The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

$DBK: Deutsche Bank Stock Nesting before Acceleration

Read MoreDeutsche Bank is a German multinational investment bank and financial services provider. It is one of the nine bulge bracket banks. Deutsche Bank is the largest German banking institution and is a part of the DAX-40 index. Founded 1869 and headquartered in Frankfurt, Germany, it can be traded under tickers $DBK at Frankfurt and $DB […]

-

Microsoft (MSFT) Should Remain Supported

Read MoreMicrosoft (MSFT) breaks to new all-time high in impulsive structure. This article and video look at the Elliott Wave path for the stock.

-

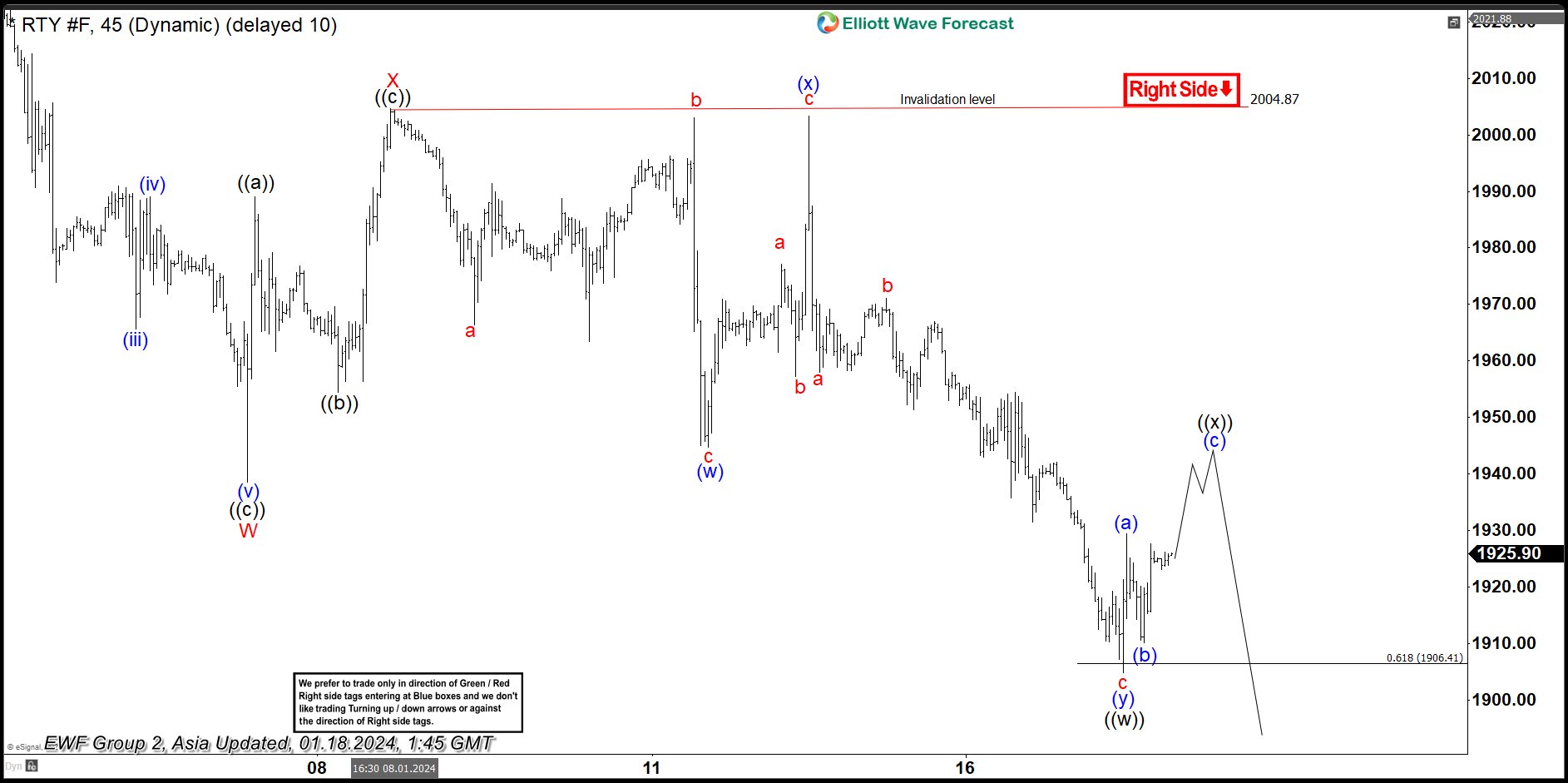

Russell 2000 (RTY) Rally Should Fail for More Downside

Read MoreRussell 2000 (RTY) shows incomplete bearish sequence from 12.28.2023 high favoring more downside. This article and video look at the Elliott Wave path.

-

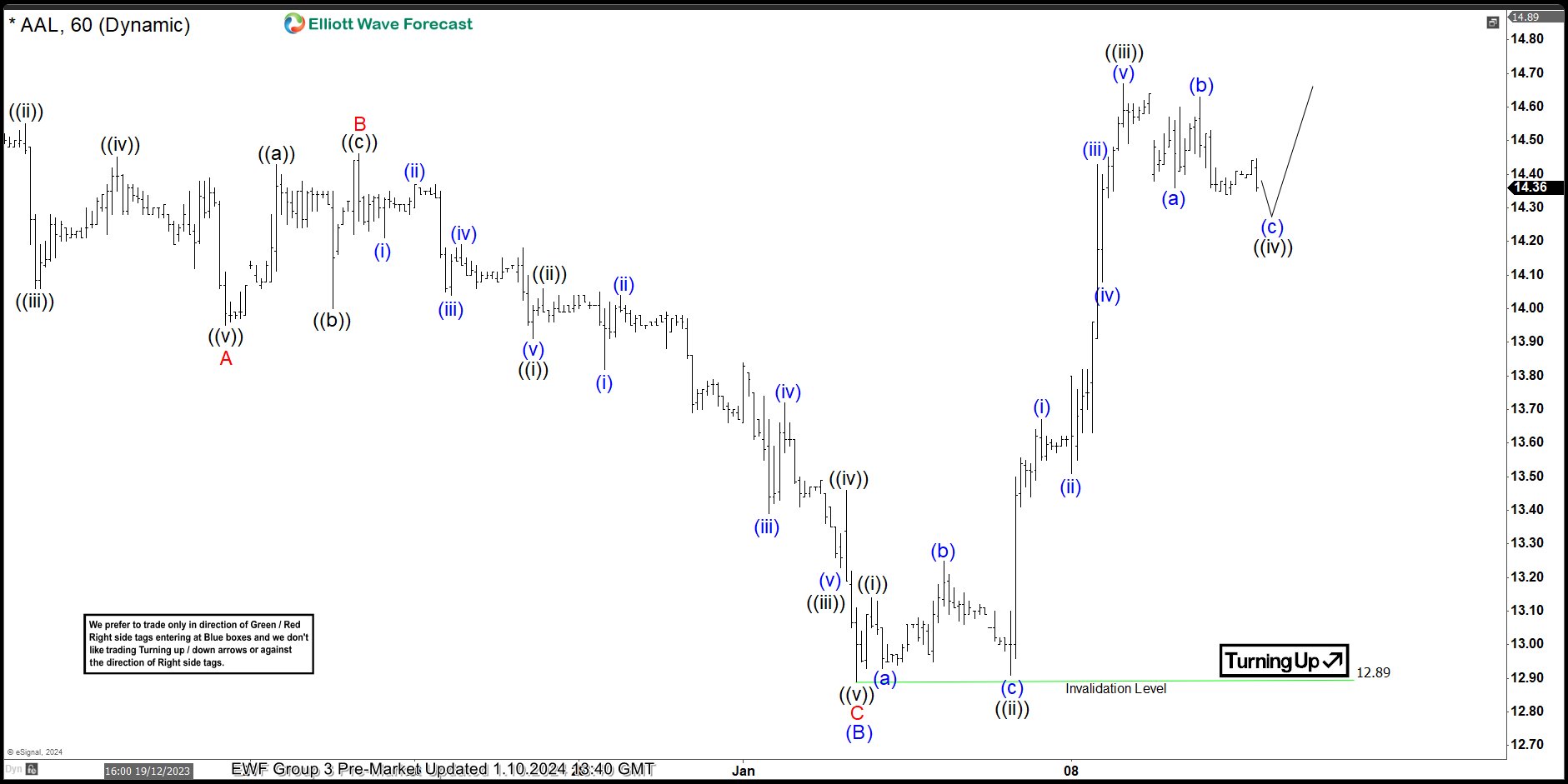

American Airlines Group Inc. ($AAL) Found Buyers After a Zigzag Pullback.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of American Airlines Group Inc. ($AAL). The rally from 1.03.2024 low at $12.89 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain the […]

-

GDXJ Should Extend Higher in 2024

Read MoreGDXJ is an ETF tracking small-cap gold and precious metals mining companies. It has a focus on smaller, more volatile firms. Thus it offers exposure to this precious metal sectors, but investors should be cautious of increased risk. In this article, we will update the Elliott Wave outlook for the ETF. GDXJ Daily Elliott Wave […]

-

Home Depot HD Is Going To Give Us Selling Opportunities

Read MoreHome Depot (HD), is an American multinational home improvement retail corporation that sells tools, construction products, appliances, and services, including fuel and transportation rentals. Home Depot is the largest home improvement retailer in the United States. After reaching all-time highs in December 2021, the price of HD fell considerably. According to the Elliott Wave Principle, […]