The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Netflix Found Blue Box Area And Reacting Higher Perfectly

Read MoreIn this technical blog, we will look at the past performance of the 1-hour Elliott Wave Charts of Netflix ticker symbol: NFLX. In which, the rally from the 27 June 2023 low unfolded as an impulse structure. And showed a higher high sequence favored more upside extension to take place. Therefore, we advised members not to sell the […]

-

RCL (Royal Caribbean Group) : The Symbol Reaches Definition Area

Read MoreRoyal Caribean has been one of the stronger symbols in the sector. The Symbol ended the Grand Super Cycle back on 01.29.2018 and did a powerful three waves back. The pullback ended on 03.13.2020, and the stock then reacted in five waves off those lows. This suggests at that moment that more upside should happen […]

-

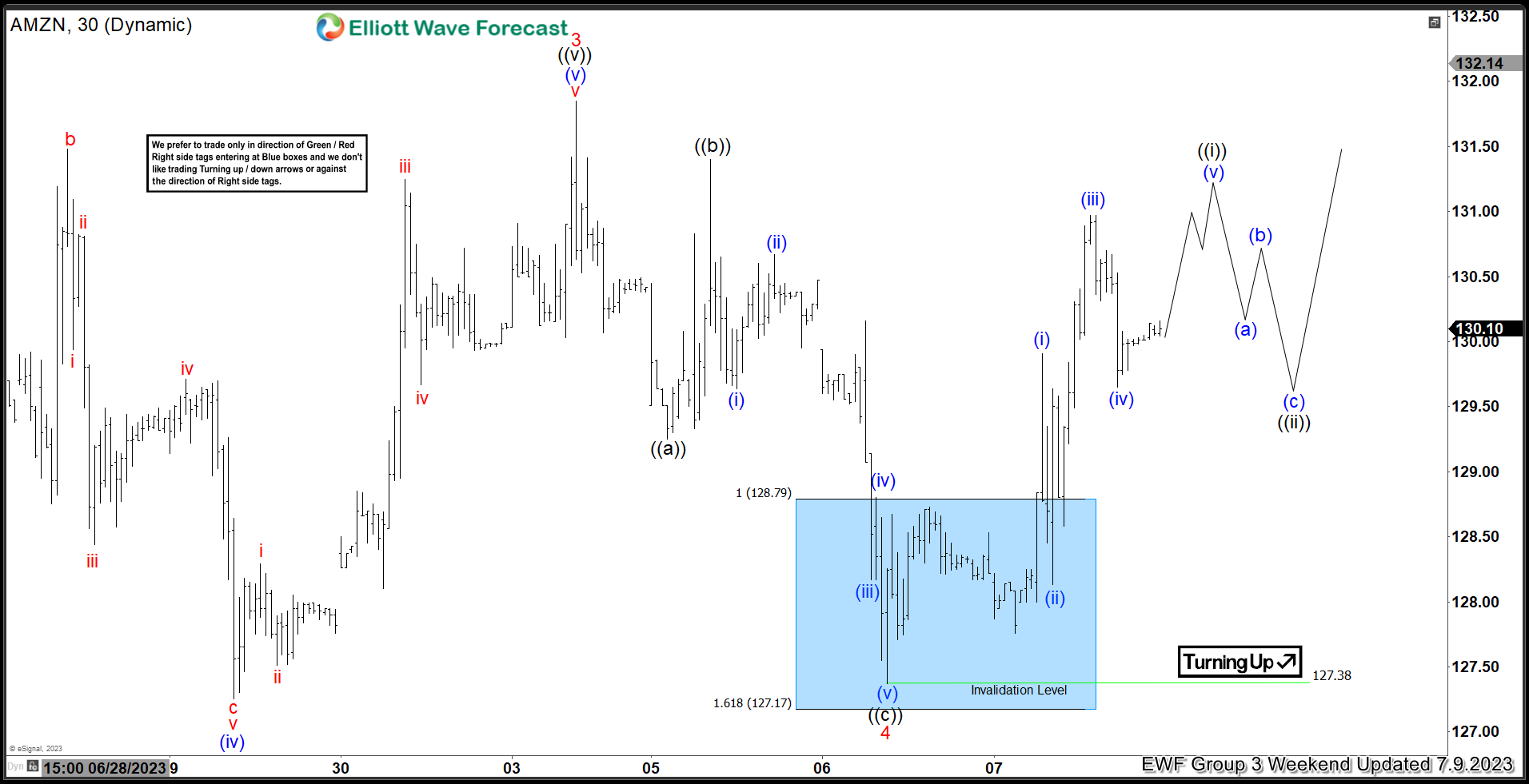

Amazon.com Inc. ($AMZN) Reacts Higher From The Blue Box Area.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1 Hour Elliott Wave chart of Amazon.com Inc. ($AMZN) The rally from 6.26.2023 low unfolded as a 5 wave impulse with an incomplete bullish sequence from 6.29.2023 low. So, we advised members to buy the pullback in 3 swings at the […]

-

Eli Lilly & Company (LLY) Favors Further Extension Higher in Bullish Sequence

Read MoreEli Lilly & Company (LLY) discovers, develops & markets human pharmaceuticals worldwide. It is having around 429 B market cap as on July, 9th. It is based in Indianapolis, Indiana, US, comes under Healthcare sector & trades as “LLY” ticket at NYSE. LLY showing higher high bullish sequence in Weekly & favors higher in (III) […]

-

Nvidia (NVDA) Made Rally After 3 Waves Pull Back

Read MoreHello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts of Nvidia (NVDA) , presented in members area of the of our website. Recently has given us 3 waves pull back as we were expecting. In the further text we are going to explain the Elliott Wave […]

-

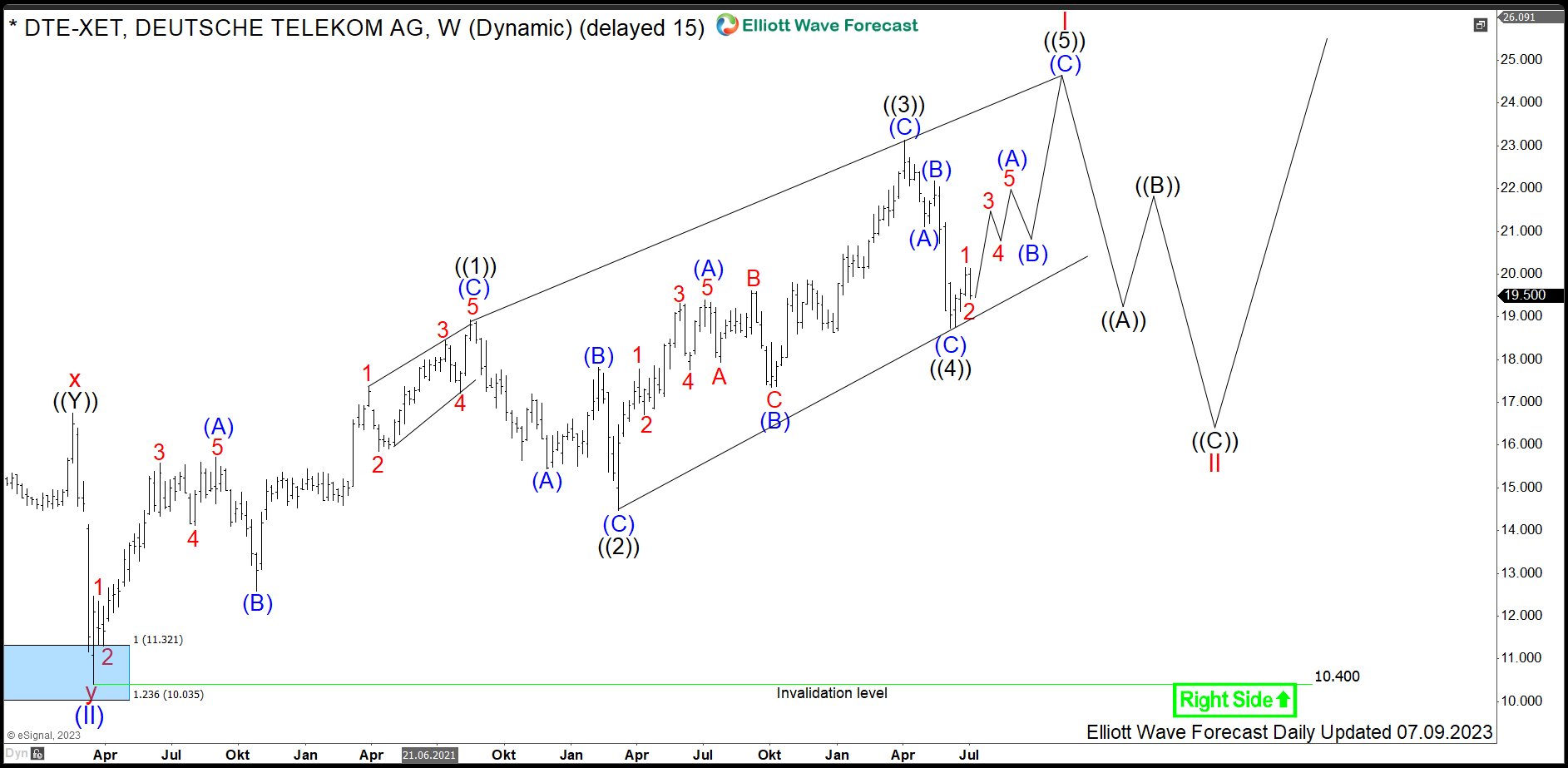

$DTE : Telecommunications Stock Deutsche Telekom Remains Supported

Read MoreDeutsche Telekom AG is a German telecommunications company and by revenue the largest telecommunications provider in Europe. Formed in 1995 and headquartered in Bonn, Germany, the company operates several subsidiaries worldwide. Deutsche Telekom is a part of both DAX40 and of SX5E indices. Even though the stock is highly appreciated by investors, the stock price […]