The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Alphabet Inc. $GOOGL Blue Box Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Alphabet Inc. ($GOOGL) through the lens of Elliott Wave Theory. We’ll review how the rally from the June 2025 low unfolded as a 5-wave impulse followed by a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. 5 Wave […]

-

QBTS Elliott Wave View: Buyers Should Wait For Pullback

Read MoreD-Wave Quantum Inc., (QBTS) develops & delivers quantum computing systems, software & services worldwide. It comes under Technology sector & trades as “QBTS” ticker at Nasdaq. It rises almost 41 times since November-2024 & can see more upside against August-2025 low. Since inception in 2020, it made all time low of 0.40 on May-2023. After […]

-

Cisco (CSCO) Elliott Wave Suggests Ideal Entry for Optimal Profit

Read MoreHello traders. Welcome to another blog post on trade setups. In this one, the spotlight is on CISCO under the ticker CSCO. The stock has been in a bullish sequence for many months. Thus, the current pullback could present a good entry opportunity for buyers. Later in the post, I indicated the ideal buying zone […]

-

Elliott Wave Analysis: NVDA (Nvidia’s) Leading Diagonal Pattern Targets $193

Read MoreNvidia (NVDA) is looking to rally in a diagonal structure. This article and video look at the Elliott Wave path for the stock.

-

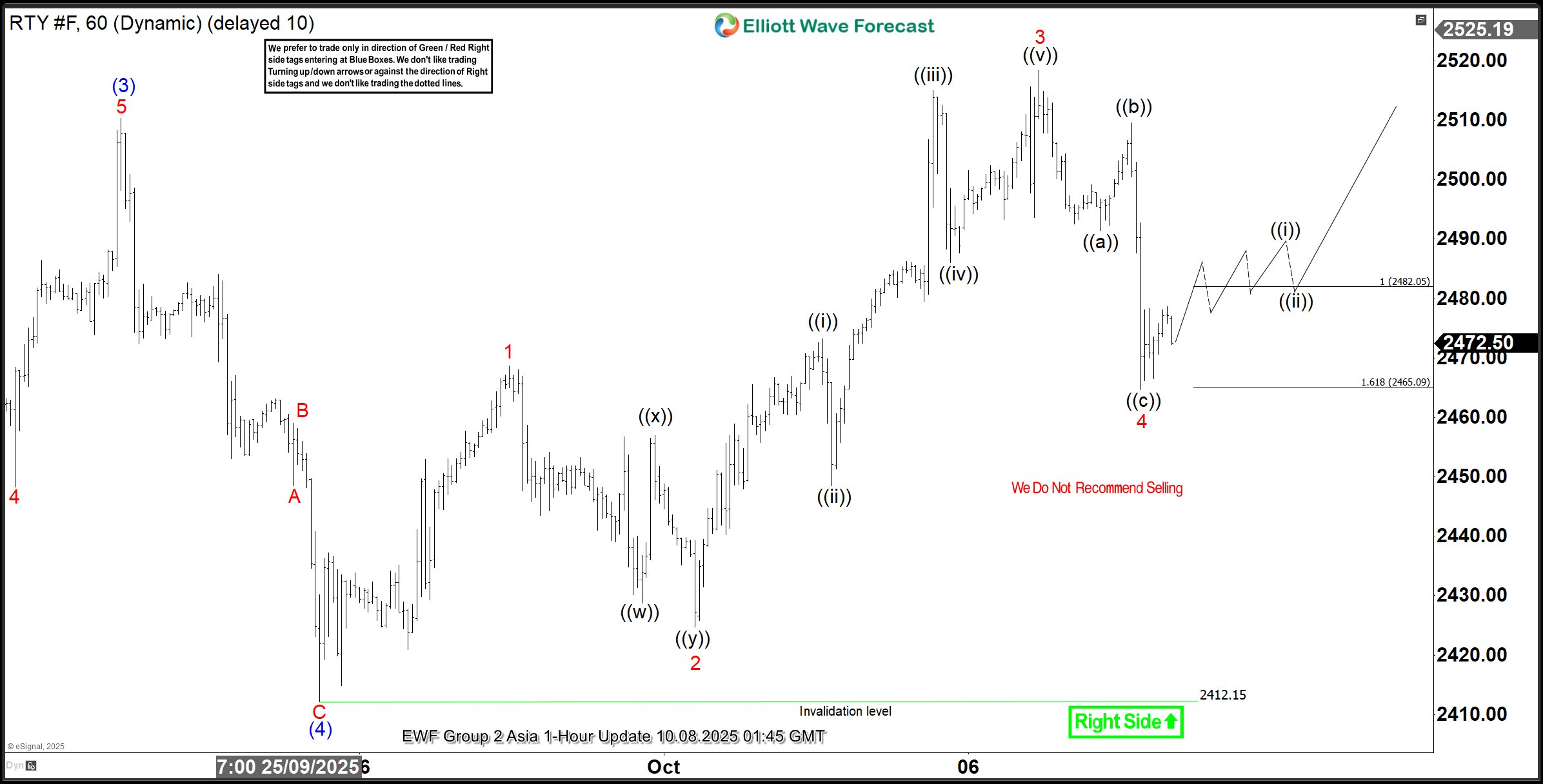

Elliott Wave Analysis: Russell 2000 Futures (RTY) Advancing in Wave (5)

Read MoreRussell 2000 Futures (RTY) correction likely ended in 3 swing and Index can resume higher in wave (5). This article and video look at the Elliott Wave path

-

AXP Approaches Exhaustion Zone: Is a Correction Looming?

Read MoreAmerican Express (AXP) delivered strong Q4 results, boosting investor confidence heading into the next quarter. Card member spending surged, net interest income rose 12%, and fee growth accelerated. As a result, management expects revenue to grow 8–10% in Q1 2026. Moreover, they increased the quarterly dividend by 17%, signaling optimism and financial strength. These moves […]