The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Amazon (AMZN) Impulse Pattern Remains Incomplete

Read MoreThe Short-Term Elliott Wave outlook from the October 11, 2025 low remains constructive, unfolding as a five-wave impulsive structure. From that low, wave ((i)) advanced and concluded at $222, followed by a corrective pullback in wave ((ii)), which bottomed at $211.03, as illustrated in the 45-minute chart. Subsequently, the stock began nesting higher within wave […]

-

Taiwan Semiconductor Manufacturing (TSM) Riding The Impulse Wave

Read MoreTaiwan Semiconductor Manufacturing Co. (NYSE: TSM) operates as the world’s leading semiconductor foundry, powering the global AI and computing evolution. As demand for advanced chips surges, the stock has broken into new high territory, confirming a powerful bullish cycle is now in force. Today, we decode the Elliott Wave pattern driving this strategic breakout. Furthermore, […]

-

NXP Semiconductors (NXPI) Elliott Wave Outlook: Wave (III) Targets Massive Upside Potential

Read MoreNXP Semiconductors N.V. (NASDAQ: NXPI) shows a strong long-term bullish setup according to Elliott Wave analysis. The monthly chart suggests that the stock completed a large corrective structure and has now entered a new bullish phase. The company, a key global player in the semiconductor industry, appears ready to extend its uptrend as long as […]

-

QQQ Short Term Elliott Wave View: Bullish Formation Not Yet Complete

Read MoreNasdaq 100 ETF (QQQ) short term bullish structure looks incomplete favoring upside. This article and video look at the Elliott Wave path.

-

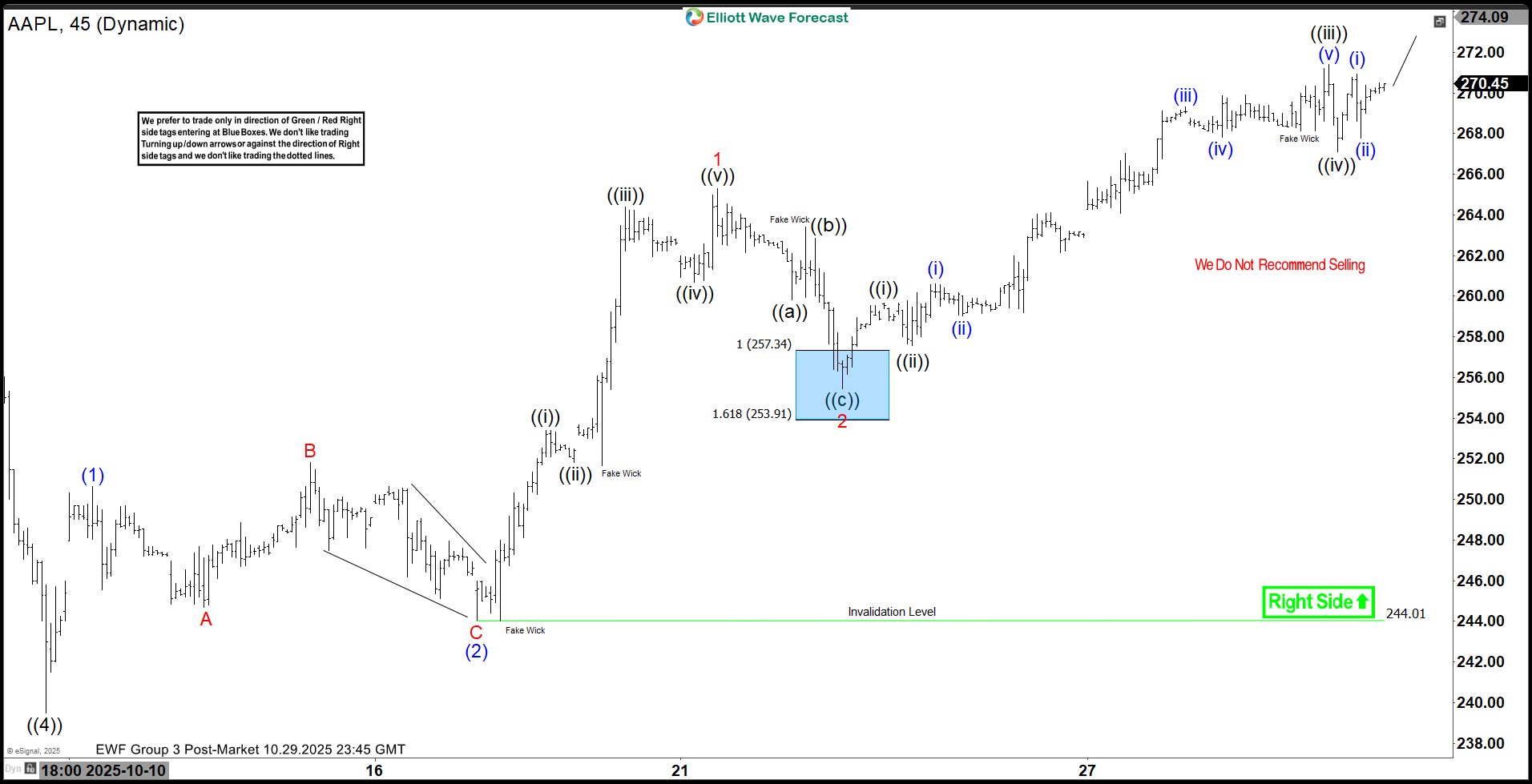

Apple (AAPL) Progressing in Wave ((5)) to New All-Time High as Nested Pattern

Read MoreApple (AAPL) cycle from April 2025 low made a new all-time high in wave ((5)). This article and video discuss the Elliott Wave path of the stock.

-

NVDA Climbs to Record Levels as Elliott Wave (5) Unfolds

Read MoreNvidia (NVDA) continues to climb to new all time high within wave ((5)). This article and video look at the Elliott Wave path of the stock.