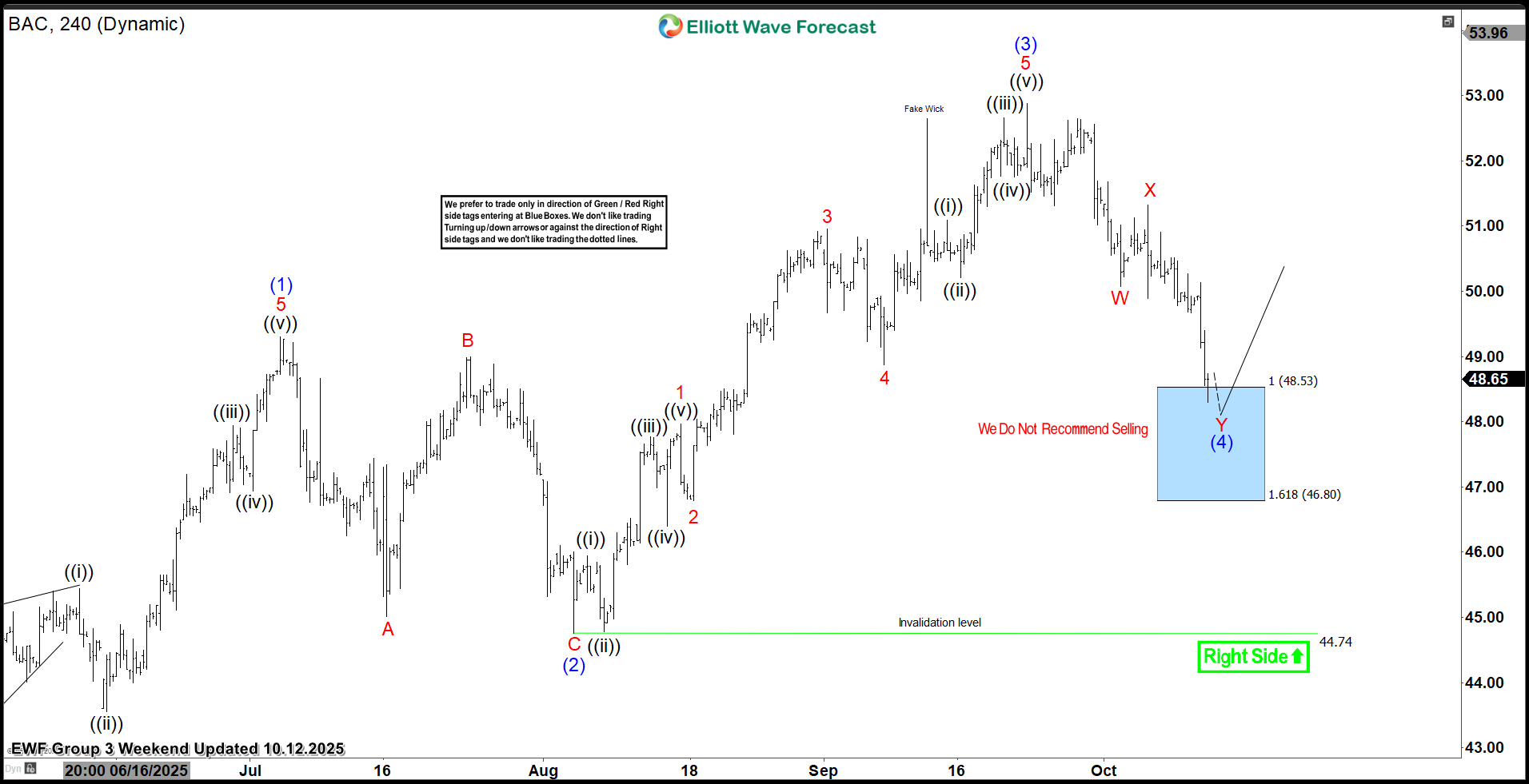

Bank of America (BAC) Rallies Strongly from the Buying Zone

Read MoreHello fellow traders. In this technical article, we are going to present Elliott Wave trading setup of Bank of America (BAC) . The stock completed its corrective decline precisely at the Equal Legs area, also known as the Blue Box. In the following sections, we’ll break down the Elliott Wave structure in detail and explain the […]

-

Dow Futures (YM) Eyeing Last Upside Push in Wave 5, Concluding April 2025 Cycle

Read MoreDow Futures (YM) is looking to extend higher in wave (5) before ending cycle from April 2025 low. This article and video look at the Elliott wave path.

-

Alphabet Inc. $GOOGL Blue Box Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Alphabet Inc. ($GOOGL) through the lens of Elliott Wave Theory. We’ll review how the rally from the June 2025 low unfolded as a 5-wave impulse followed by a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. 5 Wave […]

-

QBTS Elliott Wave View: Buyers Should Wait For Pullback

Read MoreD-Wave Quantum Inc., (QBTS) develops & delivers quantum computing systems, software & services worldwide. It comes under Technology sector & trades as “QBTS” ticker at Nasdaq. It rises almost 41 times since November-2024 & can see more upside against August-2025 low. Since inception in 2020, it made all time low of 0.40 on May-2023. After […]