The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

PulteGroup (PHM) Riding the Wave of a Booming Real Estate Market

Read MorePulteGroup, Inc. (NYSE: PHM), a leading homebuilder in the United States, has been at the forefront of the booming real estate market. With a strong track record and a solid reputation, PulteGroup has positioned itself as a key player in the industry. In this article, we will delve into the bullish case for PHM, exploring […]

-

TSLA: Weekly Blue Box May Lead Tesla Towards New Highs

Read MoreHello Traders, in this article we will analyze the Weekly cycle of TSLA ( Tesla ) and explain how might be calling for new highs. Tesla, Inc is an American multinational automotive and clean energy company headquartered in Austin, Texas. It designs and manufactures electric vehicles (electric cars and trucks), battery energy storage from home […]

-

Antero Resources (AR): Is It Ready For Next Rally ?

Read MoreAntero Resources Corporation, (AR) engages in the development, production, exploration & acquisition of natural gas, natural gas liquids & oil properties in the United States. It is based in Denver, Colorado, trades at “AR” ticker at NYSE & comes under Energy sector. Since 2014 high, AR traded lower & made a low of $0.64 in […]

-

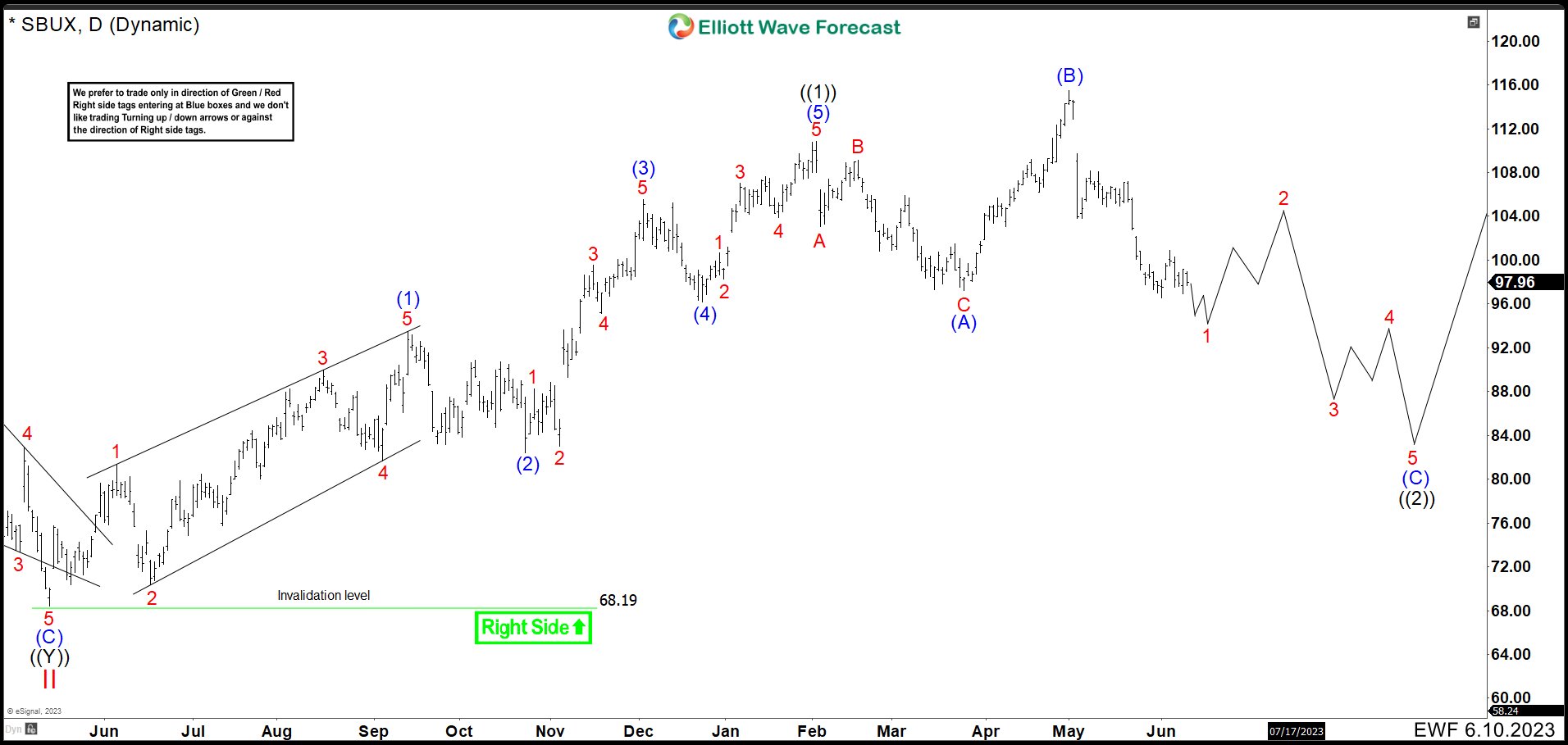

Starbucks (SBUX) Is Entering In A Expanded Flat Structure

Read MoreStarbucks Corporation (SBUX) is an American multinational chain of coffeehouses and roastery reserves. It is the world’s largest coffeehouse chain. As of November 2021, the company had 33,833 stores in 80 countries, 15,444 of which were located in the United States. Out of Starbucks’ U.S.-based stores, over 8,900 are company-operated, while the remainder are licensed. SBUX completed a cycle from March […]

-

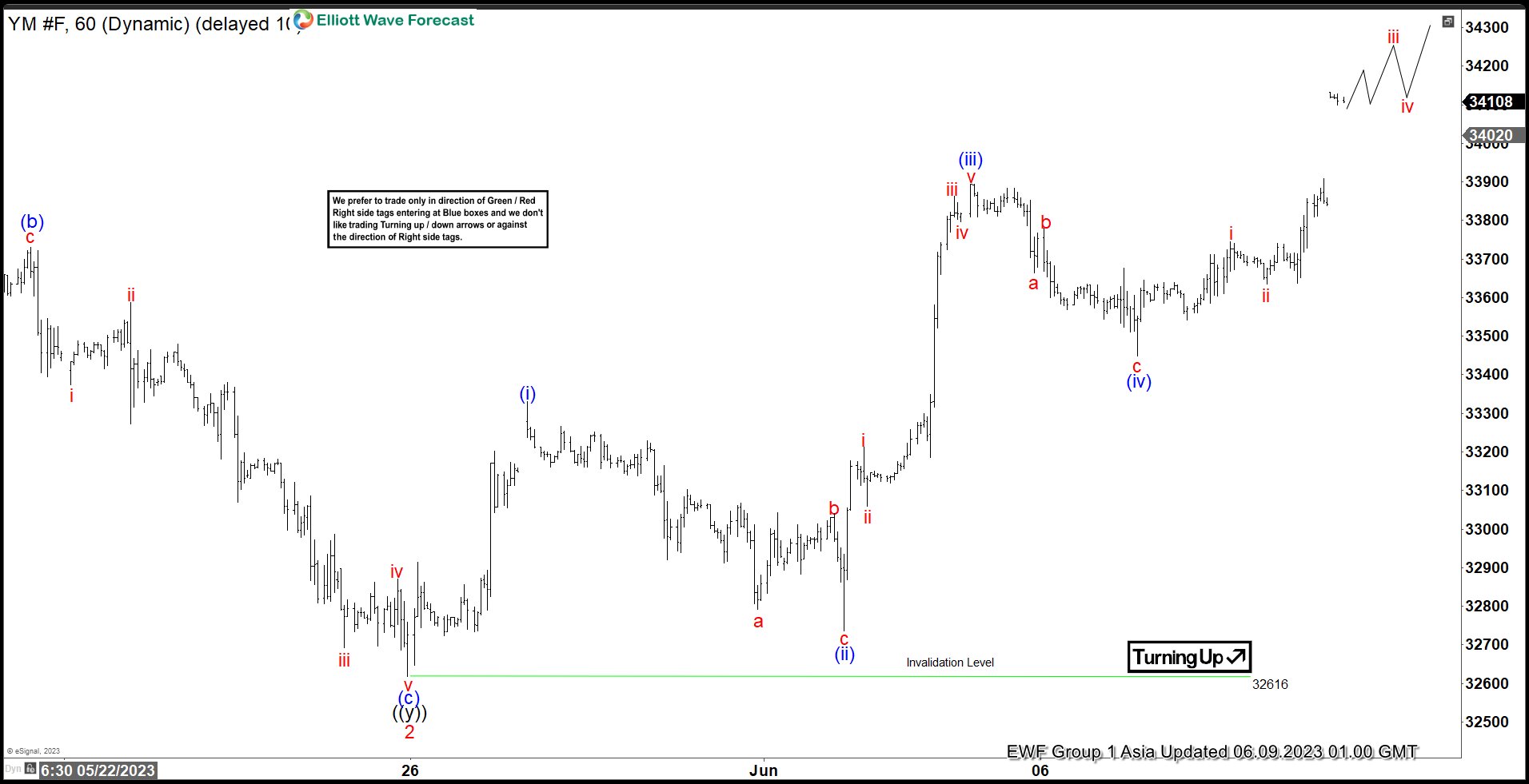

Dow Futures (YM) Rallying Higher as Impulse

Read MoreDow Futures (YM) rally from 5.25.2023 low as a 5 waves impulse favoring more upside. This article and video look at the Elliott Wave path.

-

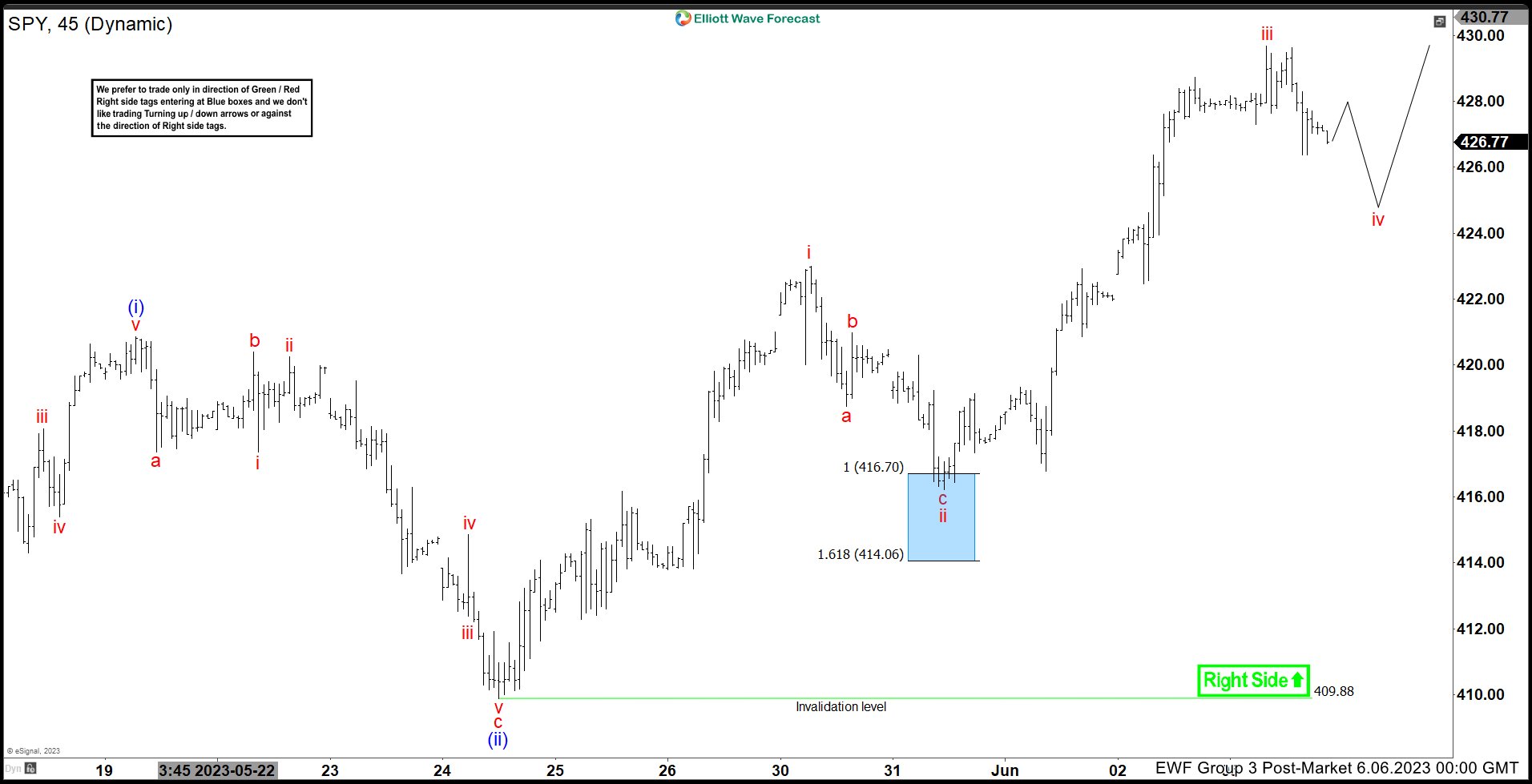

SPY ETF: Wave ii Pullback Found More Buyers In Blue Box

Read MoreHello Traders, in this article we will analyze our forecast for SPY ETF in the short term cycle. Since the short term peak of SPY from 05.30.2023 to end wave i of (iii) we have been expecting a pullback within wave ii to take place. Thereafter, we were expecting more upside within wave iii. Here […]