The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

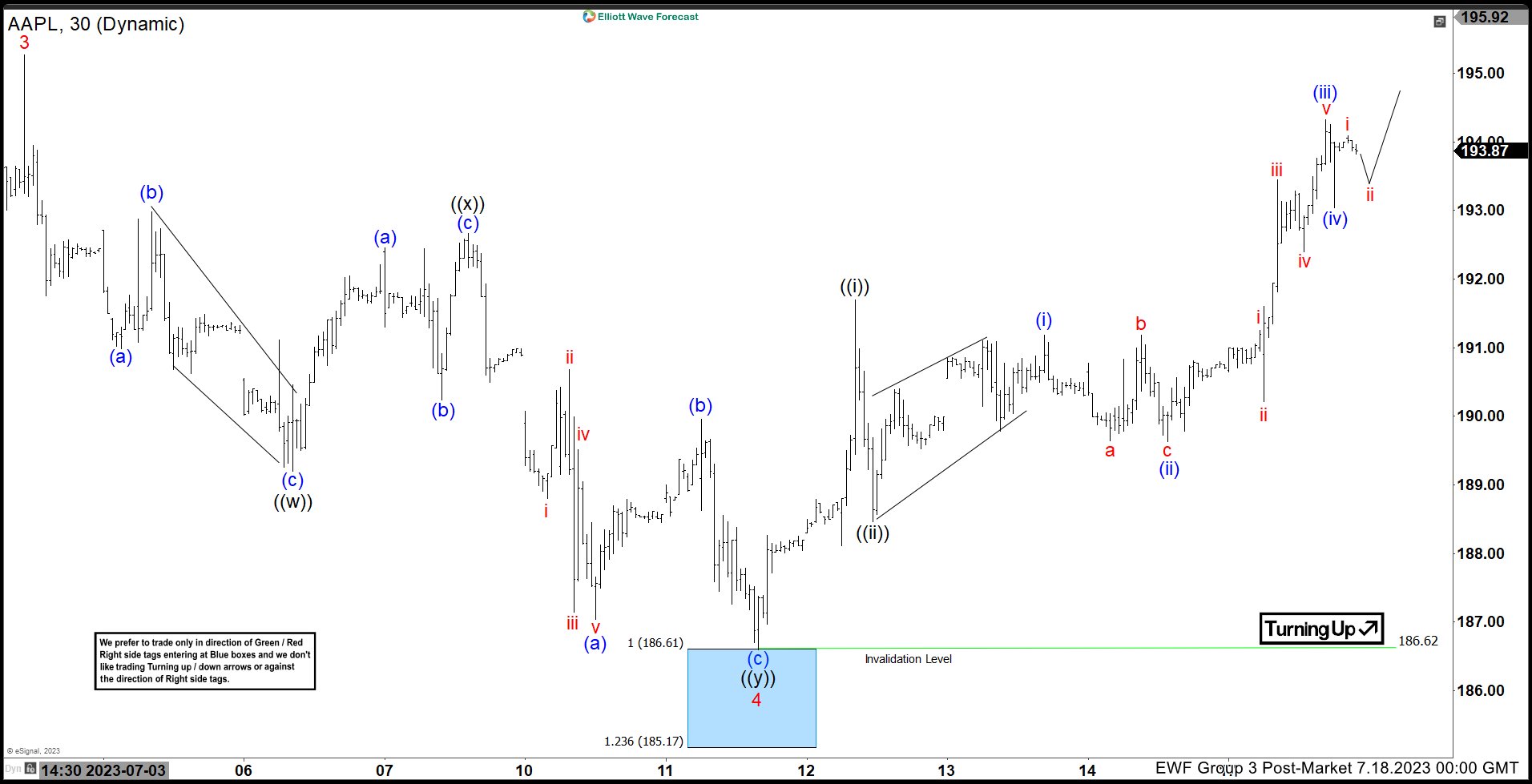

Apple (AAPL) Short Term Still Looking to End Wave 5 Higher

Read MoreApple (AAPL) Resumes Higher to Complete wave 5 of an impulse. This article and video look at the Elliott Wave path of the stock

-

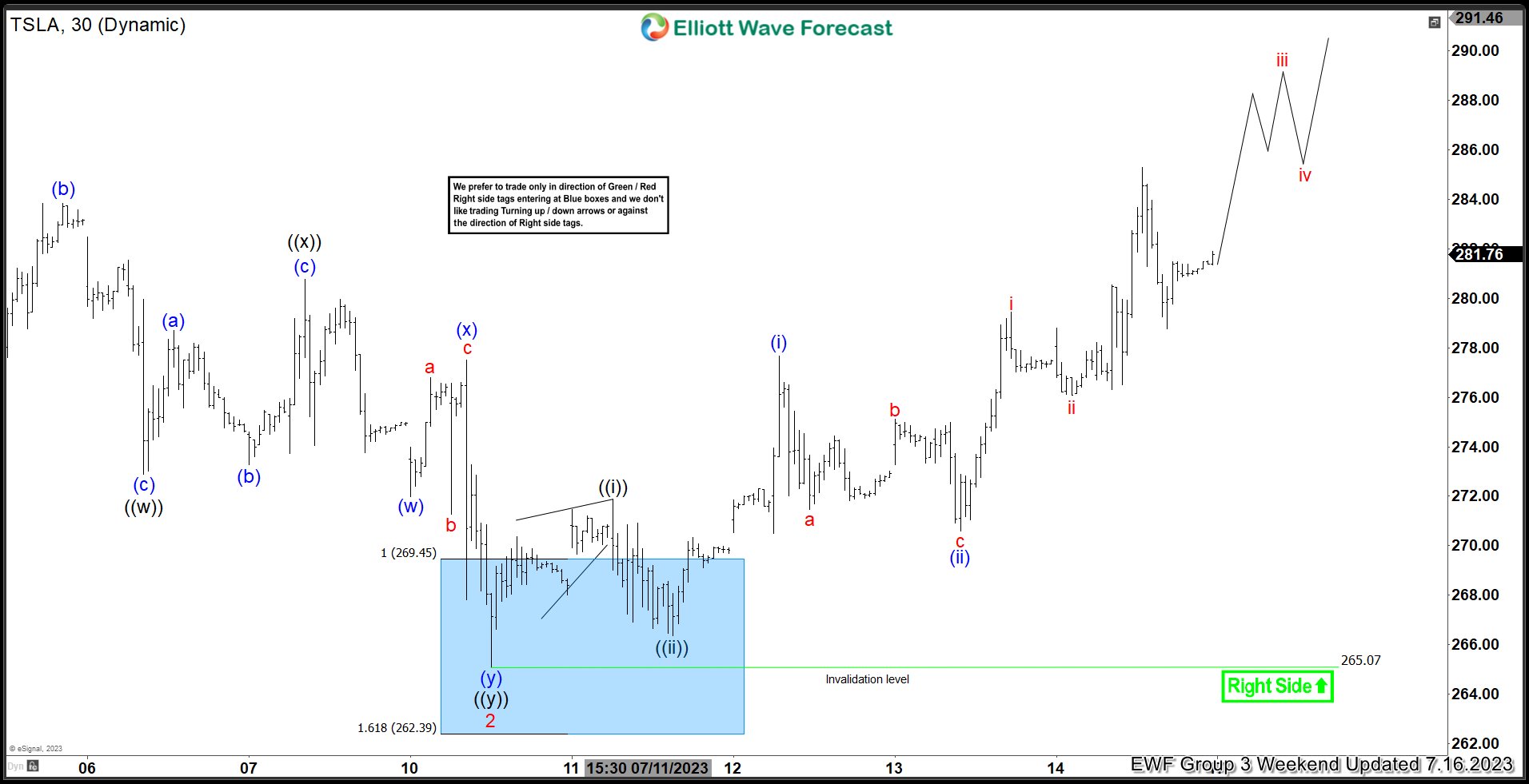

Tesla Inc. ($TSLA) Blue Box Area Wins Again. What’s Next?

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1 Hour Elliott Wave chart of Tesla Inc. ($TSLA) The rally from 4.27.2023 low unfolded as a 5 wave impulse with an incomplete bullish sequence from 6.26.2023 low. So, we advised members to buy the pullback in 7 swings (WXY) at […]

-

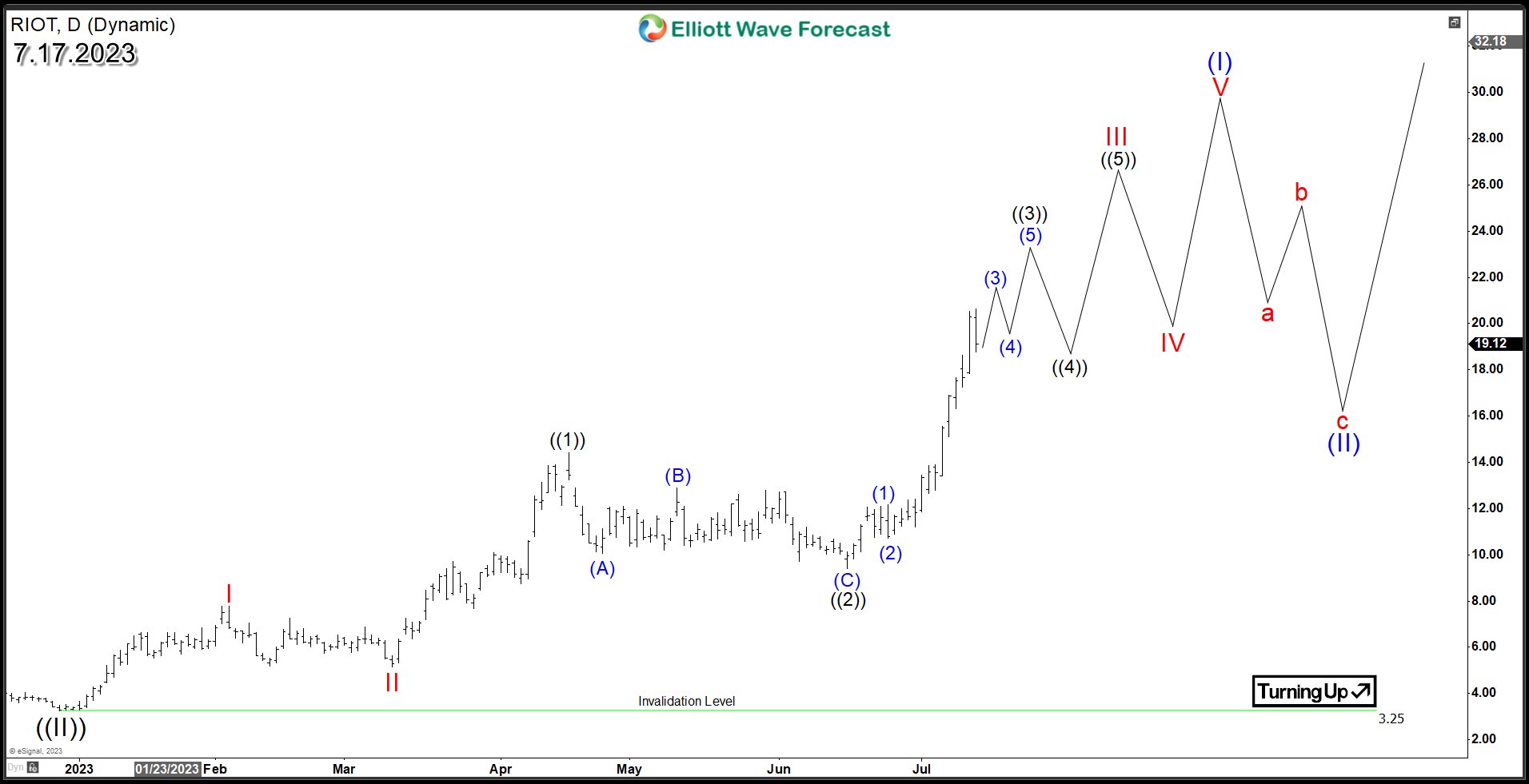

RIOT Sets the Stage for Further Advances with Strong Bullish Structure

Read MoreIn the fast-paced world of cryptocurrency, Riot Blockchain Inc (NASDAQ: RIOT) has emerged as a key player, fueled by its innovative blockchain technology and successful venture into mining Bitcoin. As the demand for digital currencies continues to rise, RIOT has positioned itself for further growth and success. In this article, we will delve into the […]

-

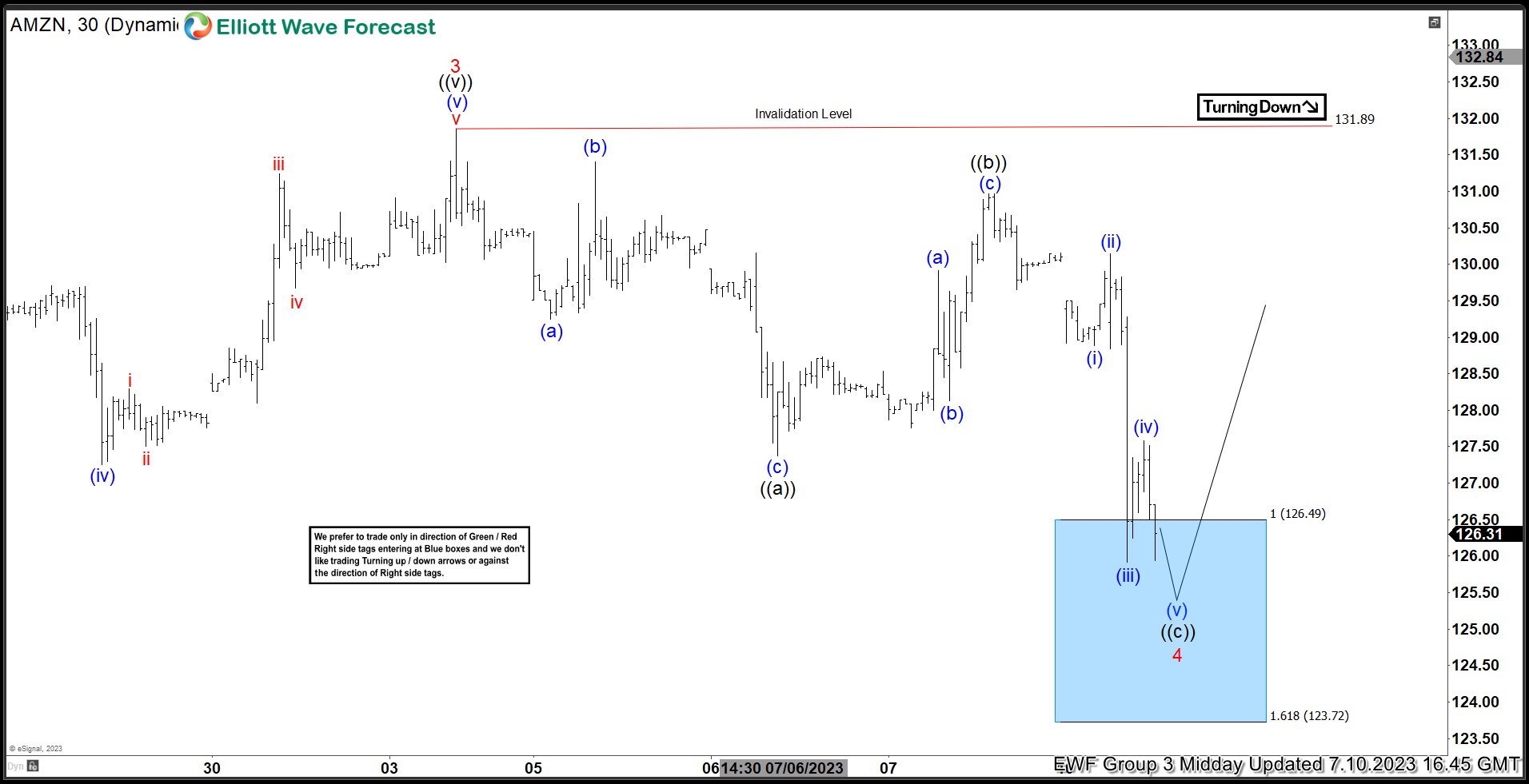

AMZN Keep Reacting Higher From The Blue Box Areas

Read MoreIn this blog, we take a look at the past performance of AMZN charts. The stock reacted higher from the blue box area where buyers were expected to appear.

-

DAX Index Rallies after Ending 3 Waves Corrective Pullback

Read MoreDAX ended 3 waves pullback and starts to turn higher in impulsive structure. This article and video look at the Elliott Wave path.

-

Crypto vs. Stocks: What Should I Invest In?

Read MoreStocks and Crypto are very different investment options. They both represent an entirely different segment of the financial industry. Let’s shed light on both these investment vehicles and then discuss which is a good option to invest in. What are Stocks? Stocks represent ownership in the company. With every share, the shareholder owns a percentage […]