In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

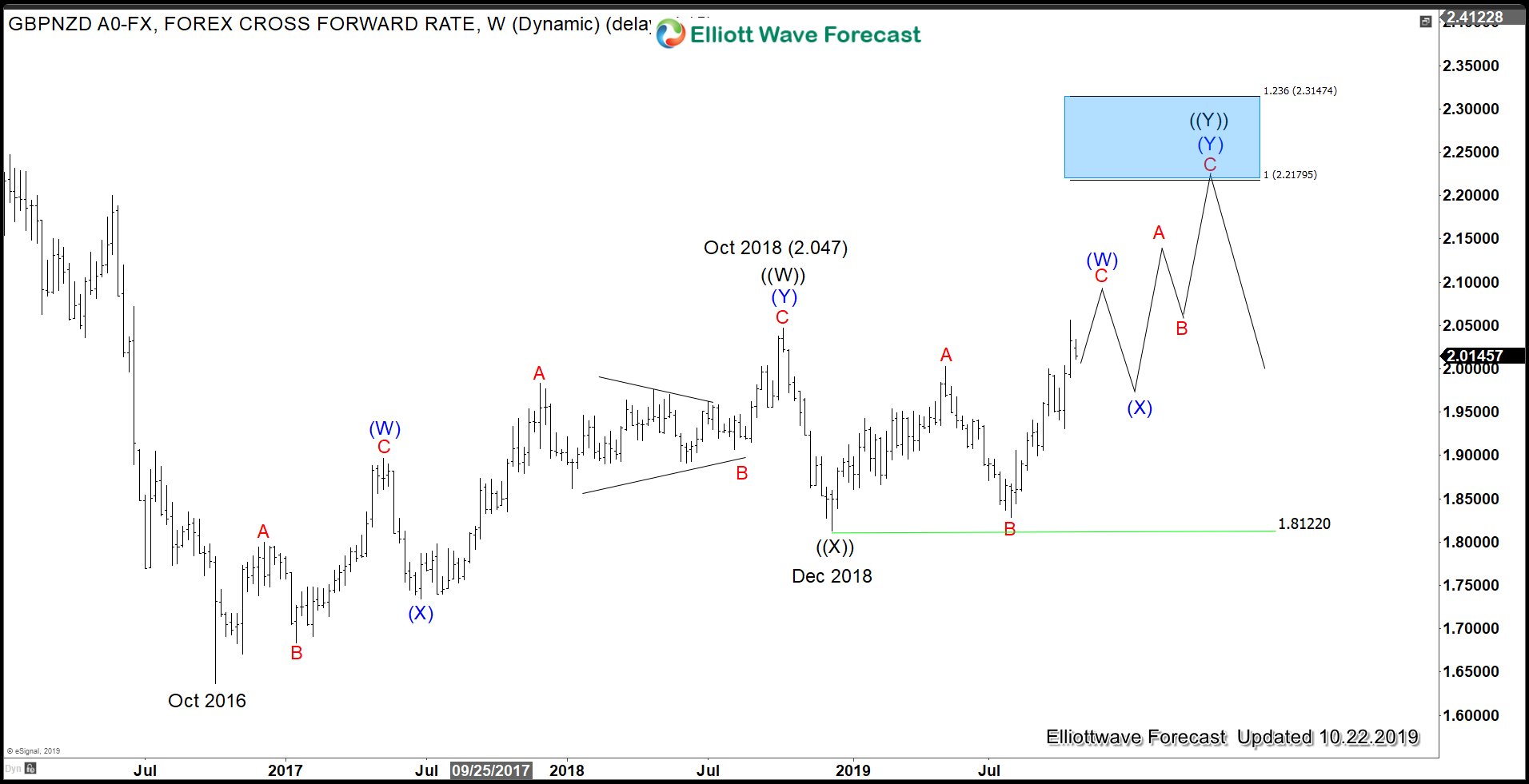

GBPNZD and GBPAUD Elliott Wave Outlook in Crucial Brexit Final Weeks

Read MoreUK Prime Minister Boris Johnson successfully negotiated a new Brexit deal with EU. However, last Saturday the Members of Parliament (MP) rejected his campaign to take Britain out of the EU by the end of the month. Mr. Johnson was instead forced to seek an extension that he had vowed never to pursue. Mr. Johnson […]

-

Poundsterling Soars as UK and Irish Leaders Find Pathway to Brexit Deal

Read MoreThe last ditch Brexit talks between British and Irish leaders last week yield unlikely breakthrough. Both leaders issued an upbeat statement after the meeting, saying they see a pathway to a possible deal. The issue of Irish border and the proposed backstop has become the bottleneck in Brexit negotiations. Irish leader Leo Varadkar reportedly said […]

-

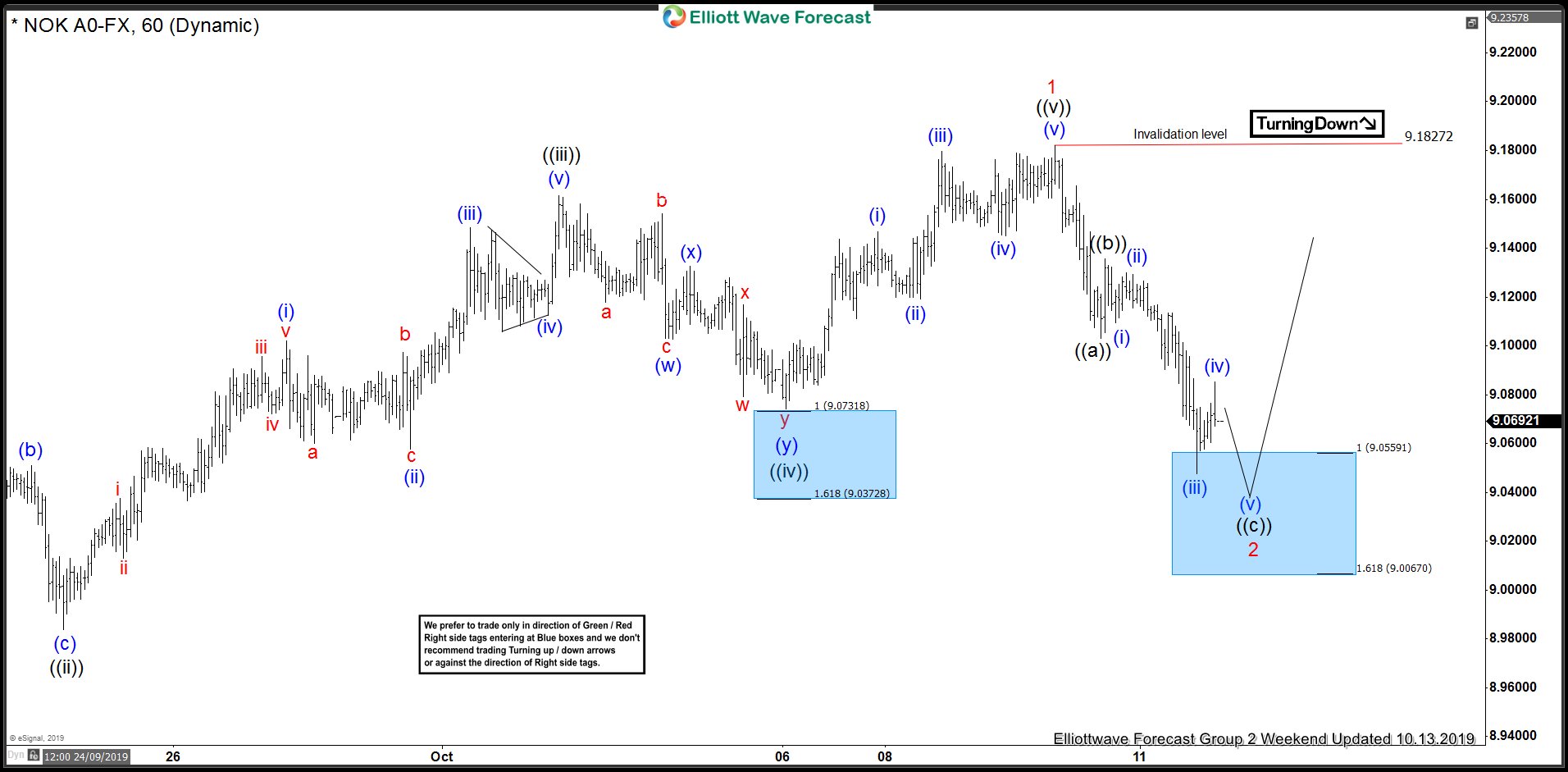

USDNOK Found Intraday Buyers At The Blue Box Area

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of USDNOK published in the membership area of the elliottwave-forecast.com . USDNOK broke September 3rd peak , which made the pair bullish against the 8.870 low. Besides that USDNOK made 5 waves up in the short term cycle from […]

-

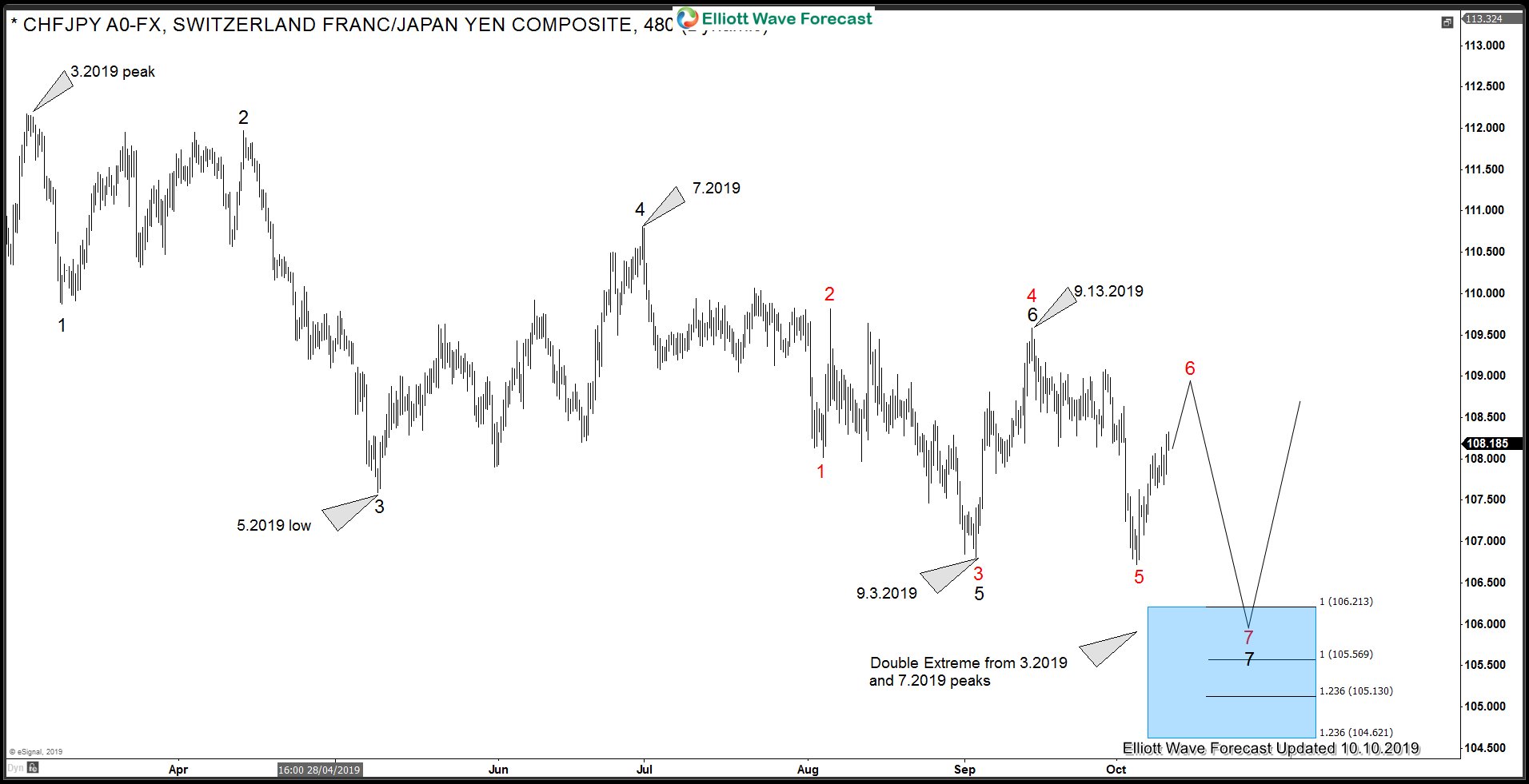

Yen Crosses Reaching Extremes. Are They Ready For A Bounce?

Read MoreIn this blog, we would take a look at some Yen crosses to gather the bigger picture and also get an idea of whether they are ready for a bounce or there would be more downside before the bounce occurs. We would also look at long-term Elliott Wave sequences two Yen crosses to explain what […]

-

Elliottwave View: GBPUSD Rally Expected To Fail

Read MoreGBPUSD shows a 5 waves impulsive decline from Sept 20 high. Rally likely fails in 3, 7, 11 swing below there for more downside.

-

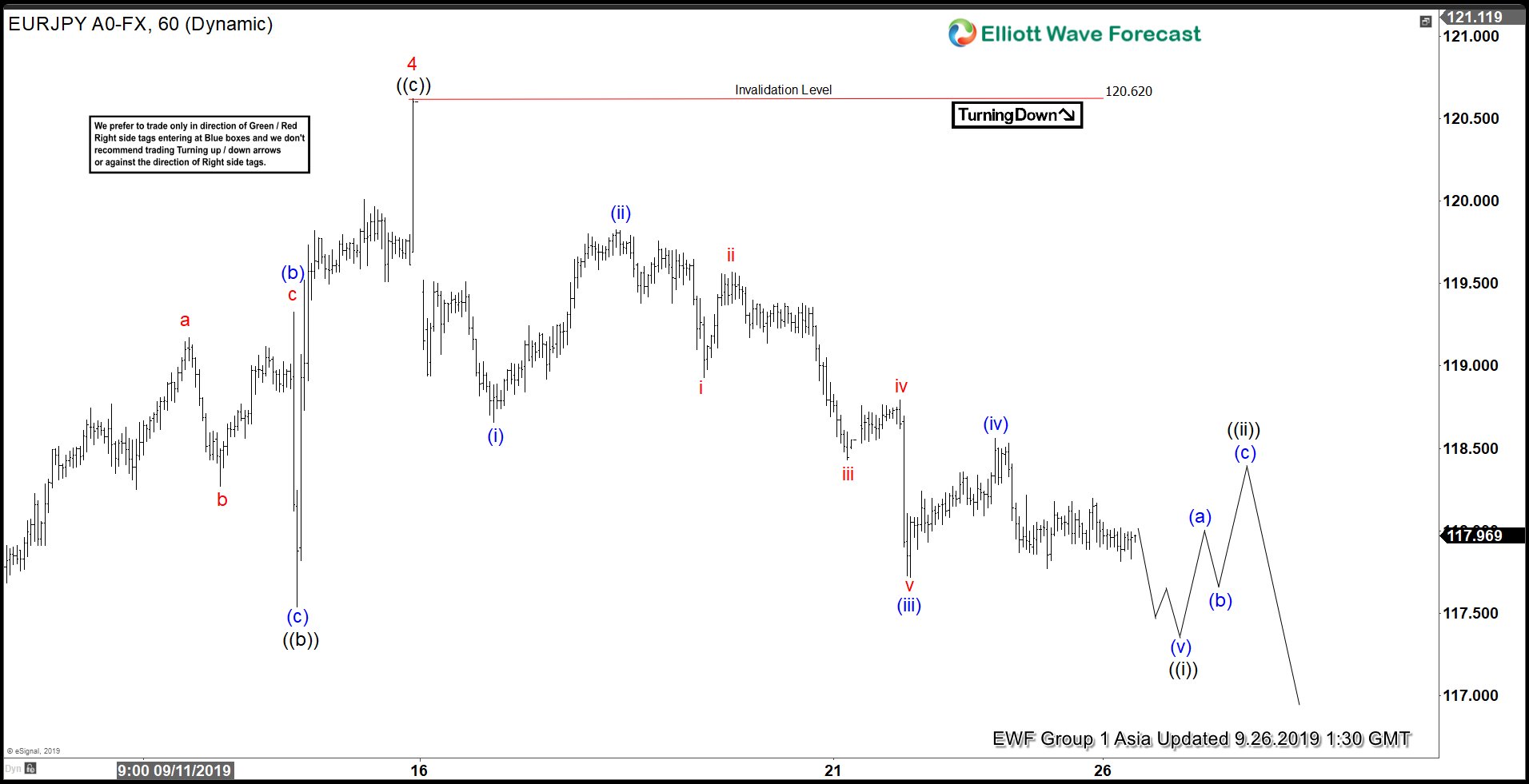

Elliott Wave View: EURJPY Has Resumed Lower

Read MoreAfter forming a low on September 3, 2019 at 115.8, EURJPY has rallied in 3 waves. The rally ended at 120.62 and we labelled this bounce as wave 4. As the structure of the rally from September 3, 2019 low is in 3 waves, this tells us that the rally is only a correction. The […]